Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

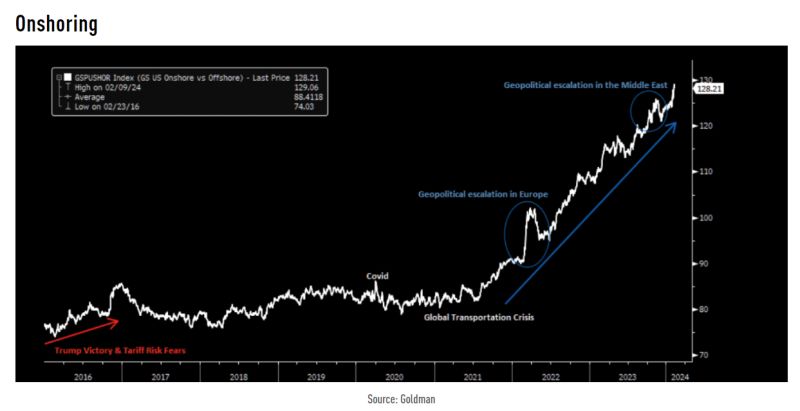

China and US elections reiterate the durability of the onshoring theme.

Source: Goldman Sachs

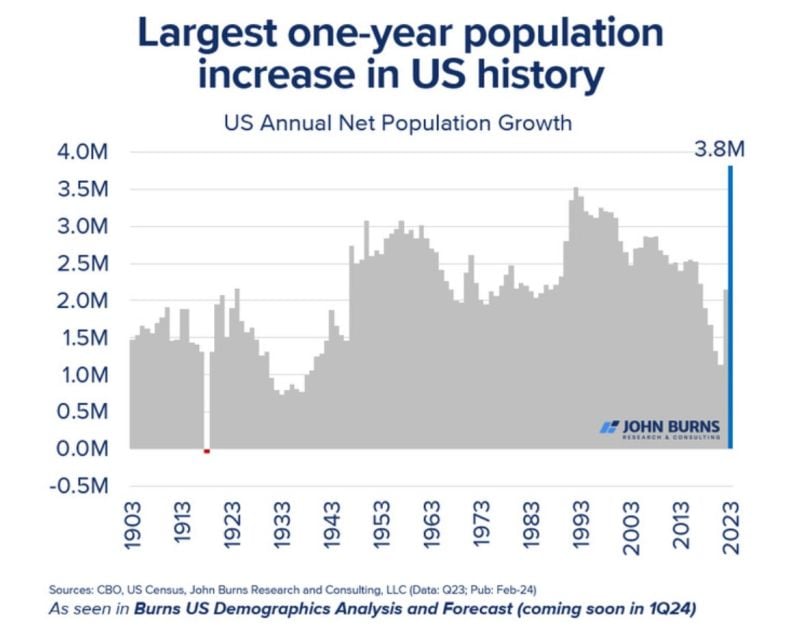

Will we soon see some relief on US wage inflation?

The US just experienced the largest population increase in a year ever. Mostly driven by the surge in immigration. Source: Tavi Costa

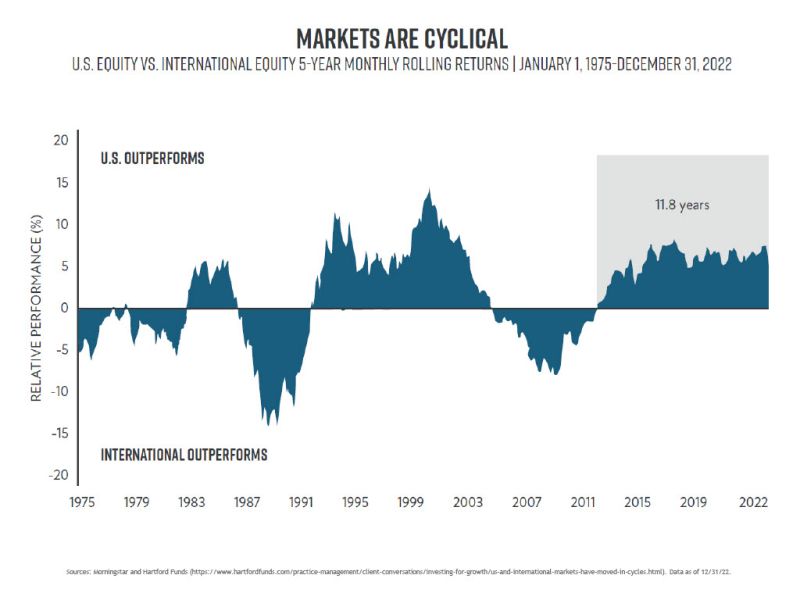

We're currently witnessing the longest period of U.S. equity outperformance in history.

But there's a cycle to everything, and international diversification is perhaps more important today than ever before. Source: Peter Mallouk

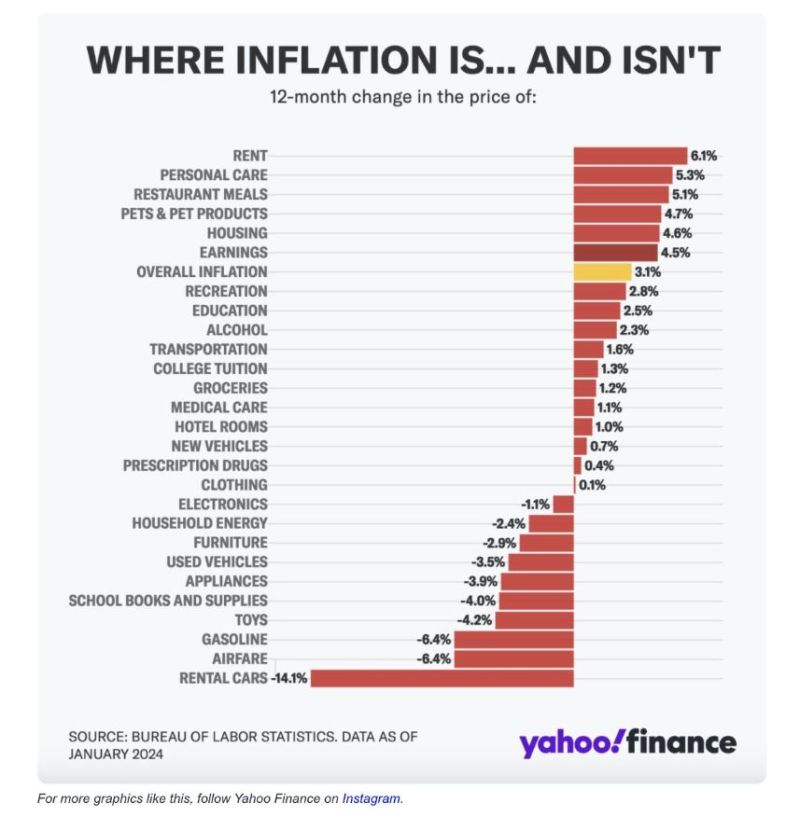

US Inflation – Where It Is And Isn’t

Source : Yahoo Finance

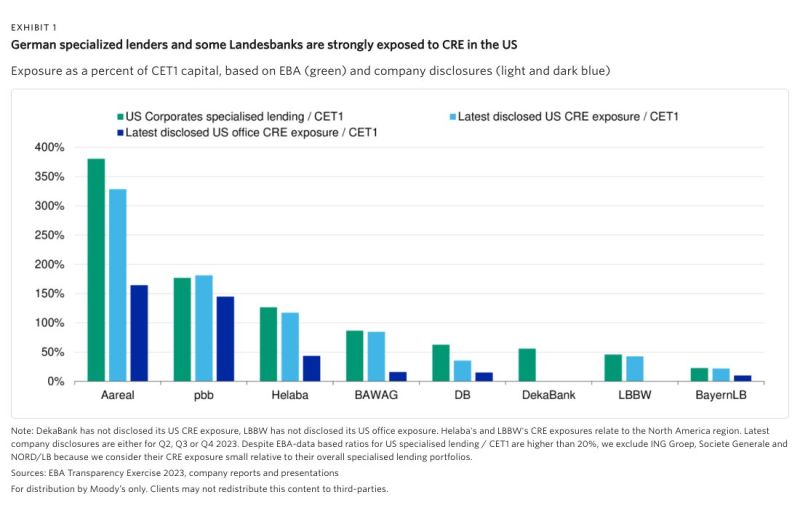

What is the exposure of German banks to us commercial real estate?

According to Moody's, Aareal Bank & Deutsche Pfandbriefbank have the largest exposure compared w/their capital levels. The shares of Deutsche Pfandbriefbank, which is the most shorted in Germany, have recently lost a quarter of their value. In case of Deutsche Bank, there is a gap between banks' exposure to US specialized lending and exposure to banks' US CRE book as DB engages to a material extent in other asset-based or project lending that would also qualify as specialised lending, according to Moody's. Source: Dekabank, HolgerZ

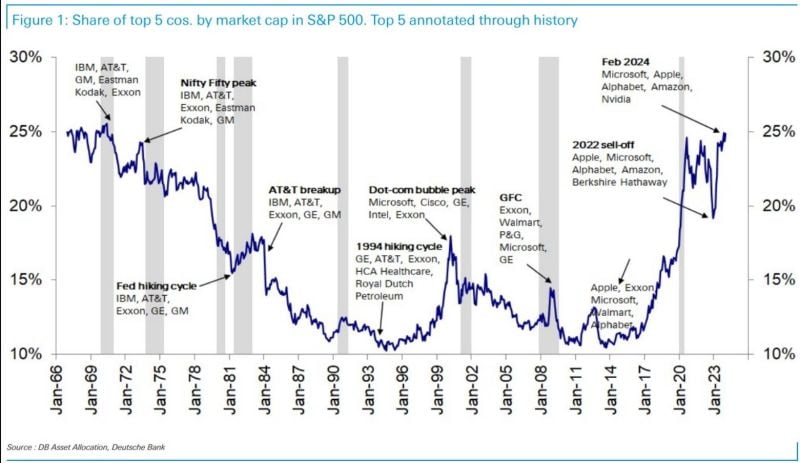

The US equity market is rivalling 2000 and 1929 in terms of being its most concentrated in history, DB has calculated.

The top 5 stocks Microsoft, Apple, Nvidia, Alphabet & Amazon account for 25% of mkt cap of the S&P 500. source : holgerz

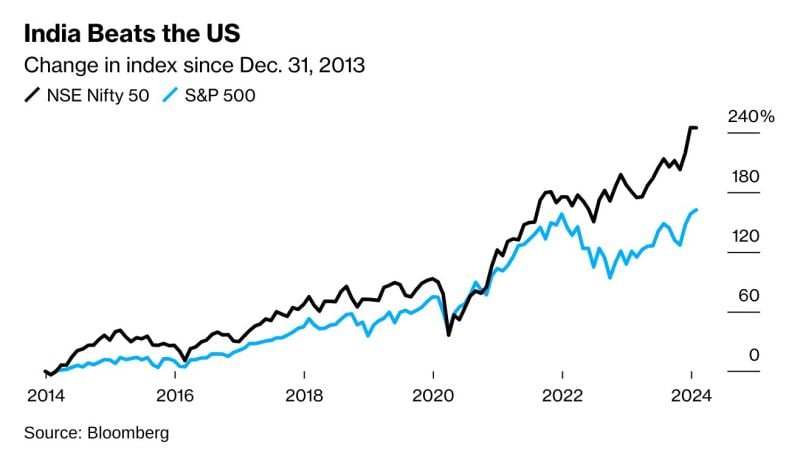

India is one of the few markets that is outperforming the US rather handily

Source: Bloomberg

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history

And experts say it could cost Americans their homes, spending power and national security - Fortune Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks