Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

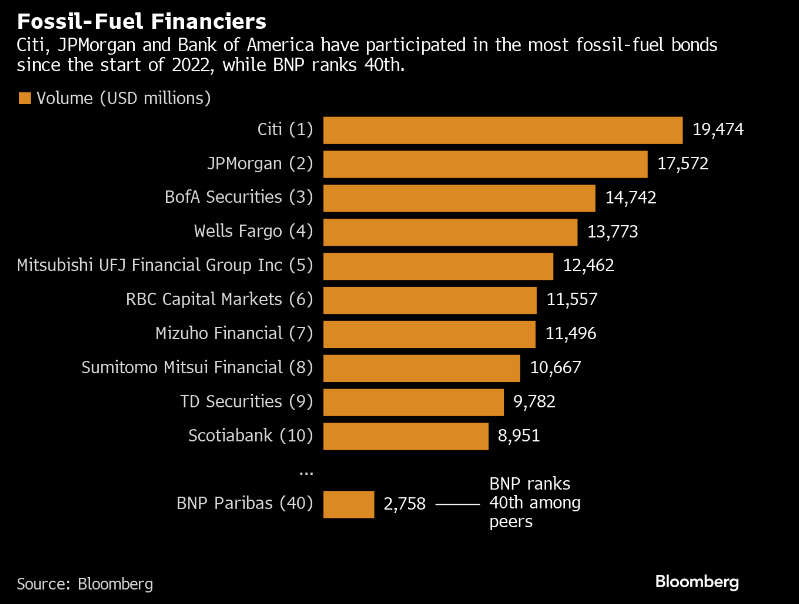

Credit Agricole’s bond desk is targeted by climate activists

The French bank is under pressure to reveal the carbon footprint of its bond business. A group of investment managers with $777 billion in combined assets is using the bank’s AGM to demand that it start disclosing the greenhouse gas emissions tied to its capital markets operations.

Source: Bloomberg

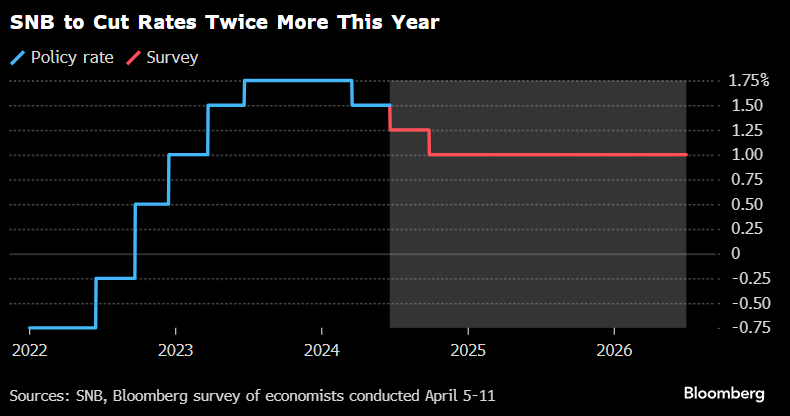

SNB’s Jordan Warns New Inflation Shocks Could Hit "At Any Time"

Speaking in Bern this morning, Jordan said: “We will therefore monitor the ongoing development of inflation closely and adjust our monetary policy again if necessary.” and also cautioned there’s “no guarantee” that the current favorable consumer-price outlook will hold.

Source: Bloomberg

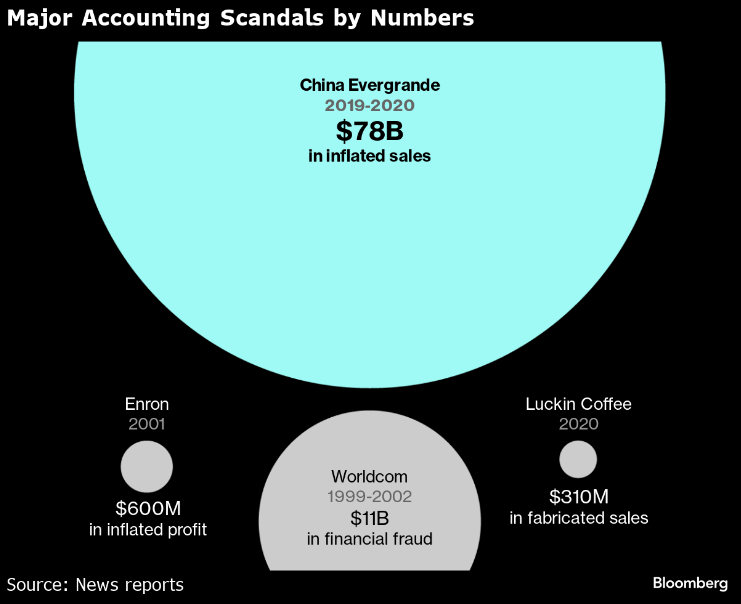

China scrutinizes PwC role in $78 billion Evergrande fraud case

Chinese authorities are examining the role of PWC in China Evergrande Group’s accounting practices after the developer was accused of a $78 billion fraud, ramping up pressure on the global accounting giant that audited a slew of developers before the sector’s meltdown.

Source: Bloomberg

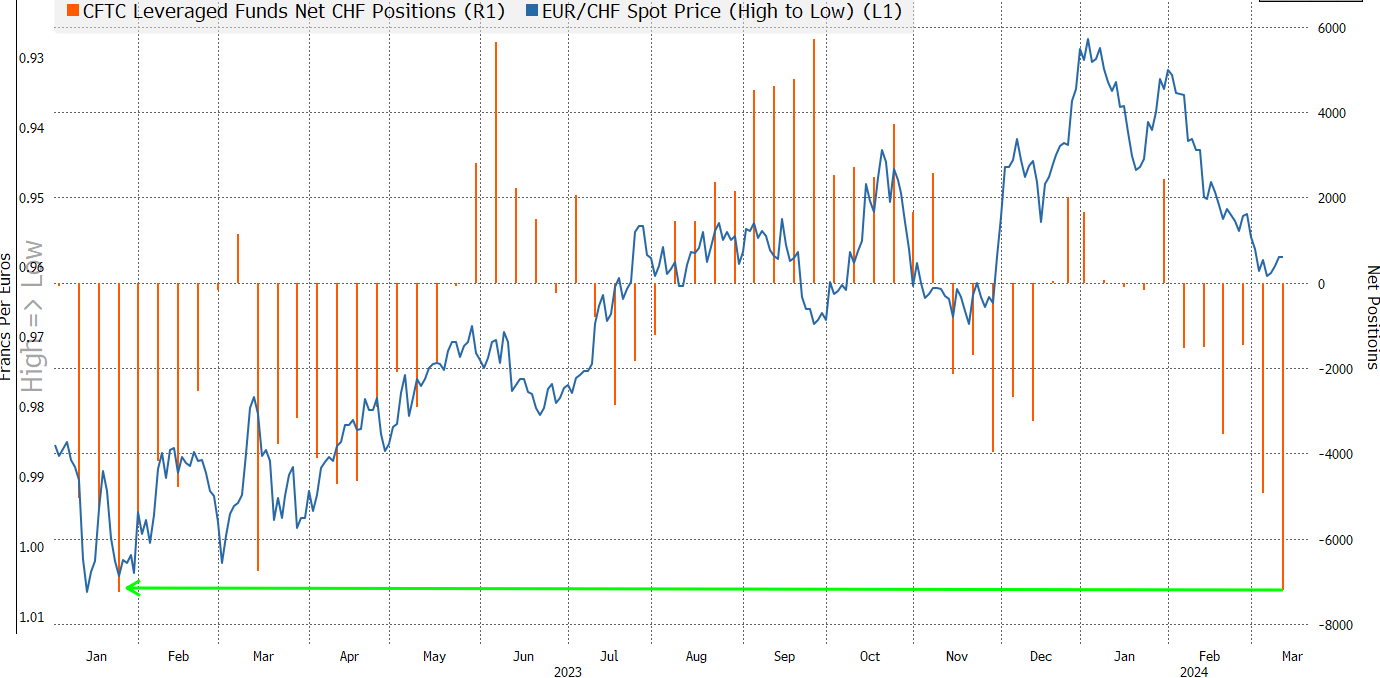

SNB could surprise with a rate cut as banks turn against Franc

A handful of banks expect Switzerland’s policymakers will go against forecasts and cut interest rates in their first decision of the year.

Barclays, Citigroup, Julius Baer and others are among the few predicting the Swiss National Bank will deliver a reduction aimed at safeguarding the economy from potential currency strength.

Source: Bloomberg

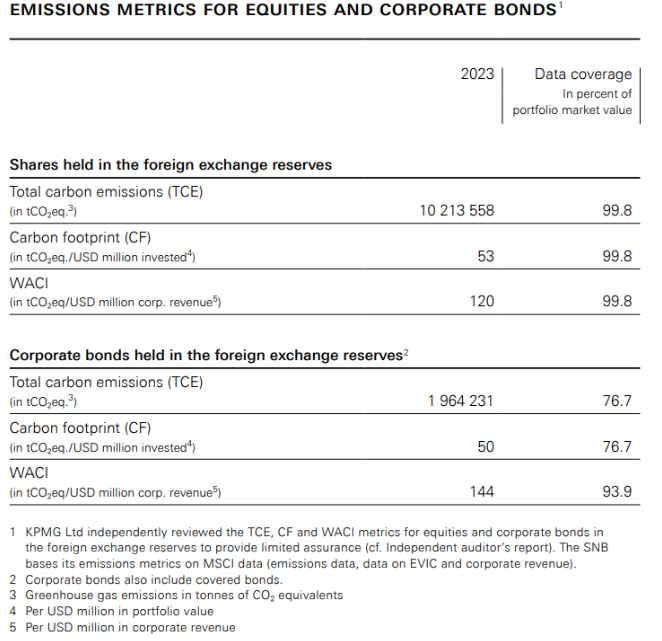

SNB reveals carbon footprint of its portfolio for first time

The Swiss National Bank disclosed the carbon footprint of its investment portfolio for the first time, responding to critics who have demanded it take a more active stance on climate change.

The SNB said it’s “not authorized to pursue structural policies” and pursuing such actions could make it more difficult for its to fulfill its primary mandate of inflation control.

The SNB’s environmental rules only ban coal miners. That means its holdings include firms involved in fracking, and the oil and gas industries.

Source: Bloomberg

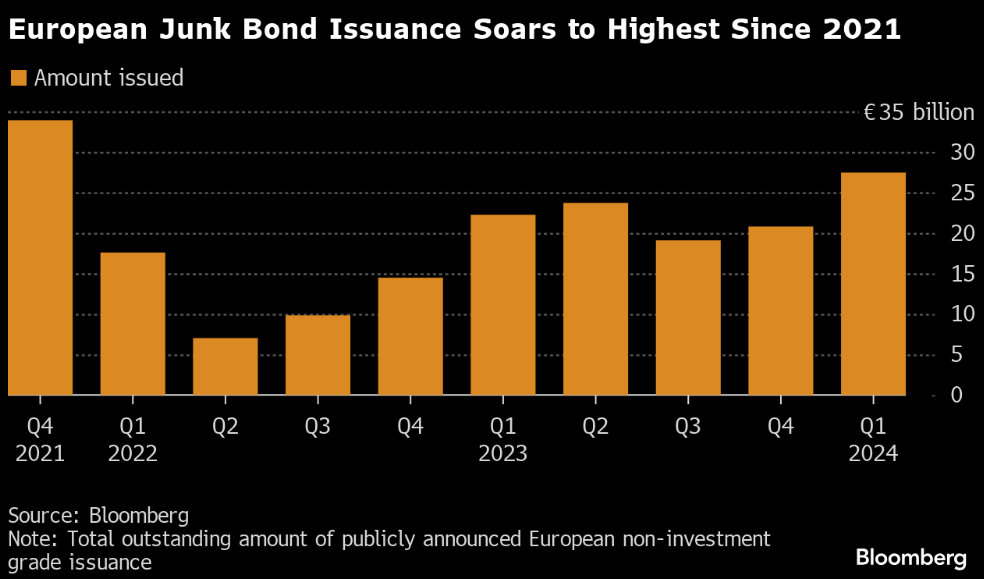

European junk bond issuance soars to highest since 2021

It is also reflected in European junk bond spreads, which are at their lowest level since January 2021.

The backdrop is a far cry from last September and October, when a slew of junk issuers, pulled bond sales as the rapid increase in interest rates made it tougher for lower-rated companies to borrow.

Source: Bloomberg

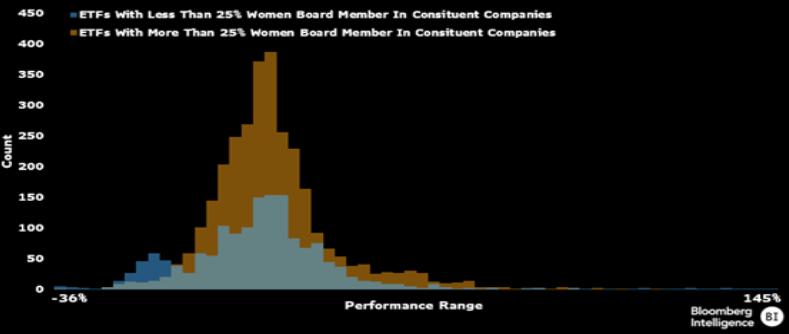

Higher female board presence may give ETFs 2.2% performance edge

ETFs that invest in companies with at least 25% women on their boards outperformed by 2.2% in 2023 rivals that invest in firms with fewer female directors. Statistical analysis suggests that relationship may be more causal than coincidental, adding to the value proposition of female corporate oversight.

Source: Bloomberg Intelligence

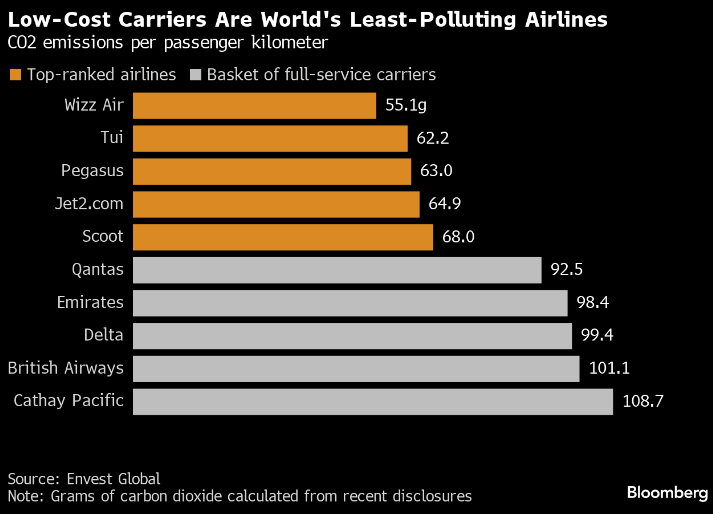

Low-Cost carriers are world's least-polluting airlines

The low-cost business model that democratized air travel in recent decades has now become an unlikely template for reducing pollution. That’s because budget airlines’ obsession with lowering weight in order to save fuel also happens to produce the best emissions metrics in the skies.

Source Bloomberg, Envest Global

Investing with intelligence

Our latest research, commentary and market outlooks