Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

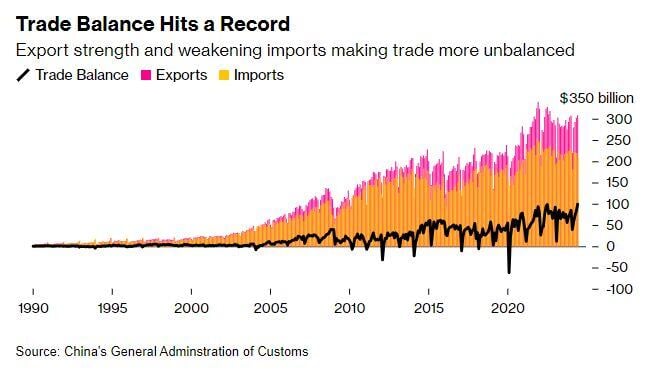

China posts biggest monthly trade surplus in at least 24 years, nearly $100B in June - Bloomberg

China’s trade surplus soared to an all-time high in June, with a jump in exports overwhelming an unexpected decline in imports and raising the risk of greater trade tensions. Exports rose to $308 billion, expanding for a third straight month to the highest level in almost two years, the customs administration said Friday. Imports fell to $209 billion, leaving a record trade surplus of $99 billion for the month. The growing imbalance has spooked China’s trade partners, who have responded with more tariffs on Chinese imports including electric vehicles. This tension has worsened ties between the European Union and Beijing, which this week opened a tit-for-tat probe into the EU’s trade barriers in what could bring the economies closer to a trade war. The surplus “reflects the economic condition in China, with weak domestic demand and strong production capacity relying on exports,” said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management. However, “the sustainability of strong exports is a major risk for China’s economy in the second half of the year. The economy in the US is weakening. Trade conflicts are getting worse.” Source: Bloomberg

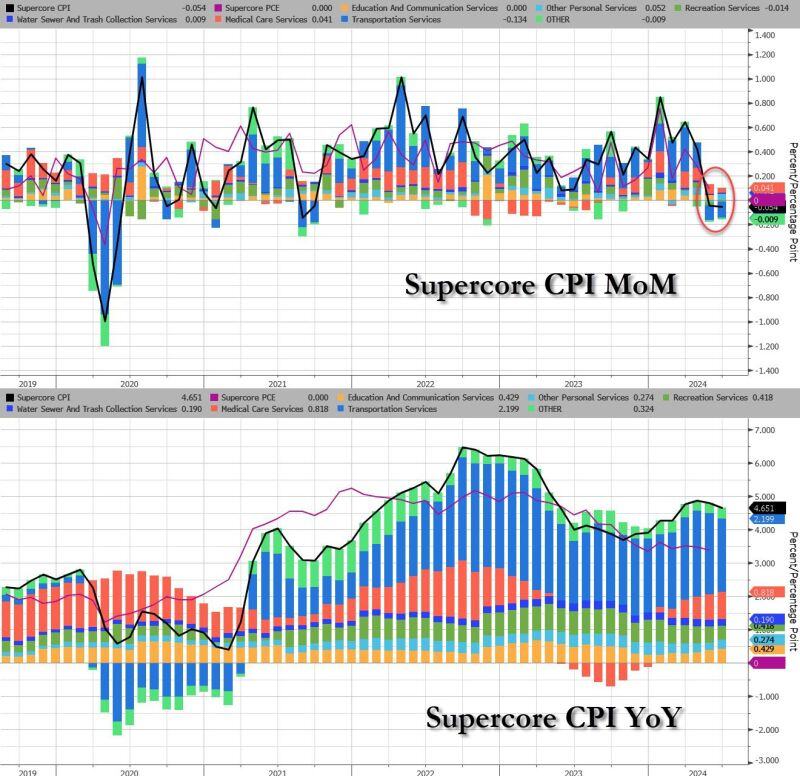

US supercore CPI is negative MoM for the 2nd month in a row

zerohedge.com, Bloomberg

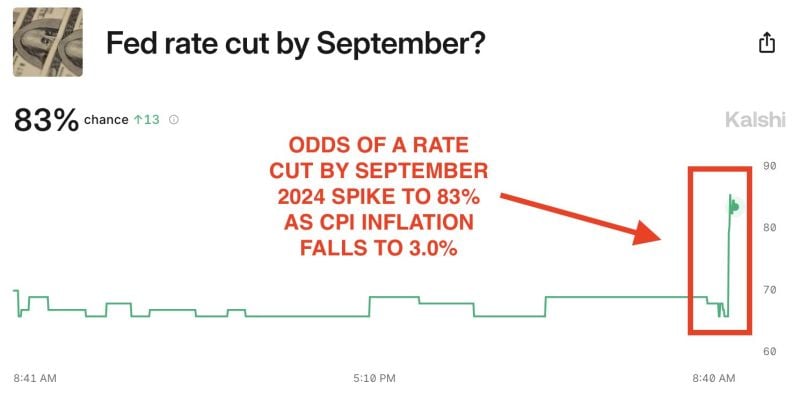

BREAKING: Odds of a Fed rate cut by September 2024 skyrocket to 83% after June CPI inflation, according to Kalshi.

June 2024 marked the first NEGATIVE month-over-month inflation print since May 2020. Headline inflation is now at a 12-month low and 100 basis points away from the Fed's 2% target. Prior to the CPI inflation report today, prediction markets saw a 67% chance of rate cuts by September. Exactly 1 year ago, the Fed stopped raising interest rates. Does the Fed have the green light to cut rates? Source: The Kobeissi Letter

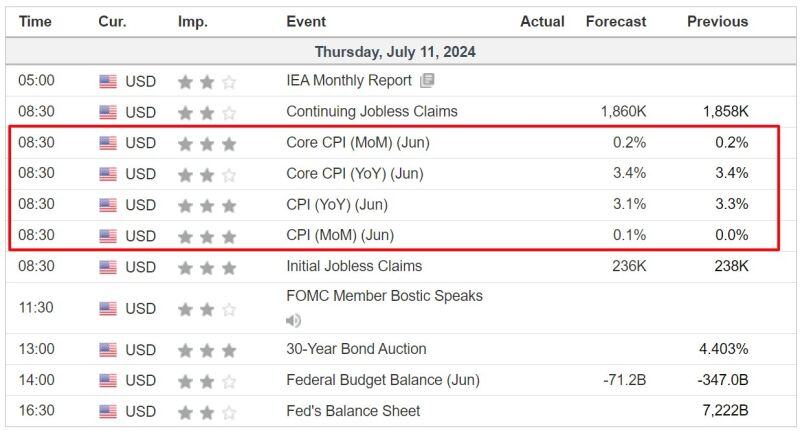

🚨 BREAKING NEWS: US CPI for June just came in at -0.1% MoM below expectations of 0.1% MoM

US CPI for June just came in at +3% YoY below expectations of +3.4% YoY Core CPI inflation fell to 3.3%, below expectations of 3.4%. This marks the 39th consecutive month with inflation at or above 3%. It's also the 3rd straight month with declining CPI inflation. Looks like a September rate cut is coming. Source: Jesse Cohen

US CPI estimates by firm

TD Securities: 3.0% JP Morgan: 3.1% Wells Fargo: 3.1% Citadel: 3.1% Barclays: 3.1% CitiGroup: 3.1% Goldman Sachs: 3.2% Bank of America: 3.2% Morgan Stanley: 3.5% Previous: 3.3% Median: 3.1% Source: TrendSpider

Some wise words by Reagan

Source: Wall Street Silver

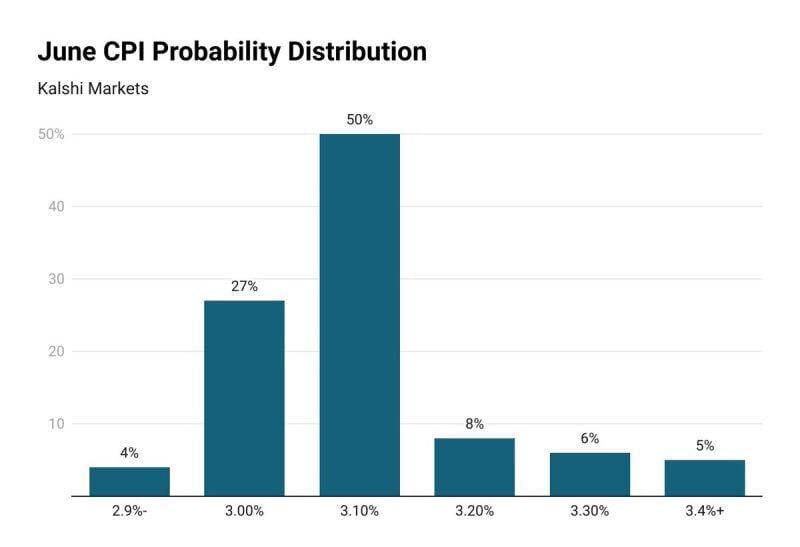

An important US macro data is expected today: the CPI inflation data for June. The median forecast for headline CPI inflation is 3.1%, but markets are showing a wide range.

Prediction markets currently show that there is a 19% chance of June CPI inflation coming in ABOVE 3.1%, according to Kalshi. On the other hand, there's a 31% chance of inflation coming in BELOW 3.1%. There's even a 5% chance of CPI coming in above 3.3%, which would put inflation back on the rise. If CPI inflation comes in as expected, it would mark the 3rd straight monthly decline in YoY inflation. Source: The Kobeissi Letter

Oops... I missed this one... Russia's economy has defied sanctions in the two years since Moscow invaded Ukraine in February 2022

So much so that the World Bank is now classifying Russia as a "high-income country." On Monday 1st of July, the World Bank announced it has upgraded Russia from an upper-middle-income country to a high-income country, according to a report from the financial institution's economists. "Economic activity in Russia was influenced by a large increase in military-related activity in 2023," World Bank economists wrote in their report. Last year, Russians earned $14,250 per person on a gross national income basis. The World Bank's upgrade confirms reports from Russia that suggest the growth is primarily driven by wartime activities that generate demand for military goods and services, making some sectors winners in Russia's wartime economy. Russia's trade jumped by nearly 7% last year, while activities in the financial sector and construction grew by 6.6% and 3.6%, respectively. This boosted Russia's real GDP — which is economic growth adjusted for inflation — by 3.6%. The development has made some poor Russians better off financially, complicating any calculus over how to end the war.

Investing with intelligence

Our latest research, commentary and market outlooks