Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

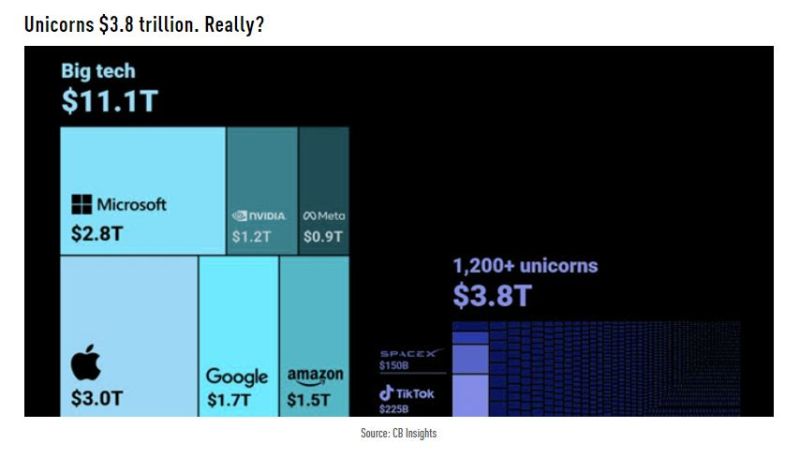

Big Tech of course "dwarfs" unicorn total market cap, but that 3.8T number still feels a little on the high side

Source: TME, CB Insights

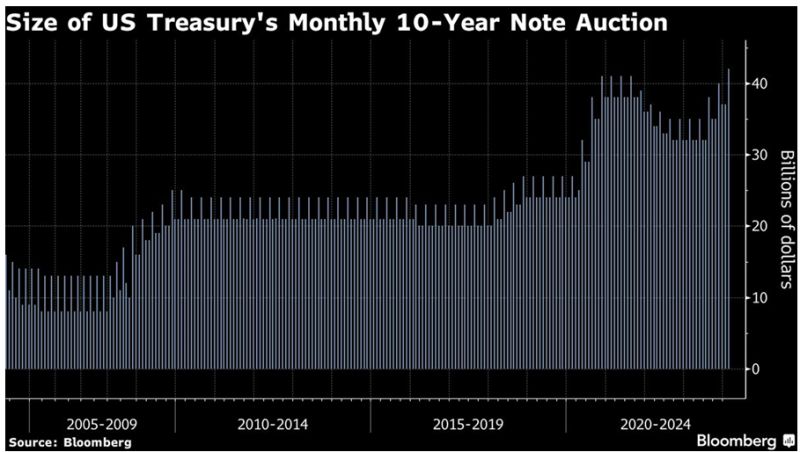

The US government sold a record $42 billion of 10-year notes Wednesday at a lower-than-anticipated yield.

The notes were awarded at 4.093%, compared with a when-issued yield of about 4.105% moments before 1 p.m. New York time, the bidding deadline. The lower yield indicates stronger demand than traders anticipated. The auction result broke a streak of tails — or a weaker result for the previous four monthly sales . source : bloomberg

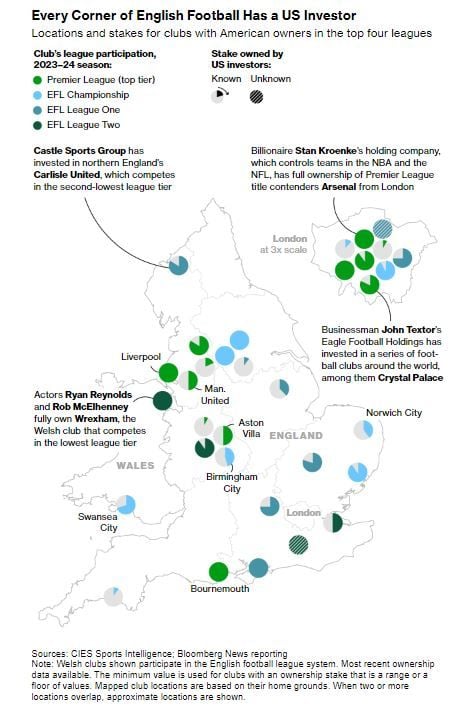

Are Americans Taking Over English Football ?

More than a third of the 92 professional teams in England’s top four leagues now have some form of US ownership. source : bloomberg

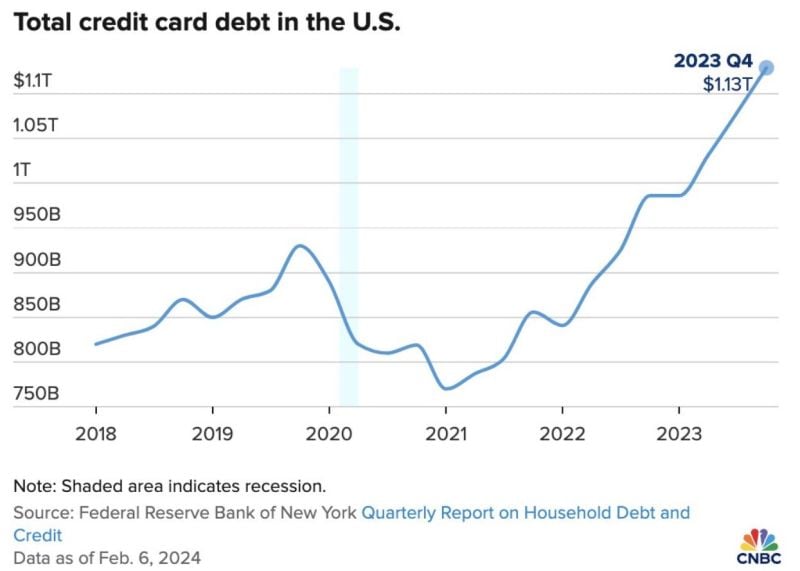

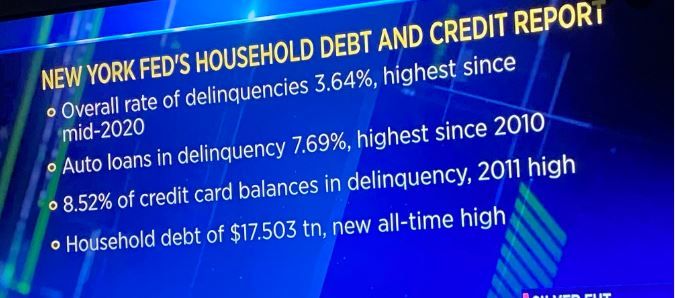

Americans now have a combined $1.13 Trillion of credit card debt, according to a new report from the Federal Reserve Bank of New York

source : cnbc

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

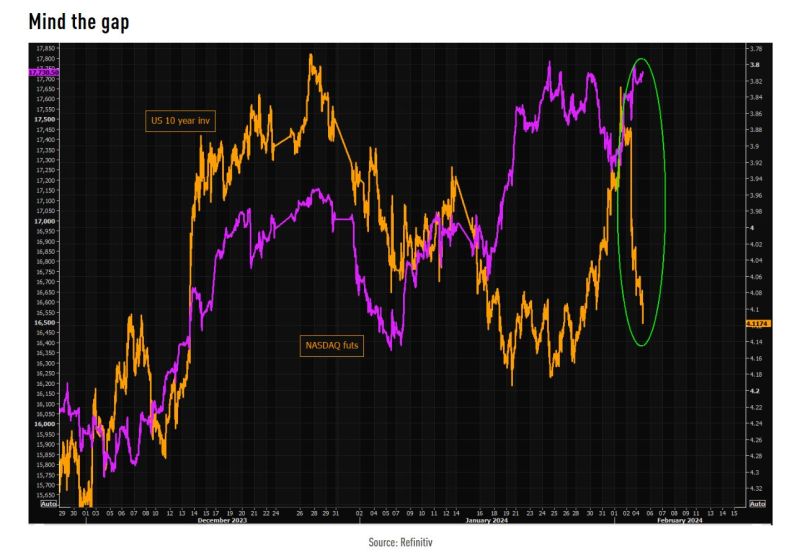

The short term gap is huge. NASDAQ futs vs US 10 year (inv), 10 min 3 mths chart.

Source: TME

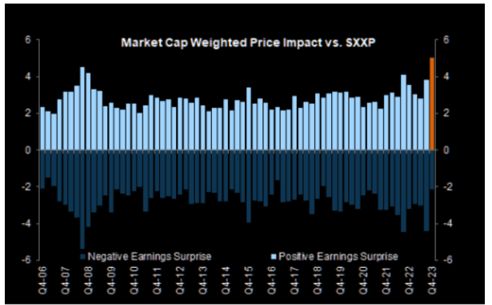

US Earnings season UPDATE

Q4 GAAP EPS +16% higher than a year ago after 46% of S&P 500 companies have reported. Note that Beats are rewarded like never before. We have seen sharp moves for positive surprises led by large cap constituents. Source. Factset, TME

Investing with intelligence

Our latest research, commentary and market outlooks