Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

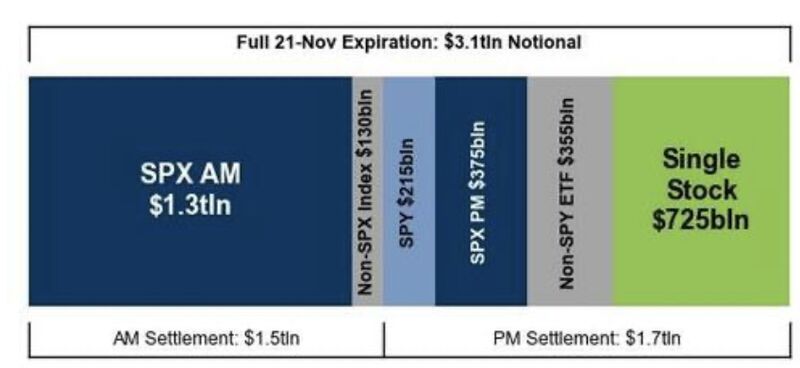

TODAY is estimated to be the largest November expiration EVER.

We’re talking $3.1 TRILLION worth of options contracts expiring all at once. Source: StockMarket.news

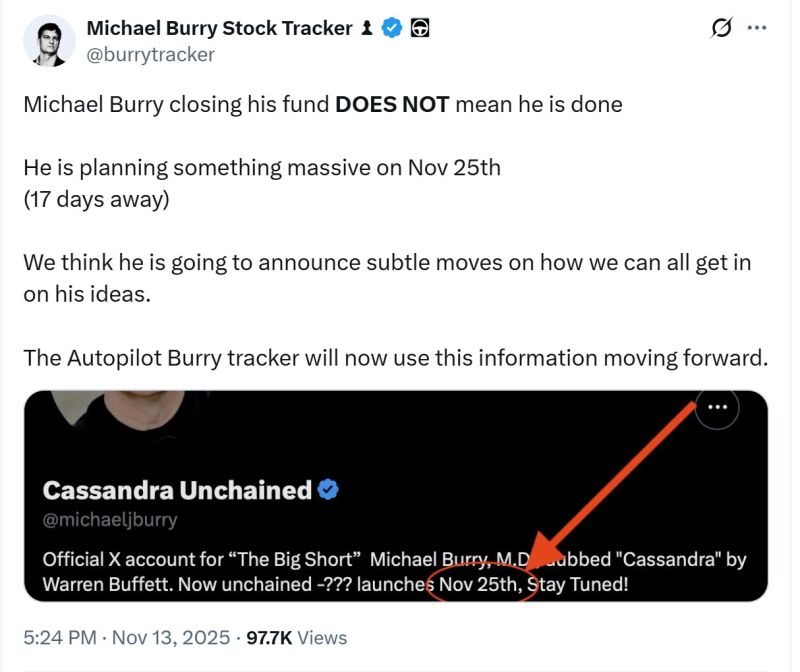

Yesterday: Michael Burry shutting down hedge fund

April 7: Tom Lee issues apology to investors Signs of time? 🤔 Source: The Market Stats @TheMarketStats

It seems that Michael Burry closing his fund DOES NOT mean he is done

He is planning something massive on Nov 25th...

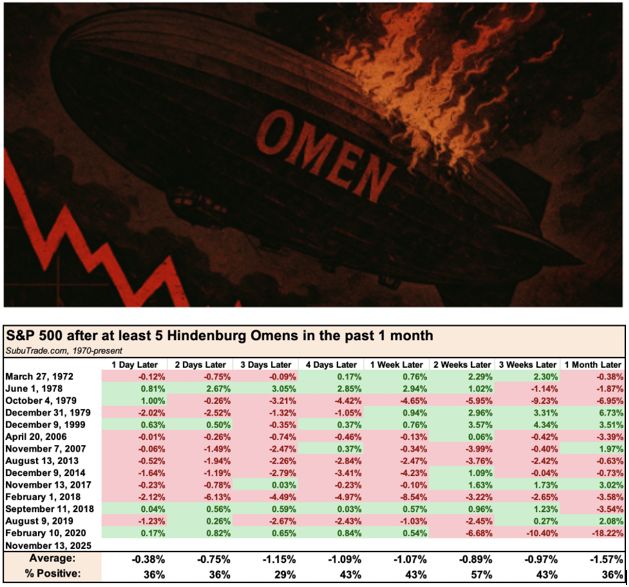

🔴 Stock Market Crash "Hindenburg Omen" Triggered 🚨

The Hindenburg Omen, an indicator that correctly detected the 1987 and 2008 stock market crashes, has been triggered for the 5th time over the last month 👻😱 ➡️ What is a Hindenburg Open? The Hindenburg Omen is a technical stock-market indicator that attempts to predict increased probability of a market crash. It triggers when several conditions occur at the same time on a stock exchange (usually the NYSE), such as: A high number of new 52-week highs and 52-week lows on the same day A rising 50-day moving average Worsening market breadth Other internal market divergences It’s named after the Hindenburg disaster because it is meant to signal potential “market instability.” Source: Barchart

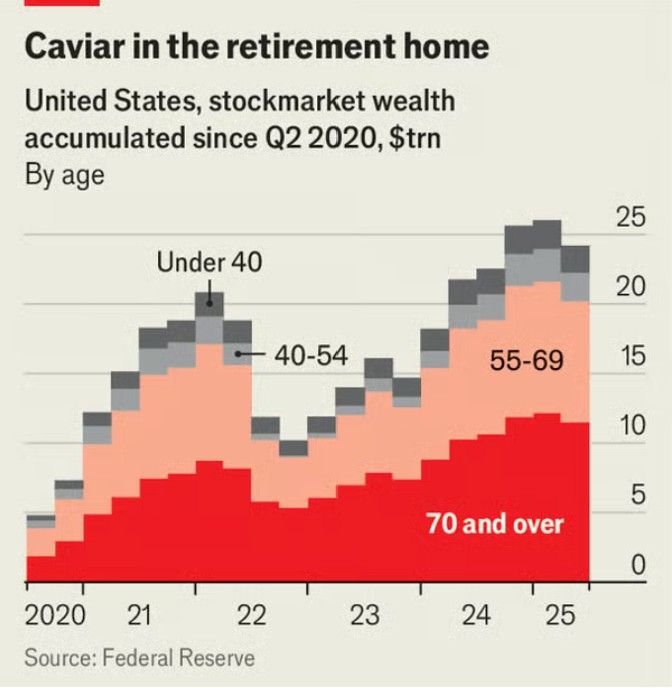

From @TheEconomist thru Mo El Erian on X:

"America’s surging stockmarket has been driven, most of all, by old investors.... Americans aged 70 and above now own 39% of all stocks and mutual funds (which mostly invest in equities), almost twice as much as was common from 1989 to 2009. The trend reflects a shift in outlook. Elderly Americans’ risk tolerance has shot up."

🚨 "Stimulating into a bubble" by Ray Dalio - here are the key takeaways 👇

The Federal Reserve announced it will end Quantitative Tightening (QT) and begin Quantitative Easing (QE) again — calling it a “technical adjustment.” But let’s be honest: That’s easing. And easing into this environment is something we’ve rarely seen in history. Let’s unpack what this means 👇 📉 Normally, QE happens during crisis. Low valuations, weak growth, wide credit spreads, and falling inflation. QE was meant to stimulate into a depression. 📈 This time is different. Stocks are near record highs AI and tech valuations are in bubble territory Unemployment is near record lows Inflation is still above target Credit and liquidity are abundant So if the Fed starts buying bonds and adding liquidity now — while deficits stay huge — it’s essentially monetizing government debt during a boom. That’s not “technical.” That’s a classic late-stage Big Debt Cycle move — where monetary and fiscal policy collide to keep the system afloat. 🧩 The mechanics: QE pushes real yields down Financial assets inflate (especially tech & gold) Wealth gaps widen Inflation reawakens — eventually forcing the Fed to tighten again ⚠️ And that’s when bubbles pop. So yes — the Fed may be stimulating into strength, not weakness. Into a bubble, not a bust. Into risk, not safety. This is the kind of pivot that separates traders from historians.

Here's an example of supply chain risk for some European companies.

Interesting numbers on Nexperia: their chips are used by half Europe's auto companies, 86% of medical device companies and almost all (95%) the mechanical engineering sector. Source: Arnaud Bertrand @RnaudBertrand on X, FT

Investing with intelligence

Our latest research, commentary and market outlooks