Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

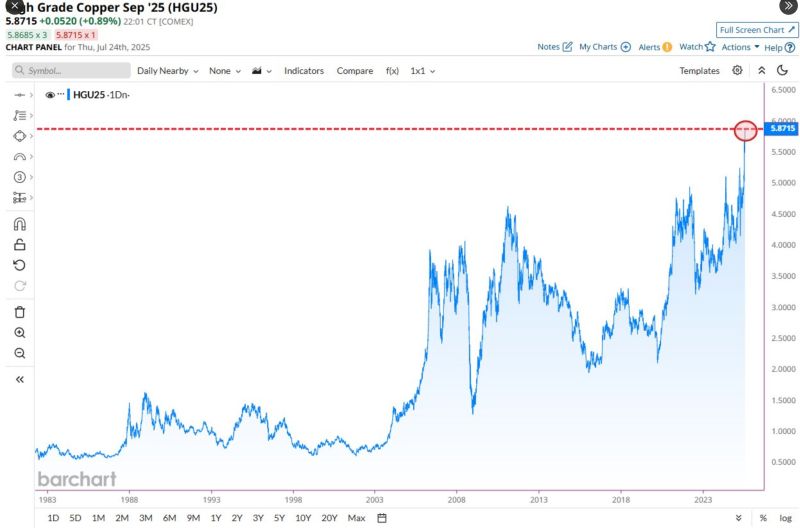

Copper soars to highest closing price in history 📈📈

Source: Barchart

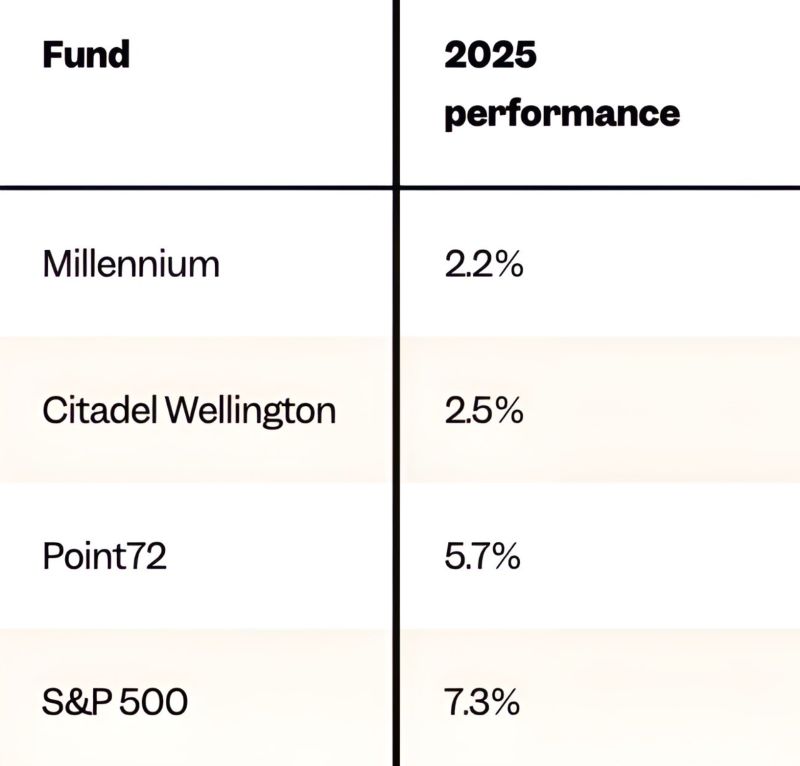

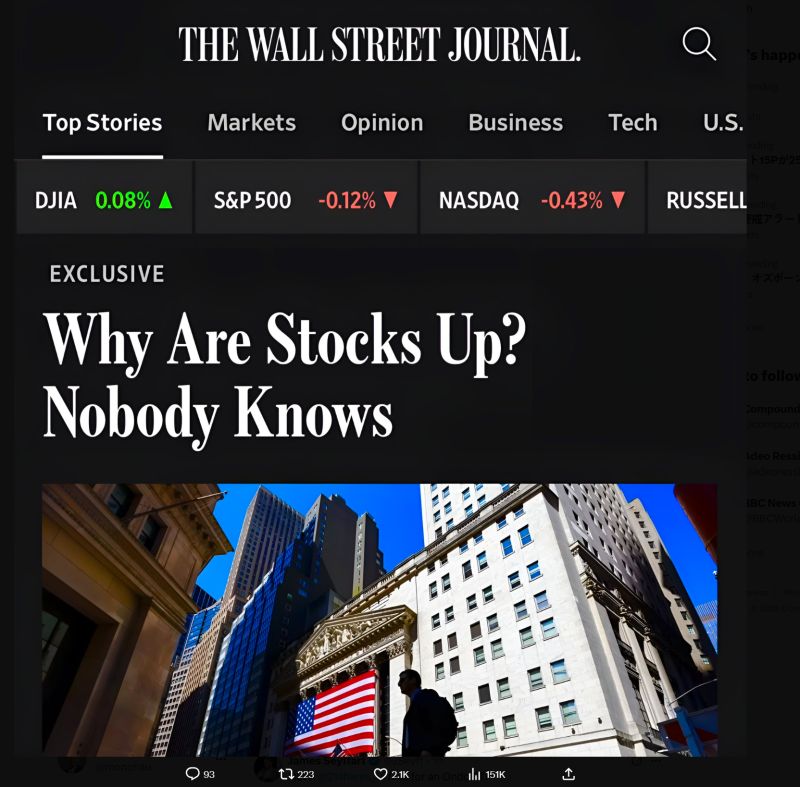

This is how many investors currently feel... but we disagree.

There are "reasons" behind the current bull market. First, liquidity conditions remain favorable with Global M2 (a global liquidity proxy) going up. Second, earnings remain a tailwind with positive earnings revision and 2026 earnings growth reaccelerating. Third, the global macro & geopolitical context is more favorable than in H1 with some clarity on tariffs expected to improve in the coming months and lower taxes ahead. Of course, there are many risks to be taken into consideration but the probability of occurrence is probably exaggerated (e.g. ousting of Fed chairman Powell seems unlikely). But yes indeed, with this level of valuations, any unexpected event could trigger a very decent correction. So stay invested but keep some dry powder to buy the next dip Source picture. Brew markets

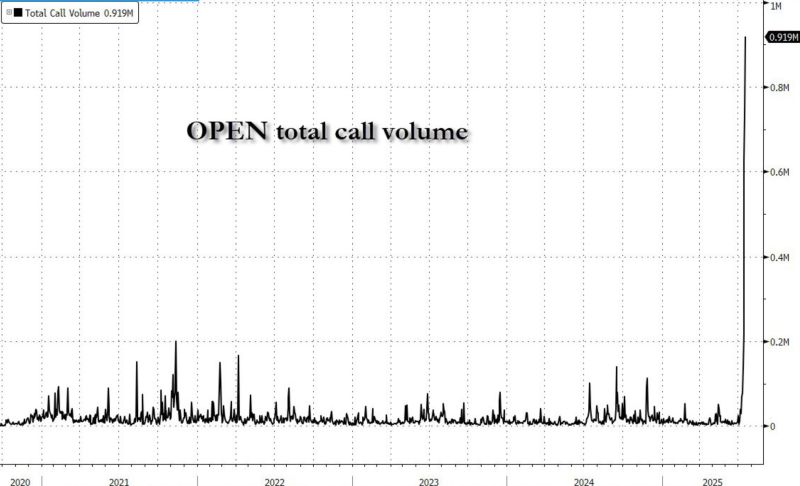

Opendoor is the market’s latest Meme Stock w/insane trading volumes.

Shares of the San Francisco-based tech group that focuses on the stagnant real estate sector have nearly tripled in value over the past week. The rally appears to have been sparked by a prominent investor discussing the stock on social media, which drew the attention of retail traders. The company has struggled since peaking at a $20.6bn valuation in February 2021, shortly after merging with the SPAC (special purpose acquisition company) Social Capital Hedosophia Holdings Corp II, led by Chamath Palihapitiya. That decline isn’t surprising: Opendoor’s core business is in the "instant buyer" market, where it aims to make home sales faster and bypass traditional realtor fees—an idea that has faced serious challenges in a cooling housing market. Yesterday was a roller-coaster, with the stock declining -40% in the last hour of trading after being up more than 67% intraday... Source: HolgerZ

The biggest gamma squeeze in history ???

Source: zerohedge

London Stock Exchange Group is weighing whether to launch 24-hour trading as bourses race to extend access to stocks amid growing demand from small investors active outside normal business hours.

According to the FT ▶️ 🔴 The group is looking into the practicalities of increasing its trading hours, according to people familiar with the situation, from the technology required to regulatory implications. 🔴LSEG is “absolutely looking at it, whether it means 24-hour trading or extended trading”, one of the people said, adding that the exchange group was “having important commercial, policy and regulatory discussions” about the “ongoing topic”. 🔴 Pioneered in the US, longer trading windows have become a hot topic among exchange groups as they seek to modernise, spurred by the rise of younger investors who trade on their smartphones. 🔴 The 24-hour nature of cryptocurrency markets, where volumes are booming, has also led bourses to consider extending hours.

Investing with intelligence

Our latest research, commentary and market outlooks