Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

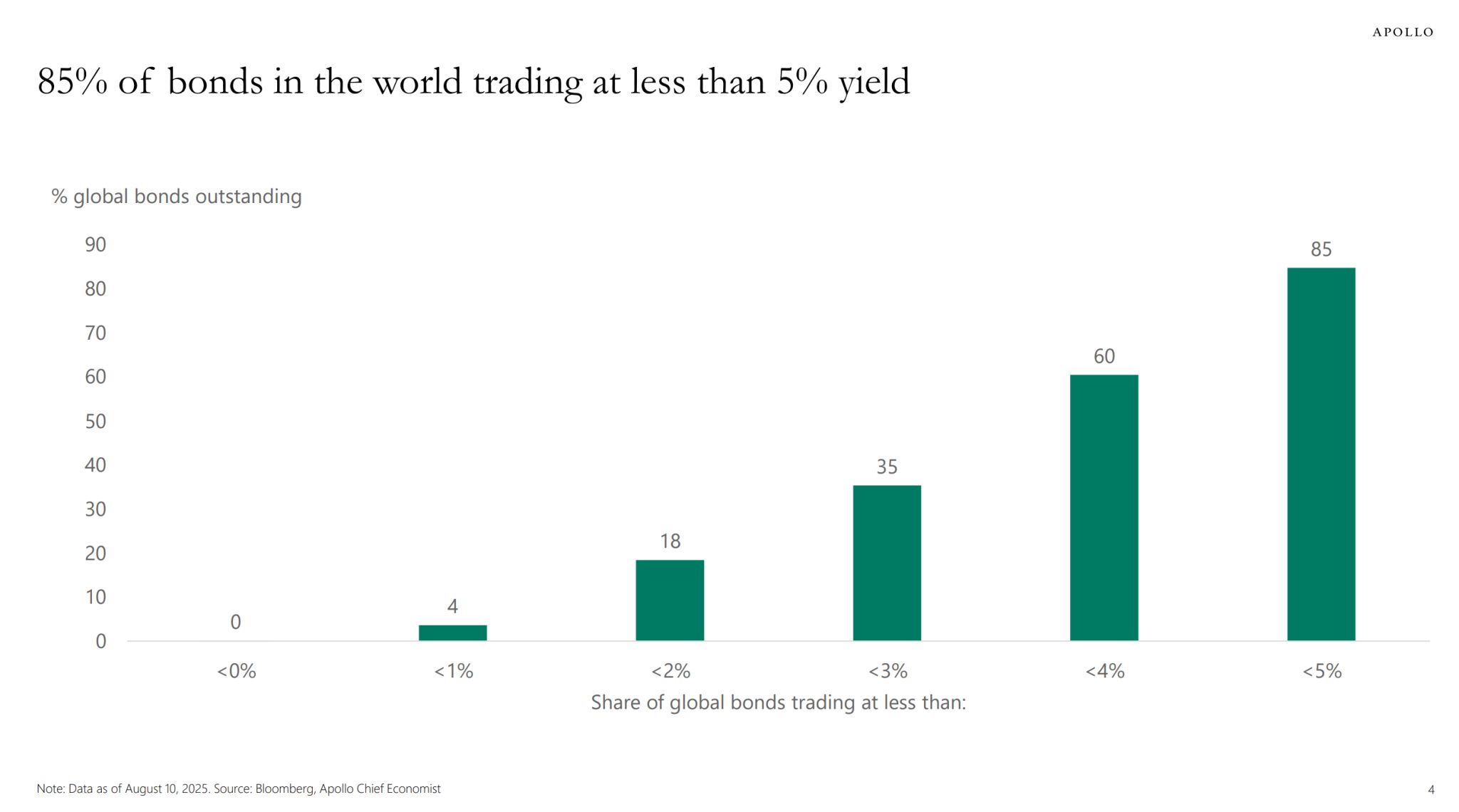

85% of bonds in the world are trading at less than 5% yield

Source: Apollo

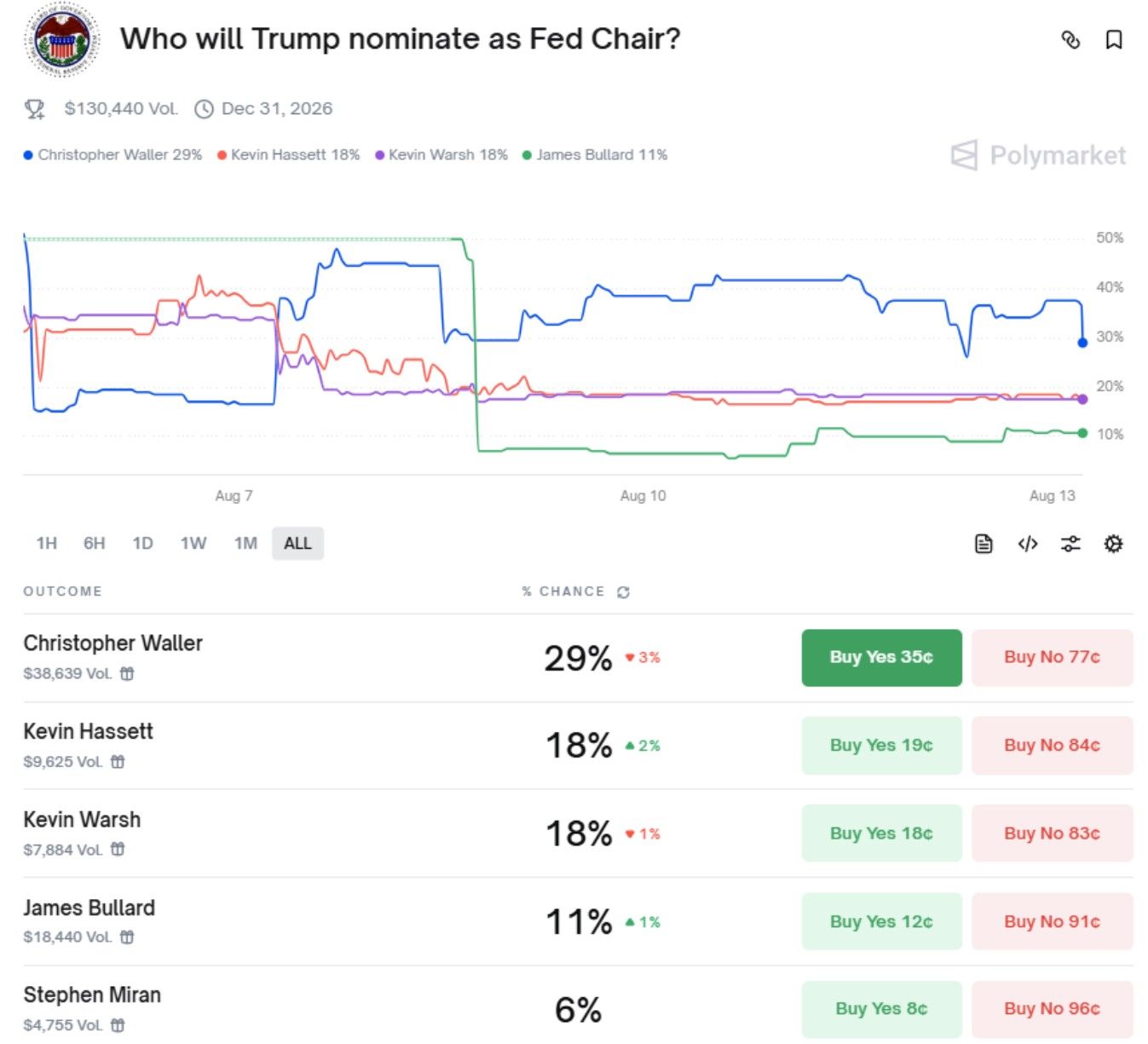

President Trump is reportedly eyeing 11 names to replace Fed chair Powell

Full List: 1. David Zervos -- Chief Market Strategist at Jefferies 2. Kevin Warsh -- Former Federal Reserve Governor 3. Rick Rieder -- CIO for Global Fixed Income at BlackRock 4. James Bullard -- Former St. Louis Fed President 5. Michelle Bowman -- Fed Vice Chair for Supervision 6. Chris Waller -- Fed Reserve Governor 7. Philip Jefferson -- Fed Vice Chair 8. Marc Summerlin -- Former economic advisor in the George W. Bush admin 9. Lorie Logan -- Dallas Fed President 10. Kevin Hassett -- Director of the National Economic Council 11. Larry Lindsey -- Former Fed Reserve Governor Polymarket lists Waller at +250 for next Fed Chair. Source: Polymarkets, Shay Boloor @StockSavvyShay

Over the last few weeks, markets have been moving higher partly due to the fact that investors have been pricing in more rate cuts.

With July PPI and core CPI prints surprising on the upside this week, odds of rate cuts in September and beyond are moving lower. Could it trigger a decent market correction? Source image: @RealStockCats

US margin debt has hit $1 trillion for the first time in history.

This is a ~65% surge over the last 3 years. Source: Global Markets Investors

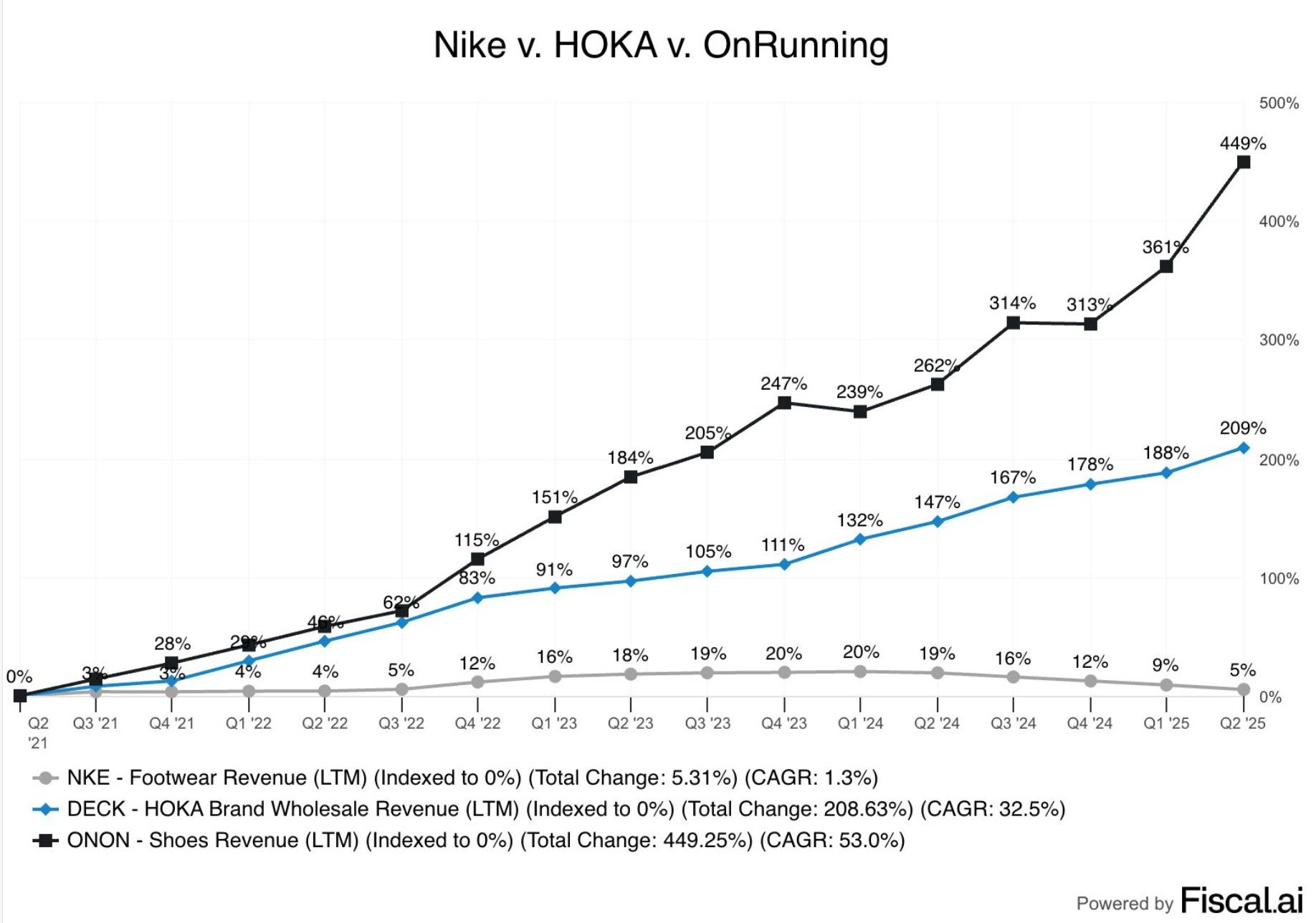

On running and Hoka continue to take market share in footwear space.

On running +449% Hoka: +209% Nike Footwear: +5% Source: fiscal.ai

⚠️This has never happened before: The NASDAQ market cap relative to US GDP hit 105%, an all-time high.

The ratio has nearly doubled since the 2022 bear market low and is now ~40 percentage points above the 2000 Dot-Com Bubble. It is also at a record relative to world GDP. Source: Global Markets Investor, econovisuals

Bullish $BLSH shares open trading at $90 above the $37 IPO price

Cryptocurrency exchange operator Bullish (BLSH.N), opens new tab was valued at about $13.16 billion after its shares more than doubled in their NYSE debut on Wednesday, underscoring investor confidence in the sector and lifting prospects for future U.S. listings by other digital asset firms. The parent of crypto news website CoinDesk raised $1.11 billion in its IPO, valuing the company at $5.4 billion — another sign of mainstream adoption in a market that recently topped $4 trillion. Source: Reuters

Investing with intelligence

Our latest research, commentary and market outlooks