Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

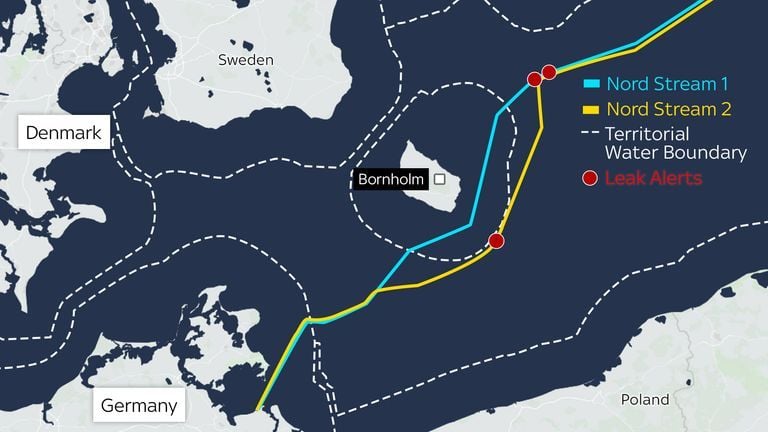

GERMAN MP: UKRAINE MUST PAY FOR DAMAGE TO NORD STREAM PIPELINES

Some major changes on Germany-Ukraine relationships took place over the recent days... Last week, Germany said it has frozen its military aid to Ukraine, claiming that a domestic budgetary crisis means it can no longer afford to supply Kyiv with new weapons. Olaf Scholz, the German chancellor, told his defence minister this month that there would be no money available for further military aid, according to a new report in the Frankfurter Allgemeine newspaper. Today, Alice Weidel has called for Ukraine to compensate Germany for the damage caused to its economy as a result of the attack: “The economic damage to our country caused by the demolition of Nord Stream presumably ordered by Zelensky - and not Putin as we were led to believe - should be "billed" to Ukraine.” Berlin-Kyiv relations were strained after the German Prosecutor General's Office issued an arrest warrant for a Ukrainian suspected of involvement in the pipeline sabotage. Source: Mario Nawfal on X

Before the euro, Greece, Italy, Spain were adjusting for their lower productivity via currency devaluations each year.

Within the European currency union the only avenue left is adjusting via real wages pushing many people into poverty. Source: FT, Michel A.Arouet

Italy has doubled the flat tax on foreign income for wealthy new residents who have been flocking here to take advantage of it.

The €100,000 a year payment — which exempts people moving to the country from taxes on overseas earnings, gifts, and inheritance for 15yrs — will rise to €200,000. The previous €100,000 tax incentive was popular w/wealthy individuals but controversial among Italians, particularly in Milan, the business capital. The recent influx of the super-rich has been blamed for significantly increasing real estate prices and living costs. The increaed flat tax for the billionaires is still set at a level that would remain interesting to wealthy foreigners, FinMin Giorgetti said. Source: Bloomberg, HolgerZ

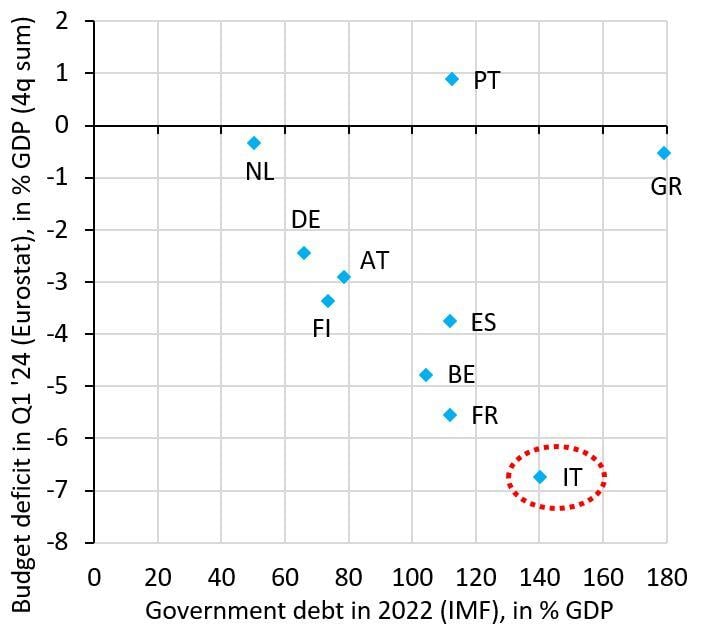

Why the ECB should keep interest rates at the lowest level possible explained in one chart

The Euro zone is an equilibrium where high debt countries like Italy, France and Spain run big deficits. The ECB enables this by capping yields when these spike like they did in 2022. This policy is an implicit subsidy of high debt countries by low debt ones... Source: Robin Brooks

German inflation unexpectedly accelerated in July to 2.3% YoY from 2.2% in June as food price inflation keeps rising, core inflation, and services inflation remain sticky at 2.9% and 3.9%.

Source: HolgerZ, Bloomberg

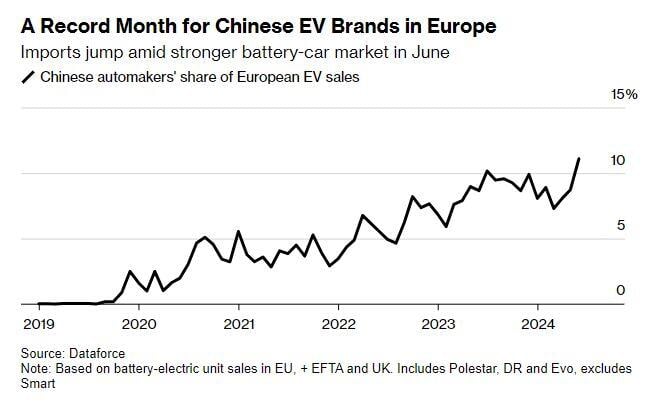

Chinese EVs Seize Record 11% Share in Europe Ahead of Tariffs - Bloomberg

Chinese brands captured 11% of the European electric-car market in June, notching record registrations as manufacturers raced to beat stiff European Union tariffs that took effect early this month.

As highlighted by Michel A.Arouet on X: the German business model was based on:

1. Cheap energy from Russia 2. Cheap subcontractors in Eastern Europe 3. Steadily growing exports to China All three are gone by now, and not much has been done to change the trend. Source: Bloomberg, Michel A.Arouet

Interesting point by HolgerZ on X. Unlike on Wall Street – big stocks in germany are still doing well, while small stocks are struggling.

This can be seen in the ratio of the Benchmark Index Dax to the Mid-Cap-Index MDax, which hit its highest level since 2011. This could be because the economy isn't doing great, and small companies are more affected by this. The Purchasing Managers' Index for Germany dropped below make-or-break 50 this week, highlighting Germany's economic challenges. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks