Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Less and less listed companies; but big companies are getting bigger...

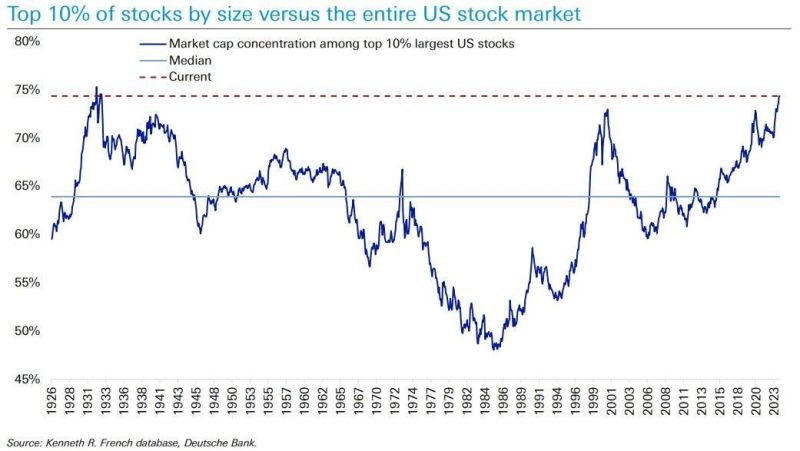

The number of publicly listed companies in the US has declined by 50% since 1995. Currently, there are just over 4200 public companies in the US. The same trend has been seen in the number of banks in the US which was at 31,000 in 1920 but just 4,000 today. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market. This is, by far, the most concentrated 🇺🇸 stock market since the Great Depression in 1931. Even in the Dot-com bubble of 2001, concentration of the top 10% of stocks peaked at ~72% before the 2008 Financial Crisis, it peaked at nearly 66%. Big companies are indeed getting bigger! Source: The Kobeissi Letter, Wall Street Engine

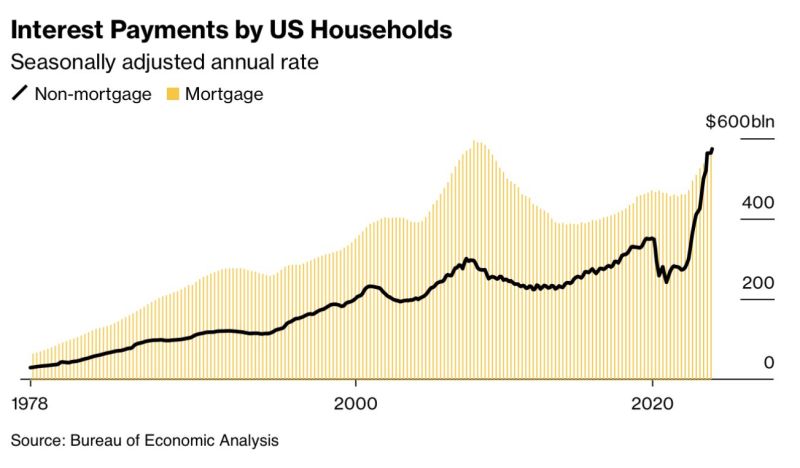

U.S. Households are now spending a record $573.4 billion on non-mortgage interest payments which for the first time in history is roughly the same as mortgage interest payments.

source : Barchart

U.S. companies will have to start telling the public about their climate risks

The SEC voted Wednesday to impose climate-disclosure requirements that will be significantly softer than those it proposed in March 2022 after the agency received thousands of comment letters and numerous litigation threats over the plan. In the biggest change, the regulator won’t force companies to quantify pollution from their supply chains or customers, known as Scope 3 emissions. Additionally, firms will face a higher bar for when they need to reveal more direct carbon footprints in their regulatory filings, which are known as Scope 1 and Scope 2 emissions. source : Bloomberg

In a surprise Monday ruling, SCOTUS determined Donald Trump is eligible to run for office again

The decision is a massive victory for Trump, whose eligibility on Colorado's ballot was challenged. The decision was issued one day ahead of Super Tuesday when 16 states will hold primary elections. Source: Business Insider

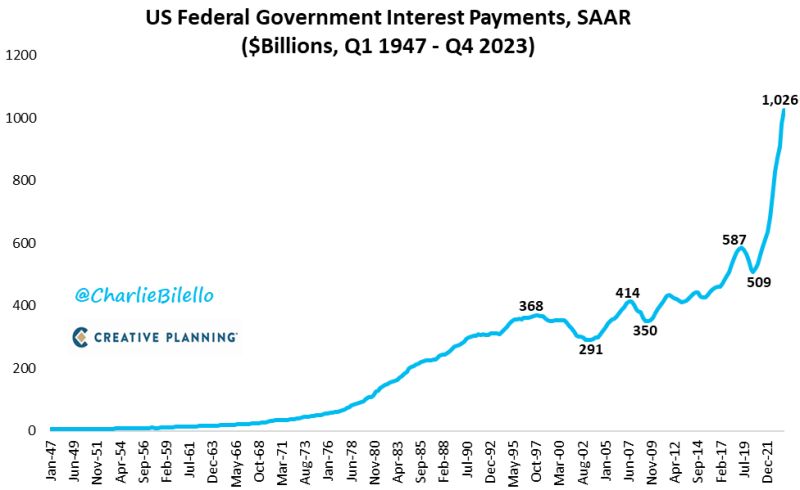

The interest payments on US Federal Government Debt have surpassed a $1 trillion annual rate, increasing 98% over the past 3 years

Source: Charlie Bilello

Another damming poll for Biden: With 8 mths left until Nov election, Joe Biden’s 43% support lags behind Donald Trump’s 48% in the national survey of registered voters

The share of voters who strongly disapprove of President Biden’s handling of his job has reached 47%, higher than at any point in his presidency. The betting markets are now also backing Trump. PredictIt has him 6%-pts ahead. Source: Bloomberg, HolgerZ

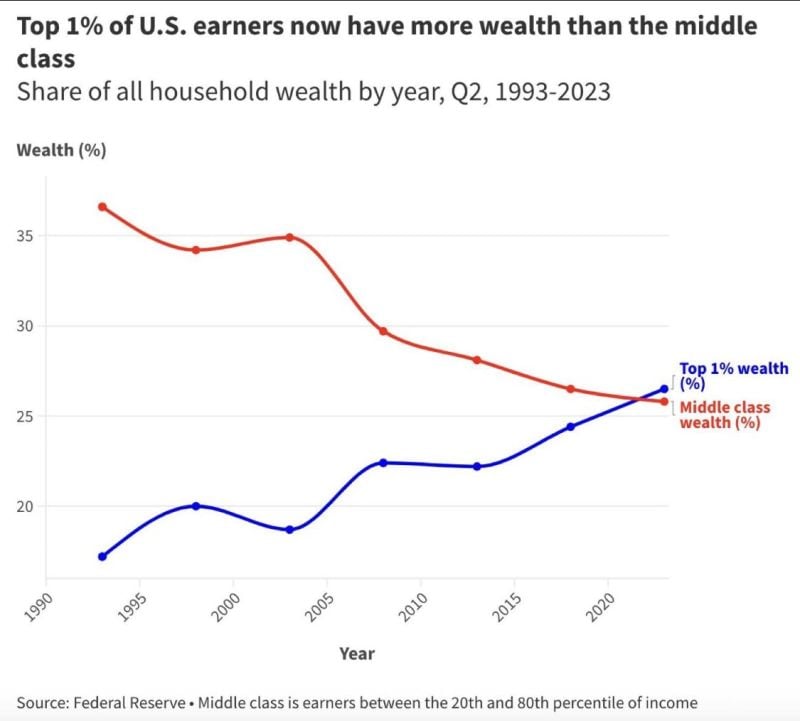

Wealth inequality keeps rising

The Top 1% of US earners now have more wealth than the middle class

🚨 February numbers are in and the Mag 7 are now the 𝗙𝗮𝗻𝘁𝗮𝘀𝘁𝗶𝗰 𝟰 year to date

Nvidia , Meta , Microsoft and Amazon driving all the gains while Apple , Google and Tesla fall out of the 7. Source: John Haslett, CA(SA), FRM

Investing with intelligence

Our latest research, commentary and market outlooks