Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

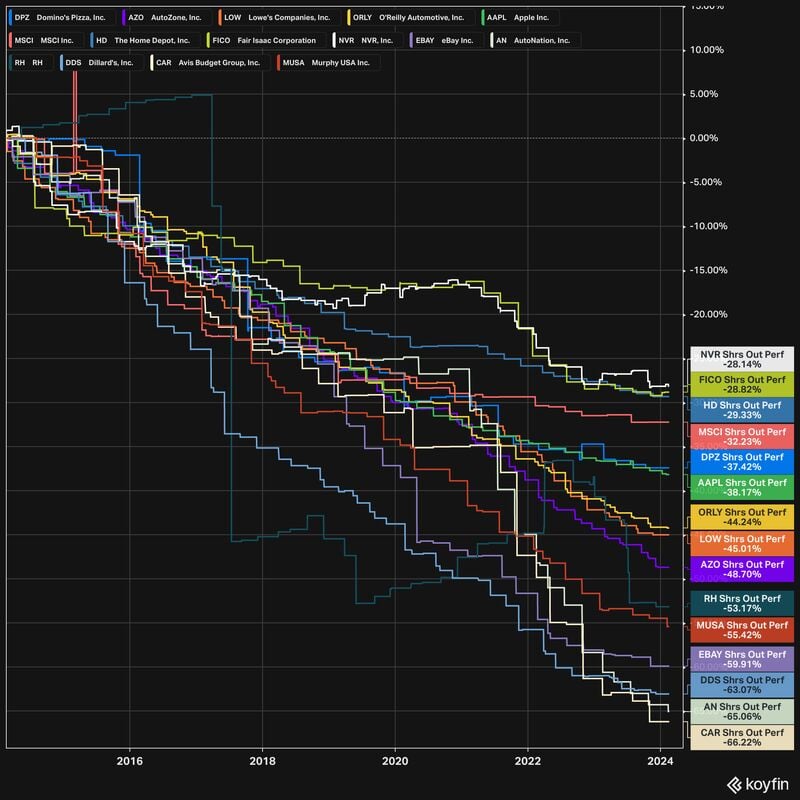

Warren Buffett loves share cannibals.

"The math isn't complicated. When the share count goes down, your interest in the businesses goes up. Every small bit helps if repurchases are made at value-accretive prices". Source: Koyfin Charts

Reminder

U.S. markets are closed Tomorrow, Monday, Feb. 19, in observance of Presidents Day. The NYSE, Nasdaq and bond markets will be closed. The next market holidays will be Friday, March 29, for Good Friday, followed by Memorial Day on Monday, May 27.

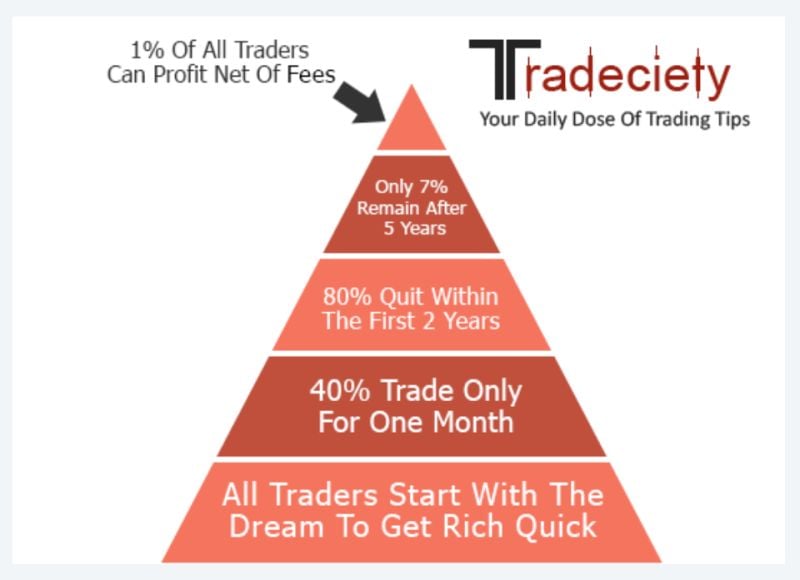

BEWARE OF SCALPING!

I see more and more amateur traders taking scalping training and lessons and engaging into day-trading activities hoping to make quick profits and a living from it. They need to be aware that the vast majority of hashtag#trading strategy are money losing (see this article: https://lnkd.in/e4vb2Nde). The best investment strategy is long-term investing, sticking to a pre-defined strategic assetallocation and rebalancing after extreme moves. What is scalping? A scalping strategy is a short-term trading technique that aims to capitalize on small price movements in highly liquid markets. Traders who employ this strategy, known as scalpers, enter and exit trades quickly, usually within seconds or minutes, to take advantage of small price differentials. But scalping is hard and almost all scalpers end up losing. Scalping is a waste of time because it involves competing with better-equipped traders and institutions and you need to deal with lots of randomness and noise in the market. Most likely you end up losing money.

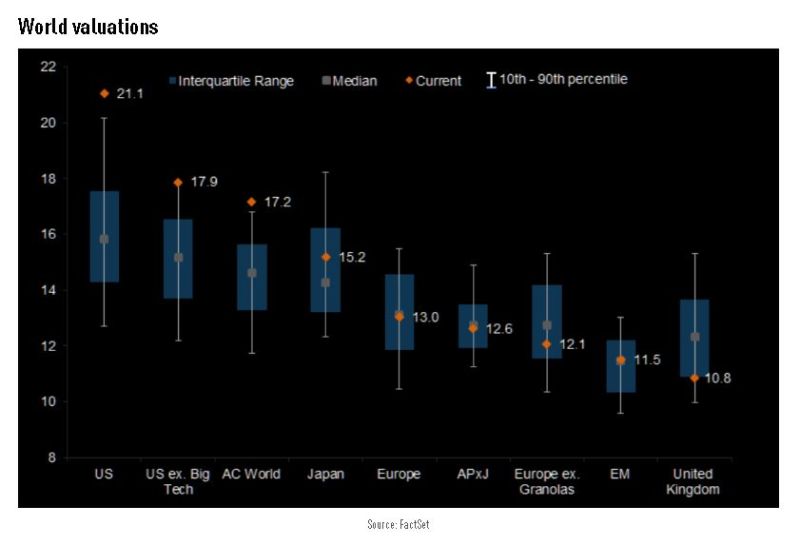

The geographical spread of valuations across regions remains significant.

12m forward P/E multiple. MSCI Regions. Data for the last 20 years. Source: TME, Factset

Treasury proposes rule to extend anti-money laundering regs to investment advisers

The Treasury Department’s corruption watchdog issued new proposed regulations that would extend major pieces of the anti-money laundering (AML) rules that apply to banks to some investment advisers. The new rules, from the Treasury’s Financial Crimes Enforcement Network, or FinCEN, would require covered investment advisers to file Suspicious Activity Reports, SARs, to FinCEN, and to disclose additional information about their clients under specific circumstances. The new rules would apply to investment advisers who are registered with or report to the Securities Exchange Commission, leaving out what FinCEN estimates to be at least 17,000 state-registered investment advisers. source : cnbc

$LYFT is surging 63.73% (!) after hours after beating earnings (500bps EBITDA margins expansion) and providing a stellar outlook 👀

But under 1 hour later, the CFO said there was a typo in their earnings release... saying they meant to report a 50 basis point increase in EBITDA margin (instead of 500bps). In other words, EBITDA margin was reported to be 10 TIMES what it actually is... The stock ended up being 18% after hours... Source: Markets & Mayhem, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks