Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A "too much growth" scare on Wall Street?

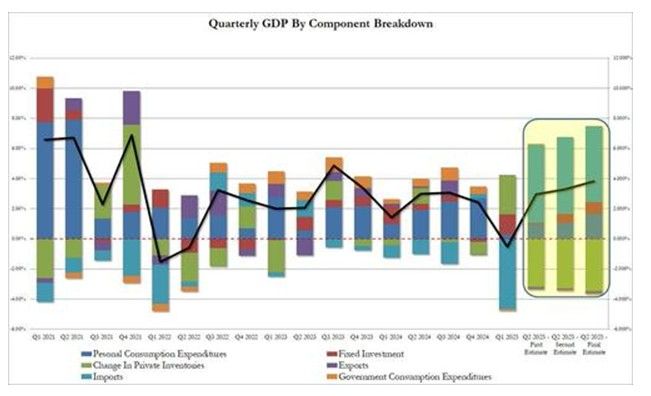

Interesting to see that yesterday's pullback was NOT prompted by bad US macro data: on the contrary, Thursday's economic number beat expectations across the board: 👉 Initial jobless claims unexpectedly tumbled to YTD lows, proving that the Texas-driven spike 2 weeks ago was indeed a one-time event... 👉 Durables goods ex-transports rose for a 5th straight month.... 👉 US Q2 GDP was unexpectedly revised sharply higher, printing at a whopping 3.8%, above all estimates, and the highest in 2 years driven by a bizarre surge in consumption - see chart below 👉US home sales were also well above expectations. In other words 4 for 4 on the data front. So much for those stagflation concerns... ‼️ But good (macro) news become bad news for the markets as the market quickly priced out odds of 2 rate cuts by December, closing the day at 1.56 rate cuts expected, down from 1.7 at the start of the day. It also pushed the 10 year yield and the greenback higher... At the time when equity valuations are extended, a rise in bond yields could indeed trigger some profit taking on US stocks Source chart: zerohedge

This table from BofA is a fantastic reminder that "all good things eventually come to an end."

Source: Lance Roberts, BofA

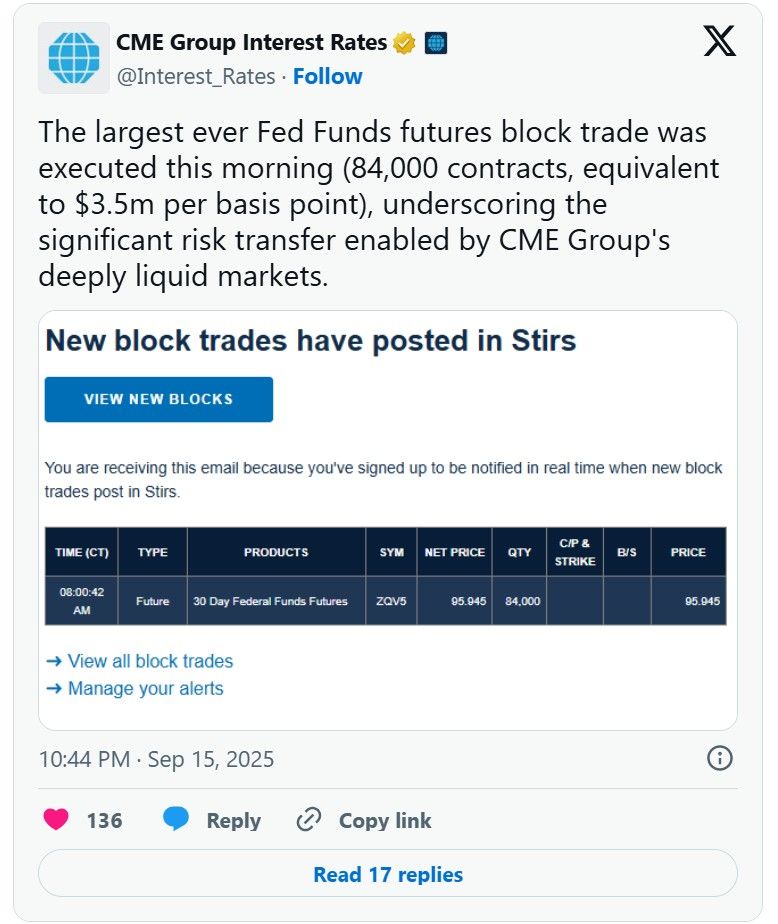

Mystery Trader Makes Record Bet On 50bps Rate Cut Today

The trade took place in the October fed funds, for an amount of 84,000 contracts which is equivalent to $3.5 million per basis point in risk. the price and timing of the trade was consistent with a buyer, potentially indicating a hedge against a half-point rate cut at Wednesday’s policy meeting, given a quarter-point cut is now fully baked into the swaps market. The CME confirmed this was the largest ever block trade in Fed Funds Futures... Source. zerohedge

Markets Up, Morale Down: A Summer of Disbelief by JC Parets, CMT

Throughout the summer, investors were wrong about stocks. And it was one of the greatest summers in stock market history. Below is the futures positioning among asset managers and hedge funds: the blue line represents the S&P 500, and the lighter green line shows you how underinvested they've been. They sold into the hole and never got the chance to get back in. This was a textbook V-bottom, and they're still not back in. This is one of those things that can help keep a bid underneath the market. Source: J-C Parets

Financial Times:

"Apollo Global Management has amassed a short position against the debt of a US automotive parts supplier that has come under scrutiny for its accounting policies and financing techniques. Apollo holds a credit default swap against First Brands Group, according to five people familiar with the matter, an Ohio-based seller of windscreen wipers and fuel pumps that last month shelved a $6bn loan deal because of concerns about its financial reporting. The derivative contract means that Apollo will profit if FBG fails to continue paying its debts. The trade has pitted one of the largest private credit specialists on Wall Street, with $840bn in assets, against a company that has borrowed billions of dollars away from the glare of public debt markets. In order to short FBG’s private debt, Apollo obtained a so-called “bespoke” contract written against the company’s loans, according to people familiar with the trade. They added that the firm had held the position for at least as long as a year and had paid a significant amount in fees to maintain the short". Link to article >>> https://lnkd.in/ejCPZSsY

The Fed is in command

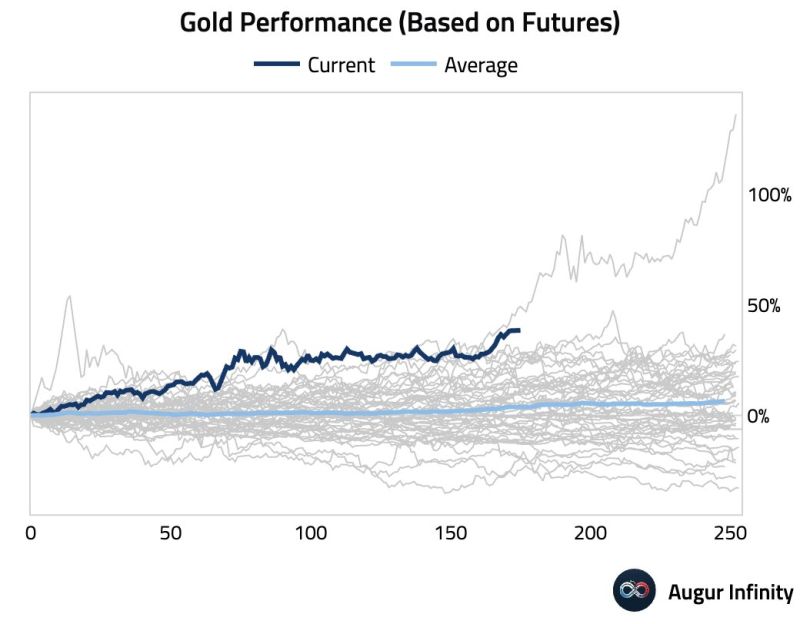

1. Stocks: all-time high, 2. Home Prices: all-time high, 3. Bitcoin: all-time high, 4. Gold: all-time high, 5. Money Supply: all-time high, 6. National Debt: all-time high, 7. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target", 8. Fed: cutting interest rates next week. Source: Charlie Bilello

Apple Launches New $1k Phone – You Buying?

Apple’s live product event delivered the usual fanfare with updates to iPhones, AirPods, and Watches. The spotlight, however, was on the iPhone Air, Apple’s thinnest phone yet, built with titanium and ceramic and powered by the new A19 chip. Despite the buzz, markets were unimpressed: $AAPL closed down 1.48%, the only Mag 7 stock in the red on Tuesday.

Investing with intelligence

Our latest research, commentary and market outlooks