Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

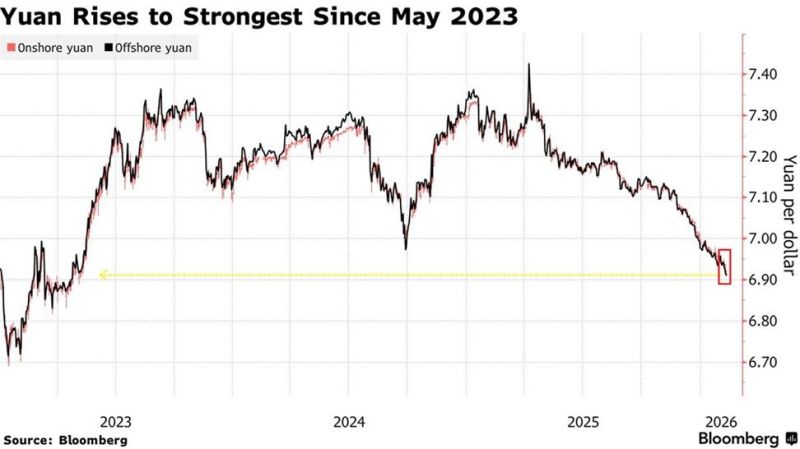

The Chinese Yuan has strengthened to 6.91 against the US Dollar, the strongest since May 2023.

The Yuan is now on track for its 7th consecutive monthly gain, the longest streak since 2020-2021, up+5% since 2025. It has also been the 3rd-best-performing currency in Asia since September. The most recent move comes after Chinese regulators advised banks to limit purchases of US Treasuries and instructed those with high exposure to pare down positions. China is benefiting from the US Dollar's weakness. Source: The Kobeissi Letter, Bloomberg

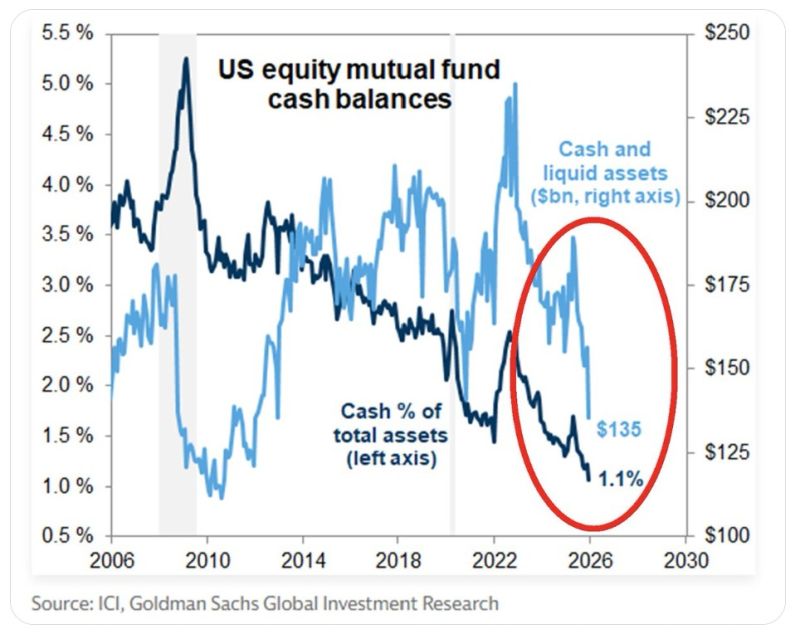

🚨There is BARELY any cash on the sidelines:

Cash levels in US equity funds fell to 1.1%, an ALL-TIME LOW. This is HALF the percentage seen just 3 years ago. US equity mutual fund cash balances as a % of total assets have been in a downtrend for the last 18 years. Nominally, cash and liquid assets fell to $135 billion, the lowest since 2013. Almost every equity fund is ALL-IN on US stocks. Source: Global Markets Investor, Goldman Sachs

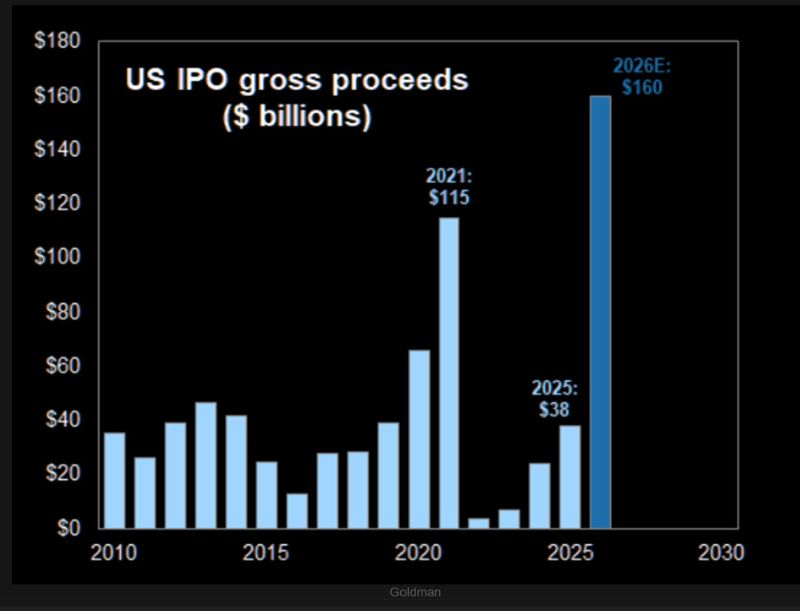

GS: "We forecast 120 IPOs this year and $160 billion in gross IPO proceeds in 2026".

Source: TME

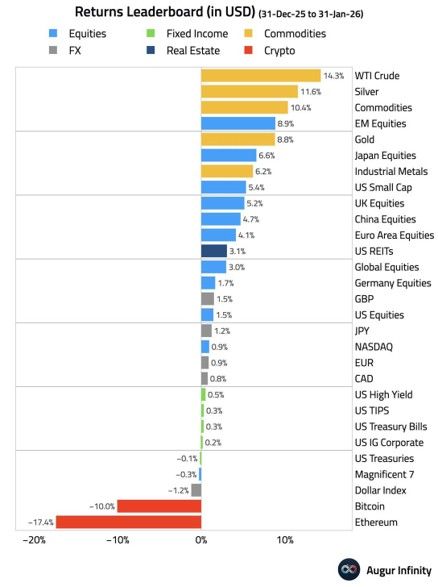

January 2026 best and worst performers 👇

🟢 Commodities is the best performing asset class YTD: WTI Crude is up +14.3%, Silver +11.65% and Gold +8,8% 🟢Global equity markets gained +3.0%. EM equities lead (+8.9%) ahead of Japan (+6.6%), UK (+5.2%), China (+4.7%) and Euro area (+4.1%). As it was the case in 2025, US equities underperform (+1.5%) as Mag 7 are negative YTD 🟢Credit posted modest gains while US Treasuries are slightly down 🔴 Dollar index is down -1.2% 🔴 Bitcoin and Ethereum are the worst performers, down double-digit Source: Augur Infinity

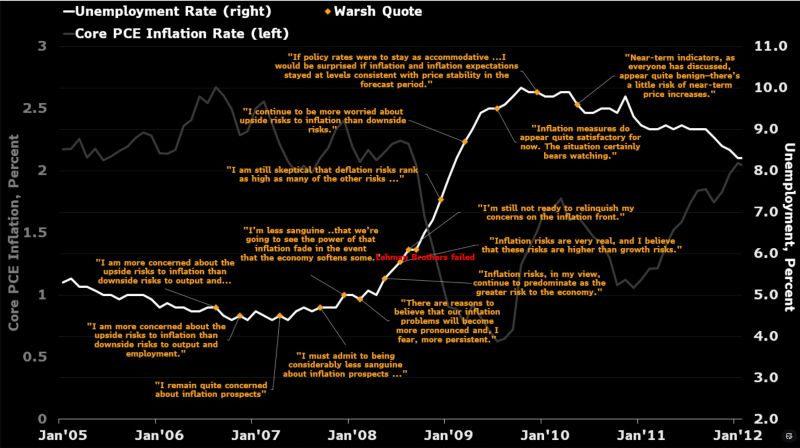

🚨 Is the market misreading the next potential Fed Chair? 🚨

If the goal is "easy on inflation," the history books tell a very different story about Kevin Warsh. Looking back at the FOMC transcripts from 2006-2011, one moment stands out that should make every investor pause. 📍 The Setting: April 2009. The world was still reeling 7 months after the Lehman Brothers collapse. - Unemployment: 9% - Core PCE Inflation: A mere 0.8% - Despite a crashing economy and deflationary pressure, Warsh’s stance was clear: "I continue to be more worried about upside risks to inflation than downside risks." The Takeaway: Warsh has historically been an "inflation hawk," even when the data suggested the opposite. If he takes the helm, we might be looking at a much more aggressive Fed than the "dovish" transition many are currently pricing in. Source: Bloomberg, Anna Wong @AnnaEconomist

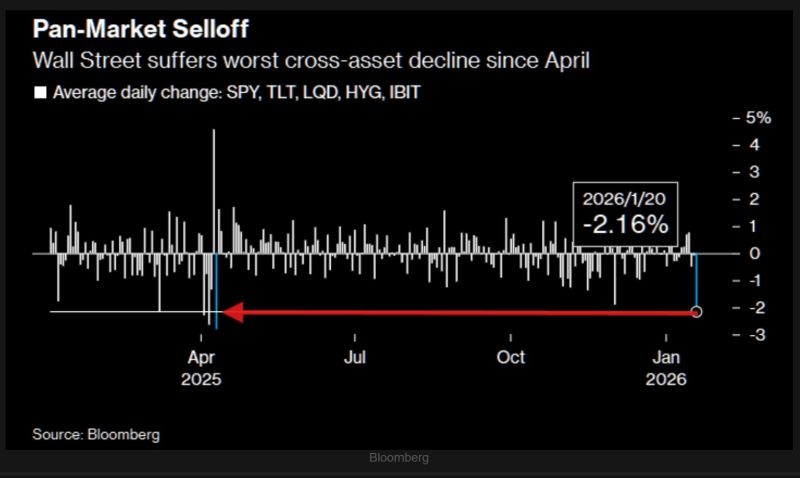

🚨 MARKET MELTDOWN: $6.5 TRILLION GONE IN 24 HOURS. 🚨

If you thought your Tuesday was stressful, take a look at the global markets. We just witnessed one of the most violent 24-hour wealth erasures in modern history. 📉 The numbers are honestly hard to process: 1️⃣ The Metals Massacre 🪙 This wasn’t just a "dip"—it was a cliff dive. - Gold: -10.9% ($4.1 TRILLION evaporated) - Silver: -21.5% - Platinum: -23% - Palladium: -20% Safe havens? Not today. 2️⃣ Tech & Equities Bleed 💻 While the indices didn't drop as far percentage-wise, the dollar amounts are staggering. - Nasdaq: -$480 Billion - S&P 500: -$380 Billion Even the "magnificent" names are feeling the gravity. 3️⃣ Crypto Chaos ₿ Digital assets followed the macro trend down. - Bitcoin: -6.6% (-$108 Billion) - Ethereum: -7.5% (-$25 Billion) Why does this matter for you? In a world of "instant liquidity" and "algorithmic trading," volatility is the new baseline. When correlations go to 1.0, everything drops at once. There was nowhere to hide today. Over $6,500,000,000,000 wiped off the map🧐 Source: Bull Theory

The BofA’s Bull & Bear Indicator is still flashing a sell signal (i.e too much bullishness = contrarian sell signal)

Indicators covered: 1) Hedge fund positioning: Bullish 2) Equity inflow: Very Bullish 3) Bond inflows: Bullish 4) Credit market technicals: Bullish 5) Global stock index breadth: Very Bullish 6) FMS global fund manager positioning: Very Bullish Source: BofA, Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks