Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

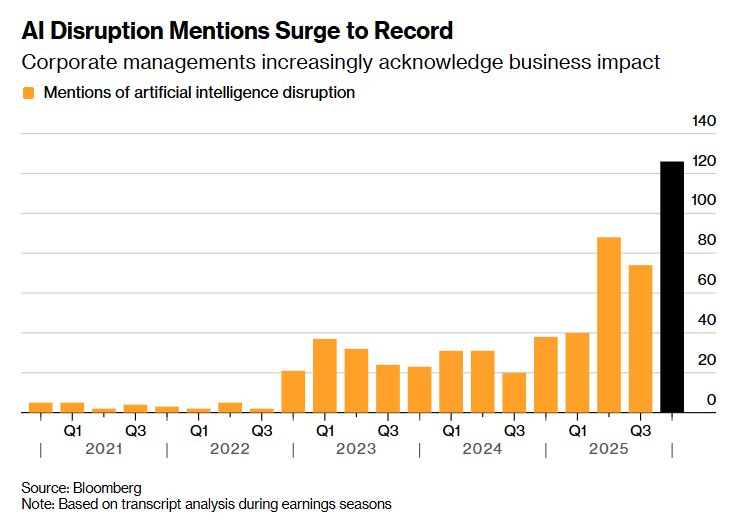

AI Risk Is Dominating Conference Calls as Investors Dump Stocks

Source: Bloomberg

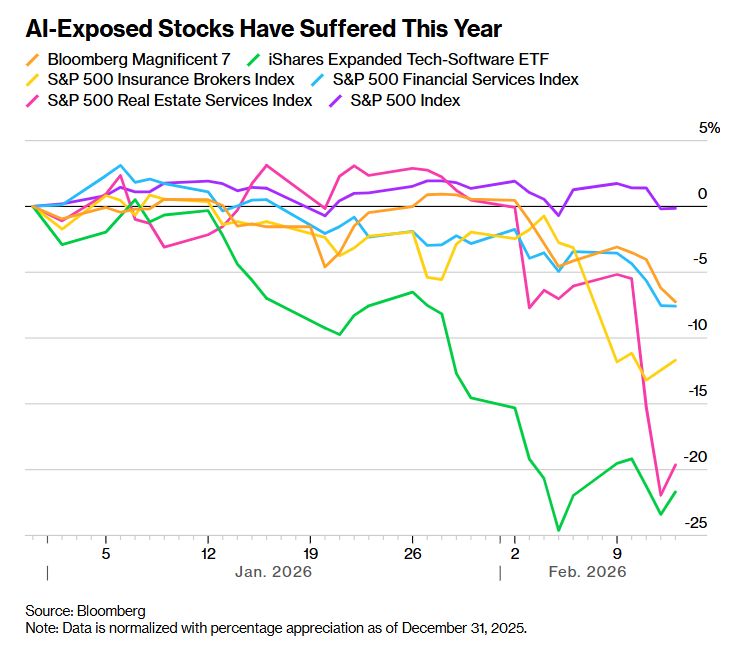

A Stock Market Doom Loop Is Hitting Everything That Touche AI

Source: Bloomberg

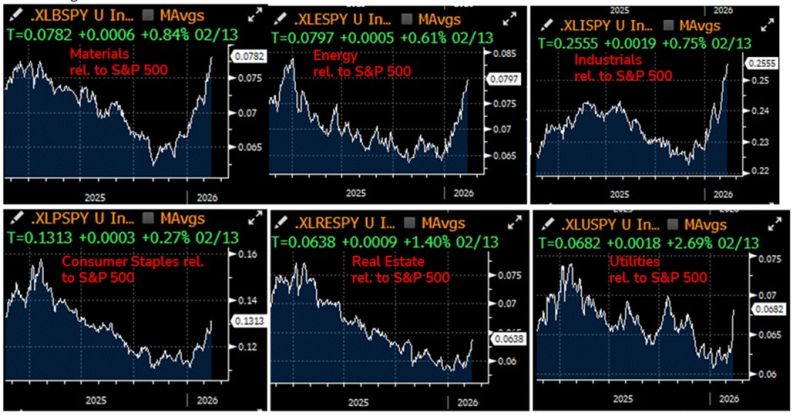

US equities market broadening in a few pics.

“Old economy” and interest-rates sensitive sectors have been outperforming lately Note there are also parts of the economy which are LESS subject to AI-disruption Source: Bloomberg, RBC

The "Feel good story of the day".

If you invested $10,000 in Beyond Meat in 2021, today you would have $41. The stock was as fake as the meat. Source: Brew Markets @brewmarkets Wall Street Mav

Perhaps the trade this year isn't so much "sell America"rather something like: "spend a lot more money everywhere else" -

At least so far this year. For example, Asian stocks have made their best start over US equities since at least 2000: @TheTerminal Source: Lisa Abramowicz @lisaabramowicz1 Bloomberg

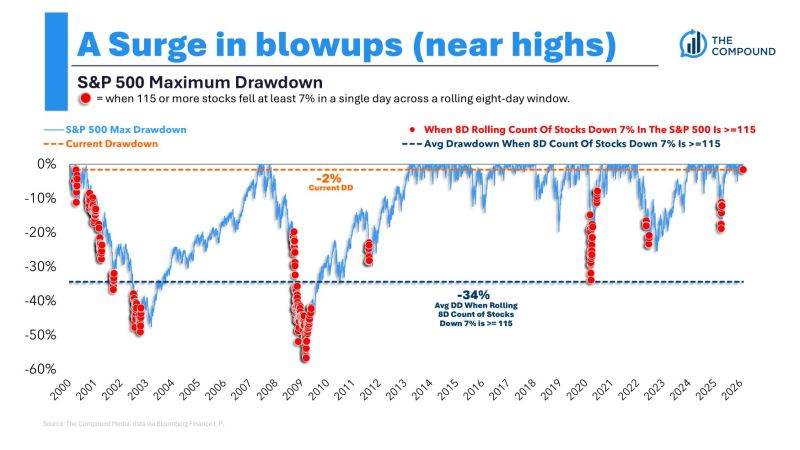

Wild market.

Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day. The average drawdown when that happens is 34%. Right now we're 1.5% below the all-time high. Source: Michael Batnick @michaelbatnick

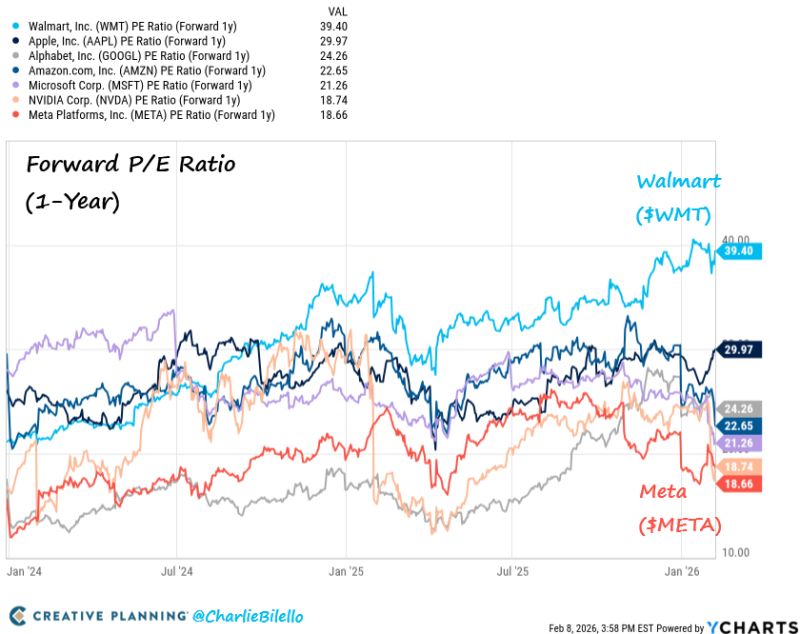

Who has the highest P/E among these mega caps? Answer: Wal-Mart $WMT...

Meta $META and Nvidia $NVDA are the cheapest, but if we factored in growth rates $NVDA is way cheaper than $META Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks