Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

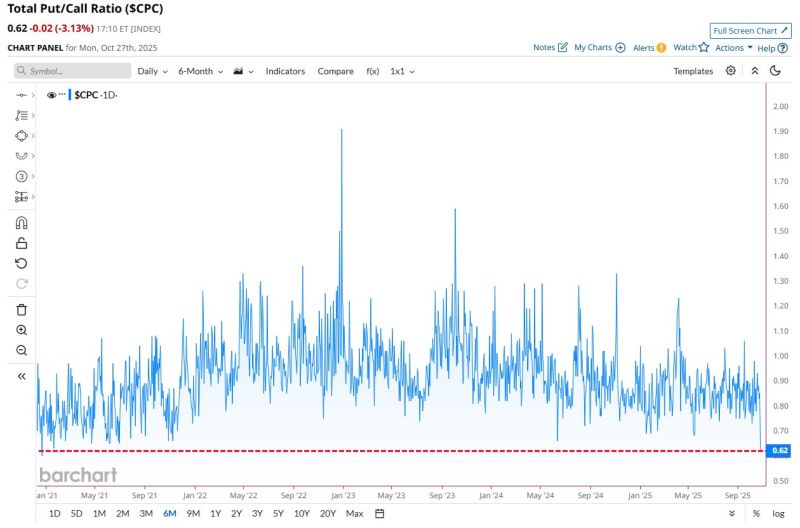

Total Put/Call Ratio falls to its lowest level since 2020

Bulls are going for it 🚀 Source. Barchart

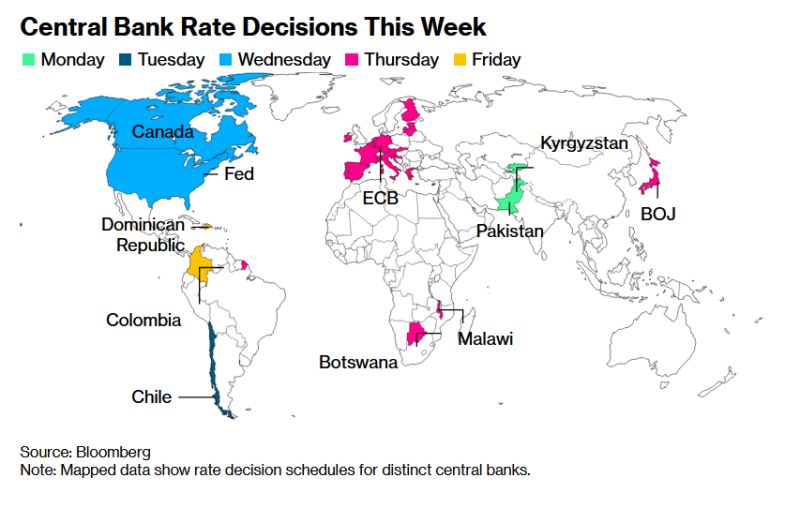

🚨 HUGE Week Ahead for Global Markets! 🚨

Four major central banks. One defining week. Here’s what’s coming 👇 💵 Federal Reserve — Expected to cut rates by 0.25% on Wednesday, and all eyes are on what comes next for its Quantitative Tightening (QT) program. 🇨🇦 Bank of Canada — Also forecasted to trim rates by 0.25%, signaling growing concern over slowing growth. 🇪🇺 European Central Bank — Likely to hold steady, keeping the focus on inflation trends across the Eurozone. 🇯🇵 Bank of Japan — Expected to stay the course, balancing yen weakness with cautious optimism. This week could set the tone for global liquidity, currencies, and market sentiment heading into year-end. 🌍.

$7,000,000,000,000 sitting in money markets.

As rates come down that $7T will go somewhere. Where? • Gold • Bitcoin • Real Estate • Stocks Source: Grant Cardone

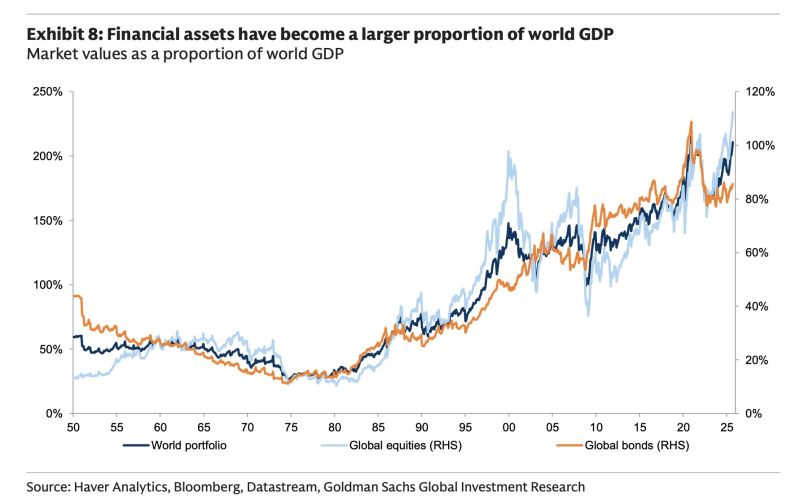

Is the Buffett rule sounding the alarm?

Since the 1990s, global financial assets have grown from 75% to over 200% of world GDP. Source: HolgerZ, Goldman

US funding market stress >>> Surging SOFR rates signaling a liquidity shortage

The most important indicator, as always, remains the SOFR rate: should the recent drift higher continue, the self-fulfilling cascade of a liquidity shortage will almost certainly be activated. And it did worsen... Source: zerohedge

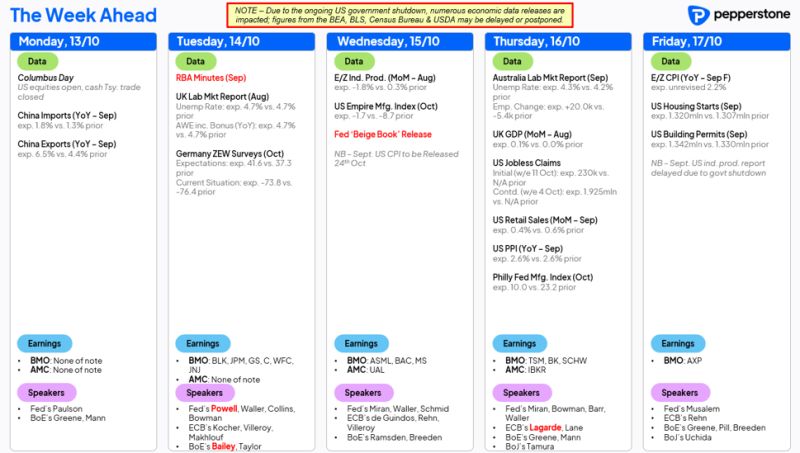

Key Events This Week:

1. OPEC Monthly Report - Monday 2. Fed Chair Powell Speaks - Tuesday 3. NY Fed Manufacturing Index - Wednesday 4. Philly Fed Manufacturing Index - Thursday 5. NAHB Housing Market Index - Thursday 6. ~10% of S&P 500 Companies Report Earnings The data blackout on the US government shutdown continues.

Key Upcoming Events This Week:

Tuesday - NY Fed Inflation Expectations data Wednesday - Fed meeting minutes release Thursday - Fed Chair Powell speech Friday - MI Consumer Sentiment & Expectations data, September Jobs Report (if govt shutdown ends) Source: investing.com

Investing with intelligence

Our latest research, commentary and market outlooks