Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

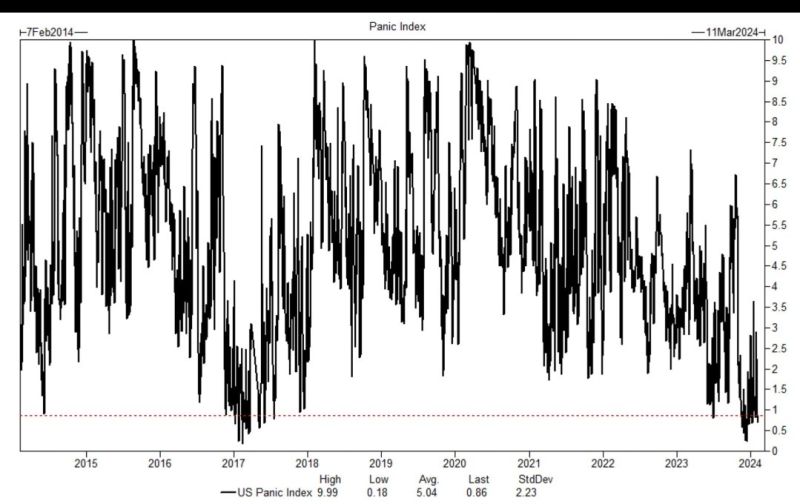

Has the market become too complacent?

Goldman Sachs Panic Index is near decade lows. Source: Win Smart

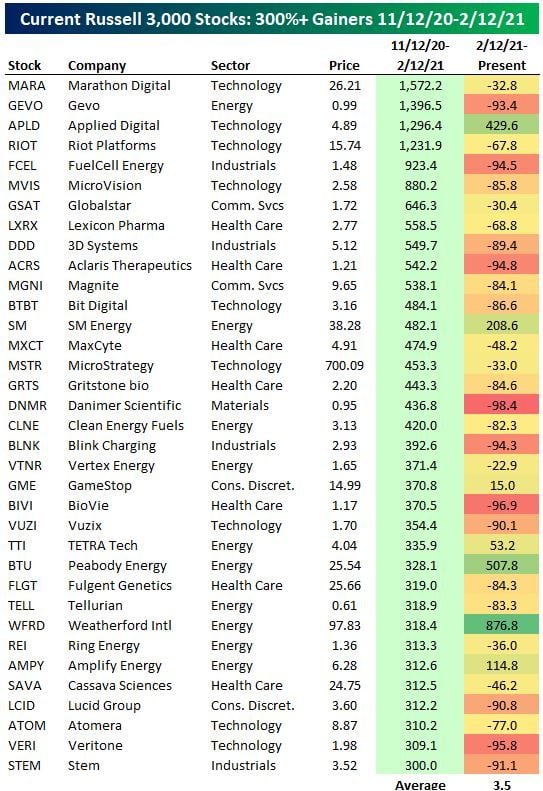

Meme Stock Anniversary

Three years ago today, the "meme-stock mania" that saw hundreds of profitless stocks surge hundreds of percent in a matter of months hit its ultimate peak. In the three months leading up to February 12th, 2021, the average stock in the Russell 3,000 (current members) rallied 40%, but there were 178 stocks that saw three-month rallies of more than 100%, 35 stocks that rallied 300%+, and four stocks that rallied over 1,000%. Below is a table of the 35 stocks currently in the Russell 3,000 that rallied 300%+ in the three months leading up to 2/12/21( include also how each of these stocks has performed since 2/12/21) source : bespoke

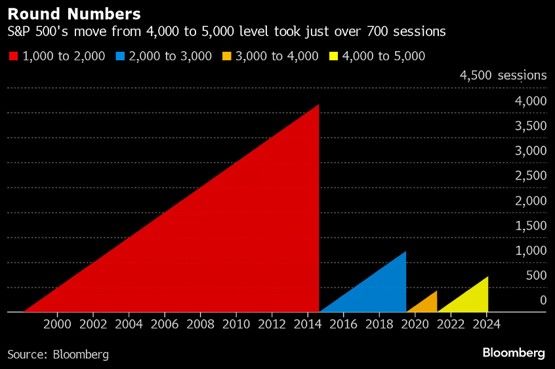

S&P 500 closes above 5,000 for first time ever.

It took 719 sessions for the index to set its latest 1,000-point milestone, a gain of 25%. The 50% advance from 2,000 to 3,000 needed 1,227 trading days, from 2014 to 2019, acc to data compiled by Bloomberg. To double from 1,000 in 1998, it needed 4,168 sessions to get to 2,000 in 2014. Source: HolgerZ, Bloomberg

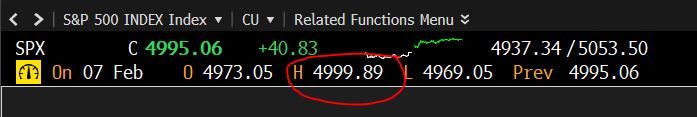

🍾 S&P 500 closes over 5,000 for the first time in HISTORY

Most of the major US equity indexes moved higher over the week, with the S&P 500 Index reaching new highs and breaching the 5,000 threshold for the first time. The advance remained relatively narrow, however, with an equally weighted version of the index significantly trailing the standard market-weighted version for the fourth time in five weeks... Source hashtag#chart: Genevieve Roch-Decter, CFA

Despite the Russell 2000 remaining in a bear market, down 20% from its peak in 2021, the S&P 500 reached a new milestone by trading above 5,000 points intraday for the first time ever yesterday.

source: bloomberg

Cocoa is now trading at a new 46-year high after 8 consecutive green days.

In fact, 18 of the last 20 days have been green for Cocoa. It really wants an all-time high! Source: Barchart

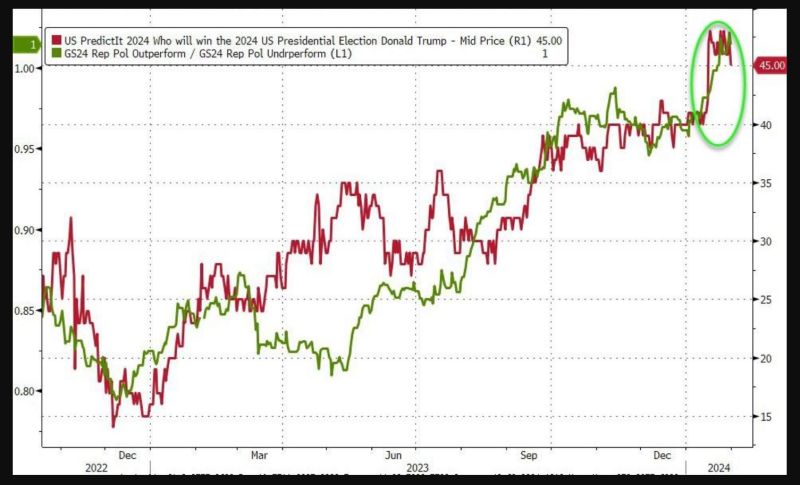

Is the market pricing in a Trump victory?

Based on Goldman's Republican winners vs losers basket performance, it appears stocks are moving in sync with Trump's odds. Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks