Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

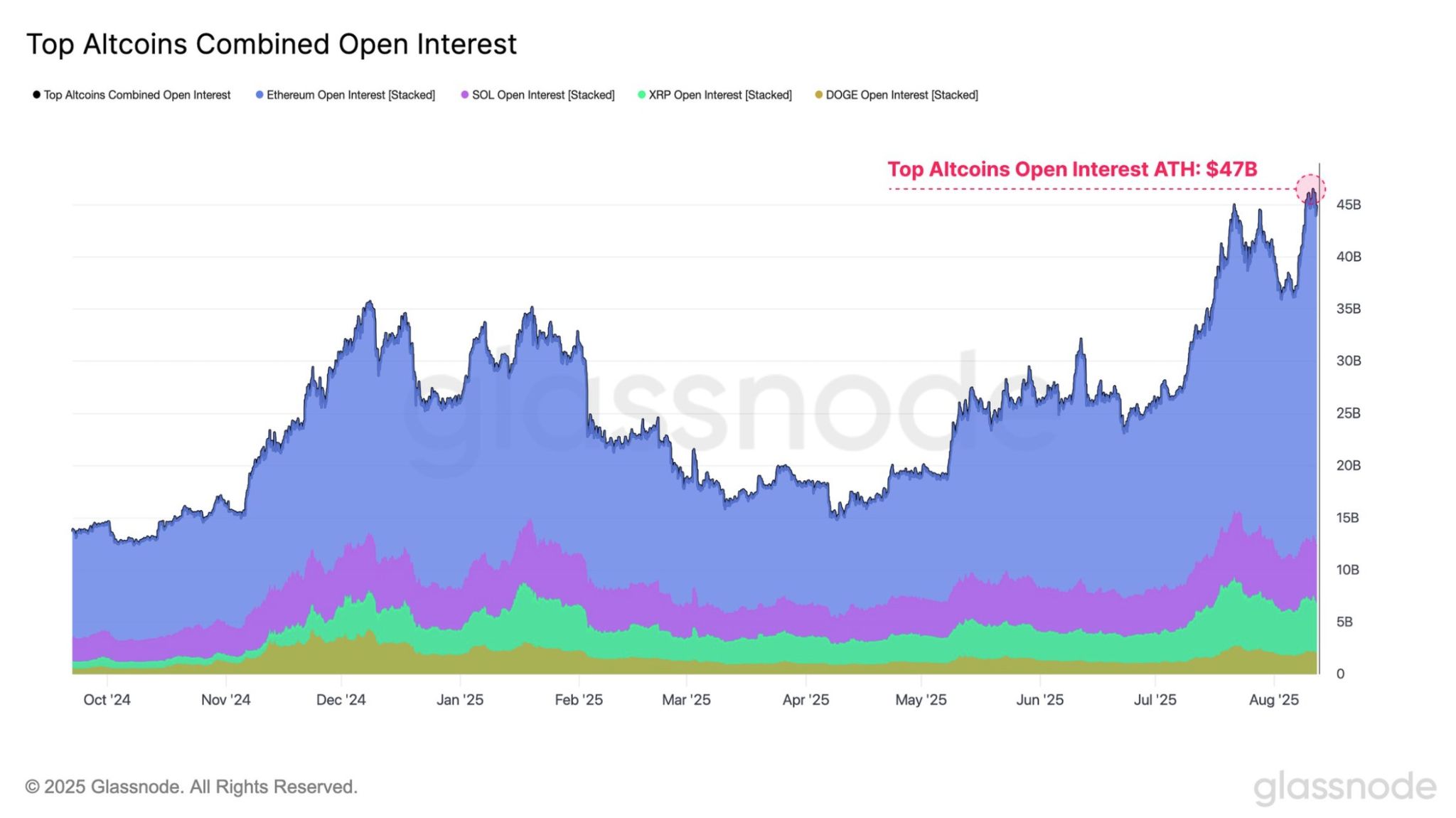

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Robinhood $HOOD July 2025 metrics

+160K funded accounts +$298B Assets under Custody (AUC), +106% YoY +$6.4B in net deposits, +28% YoY +$33.6B in cash sweep, +54% YoY +$209B in equities trading volumes, all time high +$196M option contracts traded, all time high +$16.8B crypto volumes, +217% YoY +$11.4B margin balances, +111% YoY Absolutely incredible execution. Source: amit @amitisinvesting $HOOD

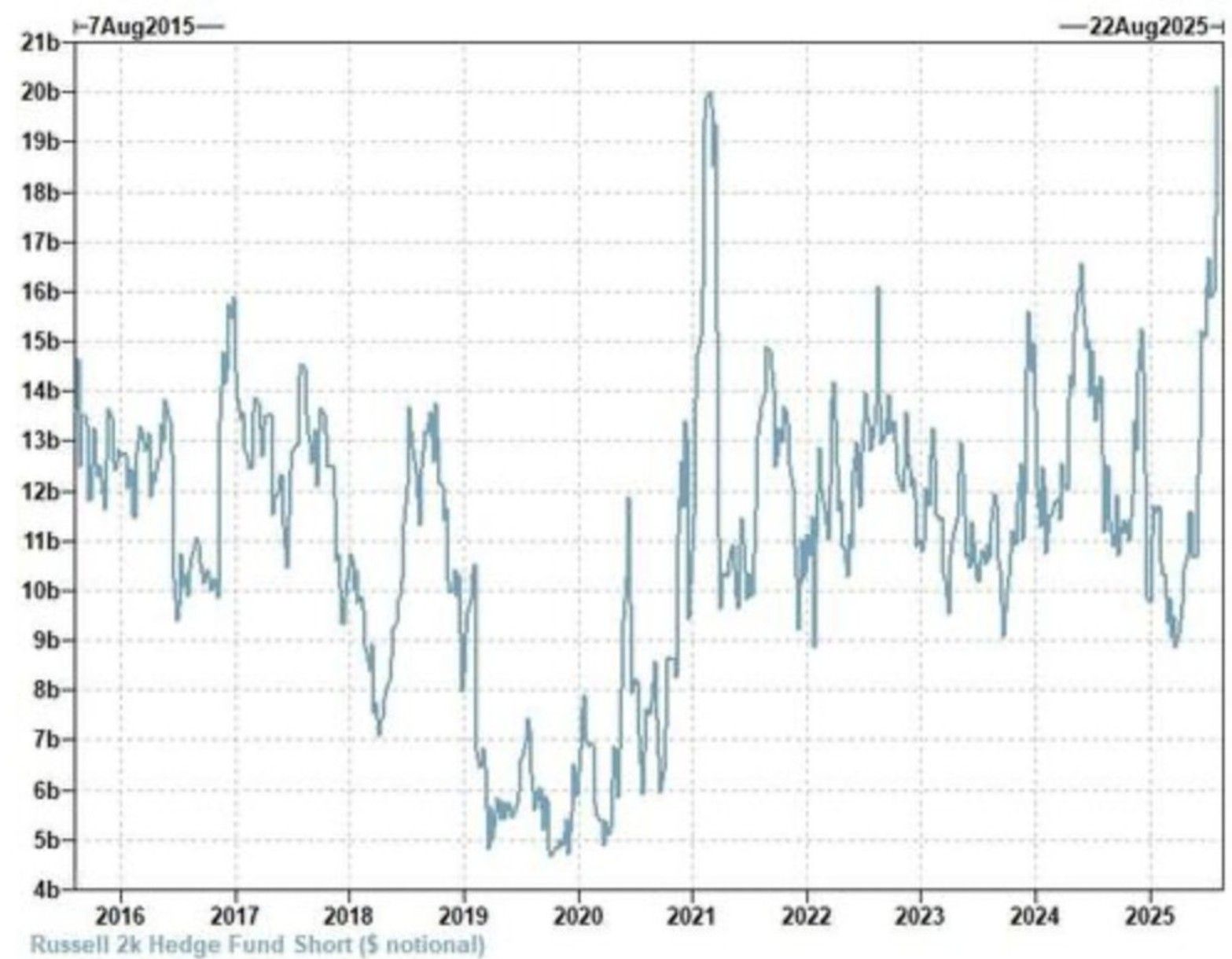

US small-caps are breaking higher in a substantial factor rotation.

As highlighted by Andreas Steno Larsen on X, being short Russell 2000 index is a very crowded trade. A short-squeeze in the making?

Isn't this the time of year when volatility typically picks up?

Source: Lance Roberts

Investing with intelligence

Our latest research, commentary and market outlooks