Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

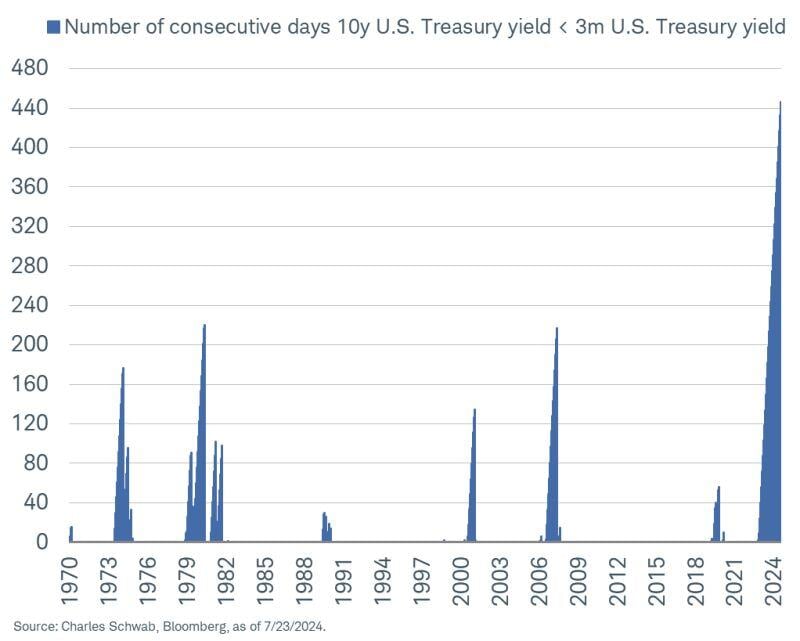

US 10y-3m yield spread has been negative for more than 440 days.

But no recession so far... Source: Kevin Gordon

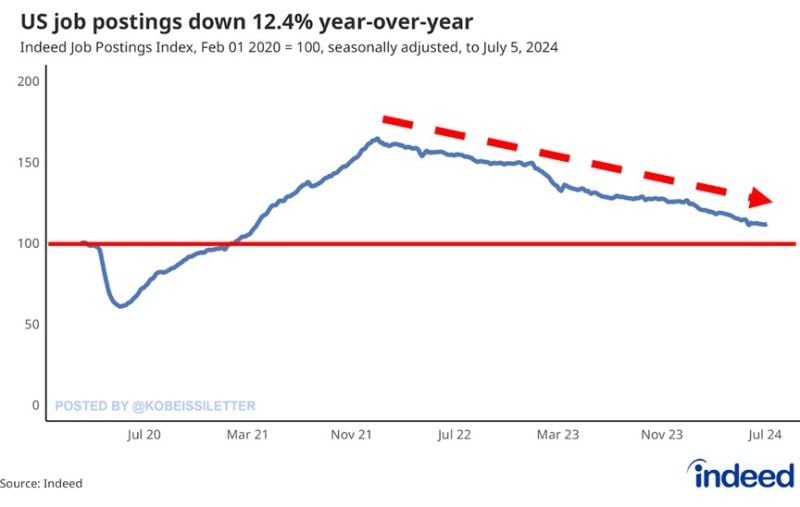

The US labor market continues to weaken.

US job postings on indeed.com declined 12.4% year-over-year to their lowest level since April 2021. Overall, US job postings are down by ~50% since their December 2021 record. However, nationwide job postings are still 11.7% above their pre-pandemic baseline, according to Indeed. Meanwhile, US job openings unexpectedly increased in May to 8.14 million from 7.92 million in April, according to the latest BLS data. Data provided by Indeed is more current than the BLS-provided series, which suggests a further decline in US job openings is coming. Source: The Kobeissi Letter, Indeed.com

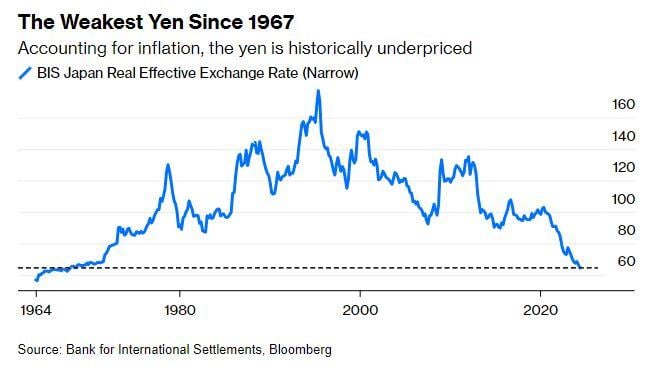

Adjusting for inflation, the Japanese Yen is at its weakest point in 57 years 🚨

Source: Barchart, Bloomberg

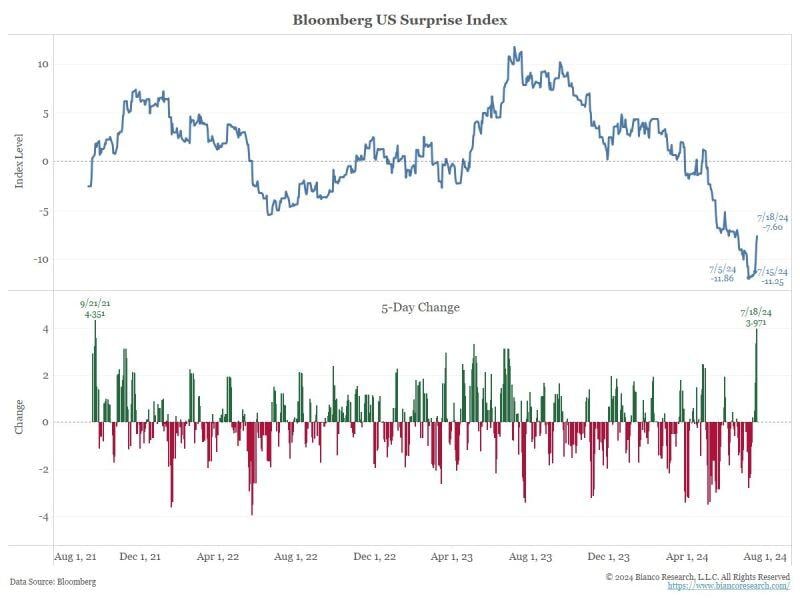

The most interesting question going into next week is whether the US economy is picking up.

Did it start with the release of the June data? Is this going to frustrate a September rate cut? The Bloomberg Surprise Index (see chart below) bottomed on July 5, the nonfarm payroll release date. Since then, it has been trending higher. The move higher over the last five days (one business week) has been the biggest since September 2021 (bottom panel). Source: Jim Bianco, Bianco Research

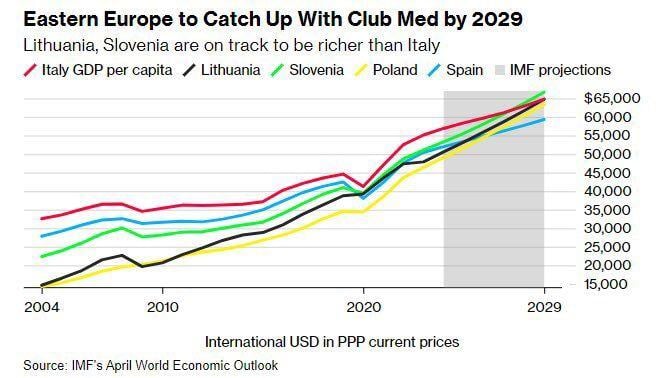

What is happening in Poland is nothing short of economic wonder.

Standard of living in Poland overtaking Spain and Italy within just one generation is amazing. Source: Michel A.Arouet, IMF

This is not a Trump trade but rather a "soft landing trade" => Stocks have rallied on the prospects of a soft landing for the economy

Source: Edward Jones

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

Stocks have rallied on the prospects of a soft landing for the economy">

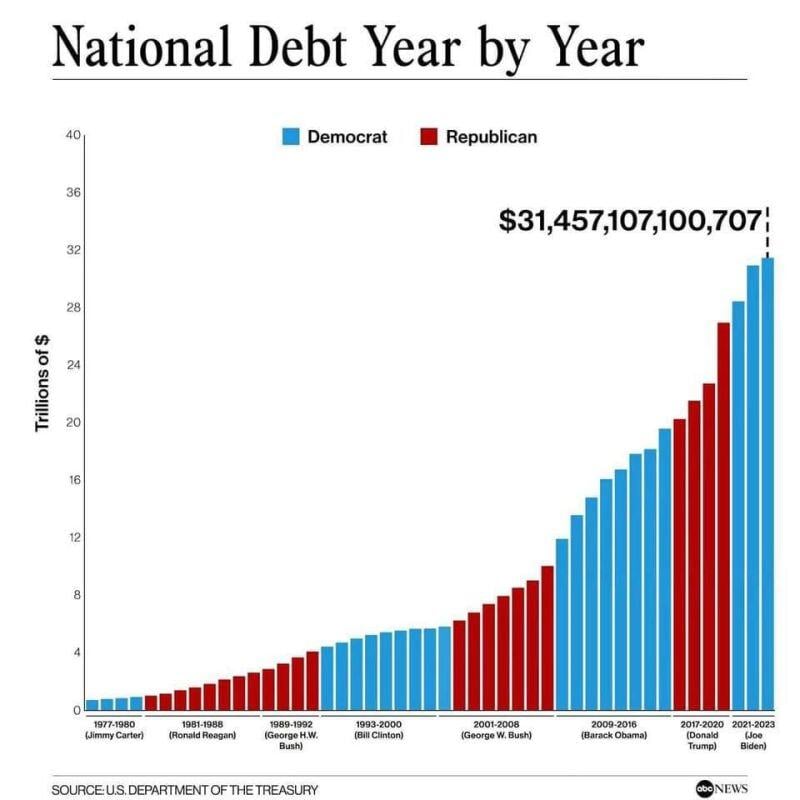

US National debt. A bit of maths...

The current level is almost $35 trillion. And the government has baked in minimum $2 trillion deficits going forward. There are $5 trillion in government revenues per year. 100% of government revenue is consumed by Social Security, Medicare, Medicaid and interest on the debt. Interest on the debt is WAY over $1 trillion per year, more than 20% of government revenue. It takes another $2 trillion minimum per year to fund defense and all of the other departments of the government that they are unwilling to cut. There are also extra items like Ukraine and whatever the wars going on that get additional off budget funding. It should thus keep rising. Source: Wall Street Silver, ABC News

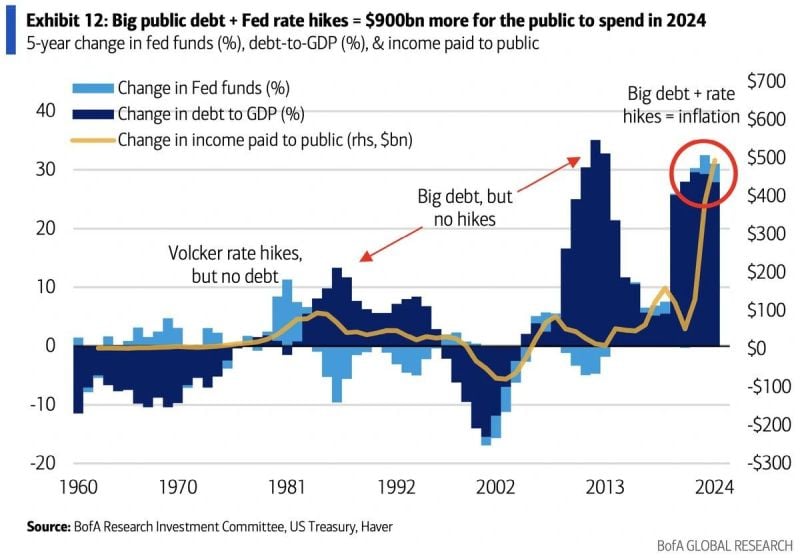

Interesting point of view by BofA:

"Fewer investors have focused on the inflationary effects of higher income. No other Fed hiking cycle in history occurred while government debt was so large ... interest payments flow to holders of Treasury securities and some portion will be spent." Source: BofA, Octavian Adrian Tanase

Investing with intelligence

Our latest research, commentary and market outlooks