Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

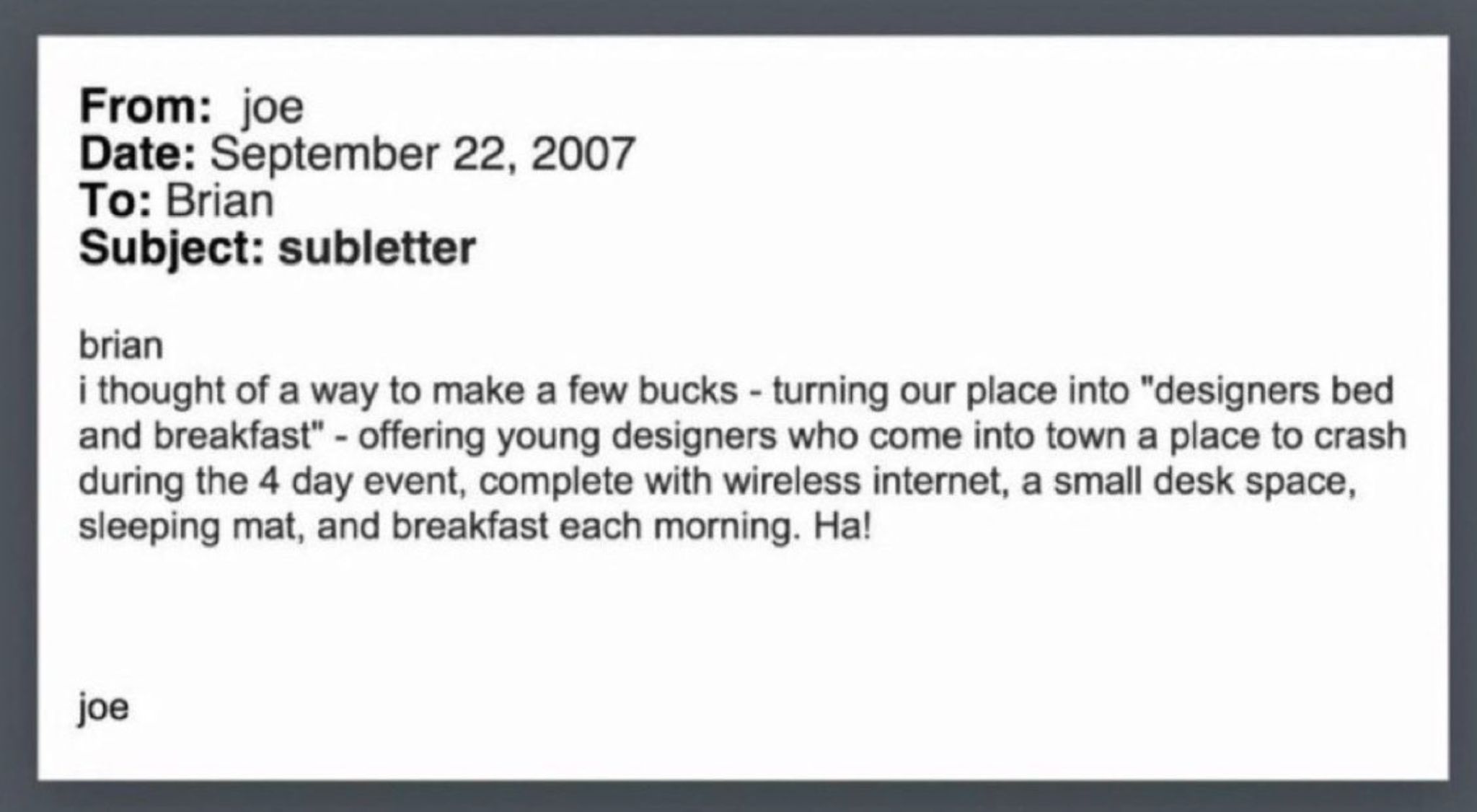

2007: Airbnb was an idea. 2025: $45 million in revenue a day.

Source: Jon Erlichman

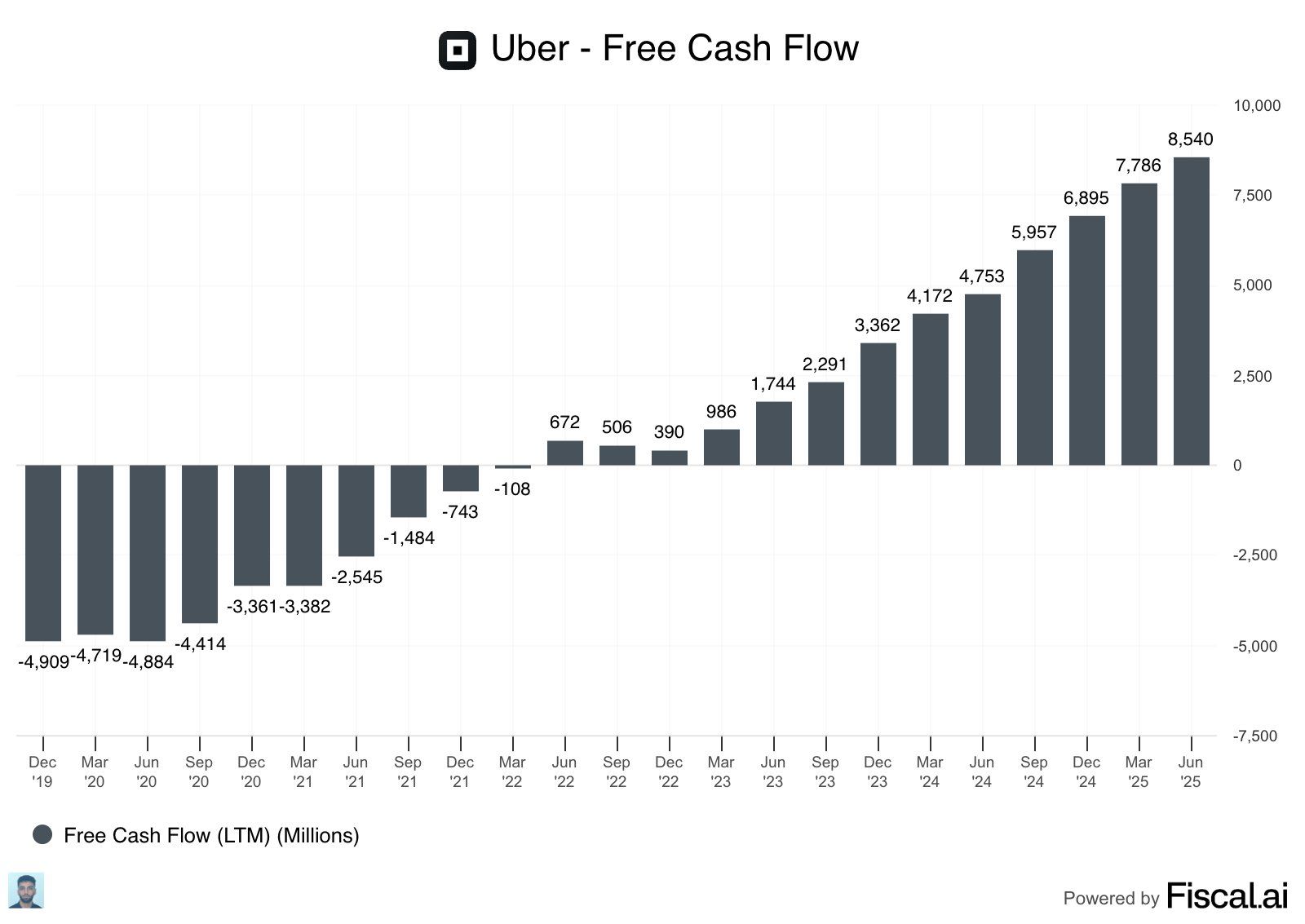

Updated Uber Free Cash Flow chart is incredible.

$8.5B and counting! 🤯 $UBER Source: Fiscal.ai

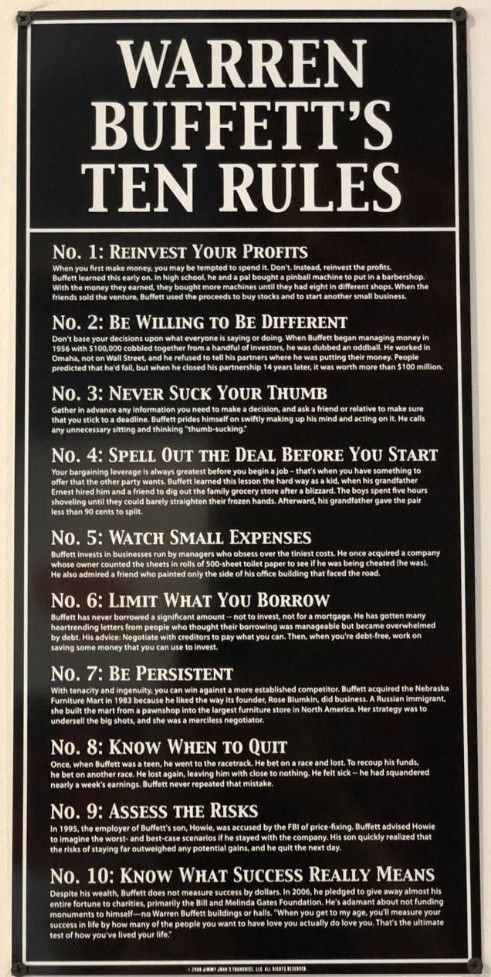

Buffett's 10 investing rules

Source: Invest In Assets @InvestInAssets

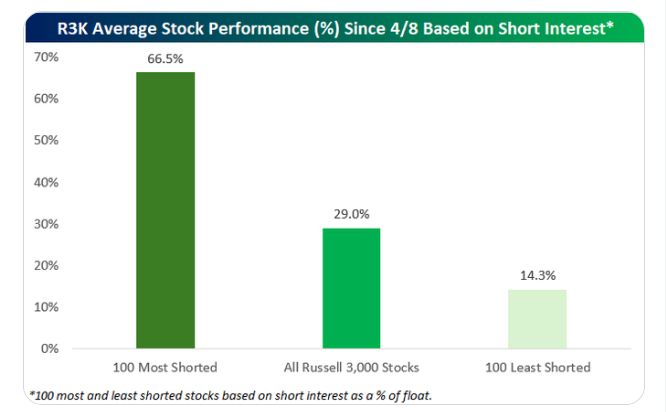

Update on the short squeeze...

The 100 most heavily shorted stocks in the Russell 3,000 are now up 66.5% since the 4/8 low versus 29% for all stocks and 14% for the 100 least shorted. Source: Bespoke

The german stockmarket’s brief comeback (as a percentage of world's market cap) appears to be over – at least for now.

The surge in US big tech stocks, the underperformance of German equities, and a weakening Euro have pushed Germany’s share of global stock market capitalization down to 2.2%, from 2.4% in May. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks