Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

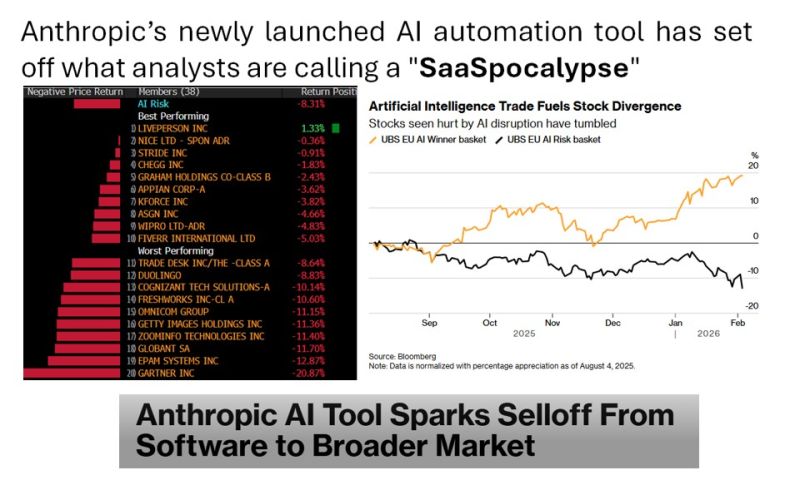

Anthropic’s newly launched AI automation tool has set off what analysts are calling a "SaaSpocalypse", rattling global technology markets

Anthropic recently released 11 new plug-ins for its Claude Cowork agent, an agentic, no-code AI assistant designed for enterprise users. The tool is aimed at automating tasks across legal, sales, marketing and data analysis functions Vishwa Sharan @vmsharan_ "Anthropic latest AI tool can automate tasks in legal, sales, marketing, and data analysis. Routine work such as document review, compliance tracking, risk flagging, and data processing. It essentially targets professionals in service automation. Expect reduced demand for consulting engagements, lesser billing hours. IT firms may see slower headcount growth or reductions as AI handles clerical work, shifting focus to higher level AI oversight and innovation" Source: Bloomberg

Nasdaq $QQQ survives the 100-day moving average test again

✅ Absolutely incredible Source: Barchart

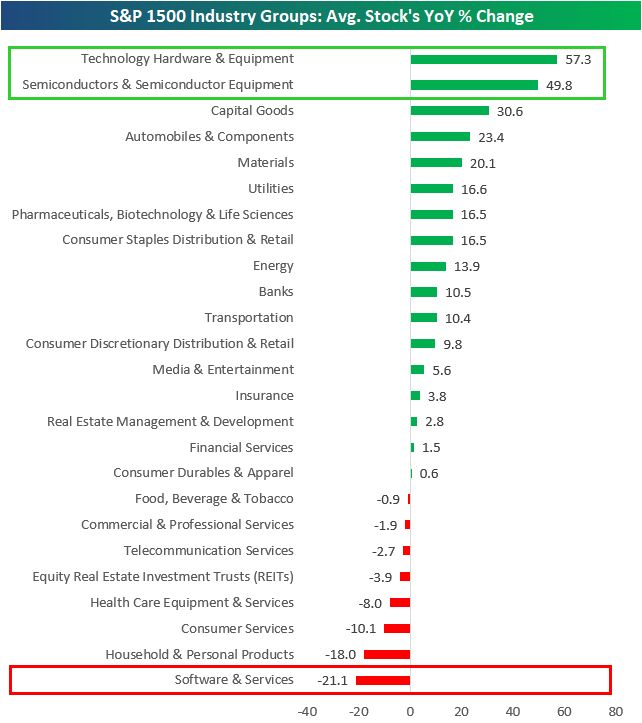

Amazing dichotomy between Tech hardware and software stocks over the last year.

Hardware and semis stocks are up the most of any group with average gains of 50%+. Software stocks are down the most of any group with an average decline of 20%+. Source: Bespoke

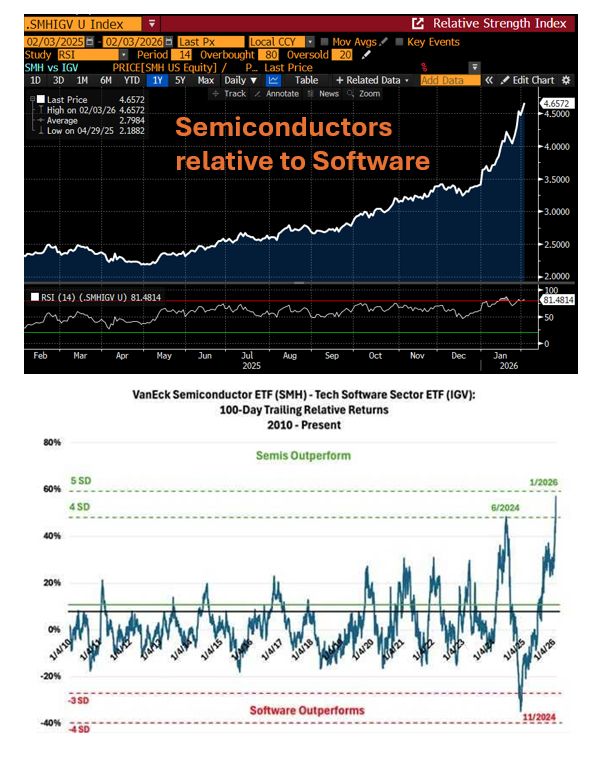

The semiconductors relative to software performance is getting very very extreme...

Long / short positioning on this pair by hedge funds is also hitting extreme levels Source: RBC, Bloomberg

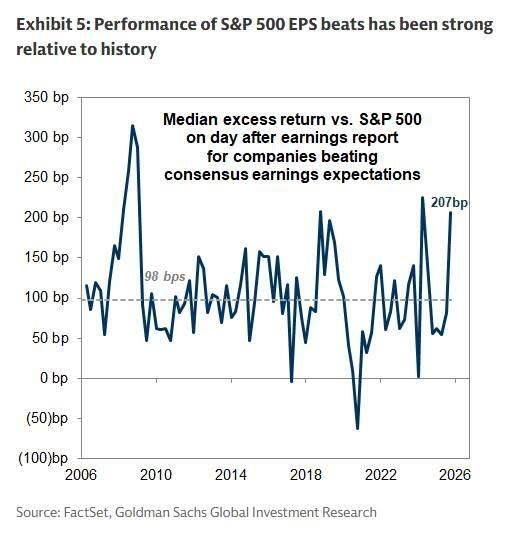

Goldman notes that after a few quarters of uninspiring market that follows positive earnings release, beats are finally being rewarded.

Companies beating consensus EPS estimates have outperformed on the day after reporting by +207 bp on average, more than double the historical average of +98 bp.

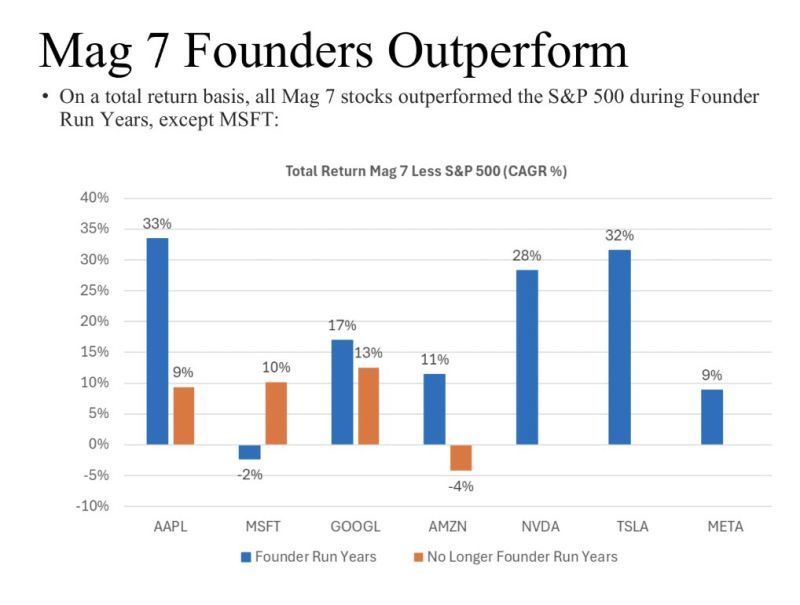

Here's how the Magnificent 7 names have performed when they were led by founders vs not

Source: Evan Evan StockMKTNewz

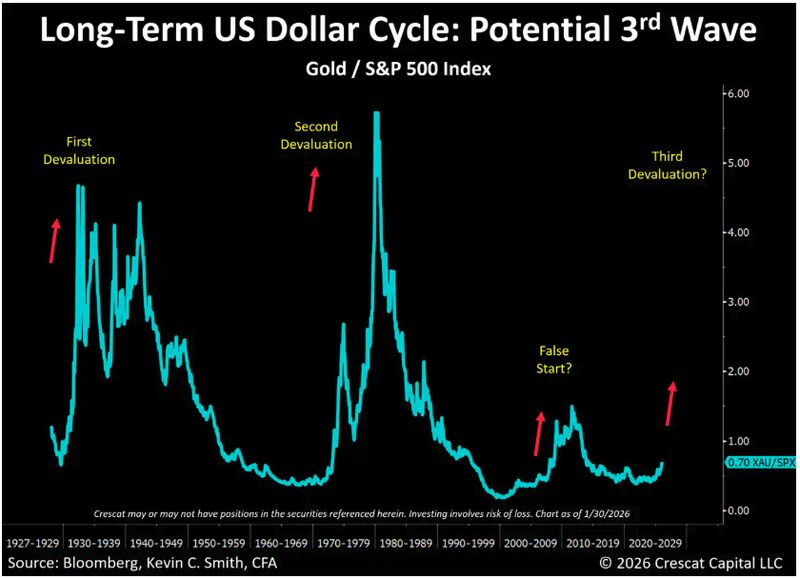

THIRD WAVE OF THE US DOLLAR CYCLE

Interesting comment by Crescat Capital: ‘We think the gold panic on Friday on the announcement of Kevin Warsh as the new Fed Chair caused a healthy pullback from short-term overbought conditions in the precious metals markets. While Warsh may appear the least dovish among President Trump’s candidates, we believe he is indeed in favor of lowering interest rates in 2026, as the President has also affirmed. Investors in Crescat’s portfolio of undervalued precious and critical metals miners should not be too concerned. Our activist mining portfolio outperformed gold, silver, and the gold equity benchmarks, both on Friday and cumulatively for the month of January. Still, the gold correction was no small matter. We think it presents a buying opportunity. In fact, now, as much as ever, is the time for gold investors not to panic but to step back and look at the big picture’. Source: Crescat Capital

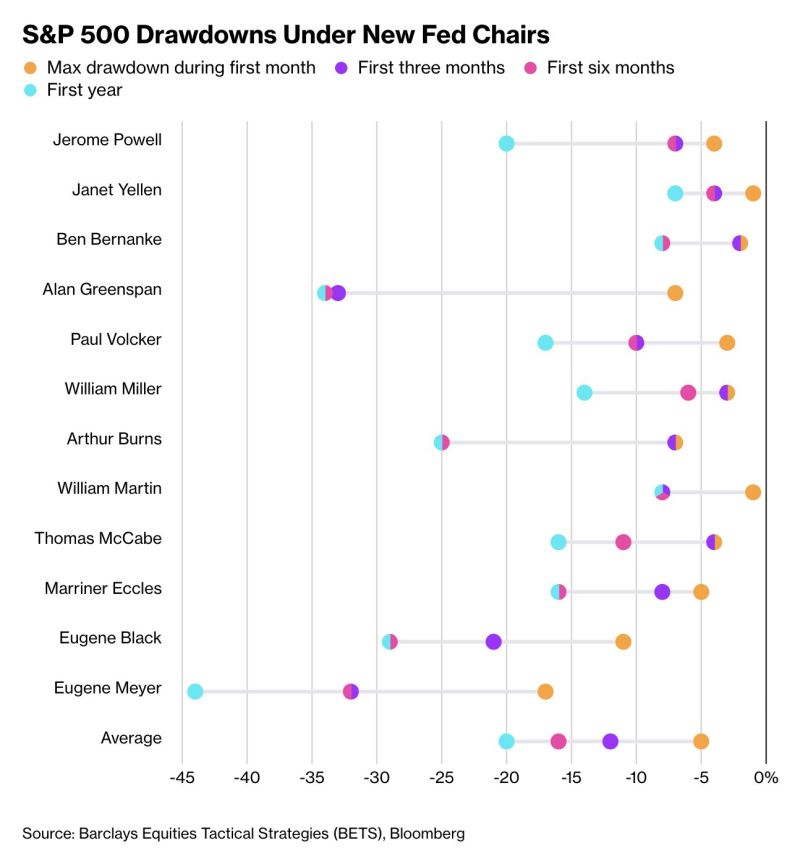

S&P 500 Drawdowns Under New Fed Chairs

Source: Bloomberg, Sam Ro, alexandraandnyc

Investing with intelligence

Our latest research, commentary and market outlooks