Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

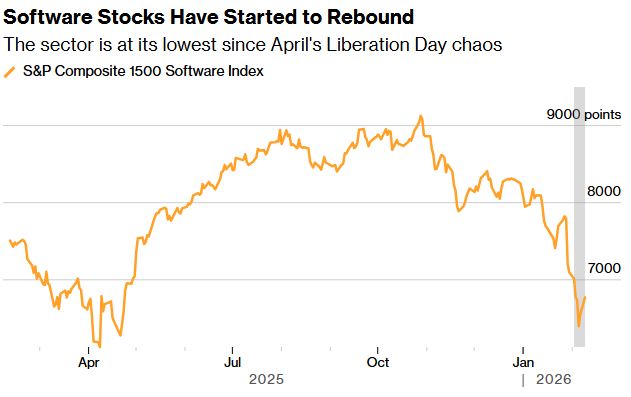

AI FEARS OVERDONE IN SOFTWARE

JPMORGAN: AI FEARS OVERDONE IN SOFTWARE JPMorgan says the selloff in software stocks is overblown, driven by unrealistic fears of near-term AI disruption. Strategists recommend rotating back into high-quality, AI-resilient names. They cite strong fundamentals, high switching costs, and positive earnings trends, naming Microsoft and CrowdStrike as beneficiaries. With 2026 earnings growth forecast near 17%, the team sees a rebound opportunity. Source: *Walter Bloomberg @DeItaone

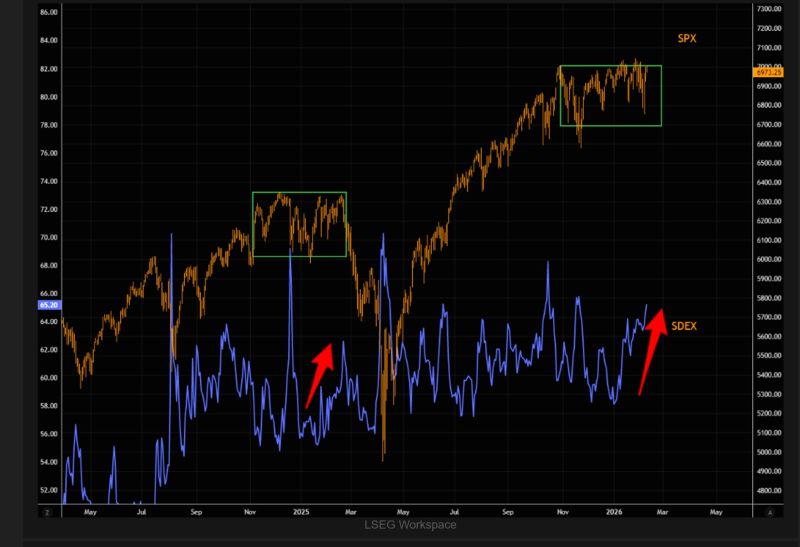

Another day, another fresh high in skew.

The year-to-date rise is becoming meaningful, with the crowd long and paying up for downside protection. Rising markets alongside rising skew are a combo worth watching closely, and looks pretty similar to last year’s setup... Source; TME

Investing with intelligence

Our latest research, commentary and market outlooks