Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

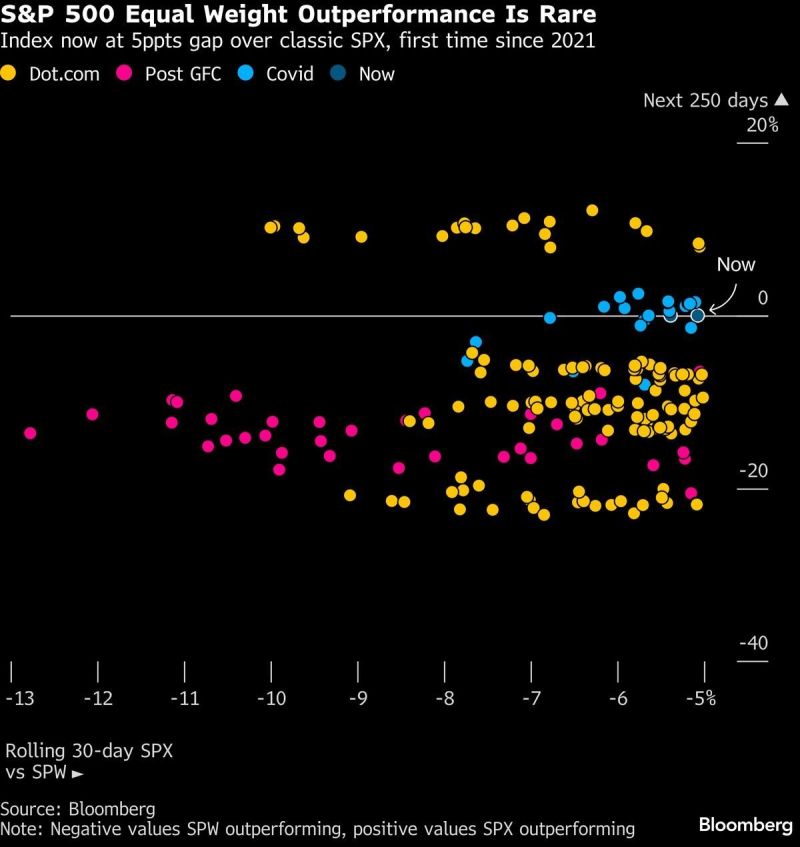

Fascinating study from Bloomberg: S&P Equal Weight outperformance was extremely rare historically:

1999-2002 Dotcom 2009 Post GFC 2020-2021 Covid “Those cases accompanied major shifts in the market.” “Equal-weight S&P managed to maintain some outperformance 250 days later.” “The big question: whether this is the start of an extended period of sharp moves around AI disruptors, and the disrupted.” Source: Macrocharts, Bloomberg

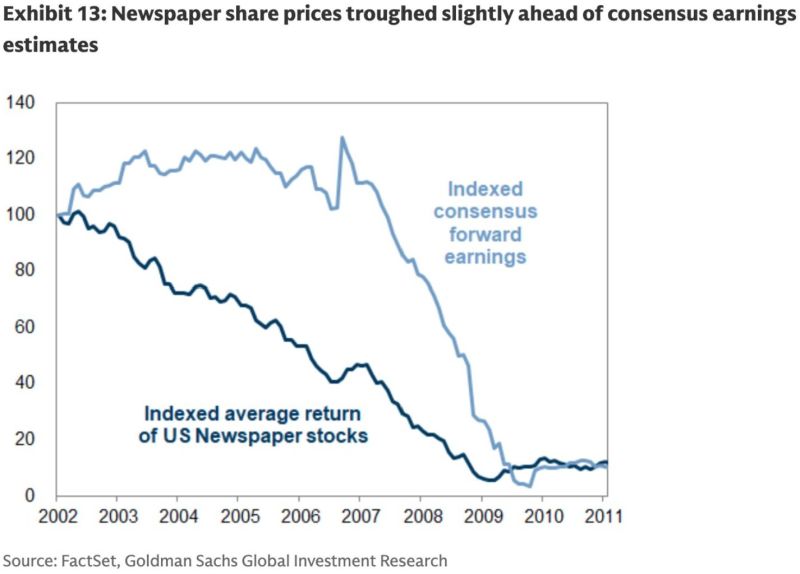

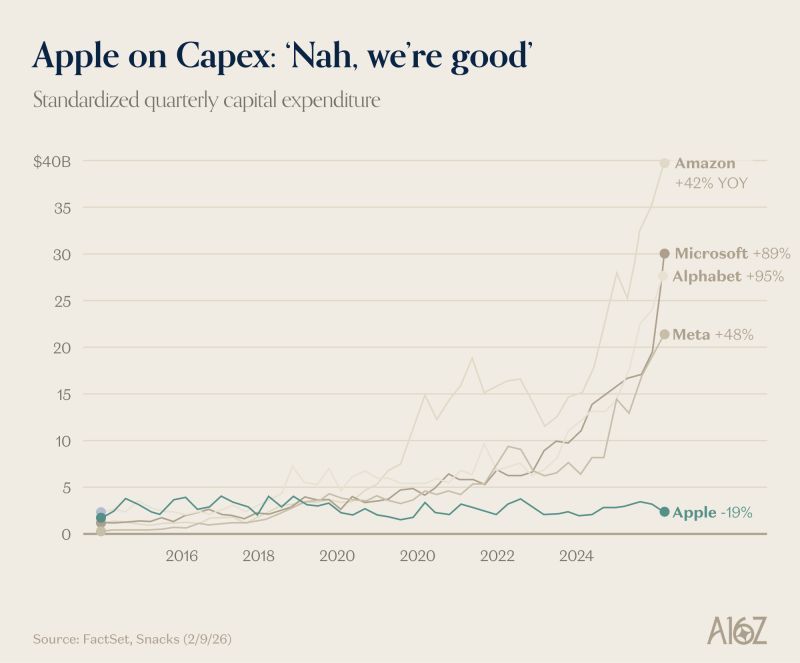

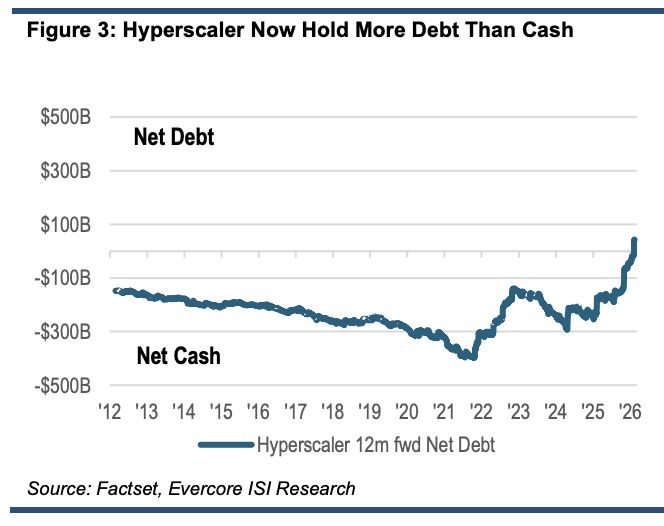

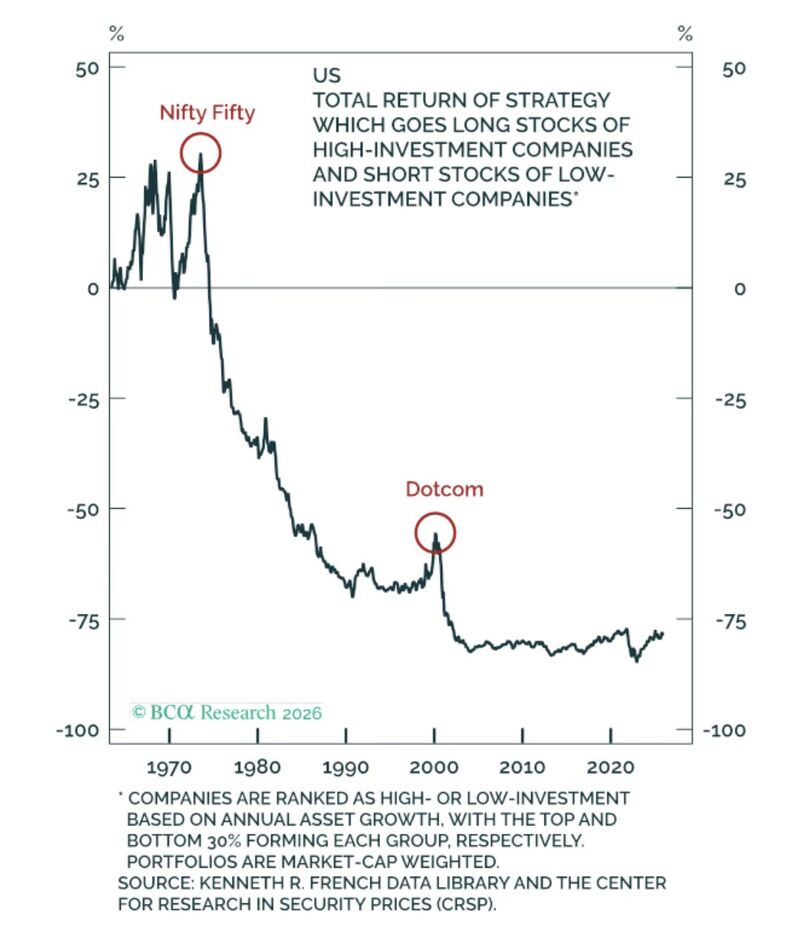

hey, capex is good. It will pay off” consider the historical record

Source: Peter Berezin @PeterBerezinBCA

Investing with intelligence

Our latest research, commentary and market outlooks