Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

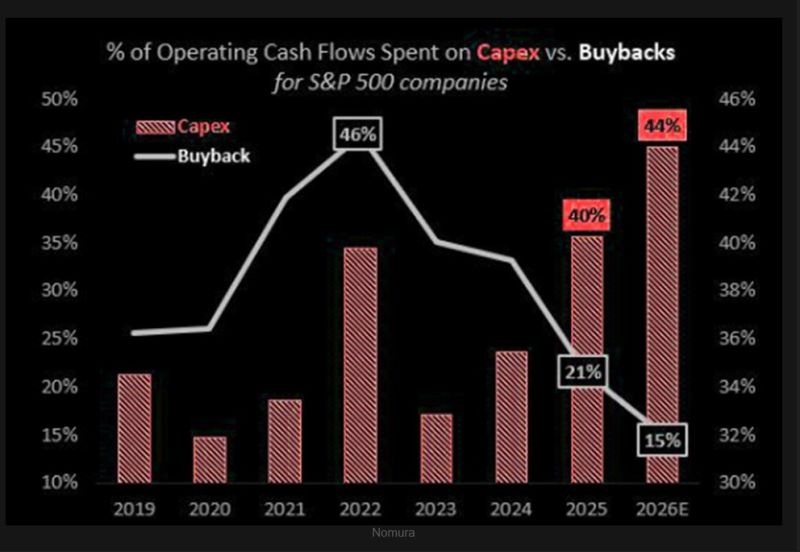

The End of the Buyback Era?

Mega-cap tech in the S&P 500 is undergoing a major shift. Before: buybacks exceeded CapEx, supporting valuation multiples. Now: CapEx exceeds buybacks, driven by the AI arms race.

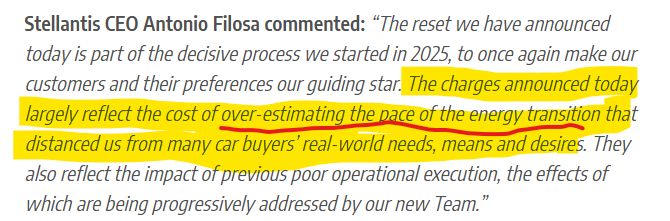

Shares of automaker Stellantis plunged 23% in European trading on Friday

The company said it expects to take a 22-billion-euro ($26 billion) hit from a business reset and hinted at a pull-back from its electrification push. After Ford and General Motors announced large write-downs linked to their EV strategy, today Stellantis has announced it will take ~€22 billion ($26 billion) in impairments as it scales back its EV plans. With a brutal admission by the CEO ⬇️ Source: Javier Blas

To put things in perspective...

The Amazon $AMZN CAPEX estimates ($200B for 2026) aren’t even on the screen on the Bloomberg GF page yet… Source: Bloomberg, RBC

Will the Nasdaq see the same pattern we saw from Nov ’24 into the Feb ’25 selloff???

This time, we consolidated since last November, and suddenly things look ugly again. Last year’s real puke began when NASDAQ broke the 100-day MA. We’re seeing that exact break today. Source: The Market Ear

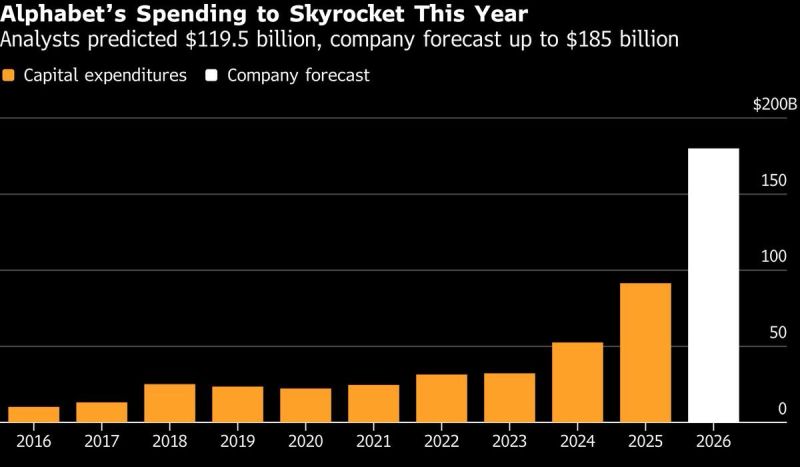

Alphabet is going to be spending more than the capex of:

ExxonMobil, Chevron, BP, Shell, TotalEnergies, Equinor, Eni, Antero Resources, APA Corporation, ConocoPhillips, Expand Energy, Continental Resources, Coterra Energy, Devon Energy, EOG Resources, EQT Corporation, Diamondback Energy, Occidental Petroleum, Range Resources, Permian Resources, Imperial Oil, Cenovus Energy, Canadian Natural Resources, Ovintiv, Suncor Energy, Tourmaline Oil COMBINED! Can the US grid support these projections ??? Source: The Crude Chronicles, Bloomberg

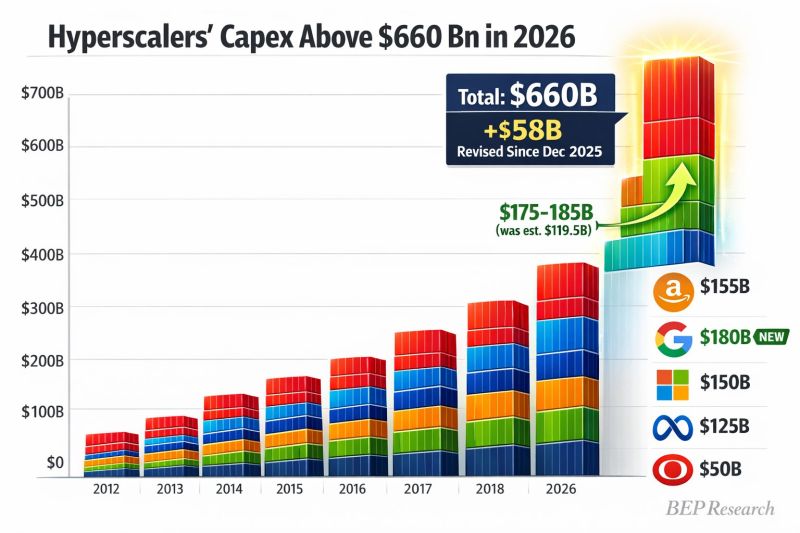

Hyperscaler capex just got revised UP $58B to $660B for 2026

Alphabet dropped a BOMB: $175-185B guidance vs $119.5B estimate That's +$55B from Google alone The AI infrastructure arms race just went nuclear ☢️ Source: Ben Pouladian @benitoz

2026 CAPEX:

$GOOGL - $175B-$185B vs $119B est $META - $115B-$135B vs $110B est $TSLA - $20B vs $11B est $AMZN - *tomorrow vs $145B est The hyperscalers are going all in on AI. Source: Geiger Capital

The drawdown in S&P 500 Software stocks is now -25.2% from the high...

That's worse than last year's plunge Source: Kevin Gordon @KevRGordon Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks