Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

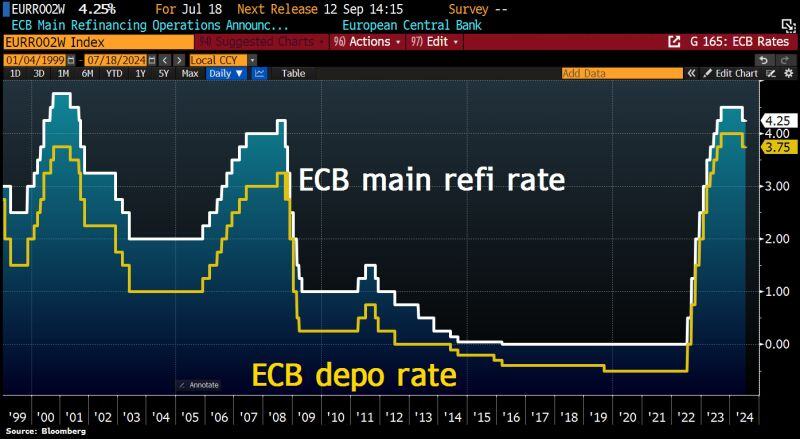

ECB leaves all rates unchanged as expected.

Main Refi at 4.25%, deposit rate at 3.75%. Guidance on interest rates also stays unchanged: Not pre-committing to particular path. ECB to follow data-dependent, meeting-by-meeting approach. Source: Bloomberg, HolgerZ

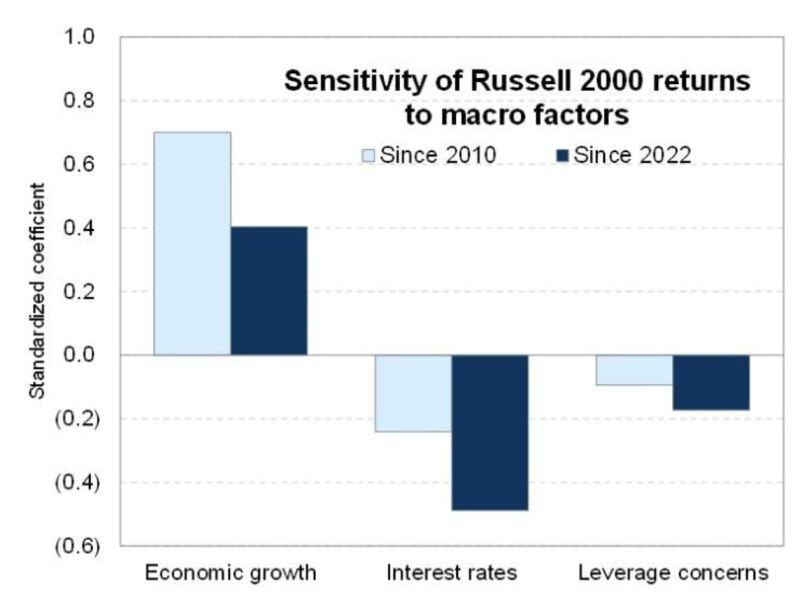

For US small caps, rates just as important as growth since 2022.

And as we know, March of 2022 is when the hiking cycle began... Source: GS, RBC

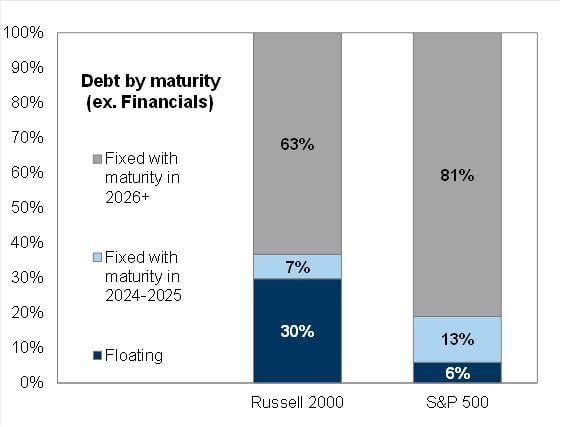

A large portion of Russell 2000 debt load is floating

It thus makes a lot of sense that small-caps were the most hot by monetary policy tightening / higher interest rates. Now the Street is anticipating rate cuts, small-caps underperformance might be coming to an end... Source: GS

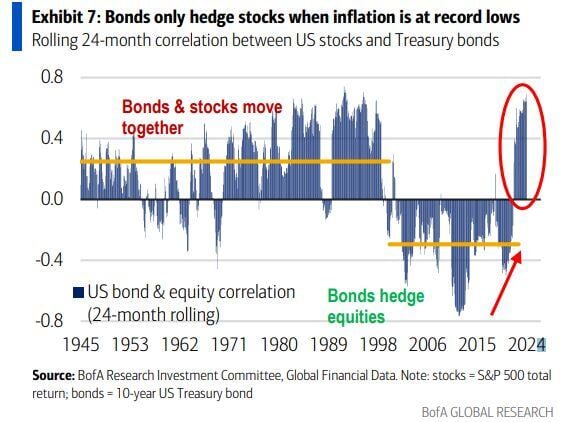

Historically, bonds acted as efficient portfolio hedges only when inflation is <2%.

Below is the rolling 24-month correlation between US stocks and Treasury bonds. Source: Mike Zaccardi

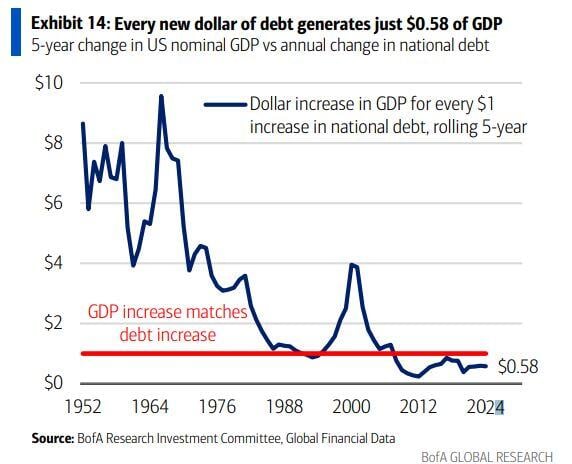

Unproductive debt...

Every new dollar of US debt generates just $0.58 of GDP Source: Mike Zaccardi, BofA

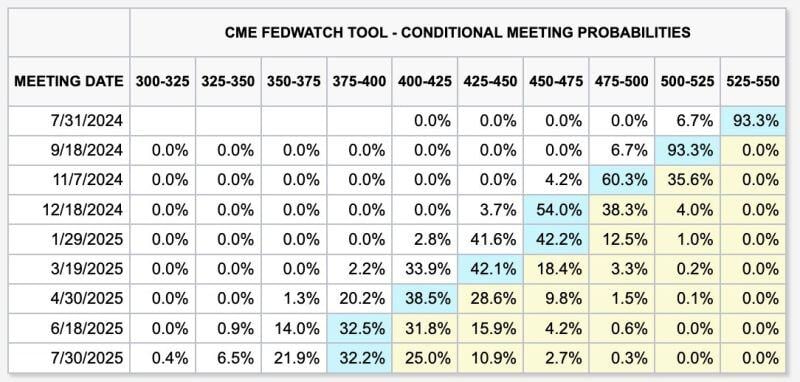

Markets now have a BASE CASE of 6 FED interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September. Discussions of a 50 basis point interest rate cut have even begun to emerge. This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks. Source: The Kobeissi Letter, CME

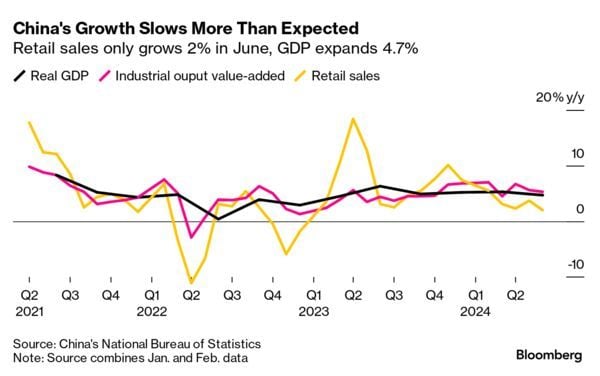

China Q2 GDP growth slowed more than expected (+4.7% yoy vs. +5.1% yoy expected), but the big surprise is just how weak retail sales were - growing only 2% in June.

-> China’s National Bureau of Statistics on Monday said the country’s second-quarter GDP rose by 4.7% year on year, missing expectations of a 5.1% growth, according to a Reuters poll. -> June retail sales also missed estimates, rising 2% compared with the 3.3% growth forecast. -> Industrial production, however, beat expectations up by 5.3% in June from a year ago, higher than Reuters estimate of 5% growth. -> Urban fixed asset investment for the first six months of the year rose by 3.9%, meeting expectations. Investment in infrastructure and manufacturing slowed their pace of growth on a year-to-date basis in June versus May, while real estate investment declined at the same 10.1% rate. The National Bureau of Statistics did not hold a press conference for the data release. China’s high-level policy meeting, the Third Plenum, kicks off Monday and is set to wrap up Thursday. Source: Bloomberg, CNBC

In Germany, the number of corporate insolvencies up by a third.

In April 2024, the local courts reported 1,906 corporate insolvencies. The courts put the creditors' claims from the corporate insolvencies reported in April 2024 at ~€11.4bn. In April 2023, the claims had totaled ~€1.3bn. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks