Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

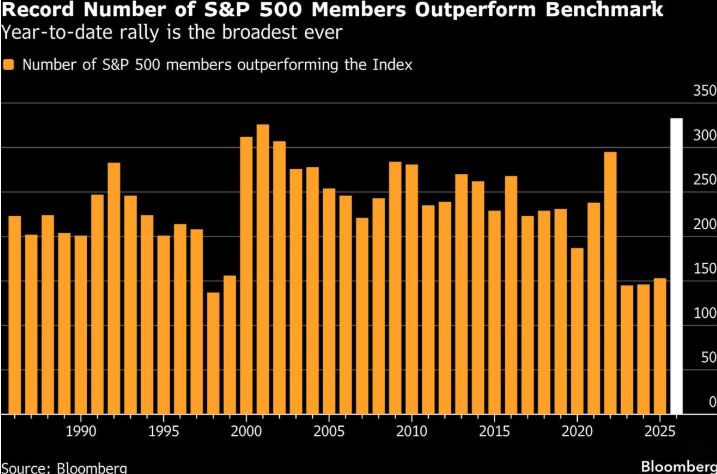

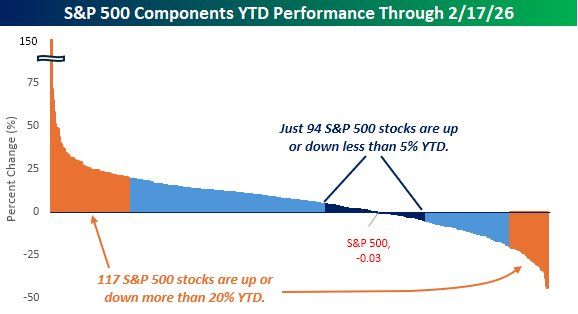

Number of S&P Stocks Beating Index Is at Record (Bloomberg)

Roughly 66% of the individual stocks in the S&P 500 are beating the index so far this year — which would put it on pace for the highest level of breadth in the market in records going back to 1986. Source: Bloomberg, Christian Fromhertz

Software stocks didn’t just pull back. They got repriced.

Le discours affirmant que le SaaS est mort se répand, mais la réalité est plus nuancée. Même les entreprises SaaS solides, avec des revenus récurrents, des clients fidèles et des bilans robustes, sont sous pression car l’IA transforme radicalement les règles du jeu : un seul développeur peut désormais créer des outils en quelques minutes, automatiser des processus et réduire le besoin d’équipes entières. Cela remet en cause leur capacité à maintenir des prix élevés, la nécessité d’un grand nombre d’utilisateurs, et la solidité de leurs avantages concurrentiels. Si l’IA réduit presque à zéro le temps de développement, les solutions isolées deviennent vulnérables, tandis que survivront surtout les entreprises disposant de données propriétaires, d’un fort réseau de distribution, d’une sécurité de niveau entreprise et d’intégrations profondes dans les systèmes. Ce n’est pas la fin du logiciel, mais celle des entreprises qui ne s’adaptent pas, et la reprise sera très sélective. Source : Danny Naz @ThePupOfWallSt

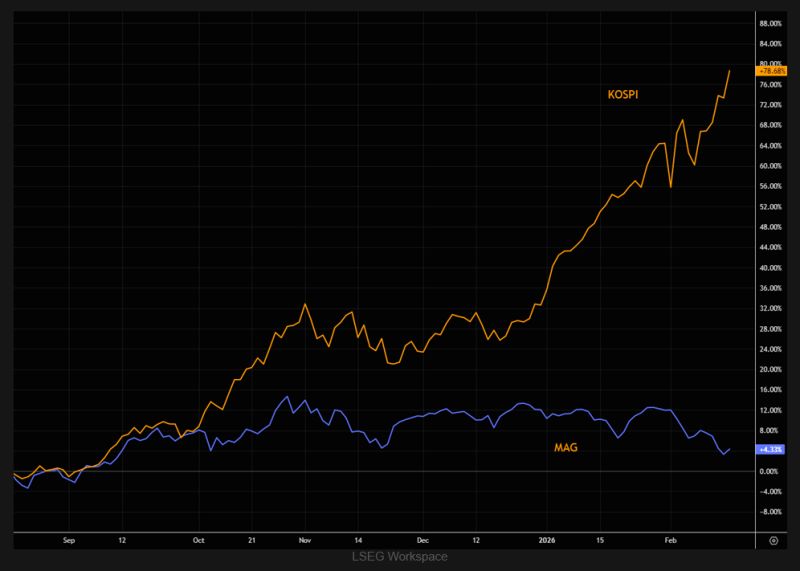

KOSPI vs MAG index performance over the past 6 months needs little commenting.

Source: TME

Alphabet $GOOGL fell below its 50-day moving average last week and now sits right at the 100-day

If that breaks, a return to the 200-day MA might be in play Source: Barchart

A tale of two tech markets semis versus software

Source. TME, Bloomberg / Kevin Gordon

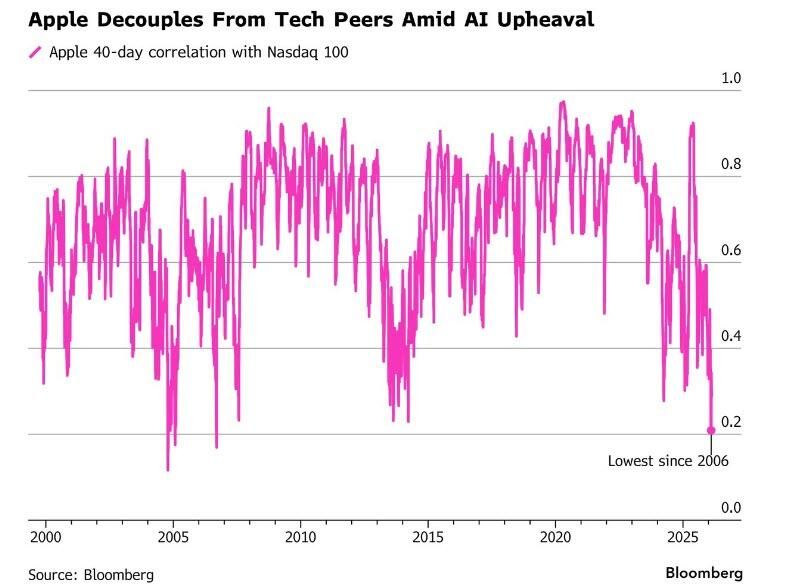

Apple’s 40-day correlation to the Nasdaq 100 Index tumbled to 0.21 last week, the lowest since 2006, according to data compiled by Bloomberg.

Its correlation with the benchmark has been on the decline since May, when it reached 0.92, as Apple’s decision to mostly sit out the AI arms race has turned it into an outlier compared with many of its rivals. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks