Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace

Hedgefunds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Source: Global Markets Investor

Revolut employees are in line for big windfalls as the UK’s most valuable fintech allows staff to sell down their holdings in the company at a $75bn valuation

Revolut told staff on Monday that they would be allowed to sell up to 20 per cent of their shares to make way for other investors, according to people with knowledge of the matter and a document seen by the Financial Times. Source: FT https://lnkd.in/eRpjTMad

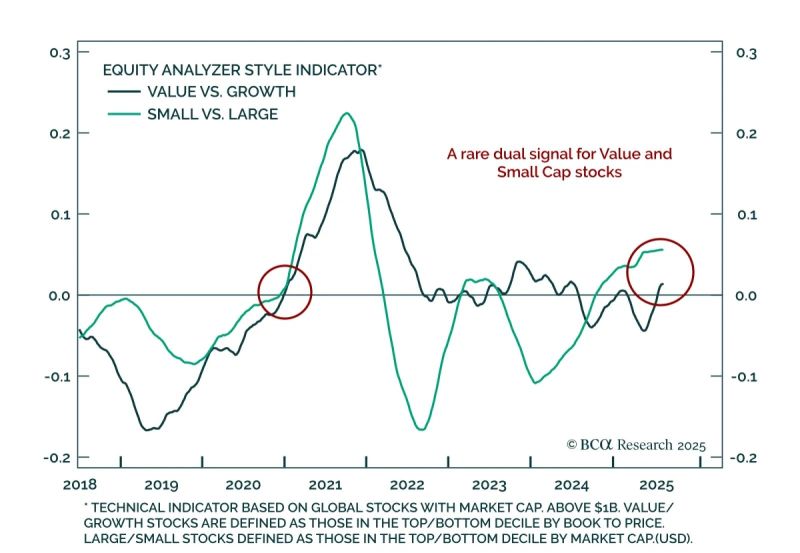

This is BCA's "Chart Of The Week": Has momentum turned in equities?

Two momentum signals: 1) Value vs. Growth just flipped positive for the first time since mid-2024. 2) Small vs. Large has been rising since late 2024. BCA team noted this rare alignment has historically fueled multi-quarter cyclical outperformance. Source: BCA

The 12-month rolling sum of foreign flows into longer-term US assets reached an all-time high in June.

That's well after all the chaos in April around "Liberation Day" and all the weirdness on Russia and China. Markets just don't care. They continue to see US "exceptionalism..." Source: Robin Brooks @robin_j_brooks on X

Investing with intelligence

Our latest research, commentary and market outlooks