Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

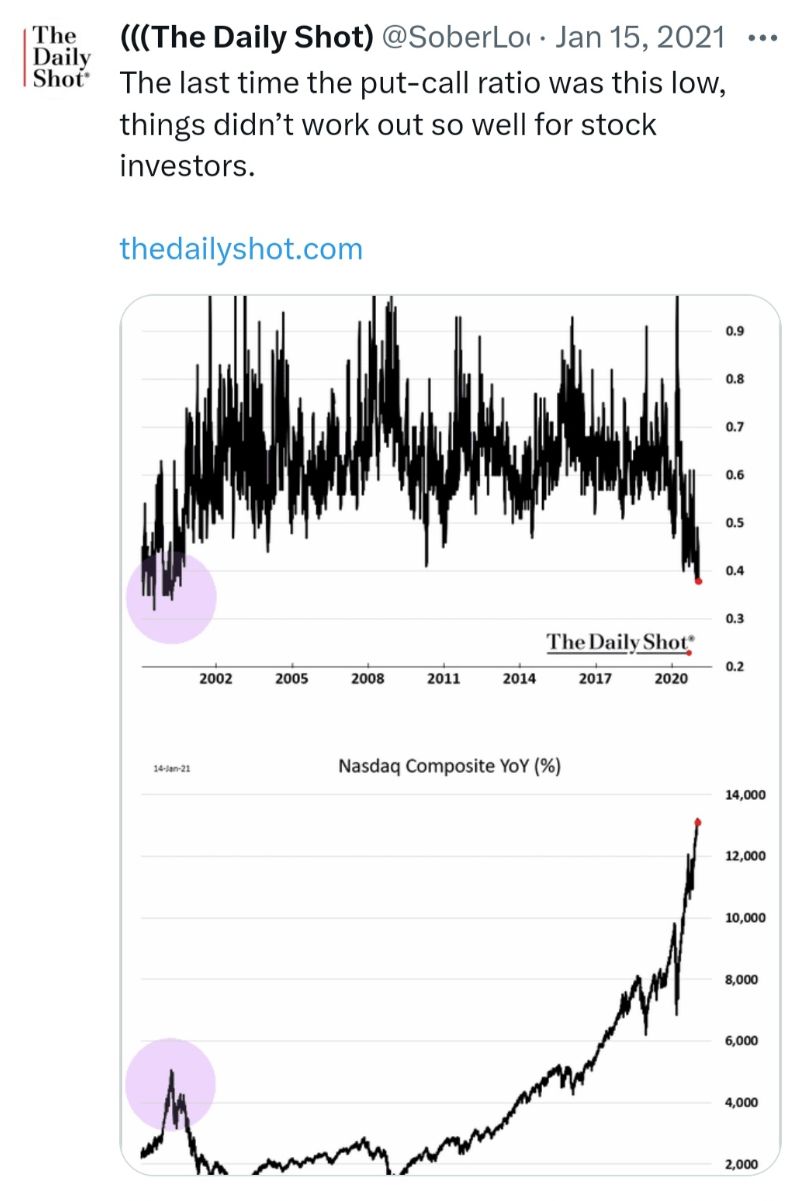

The put/call ratio is as low as at the DotCom peak

Source: The Daily Shot, WinSmart

CBOE Volatility Index $VIX jumps to highest level in more than 2 months

Source: Barchart

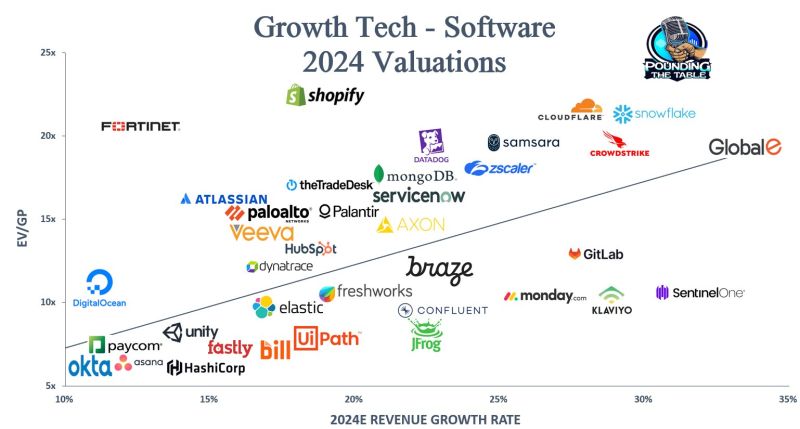

This scatter plot shows where growth tech valuations stand based on 2024 metrics

Source: Shay Boloor

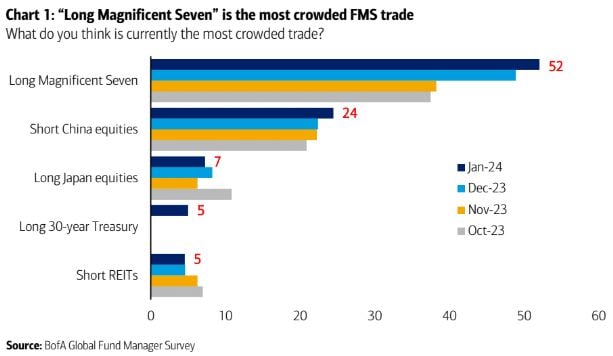

BofA's Fund Manager survey shows the mag7 is still the most crowded trade.

Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks