Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

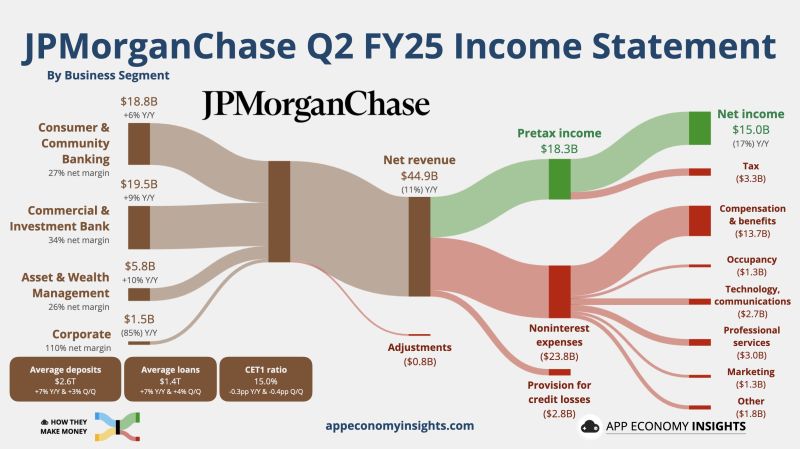

⚠️ JPMorgan Chase on Tuesday topped analysts’ estimates on better-than-expected revenue from fixed income trading and investment banking.

▶️ The bank said that second-quarter earnings fell 17% to $14.9 billion, or $5.24 a share, from the year-earlier period, when it had a $7.9 billion gain on Visa shares. But even when backing out a $774 million income tax benefit that boosted per share earnings by 28 cents, JPMorgan topped estimates for the quarter. 🔴 $JPM JPMorganChase Q2 FY25. • Net revenue -11% Y/Y to $44.9B ($1.7B beat). • Net Income -17% Y/Y to $15.0B. • EPS: $4.96 ($0.48 beat). • FY25 NII ~$95.5B ($1.0B raise). Source: App Economy Insights, CNBC

German long-term bond yields keep rising.

The yield on 30y Bunds has reached 3.23% — nearing its highest level in 14 years. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks