Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

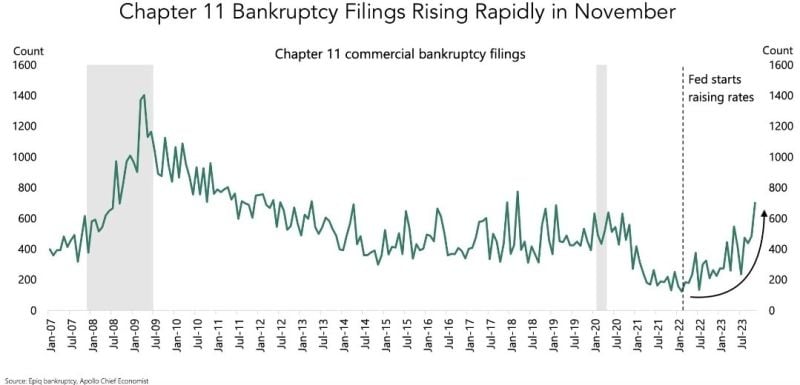

US Bankruptcy filings keep moving higher

This sounds like a logical consequence of 2 years of aggressive FED tightening but still something to keep an eye on Source: Win Smart, CFA

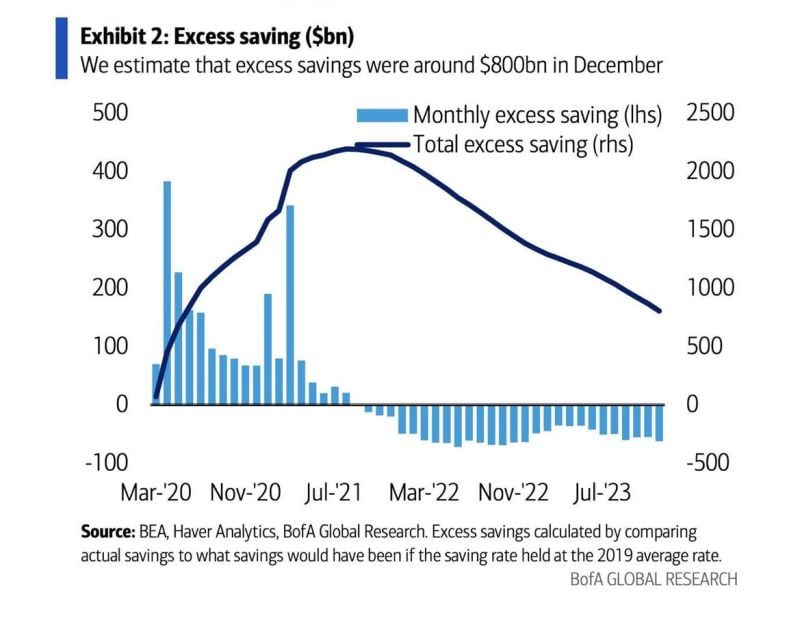

B of A: “.. At the current monthly rundown pace, excess savings should continue to support consumer spending at least through the rest of 2024."

.

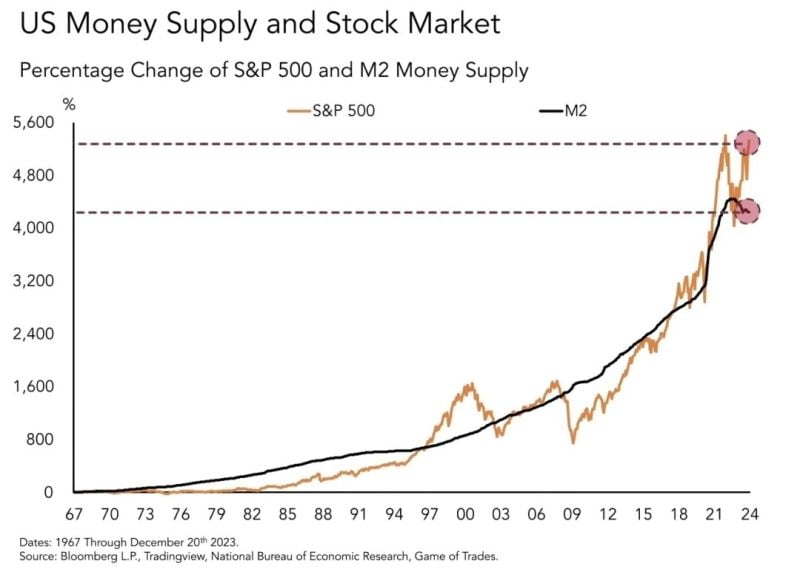

- The stock market's rise mirrors the money supply's growth. Both have risen over 4,500% since 1967&summary=Source: Win Smart, CFA, Game of Trades&source=https://blog.syzgroup.com/syz-the-moment/sgs-under-pressure-on-long-term-swing-support-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-1705-90b7fb5c' target="_blank">

Liquidity as a key market's driver in one chart -> The stock market's rise mirrors the money supply's growth. Both have risen over 4,500% since 1967

Source: Win Smart, CFA, Game of Trades

Rabobank: "What happens when all of those regional US banks with balance sheets loaded with dubious commercial real estate loans can no longer pledge underwater securities at par?

The answer is more money printing, which explains the price action in the S&P500." Source: www.zerohedge.com, Bloomberg

All the headline numbers have showed that the labor market is incredibly strong

But is it really? Currently, the US has a record ~8.6 MILLION people that are holding 2 or more jobs. Since 2020, nearly 2.6 million people have taken on an additional job. Source: Bloomberg, The Kobeissi Letter

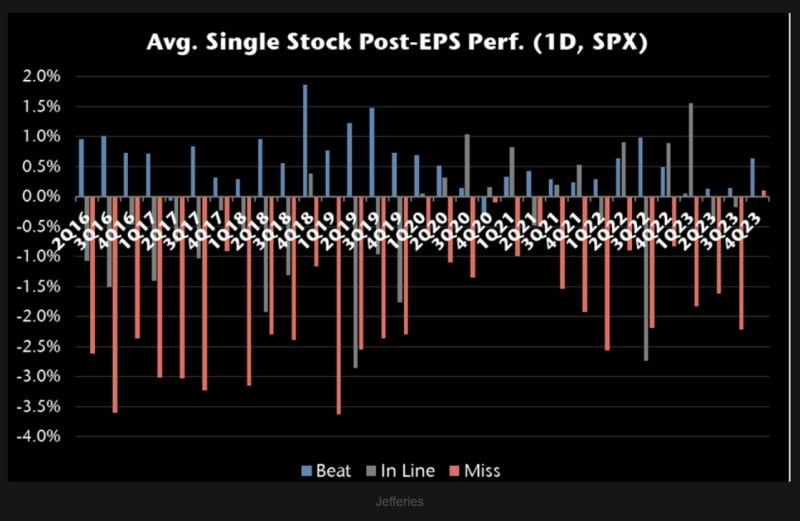

This US equity bull market doesn't care about earnings misses...

Despite the fact that >20% of SPX companies have missed, on average, they are still getting rewarded for it. Source: TME, Jefferies

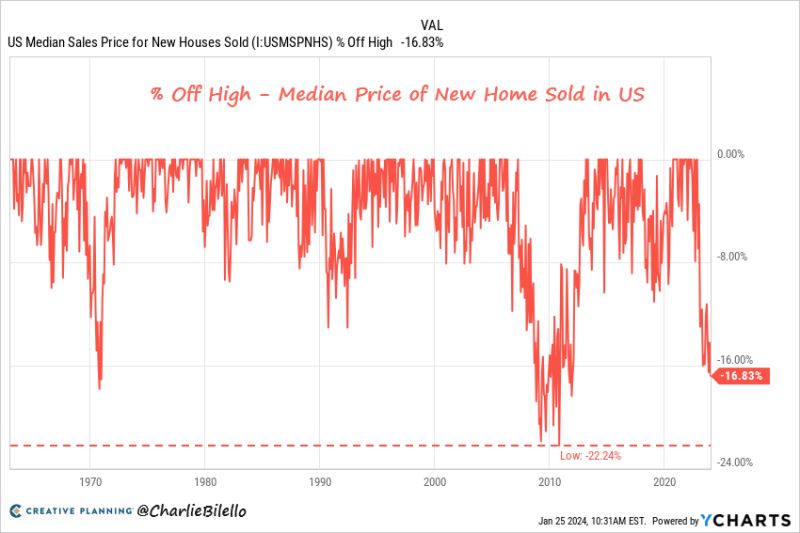

The median price of a new home sold in the US is down 17% from its peak in October 2022 (from $496,800 to $413,200)

After the last housing bubble peak the median new home price fell 22% nationally before bottoming. Source: Charlie Bilello

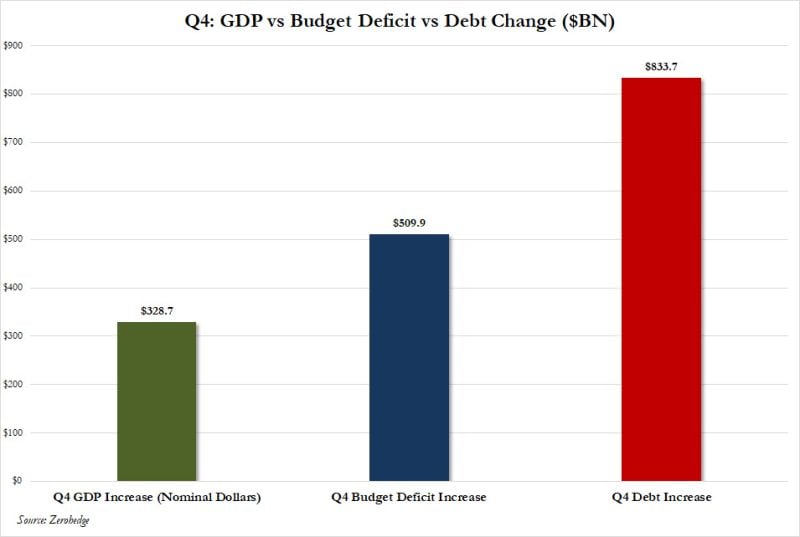

Gross domestic product data showed the U.S. economy grew at a rate of 3.3% in the fourth quarter

That’s much higher than the 2% expectation from economists polled by Dow Jones, underscoring continued economic resiliency despite interest rate hikes from the Federal Reserve. The result, for better or worse, speak for themselves: while Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50%, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth... and it takes over $2.50 in new debt to generate $1 of GDP growth! Source; www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks