Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Today's report unveiled the largest positive surprise in US personal income since the surge in consumer prices began in 2021

Source: Tavi Costa, Bloomberg

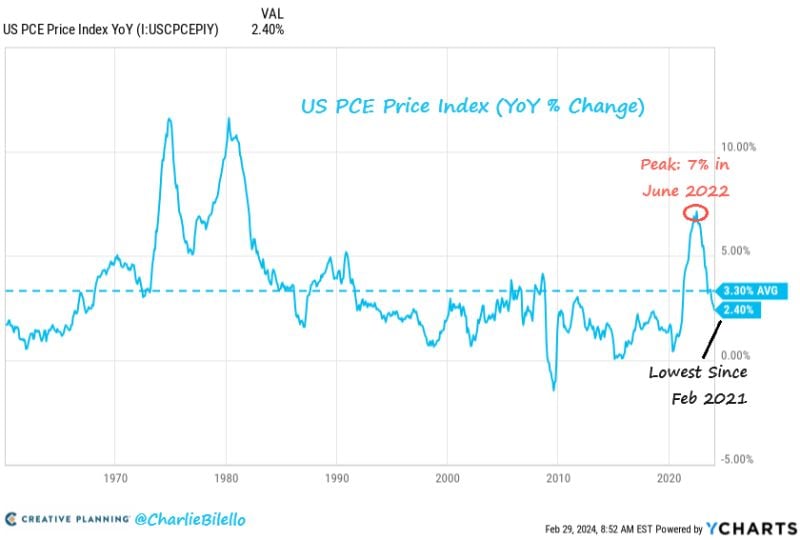

More evidence of a decline in US Inflation...

The PCE Price Index moved down to 2.4% in January, its lowest level since February 2021. Cycle peak was 7% in June 2022. Source: Charlie Bilello

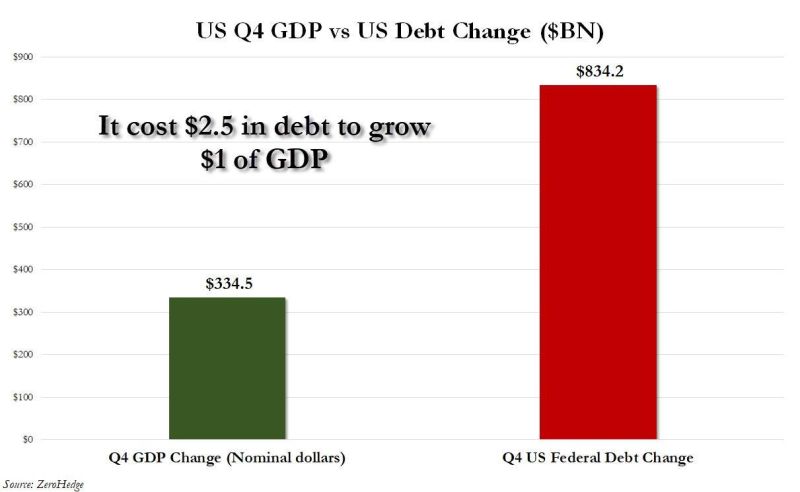

When you invest in US debt, think twice...

In Q4 2023, nominal GDP grew by 3.2% according to data on Wednesday. This would mean a $334.5 billion increase in nominal GDP. Meanwhile, over the same time period the US added $834.2 billion of debt. In other words, it cost us $2.50 of debt for every $1.00 of GDP last quarter, according to Zerohedge. As Fed Chair Powell recently said, "we are on an unsustainable fiscal path." What's the long term plan here? Source: The Kobeissi Letter, www.zerohedge.com

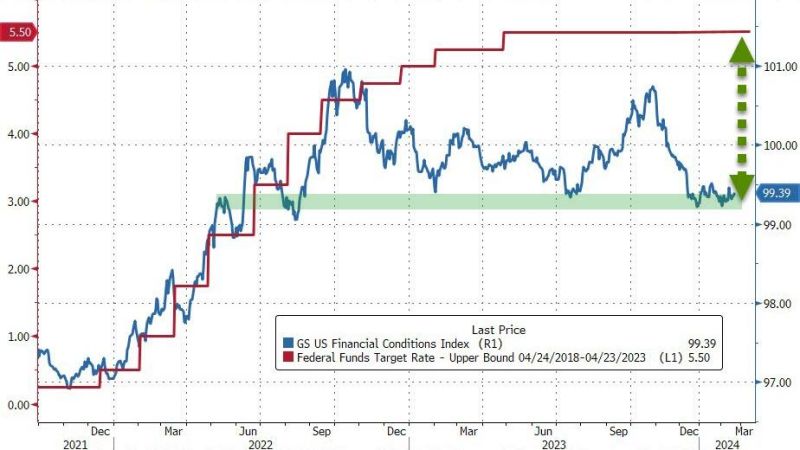

US financial conditions are very easy compared to Fed Funds...

Too easy? Bear in mind what the FOMC said in the Minutes on Wednesday: "Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall." Could this lead the fed to keep rates higher for longer? How long will the market be able to shrug off high rates and higher bond yields? Source: www.zerohedge

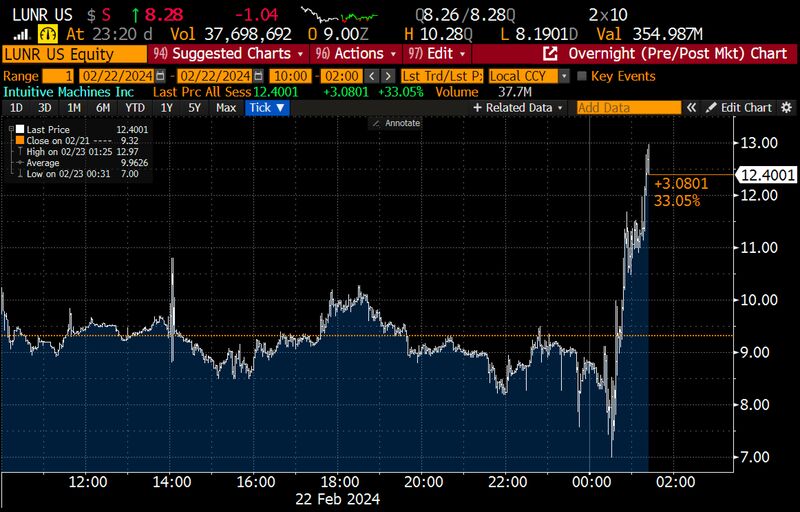

To the Moon: Intuitive Machines successfully landed its Odysseus lunar lander, at 6:11 p.m. ET on Feb. 22, making it the first privately (non-government) built spacecraft to achieve this feat.

The US hasn't had a moon landing — manned or unmanned — since 1972. Source: Bloomberg, HolgerZ

Four Years Since COVID

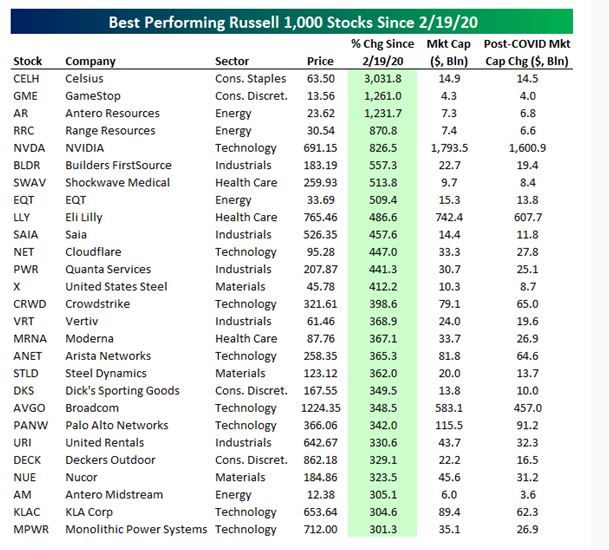

Sunday, 2/19/24 marked the four-year anniversary of the US stock market's peak closing level just before COVID hit in 2020. February 19th, 2020 was an unremarkable trading day that saw the S&P 500 rally about 0.5% and gold hit its highest level since 2013. At that point, the novel coronavirus was taking a serious toll on China, but there was still only slight anxiety and nervousness about it having a major impact on US shores. Below is a list of the best performing stocks in the Russell 1,000 since then. At the top of the list is energy-drink maker Celsius (CELH), which is far ahead of the pack with a gain of 3,030%. source : bespoke

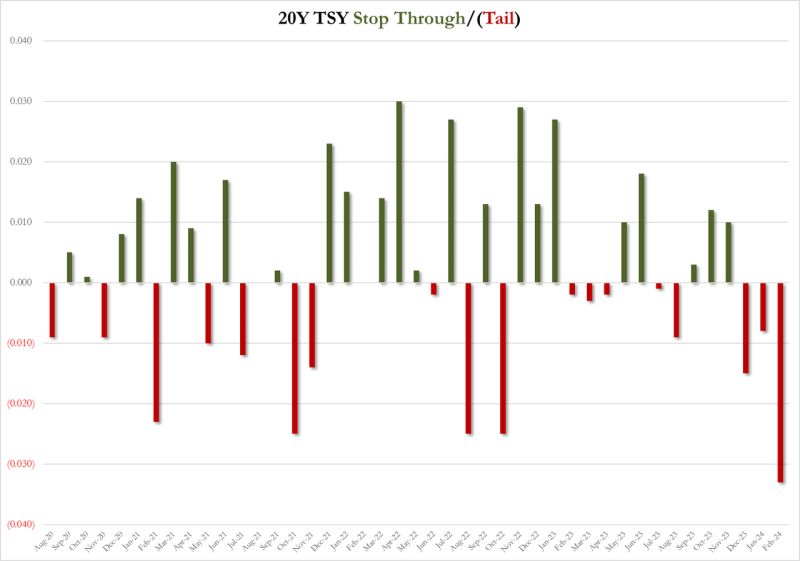

US yields surged after terrible 20Y Auction with biggest tail on record.

The high yield of 4.595% was well above last month's 4.423% but worse, it tailed the yields that prevailed when it was issued (4.562%) by a whopping 3.30bps, which was the biggest tail on record for the tenor since the 20Y auction was introduced in May 2020. The bid to cover tumbled to 2.39, down from 2.53, well below the 2.59 six-auction average, and was the lowest since August 2022. The internals were even uglier, with Indirects awarded just 59.08%, lower than last month's 62.16%, sharply lower than recent average of 68.2% and the lowest since May 2021. And with Directs taking down 19.7%, Dealers were left holding 21.2%, the most since May 2021. Overall this was a very ugly auction, perhaps one can attribute it to nerves from today's FOMC Minutes which however should be a non-event as they are already rather dated and do not reflect the latest reflationary spike. In any case, yields promptly spiked with the 10Y rising as high as 4.325% before retracing some of the move, which also sent stocks sliding briefly before recovering. Source: www.zerohedge.com

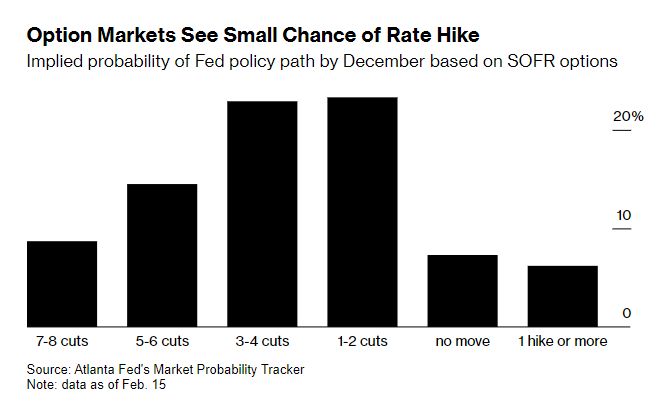

US markets start to speculate if the next Fed move is up, not down - Bloomberg

Investors are beginning to war-game how the Federal Reserve can manage a us economy that just won’t land, with some even debating whether interest-rate hikes will be needed only weeks after a steady run of reductions appeared all but certain. Bets on lower rates coming soon were so prevalent a few weeks ago that Fed Chair Jerome Powell publicly cautioned that policymakers were unlikely to be in position to cut as of March. Less than three weeks later, traders have not only removed March as a possibility but May also looks improbable, and even conviction about the June Fed meeting is wavering, swaps trading shows.

Investing with intelligence

Our latest research, commentary and market outlooks