Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A Los Angeles office building just sold for 52% less than its price five years ago.

The office building was originally purchased in 2018 for $92.5 million. Now, it sold for $44.7 million even after over $11 million in renovations. Just weeks ago, the Aon Center in downtown LA sold for $147.8 million, 45% less than its previous purchase price in 2014. Source: The Kobeissi Letter

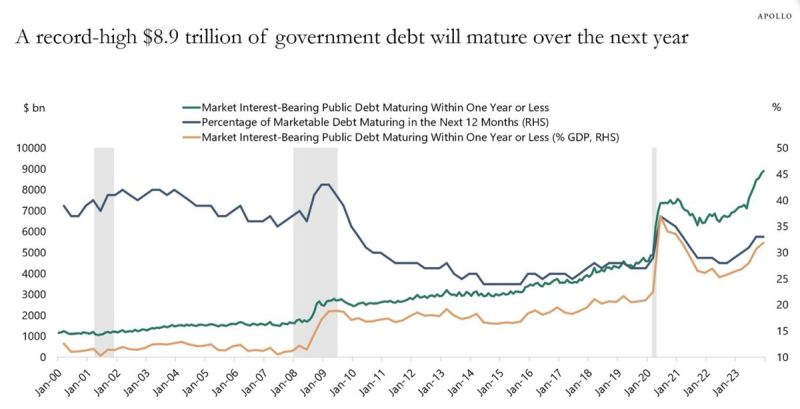

A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion. This means that someone will need to buy more than $10 trillion in US government bonds in 2024. That's nearly ONE THIRD of all outstanding US federal debt right now. All while the Fed is expected to start cutting rates, making buying these bonds less attractive. Who's going to fund all of this debt? Source: The Kobeissi Letter, Apollo

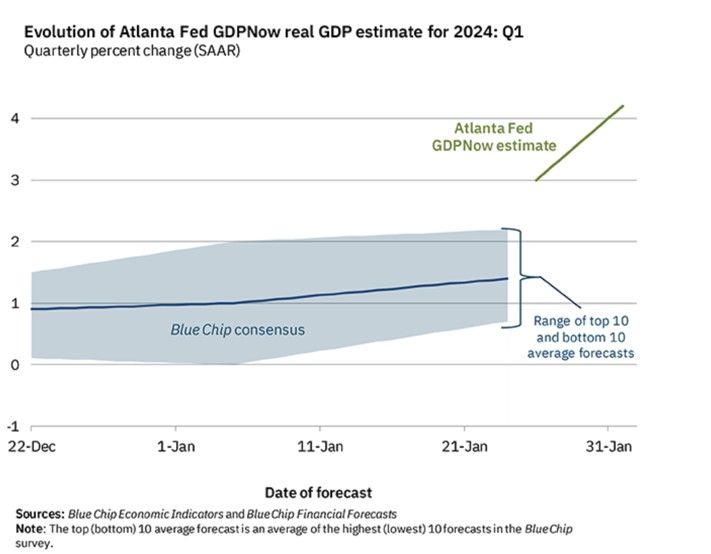

Do you remember the dramatic loosing of Financial conditions at the end of 2023?

The lagged effect of this massive loosening is now hitting and is supporting the US economy (and this NOT doing The Fed's job...). Indeed, US economic surprises keep surprising on the upside. The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 4.2 percent (!!!) on February 1, up from 3.0 percent on January 26

While the US economy remains very resilient, many consumers continue to struggle and need to find ways to keep their purchasing power

Pay rent or parents

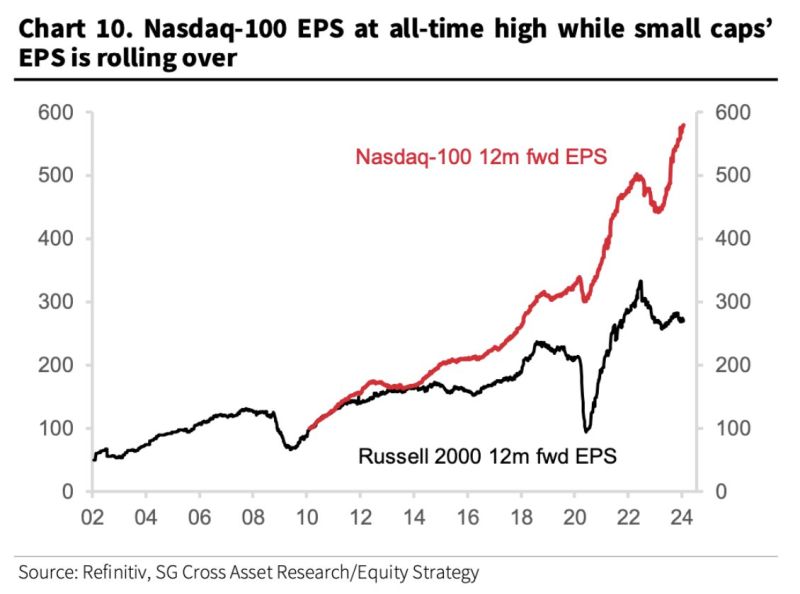

The performance differential between Nasdaq 100 (Tech) and Russell 2000 (us small-caps) is extreme.

Yet the earnings gap between Mega Cap Tech Stocks and Small Caps has widened to all an all-time high. Source: Barchart

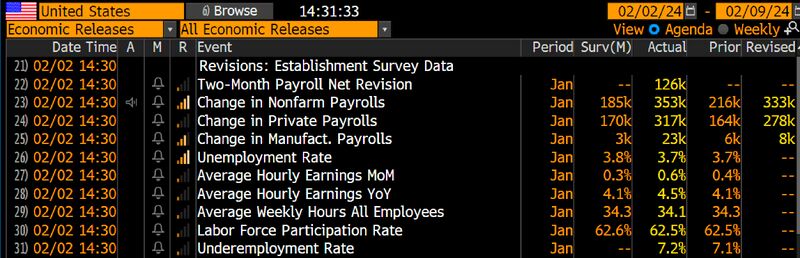

BREAKING: US NFP at 353k way above the estimated 185k, Wages came in hotter than expected +4.5% YoY vs +4.1% expected.

The December jobs report has been revised UP, showing 333,000 jobs added rather than the 216,000 originally reported. This breaks a 10-month trend of downward revisions in the reported jobs number. Meanwhile, average hourly earnings in January rose 0.6%, DOUBLING expectations. Unemployment rate held flat MoM at 3.7% (the Street was anticipating 3.8%). Note that according to the Household survey, the number of employed people dipped by 31k MoM, so US Non-farm-payroll report is not as hot as at 1st sight. Source: Bloomberg, HolgerZ

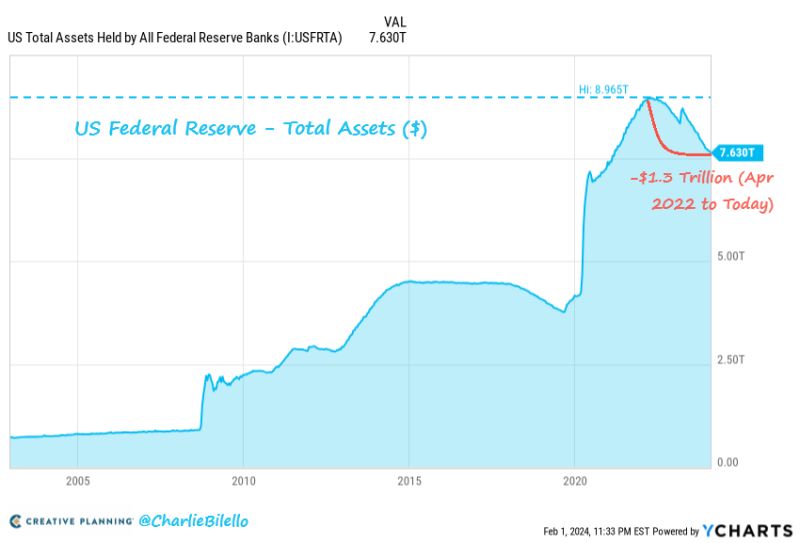

The Fed's balance sheet is now at its lowest level since March 2021, down $1.3 trillion from its peak in April 2022.

How much more QT is needed to unwind the massive QE from March 2020- April 2022? $3.5 trillion. Source: Charlie Bilello

If you cannot afford your rent, you are in good company.

According to Harvard University, half of all renters in the United States are paying more in rent than they should. That is defined as using up more than 30% of your income. The good news is rent is coming down in most of the country. The median asking rent is just above $1,700, which is down $63 from its peak in July 2022. That number is going to vary from city to city, but even in Manhattan, rents dropped for the first time in more than two years in November. https://lnkd.in/e_dmjidG

Investing with intelligence

Our latest research, commentary and market outlooks