Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A (bearish) contrarian call?

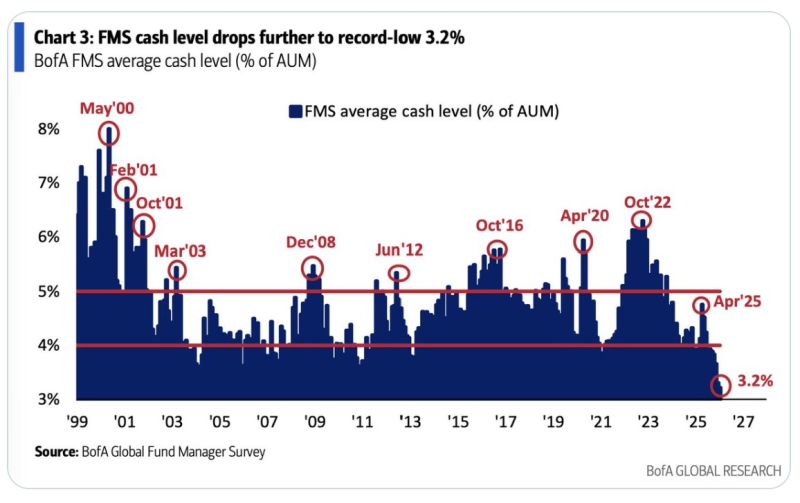

January’s Fund Manager Survey is most bullish since Jul2021: expectations for global growth have jumped, cash levels have fallen to a record low of 3.2%, and protection against equity sell-off is at its lowest since Jan2018. BofA’s Bull & Bear Indicator flashing extreme optimism at 9.4. Source. HolgerZ, BofA

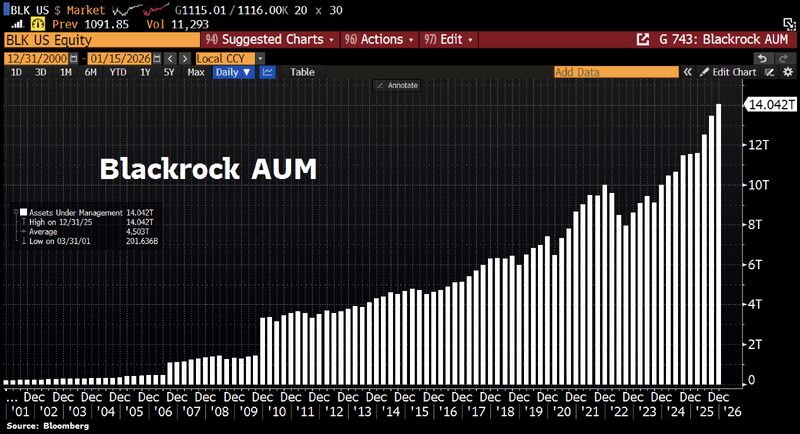

BlackRock is eating the world. Total assets under management hit a record $14 TRILLION after the firm pulled in $342bn of client money in Q4 alone.

Source: HolgerZ, Bloomberg

$7.8 Trillion is now sitting in Money Market Funds, a new all-time high

Source: Barchart

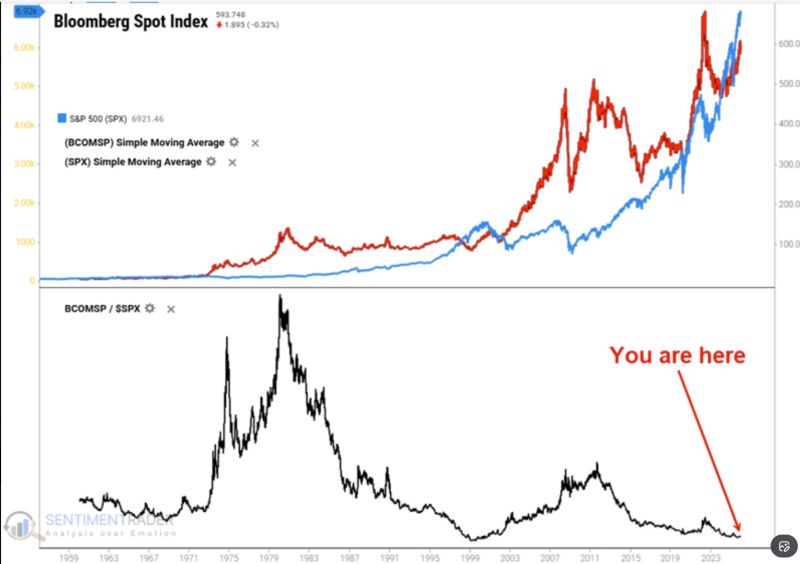

Stocks keep making new highs, but commodities are telling a very different story.

The relative performance of commodities versus the S&P 500 is sitting near levels that have only shown up a few times in history. Those gaps didn’t last forever Source: SentimenTrader

BREAKING: U.S. stock market has wiped out $650 billion in market value this week.

Nasdaq -1.40% Dow -1.21% S&P 500 -1% While Bitcoin is up 7%. BTC has added $130 billion, and the total crypto market has added $190 billion this week. Remember the stocks are at all time high, while Bitcoin is still down -23% from its ATH of $126k. Source: Bull Theory

According to technical models, hashtag#silver $SLV should’ve stopped about 47 trendlines ago...

Source: Trend Spider

Hear that sound? Over $20 trillion in market cap quietly breaking down to new 4-month lows relative to the S&P500.

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks