Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

Setting the stage for a two-day appearance on Capitol Hill this week, the central bank leader said the economy remains strong as does the labor market, despite some recent cooling. Powell cited some easing in inflation, which he said policymakers stay resolute in bringing down to their 2% goal. “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Source: CNBC, Yusuf on X

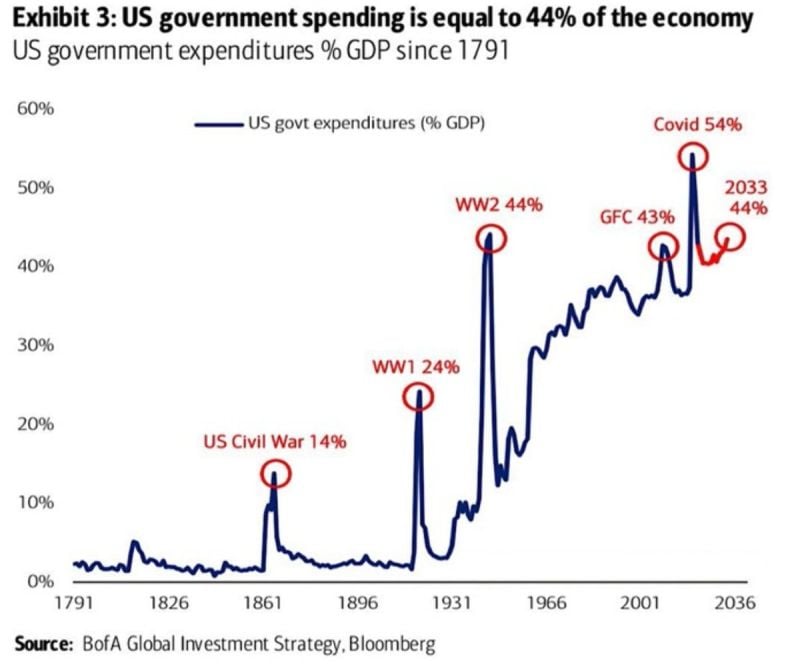

US GOVERNMENT SPENDS MONEY AS IF THERE IS A CRISIS:

US government spending as a % of GDP is now ~43%, in line with THE GREAT FINANCIAL CRISIS. This is just 1 % below World War II levels. Only the COVID crisis saw higher expenditures as a share of GDP of 54%... Source: BofA, Global Markets Investor

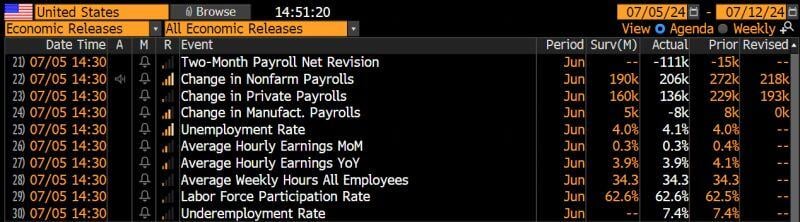

Latest US jobs numbers show economic momentum keeps cooling: Non-farm-payrolls rose by 206k jobs in June, ahead of 190k forecast.

However, 2 months net revisions were NEGATIVE with -110k. Moreover, government employment rose by a whopping 70k while PRIVATE employment with 136k was below estimates. Unemployment rate rose to 4.1% from 4.0% due to higher labor participation rate. Wage rose 3.9% YoY in line w/estimates. Bottom-line: these numbers seem to confirm our thesis that the US job market is NORMALIZING hence reinforcing the disinflation trend which will ultimately enable policy makers to NORMALIZE. More to come from our Chief Economist Adrien Pichoud... stay tuned... Source: Bloomberg, HolgerZ

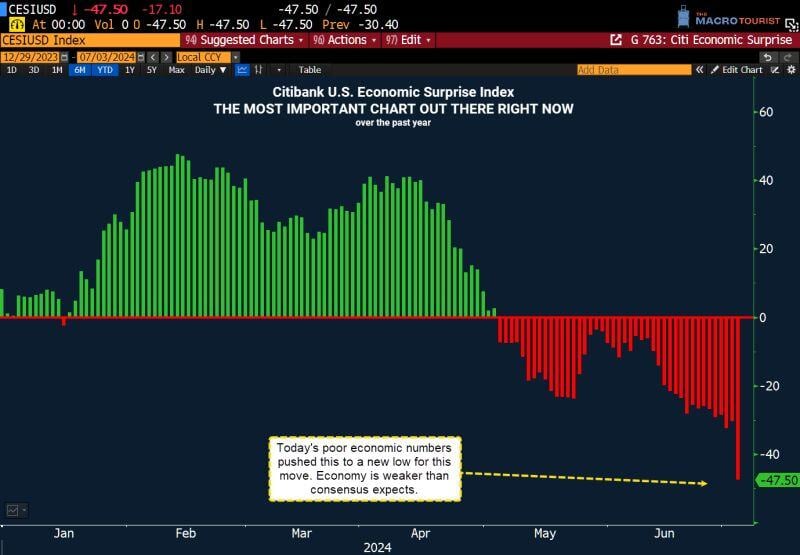

Another new low for the Citigroup US surprises index on the back of poor macro numbers this week (ADP employment, ISM services, etc.)

Source: Bloomberg, Ronald-Peter Stoeferle, CMT, CFTe, MSTA

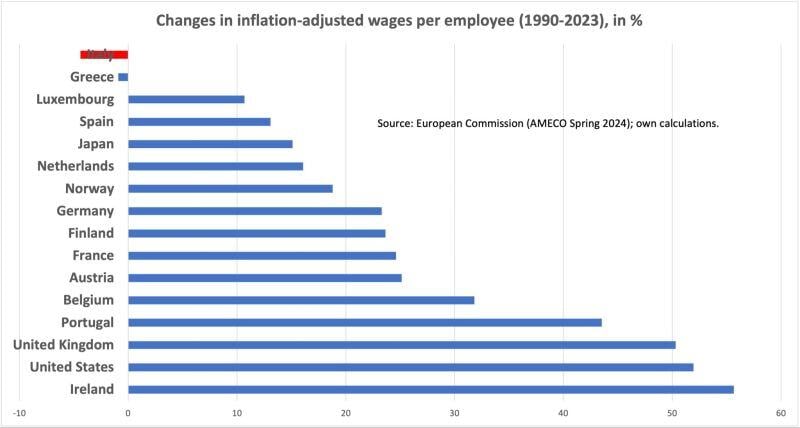

Italians make in real terms less today than they used to in 1990, one really needs to admire how calm they stay about it.

Chart: Michel A.Arouet, @heimbergecon

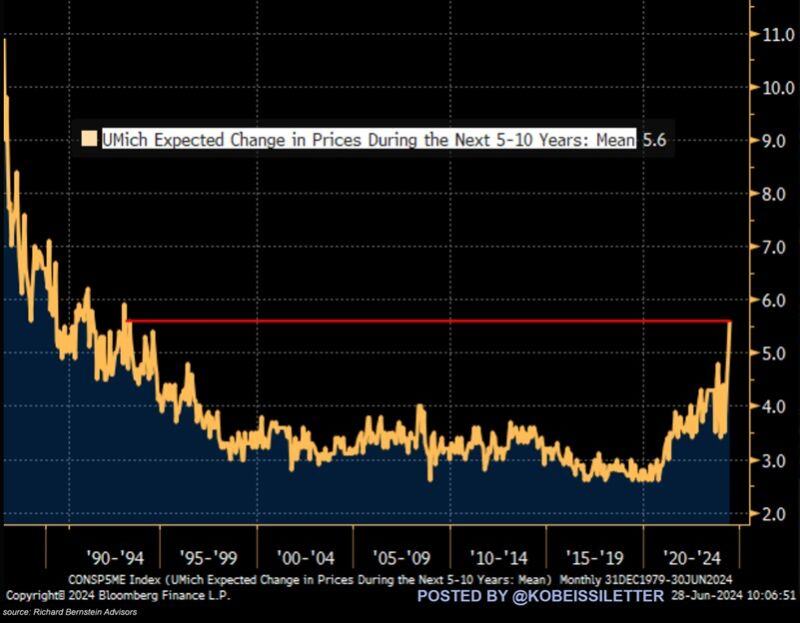

BREAKING: US consumers' average 5-10 year inflation expectations have spiked to 5.6%, the highest in 31 years.

This measure increased by ~2 percentage points in just a few months. By comparison, median inflation expectations are around 3%, in-line with the readings seen over the last 3 years. Meanwhile, CPI inflation has been above 3% for 38 consecutive months, the longest streak since the 1990s. Will inflation stay a major issue in H2 2024? Source: The Kobeissi letter, Bloomberg

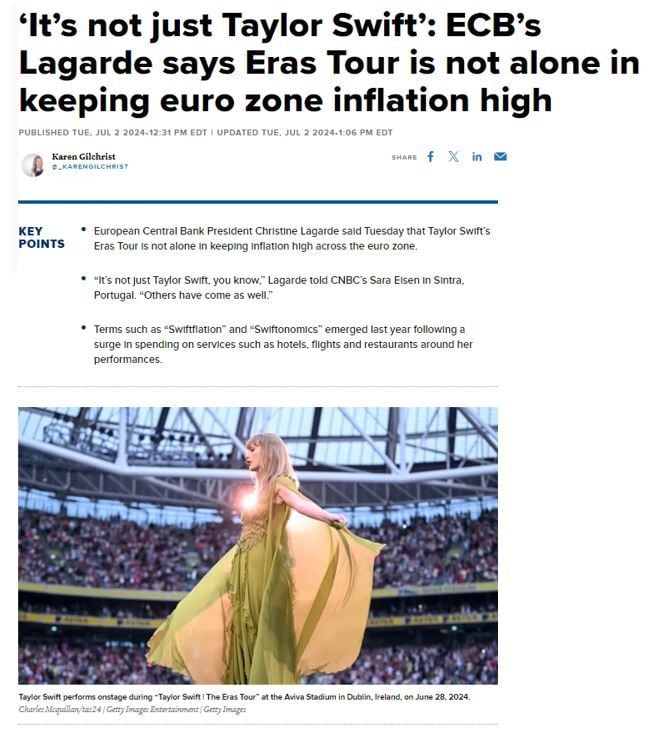

Good to know Mrs Lagarde...

ECB President Christine Lagarde said Tuesday that Taylor Swift’s Eras Tour is not alone in keeping inflation high across the euro zone. “It’s not just Taylor Swift, you know,” Lagarde told CNBC’s Sara Eisen in Sintra, Portugal. “Others have come as well.” Terms such as “Swiftflation” and “Swiftonomics” emerged last year following a surge in spending on services such as hotels, flights and restaurants around her performances.

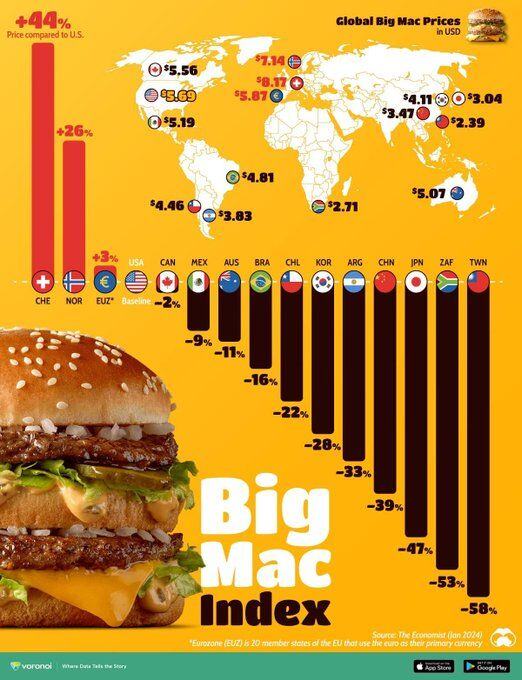

The price of a Big Mac vs. the US in selected countries

Source: Voronoi

Investing with intelligence

Our latest research, commentary and market outlooks