Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

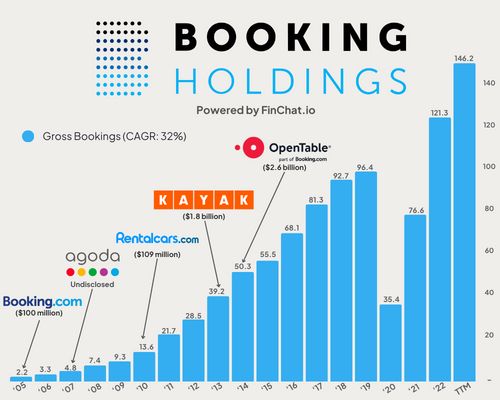

In 2004, Priceline $BKNG acquired Booking.com for $100 million.

Over the last 12 months, http://Booking.com generated ~$20 billion in revenue! Source: Finchat

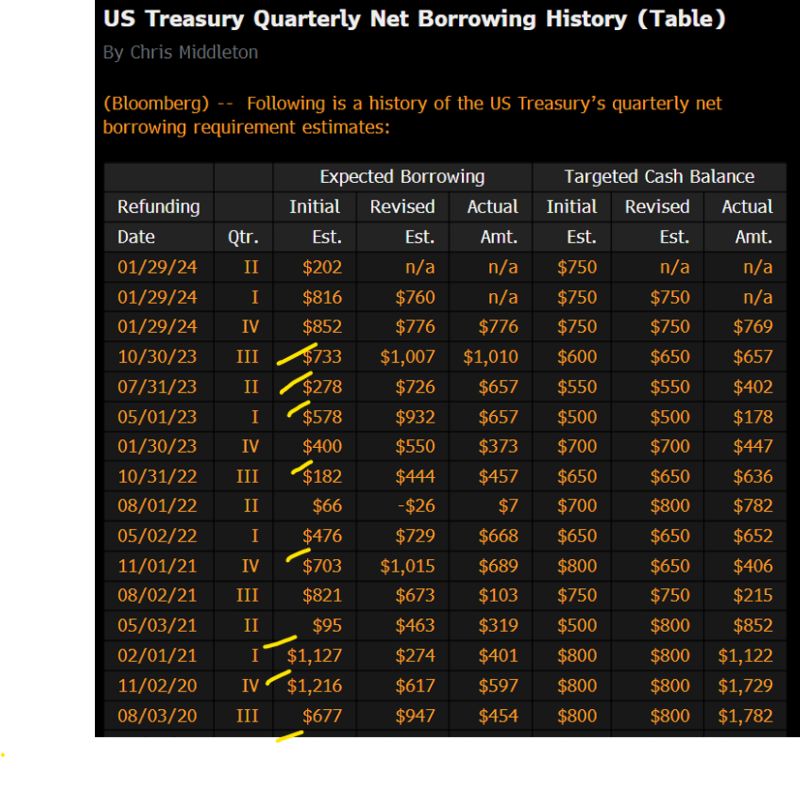

Equity futures spiked while bond yields dropped yesterday after the close after US Treasury unexpectedly slashed borrowing estimates:

- For Q1, US Treasury now expects to borrow "only" $760 billion in debt, which is $55 billion lower than what it expected in October 2023, and is about $30BN below wall street estimates. The difference the Treasury explained is "largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance." In other words, Treasury expects higher taxes to more than make up the $55BN difference from the previous estimate. - For Q2, the Treasury now expects to borrow only $202 billion in debt. While there was no previous Treasury forecast for this period, Wall Street expected a number somewhere in the $500BN vicinity, so clearly this is far lower than preciously expected. Source: Bloomberg, Chris Middleton, Lawrence McDonald, www.zerohedge.com

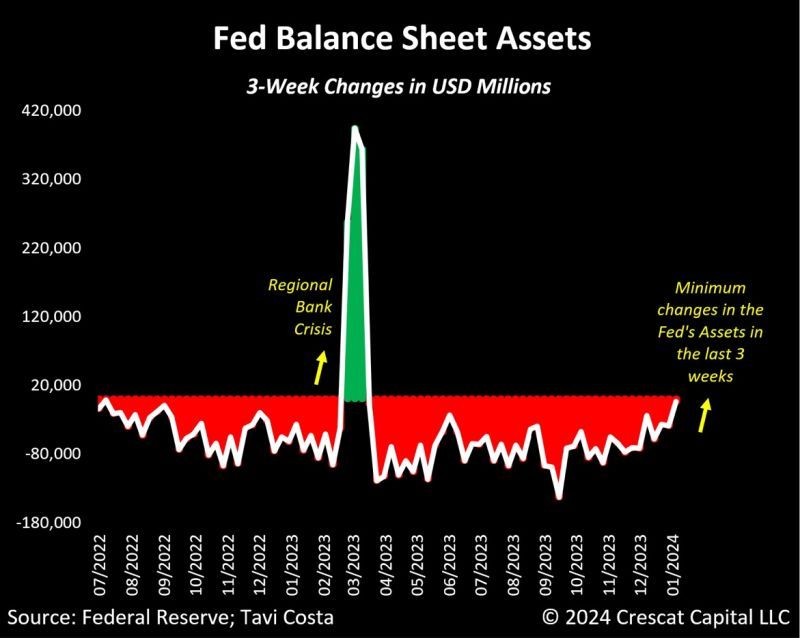

The Fed did almost no QT in the last 3 weeks

As highlighted by Tavi Costa, this was the smallest change in their balance sheet since the regional bank crisis in March 2023. Source: Bloomberg, Crescat Capital

How are the 'Magnificent 7' Tech Stocks doing so far this year?

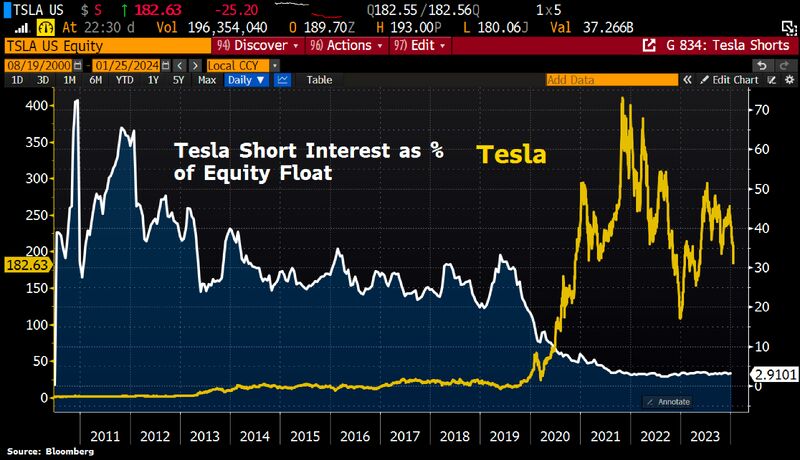

Nvidia Is Up +23.2% $NVDA. Meta Is Up +11.3% $META. Alphabet Is Up +9.1% $GOOGL. Microsoft Is Up +7.4% $MSFT. Amazon Is Up +4.7% $AMZN. 🔴 Apple Is Down -0.1% $AAPL 🔴 Tesla Is Down -26.2% $TSLA Source: Jesse Cohen, Bloomberg

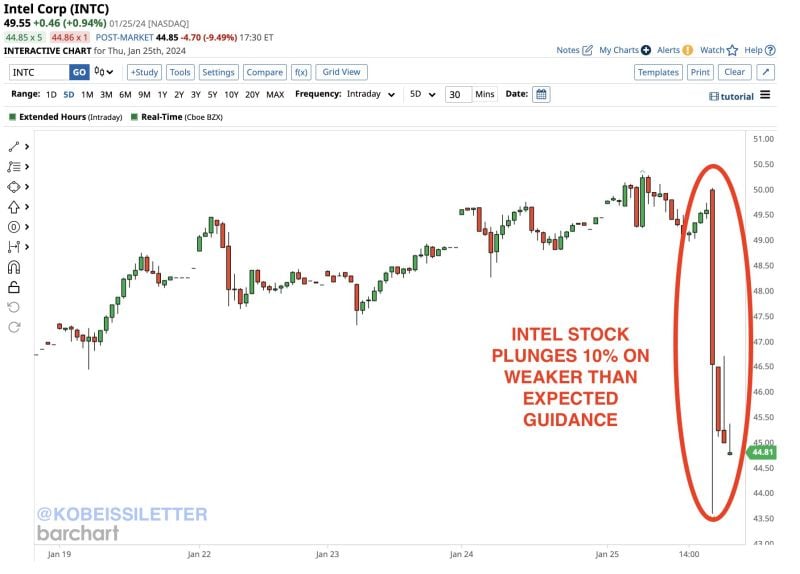

Intel $INTC, is down 10% after-hours after providing weaker than expected guidance in their earnings release

The move lower has erased $20 billion in market cap in just two hours. Intel provided Q1 2024 EPS guidance of $0.13, which is well below expectations of $0.34. They are also guiding Q1 2024 revenue of $12.2B-$13.2B, below expectations of $14.2B. The question becomes if this weakness is an Intel issue or an industry-wide issue. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks