Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

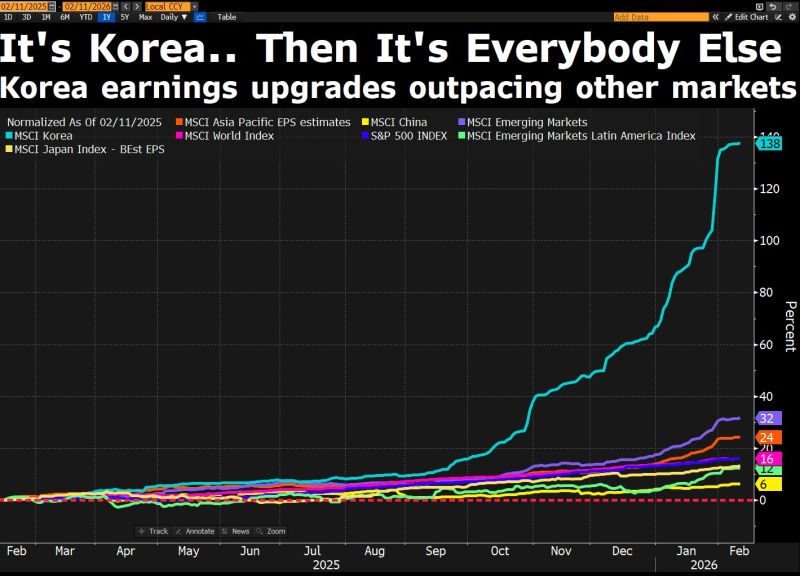

As far as the standout global earnings story is concerned, it's Korea... and then it's everybody else.

Source: David Ingles @DavidInglesTV

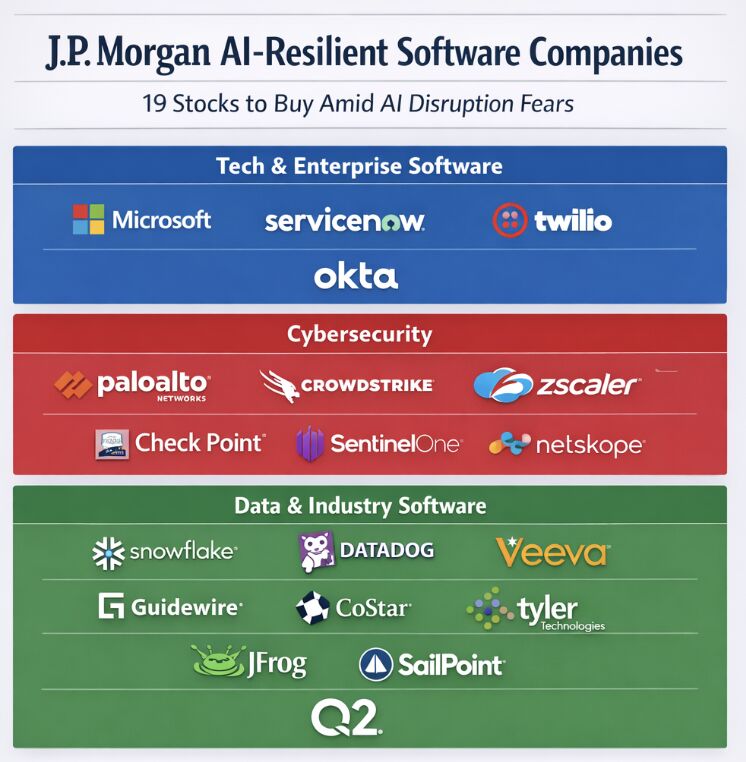

JP Morgan analysts just compiled a list of 19 software stocks that they believe 'are AI resistant'.

What do you think of their list? Source: Dividendology

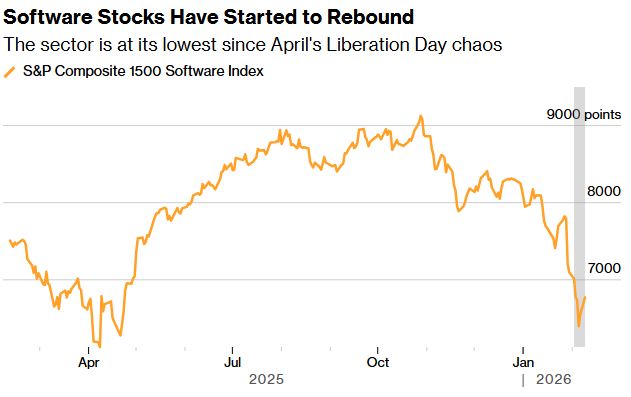

The "Sell First, Ask Questions Later" Era is officially here.

Markets are panicking over AI replacing jobs and businesses—a trend called AI Displacement Anxiety. Investors aren’t just worried about current earnings; they’re fearing future obsolescence from AI that doesn’t even exist yet. Example: Commercial real estate giants ($CBRE, $JLL, $CWK) saw shares drop 15%+ because of AI fears, not actual competition.

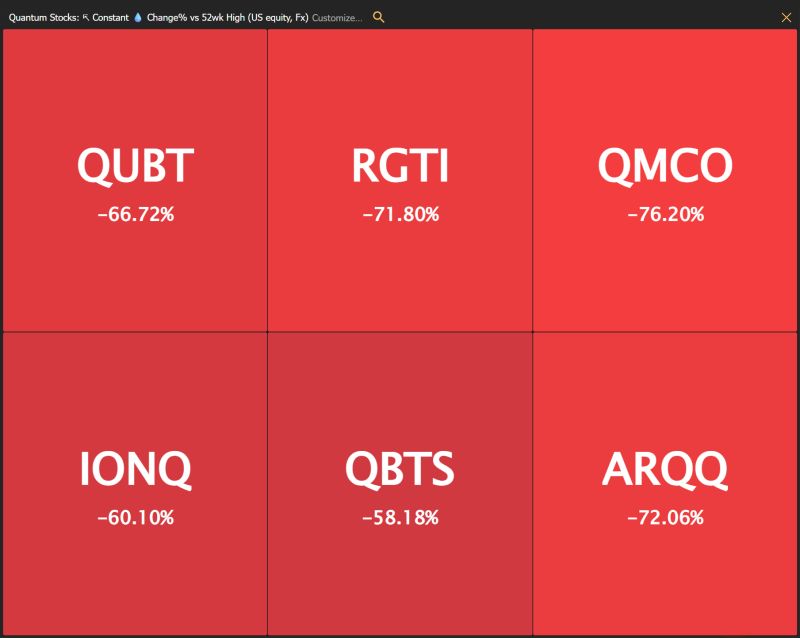

Quantum stocks are down substantially from their 52-week highs...

Source: Trend Spider

AI FEARS OVERDONE IN SOFTWARE

JPMORGAN: AI FEARS OVERDONE IN SOFTWARE JPMorgan says the selloff in software stocks is overblown, driven by unrealistic fears of near-term AI disruption. Strategists recommend rotating back into high-quality, AI-resilient names. They cite strong fundamentals, high switching costs, and positive earnings trends, naming Microsoft and CrowdStrike as beneficiaries. With 2026 earnings growth forecast near 17%, the team sees a rebound opportunity. Source: *Walter Bloomberg @DeItaone

Another day, another fresh high in skew.

The year-to-date rise is becoming meaningful, with the crowd long and paying up for downside protection. Rising markets alongside rising skew are a combo worth watching closely, and looks pretty similar to last year’s setup... Source; TME

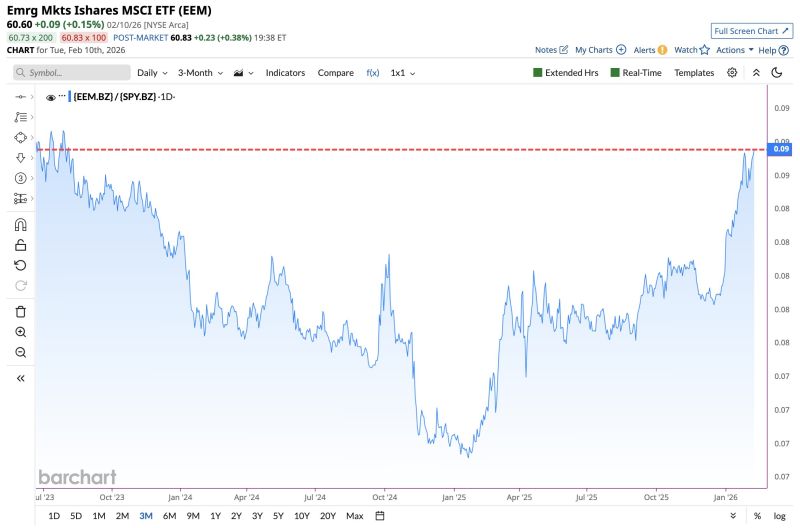

Emerging Market Stocks now outperforming U.S. Equities by the largest margin since 2023

Source: Barchart @Barchart

Investing with intelligence

Our latest research, commentary and market outlooks