Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

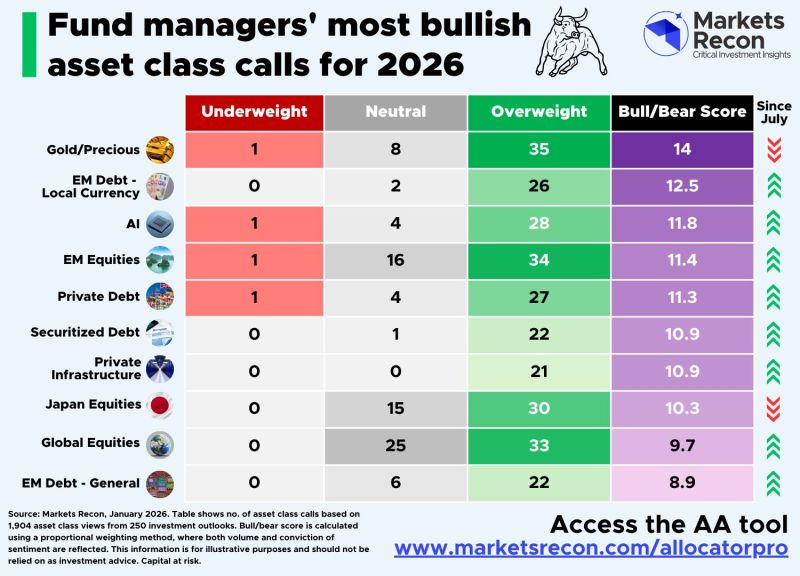

Where are fund managers most bullish for 2026? 🤔

Based on Markets Recon's review of ~250 asset manager outlooks for 2026, the most frequently mentioned overweight call was... GOLD 🥇 What else do asset managers like for 2026 portfolios? 📈 In Equities, it's AI 🤖, EM 🌍, and Japan 🇯🇵 stocks getting the most love. 📄 In Bonds, its EM Debt 🌎 and Securitised Debt 🧩. And in Private Markets, Infrastructure 🌉 is the most admired. Source: Stephen White, CAIA from Markets Recon

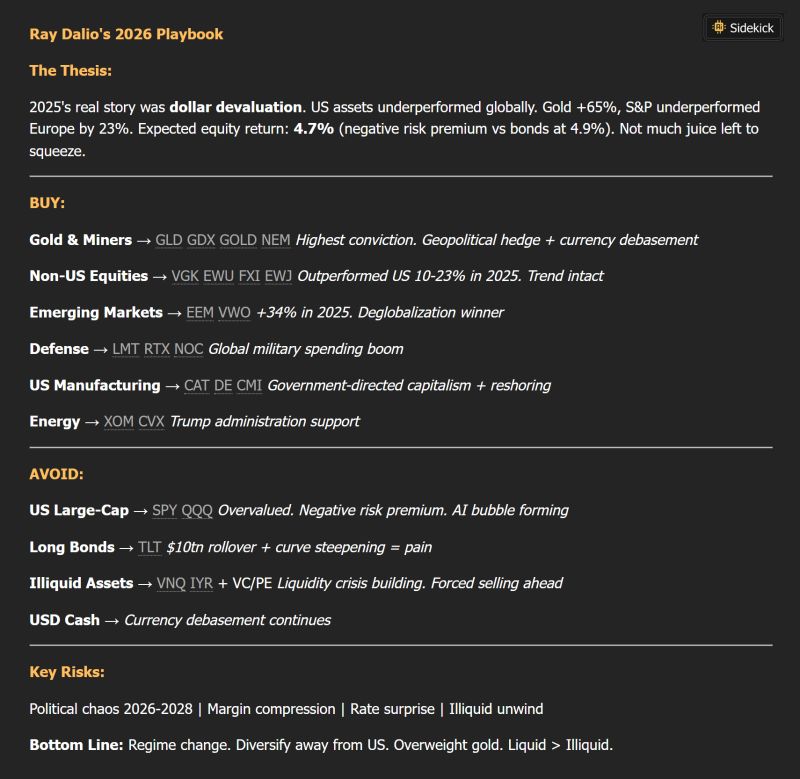

The founder of the world's largest hedge fund just dropped his roadmap for 2026.

We ran it through Sidekick to break down the key takeaways and where he’s positioning as markets shift. Here’s the breakdown: Source: TrendSpider @TrendSpider

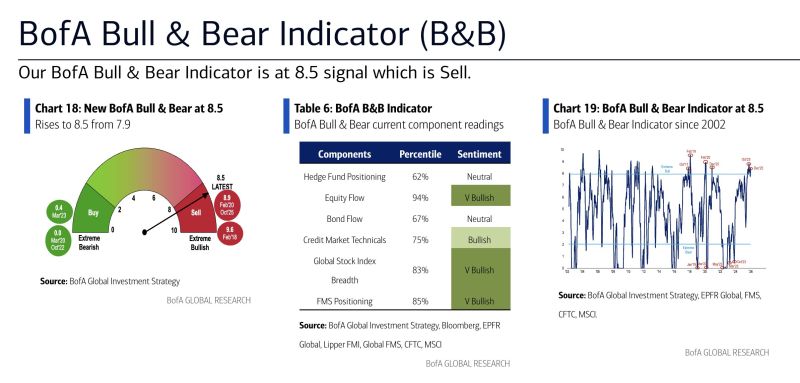

CONTRARIAN ALTERT >>>

BofA’s Bull & Bear indicator has moved into Extreme Bullish territory, rising to 8.5 from 7.9 and triggering a contrarian sell signal for risk assets. Readings above 8.0 have often preceded pullbacks, with global equities declining a median 2.7% over the following 2 months, with a 63% hit rate. Source; HolgerZ, BofA

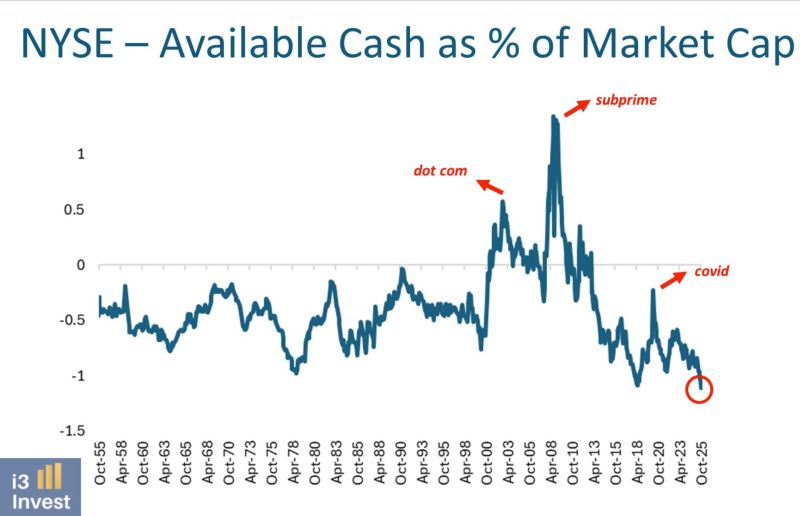

How far can this go?

Investors are in "all-in mode", as NYSE available cash as a percentage of market cap has just reached its lowest level ever. Source: Guilherme Tavares i3 invest

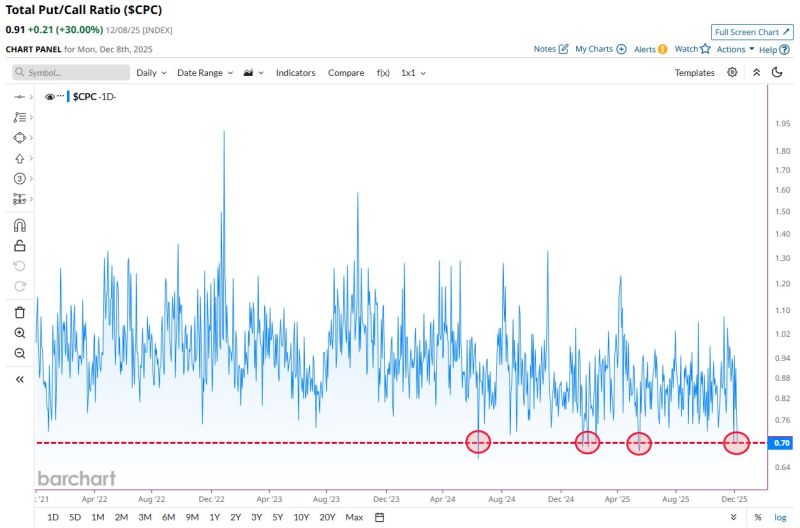

Total Put/Call Ratio fell to 0.70 on Friday, one of the lowest levels in the last 4 years 👀

Source: Barchart

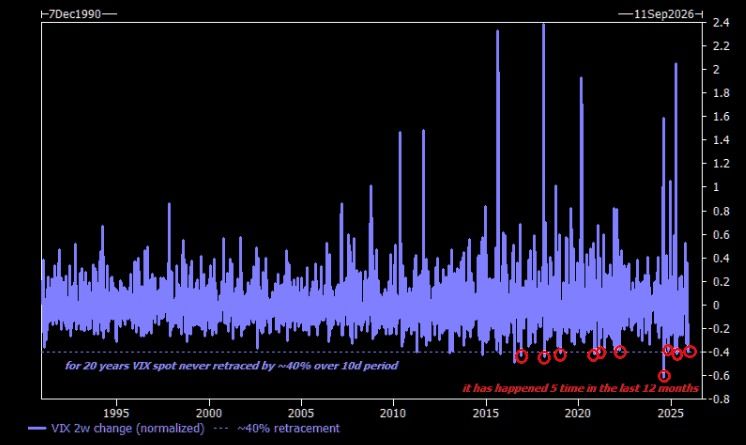

Before 2011, VIX never retraced 40% in two weeks…

It’s happened five times in the past twelve months. Source: The Market Ear @themarketear

Investing with intelligence

Our latest research, commentary and market outlooks