Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

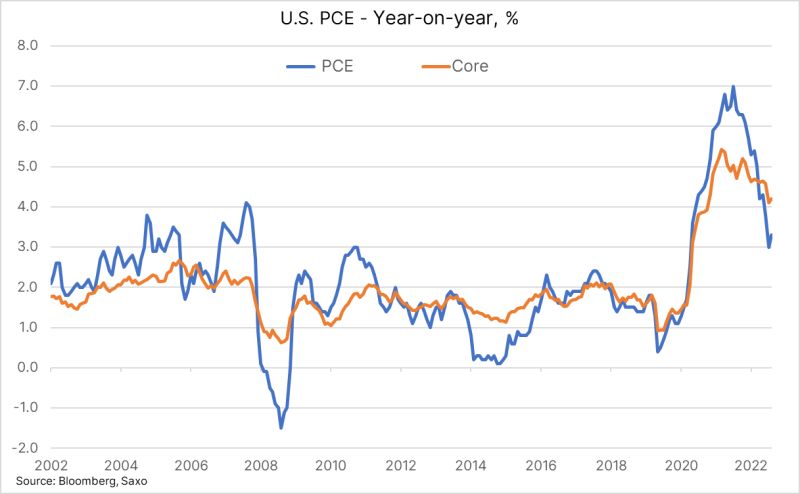

PCE Deflator, the FOMC's favorite inflation number, show a rise as expected with the YoY at 3.3% (from 3%) and the core at 4.2% (from 4.1%)

Jobless claims at 228k (235k expected) showing continued strength ahead of Friday's NFP report Source: Ole S.Hansen

Disinflation pause?

Eurozone inflation remained stuck at 5.3% in Aug, higher than the 5.1% that economists expected. Core inflation, which excl volatile energy, food, alcohol & tobacco prices & closely watched by ECB as measure of underlying inflation, tumbled to 5.3% in Aug from 5.5% in July, matching expectations. Source: HolgerZ, Bloomberg

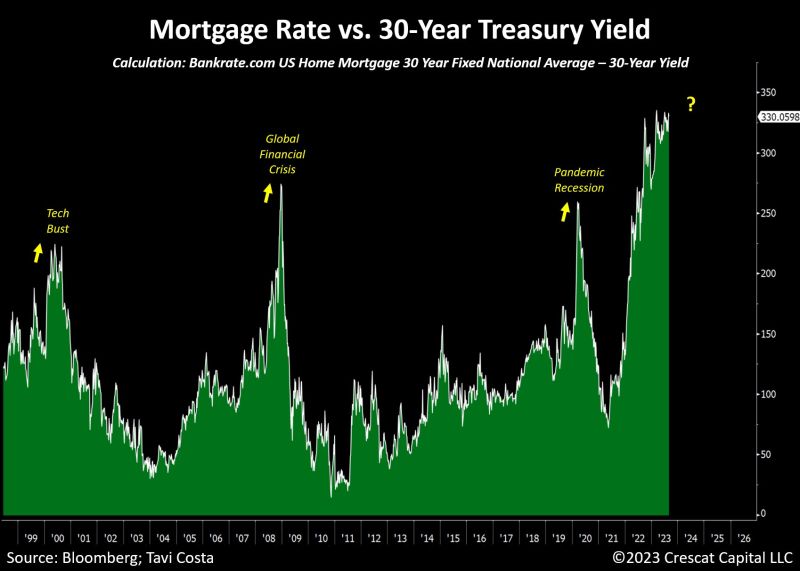

We are now seeing the widest spread between mortgage rates and 30-year risk-free rates in history

Should we see this as another barometer of credit tightness in the system? Source: Crescat Capital, Bloomberg

French CPI a little hotter than expected, rising 50bp in August

This was all due to energy (including higher regulated prices) and the end of the summer sales, but services inflation is still easing driven by transports and "other services". FRENCH CPI YOY NSA PRELIM ACTUAL 4.8% (FORECAST 4.6%, PREVIOUS 4.3%) FRENCH CPI MOM NSA PRELIM ACTUAL 1% (FORECAST 0.8%, PREVIOUS 0.1%) FRENCH HICP MOM PRELIM ACTUAL 1.1% (FORECAST 1%, PREVIOUS 0.0%) FRENCH CONSUMER SPENDING MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.9%) Source: Bloomberg

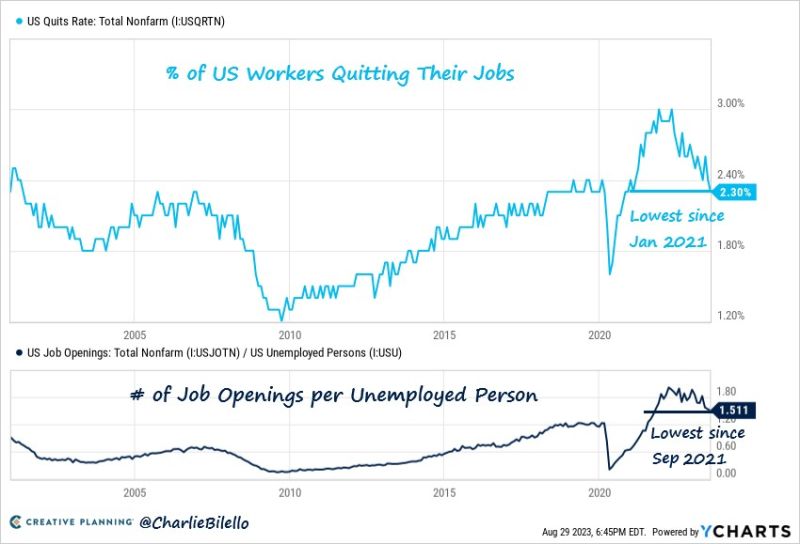

The percentage of US workers quitting their jobs has moved down to 2.3%, the fewest since January 2021

The 1.5 job openings per unemployed person in the US is lowest since September 2021. Labor market continues to loosen... Source: Charlie Bilello

Treasury yields extend retreat from year’s highs after GDP data

Short-maturity yields led the move, with two-year yields declining about five basis points to around 4.85%, and most yields reached the lowest levels in more than two weeks. The

benchmark 10-year note’s yield touched 4.085%, the lowest level since Aug. 11.

Following downward revisions to the economy’s Q2 growth rate and related inflation measures, swap contracts tied to Fed meeting dates priced in slightly less than a 50% chance of another rate increase this year. Source: Bloomberg

Germany's inflation drops to 6.1% in Aug from 6.2% in July while Core inflation stagnates at 5.5%

BUT 6.1% headline reading was 10 basis points above market predictions as energy prices accelerated to 8.3% in Aug from 5.7% in Jul. Food price inflation slowed to 9% in Aug from 11% in July. Source: HolgerZ, Bloomberg

EGGFLATION... With the price of eggs up +13% yesterday and +33% for the month, consumers are shelling out more and more for groceries

Thank you Hedgeye for the great cartoon Source: WallStreetSilver, WSJ

Investing with intelligence

Our latest research, commentary and market outlooks