Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

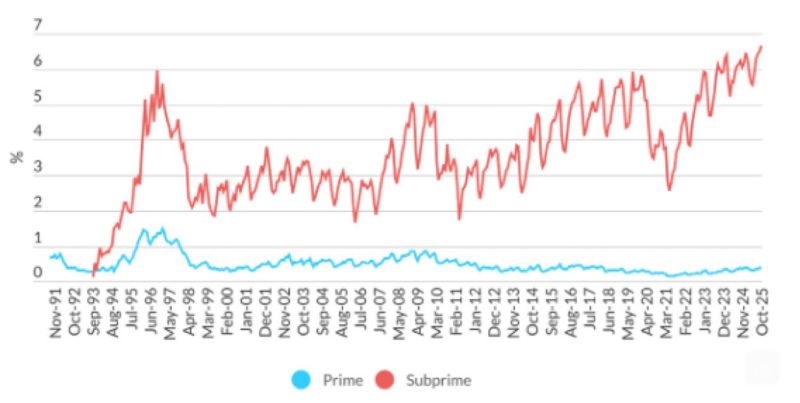

% of subprime auto loans that are 60 days or more overdue on their payments hit an all-time high of 6.65%

Source: Barchart

"Winner Winner": $CRML's Record-Breaking Day

Critical Metals $CRML, which controls one of the largest rare earth deposits in the world (also in Greenland), just soared more than 32% yesterday for one of its best days in history Source: Barchart

Average customer account size at Robinhood vs peers

The Sovereignty Trap: By offshoring industry to China for higher margins, the West traded its independence for cheap labor; China now controls the minerals essential for Defense, EVs, and tech. Resource vs. Currency: The ability to print money is irrelevant if China refuses to sell the raw materials required for survival and industry. The Great Rebuild: To regain independence, Western nations are aggressively reshoring industry, stockpiling minerals, and rebuilding infrastructure. The Irony of Tech: Building the "New Economy" (Silicon Valley, AI, Green Tech) is impossible without massive amounts of "Old Economy" materials like copper, lithium, and steel. Source: Topdown charts, LSEG, Lukas Ekwueme @ekwufinance

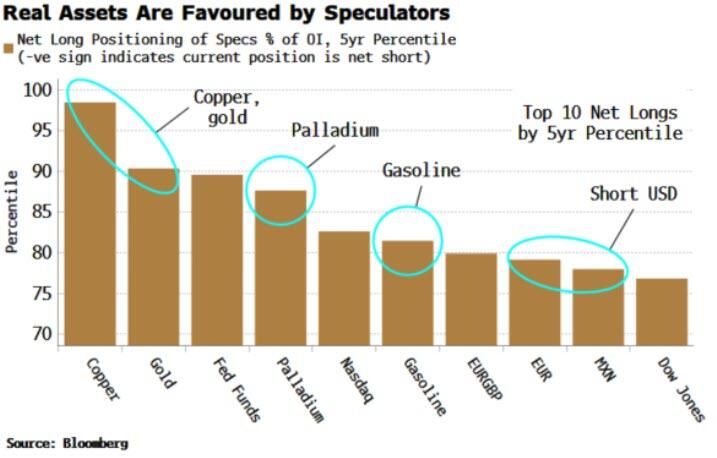

Speculators Are Positioning For A Fiscally Dominant World

In 2026, the global financial landscape is shifting from central bank independence to Fiscal Dominance, where political spending needs now dictate interest rate policy. To hedge against this, "smart money" is fleeing the US Dollar and Treasury bonds fearing structural inflation and pivoting into hard assets like gold and copper. This trend is confirmed by current Commitment of Traders (COT) data, showing record institutional positioning in precious metals as a final shield against currency debasement. Source: zerohedge, Simon White, Bloomberg macro strategist

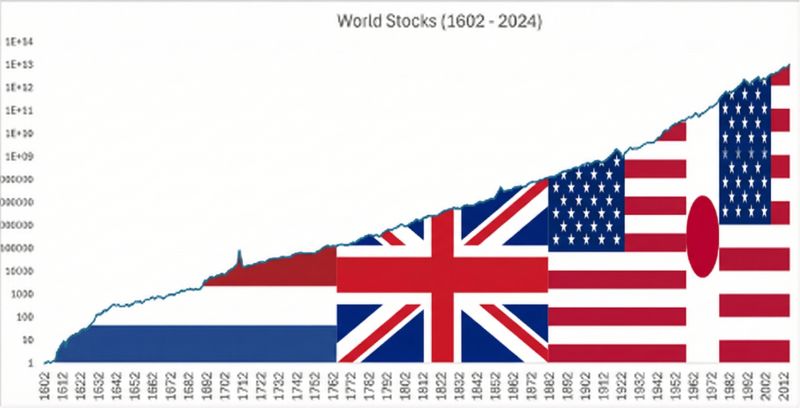

Largest stock market in the world at the time

not always U-S-A... Source: Meb Faber

BofA Bull & Bear Indicator (B&B)

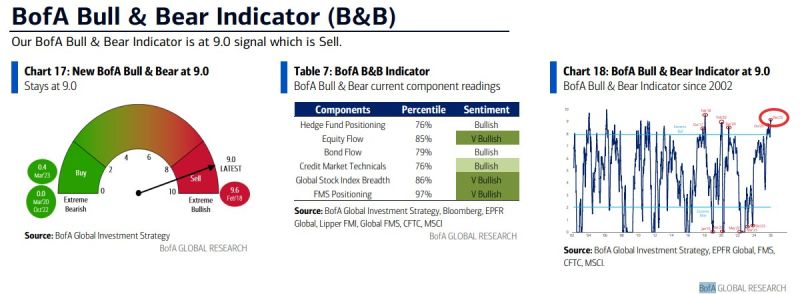

The revamped BofA Bull & Bear Indicator is now at 9.0, exceeding the 8.9 on Oct 1st which was “an extreme bullish level last seen in Feb’18 & Feb’20,” and remaining above the “contrarian sell signal” level. “[Outflows from tech stocks & EM debt [were] offset by very strong global equity breadth (98% of country indices above 200dma), super-low BofA Global FMS cash positions (record low 3.3%), hedge funds adding to S&P 500 longs via futures; new revamped B&B Indicator 8.5 on Dec 17th, 8.8 on Dec 24th, 9.0 on Dec 31st [and Jan 7th]” Source: BofA through Neil Sethi

Is the volatility index VIX set to spike?

Asset managers have aggressively increased their VIX futures shorts to the highest level since July 2024. In other words, funds are betting heavily on continued low stock market volatility. Such extreme short VIX positioning often leaves markets vulnerable to sharp volatility spikes if sentiment turns. A similar setup occurred in July-August 2024, when a sudden shift in risk appetite drove a nearly -10% market drop. Are we heading for a pullback? Source. Global Markets Investors

Investing with intelligence

Our latest research, commentary and market outlooks