Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

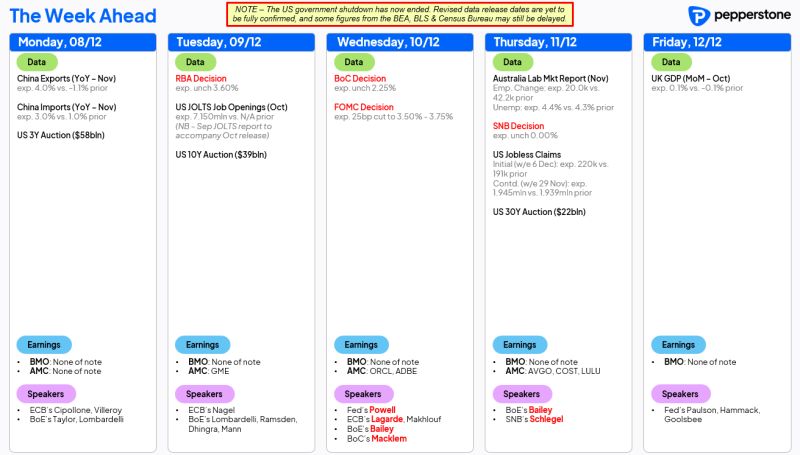

Key events for the week ahead...

FOMC set for a third straight 25bp cut...while RBA, BoC & SNB should stand pat...JOLTS & UK GDP highlight the data docket...while a chunky slate of Treasury supply awaits... ORCL & AVGO highlight the earnings calendar... Source: Pepperstone

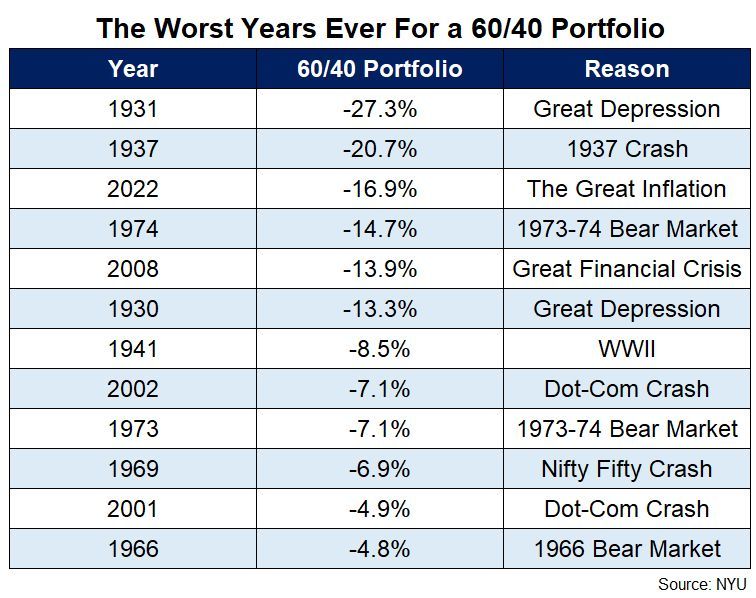

Boring Investing Still Works

"Introducing more complexity into your portfolio can make it much harder to manage. The fees are higher, they’re more illiquid, it’s harder to rebalance, and there isn’t nearly as much transparency." Source: Ritholtz @RitholtzWealth NYU

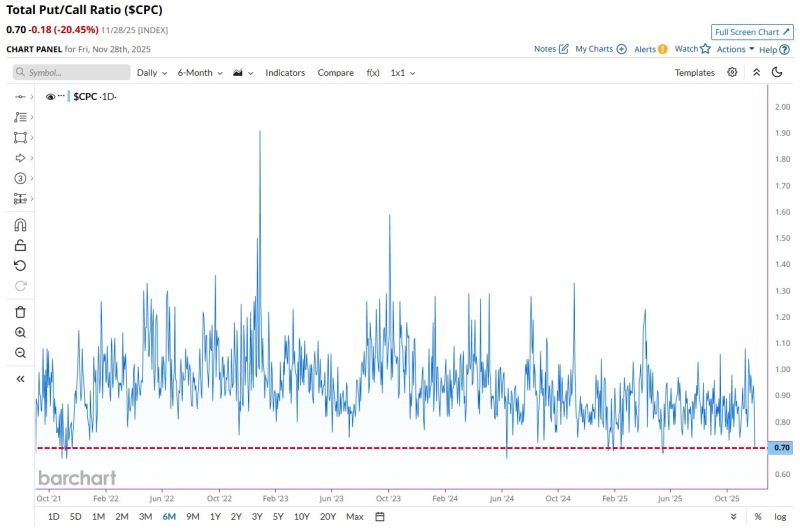

Total Put/Call Ratio drops to 0.70, one of the lowest levels in the last 4 years 👀

Source: Barchart

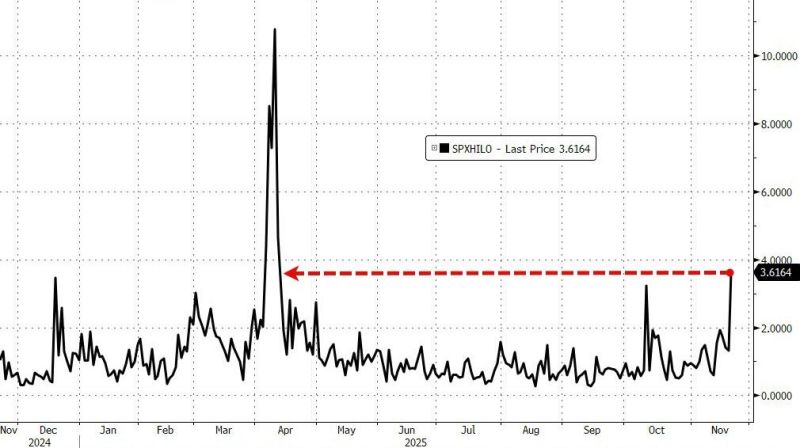

Goldman: As Panic Index Nears Record, Chase For Downside Protection Is Off The Charts

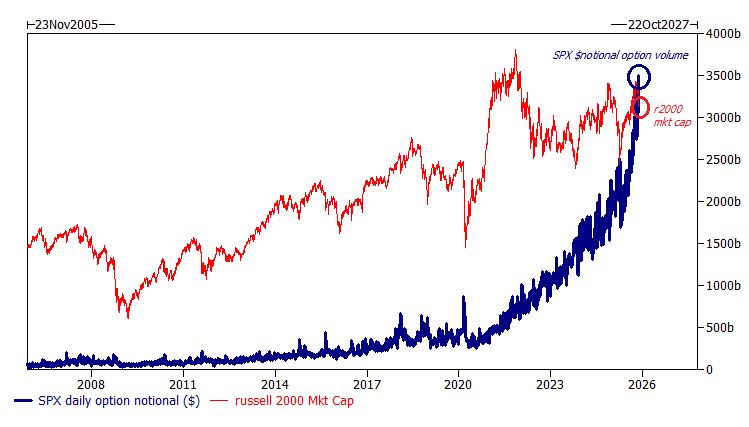

After an early post-Nvidia rebound, markets reversed sharply on Thursday, and the demand for hedges became obvious. Goldman reported “a massive bid for puts,” with option activity staying extremely elevated. As the chart shows, total put volume hit its third-highest level of the year, while overall option volume climbed to one of the highest readings on record. The scramble for downside protection has pushed normalized put/call skew to one of its highest levels in the past three years. Another way to illustrate the sheer surge in activity: average daily trading volume in SPX options has now reached $3.5 trillion. That’s an all-time high—and, remarkably, larger than the entire market capitalization of the Russell 2000 (RTY). Source: zerohedge

WHAT JUST HAPPENED ON WALL STREET? 🤯

Today the S&P 500 opened up +1.4%… and finished deep in the RED (-1.5%). That move has happened only twice in modern history: Apr 7, 2020 — Post-COVID crash volatility Apr 8, 2025 — Post-Liberation Day shock Today just became the third. So what actually drove the reversal? Goldman’s trading desk points to a perfect storm: 🔥 1) NVDA -7% fade Yes, they beat. Yes, they raised. But the “clear all” bull case didn’t show up. ⚠️ 2) Private credit risk can’t be brushed aside Fed’s Cook literally flagged “potential asset valuation vulnerabilities.” 📉 3) September NFP = fine… but not decisive December rate-cut odds barely nudged higher (now ~35%). 💥 4) Crypto cracked below the $90K psychological line 📊 5) CTA supply hit the gas Positioning was crowded long… and we just crossed short-term triggers. Medium-term supply looms at 6456. 🐻 6) Shorts are waking back up 🌏 7) Weak global price action SK Hynix, SoftBank… not helping. 💧 8) Liquidity? Nearly nonexistent Top-of-book S&P liquidity ~$5mm vs ~$11mm YTD average. 📈 9) ETF-driven market ETFs were 41% of the tape today (YTD avg: 28%). When passive flows dominate, macro > fundamentals. Here’s the kicker: NVDA’s results were good. Objectively good. But as Goldman’s John Flood put it: 👉 “When really good news isn’t rewarded, that’s usually a bad sign.” So the real question: Is the market pricing in a Fed policy mistake? (No December cut → forced tightening → equity stress?) Or is this the market’s way of dragging the hawks back to the dovish table? Either way… Volatility is back. And the macro tape is driving the bus. 📡 Stay tuned. Source: zerohedge

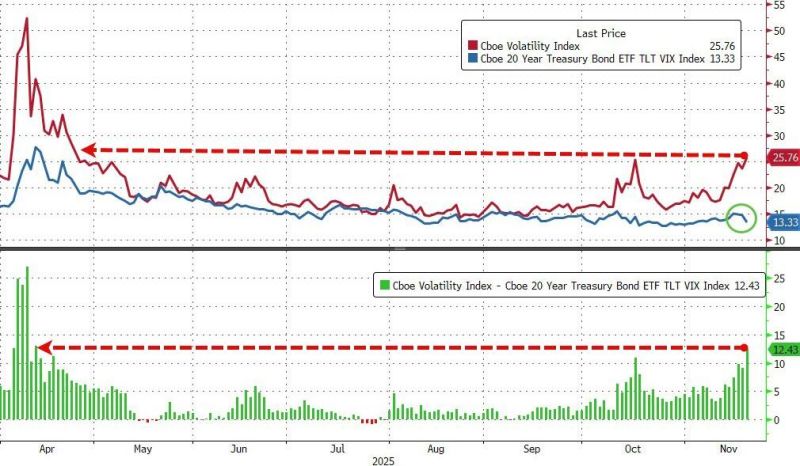

VIX (equity vol) exploded higher yesterday, topping 28 at its peak, and dramatically decoupling again from bond vol (biggest divergence since Liberation Day fallout)...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks