Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

Update: the world didn't end. New all-time closing high

Source: Charlie Bilello

SMALL IS BIG...

The Russell 2000 US small-caps index is extending the break out move. This looks like an inverse head and shoulders formation. Plenty room to run before we reach trend channel highs. Source: LSEG, The Market Ear

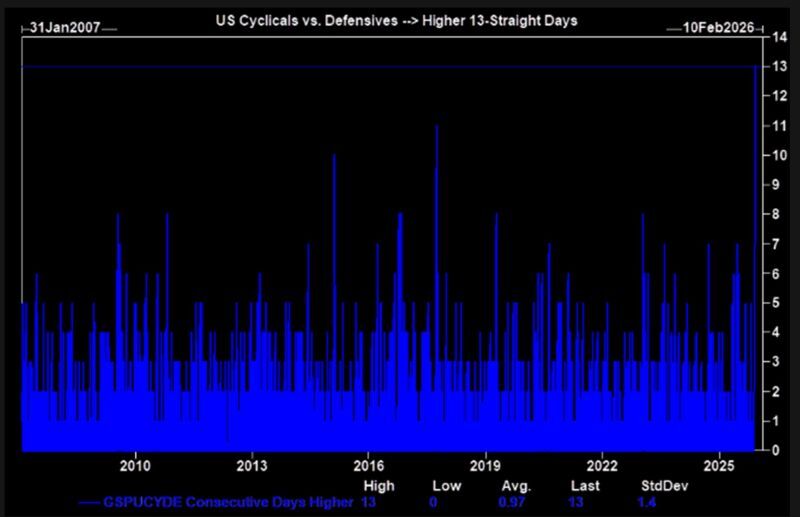

US cyclicals vs. defensives up 13 days in a row.

Goldman's Coppersmith: "You don’t get moves like this unless the market is starting to lean into a better growth outlook". Source: LSEG, The Market Ear

They are all cutting target price on Oracle $ORCL...

Goldman PT New $220, Old 320 JPMorgan PT New $230, Old 270 Cantor PT New $320, Old 400 Barclays PT New $310, Old 330 Evercore PT New $275, Old 385 Scotiabank PT New $260, Old 360 TD Cowen PT New $350, Old 400 Melius PT New $260, Old 400 Source: zerohege

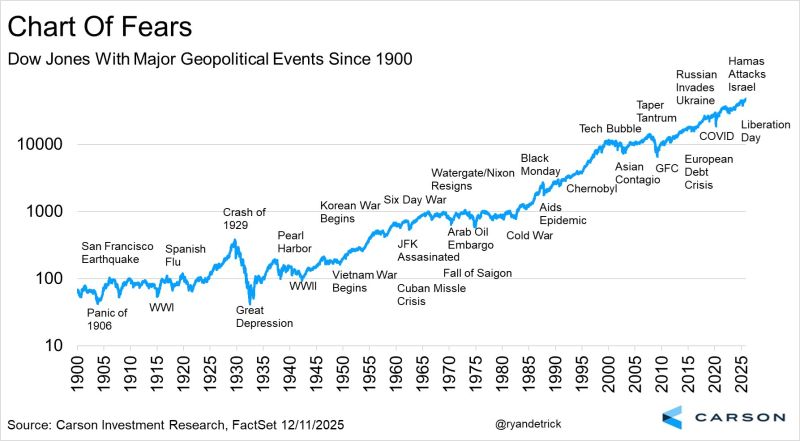

The Dow started trading on May 26, 1896.

Yesterday it closed at the highest level ever. Congrats to investors who used the events on this chart as reasons to buy, not panic. Source: Ryan Detrick

Oracle $ORCL is exposed to massive concentration risks..

It has $125 billion debt, of which $25 billion is due in three years. Meanwhile, FCF is already negative, and its largest customer, OpenAI, needs to raise $207 billion by 2030 to meet its obligations. Source: Oguz O. | 𝕏 Capitalist 💸 @thexcapitalist FT

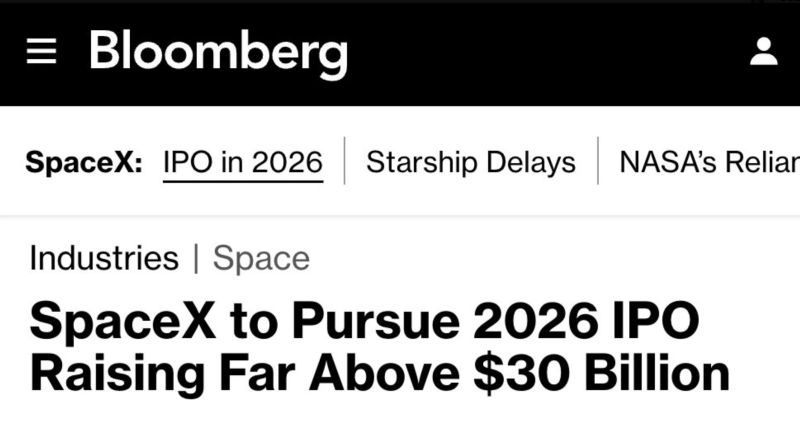

Largest IPOs in History (by amount raised):

1. SpaceX $30.0B* 2. Saudi Aramco $29.4B 3. Alibaba $21.8B 4. Softbank $21.3B 5. NTT Mobile $18.1B 6. Visa $17.9B 7. AIA $17.8B 8. ENEL SpA $16.5B 9. Facebook $16.0B 10. GM $15.8B Elon would take the top spot. Source: Morning Brew, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks