Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

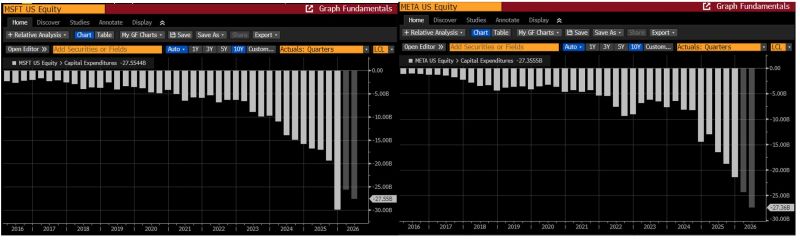

Microsoft and Meta quarterly CAPEX -realised and projected

These aren’t the old MSFT and META... Source: Bloomberg, RBC

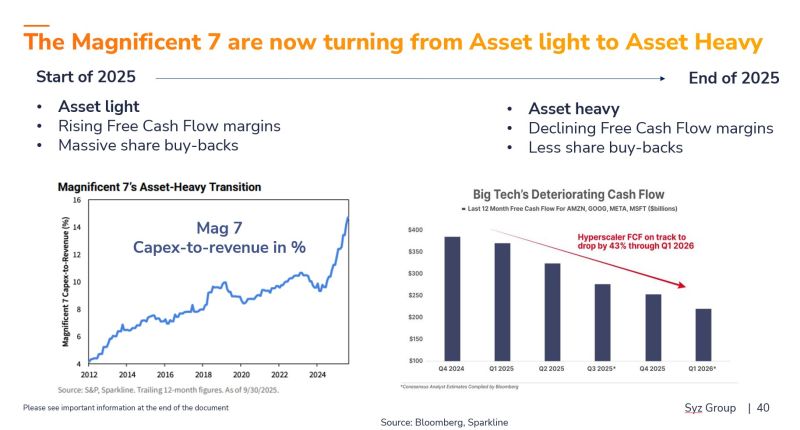

MSFT and META quarterly results (and capex projections) confirm our thesis: these are not your "old" Mag 7.

Indeed, the AI revolution has hit a major turning point as the largest U.S. tech companies embark on unprecedented AI infrastructure spending. The Magnificent 7 are now turning from Asset light to Asset Heavy. Although markets have so far rewarded this surge in investment, history shows that capex booms often lead to overbuilding, intensified competition, and disappointing stock performance. From Magnificent 7 to Magnificent risks ???

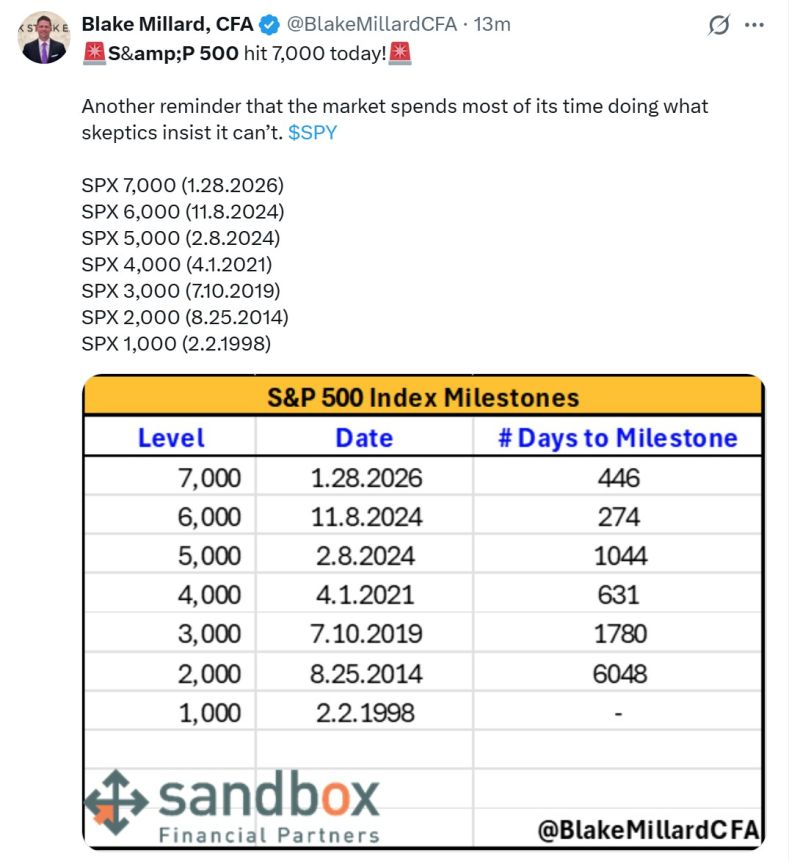

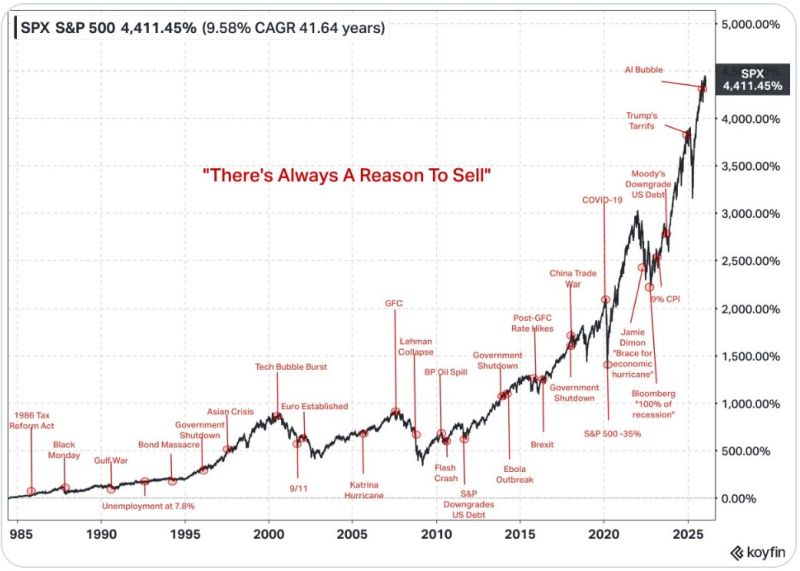

The S&P 500 just passed 7,000 for the first time ever

The index has added over $1.5 TRILLION in market cap within the past week 😳 Source: Peter Tuchman @EinsteinoWallSt Barchart

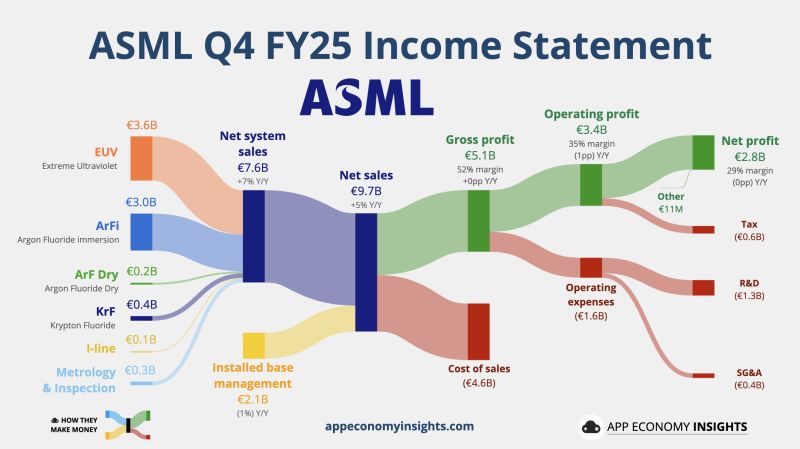

ASML just dropped their Q4-25 earnings, and the market is absolutely electric. ⚡️

Shares jumped 7%, and it’s not hard to see why. While the world was debating an "AI bubble," ASML’s customers just placed a record-breaking bet on the future. The headline? A massive demand explosion. 🚀 The Numbers You Need to Know: Net Bookings: €13.2B (Massive beat vs. €7B estimate). The demand isn't just there; it’s doubling expectations. Revenue: €9.7B (Beating the €9.58B estimate). Backlog: A staggering €38.8B. ASML has years of work already sold. 2026 Guidance: Revenue projected between €34B - €39B (Top end well above the €35B consensus). The "AI Realism" Shift 🧠 CEO Christophe Fouquet’s statement is the real kicker. He noted a "notably more positive assessment" from customers regarding the sustainability of AI-related demand. This isn't hype. This is capacity planning. This is the "picks and shovels" of the AI revolution being bolted into factories right now. Two High NA systems (the most complex machines humans have ever built) were officially recognized in Q4 revenue. The future is being shipped. Shareholder Value 💰 ASML isn't just growing; they are rewarding. A new €12B share buyback program through 2028 shows massive confidence in their long-term cash flow. The Verdict: ASML remains the ultimate bottleneck of the digital age. If you want AI, you need chips. If you want chips, you need ASML. Period. Is the semi-cycle just getting a second wind? 🌬️ Below the numbers and breakdown by App Economy Insights @EconomyApp · $ASML ASML Q4 FY25: • Net bookings €13.2B (€6.9B beat). • Net sales +5% Y/Y to €9.7B (€0.1B beat). • Gross margin 52% (+0pp Y/Y). • Operating margin 35% (-1pp Y/Y). • EPS €7.35 (€0.23 miss). • FY26 Net sales ~€36.5B (€1.4B beat).

FT headline today as S&P 500 hit a new all-time high yesterday

Does it mean that the "sell US assets" narrative is already dead? Source: FT

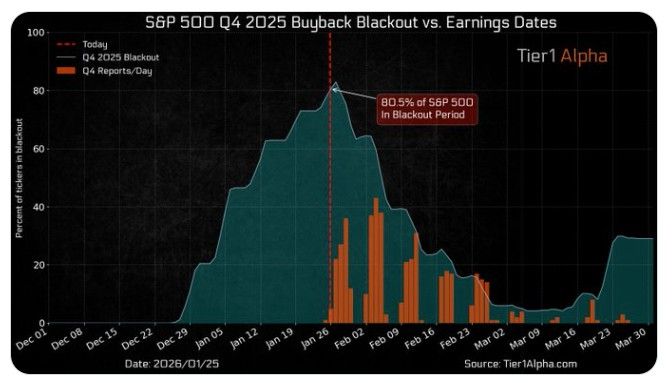

Over 80% of $SPX constituents have entered their buyback blackout window, reducing corporate support as we kick off the Q4 earnings season.

Source: Hedgeye

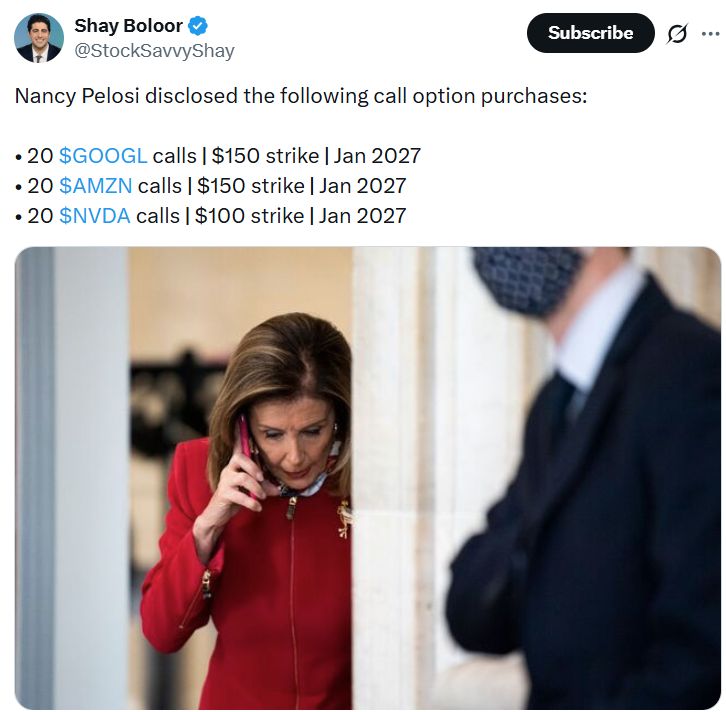

Nancy Pelosi just filed ~$69M worth of new stock trades

Including selling $50M of Apple $AAPL Major sells include: - Sold $50M shares of Apple $AAPL - Sold $5M shares of Nvidia $NVDA - Sold $5M shares of Disney $DIS She bought new call options: - Bought $500K of $GOOGL LEAPS - Bought $500K of Amazon $AMZN LEAPS - Bought $500K of Apple $AAPL LEAPS - Bought $250K of Nvidia $NVDA LEAPS Source: Nancy Pelosi Stock Tracker on X

Investing with intelligence

Our latest research, commentary and market outlooks