Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

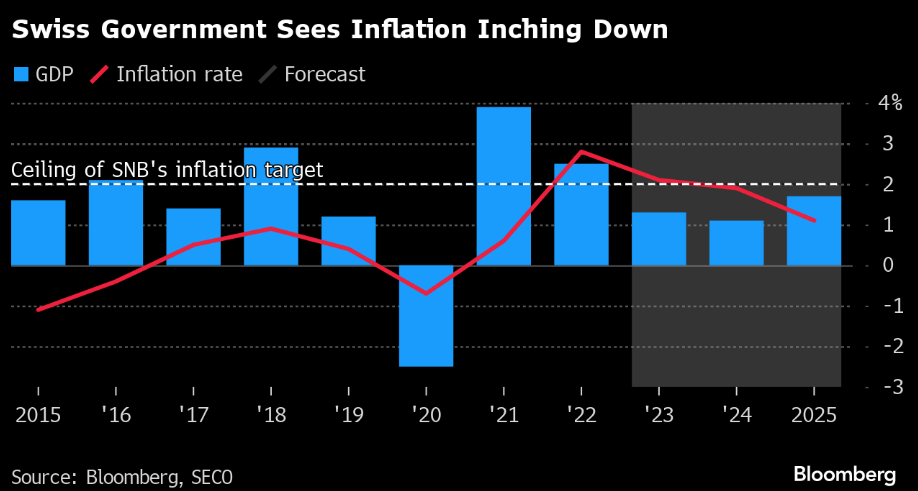

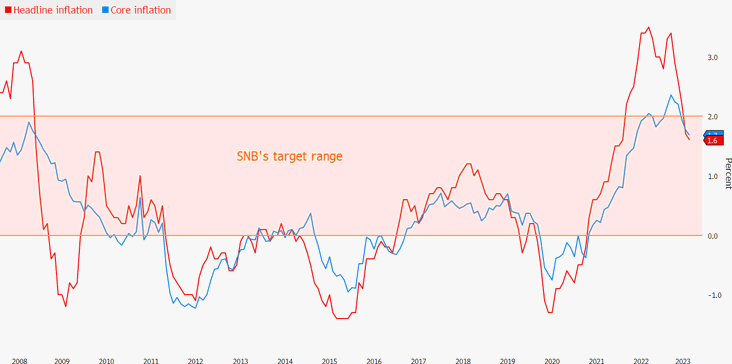

Switzerland’s inflation forecast backs SNB rate staying on hold

Switzerland’s government sees next year’s

inflation within the central bank’s target range, the latest evidence supporting a likely hold from policymakers this week. Consumer prices will grow at an annual 1.9% in 2024, in line with the previous forecast, the State Secretariat for Economic Affairs said on Wednesday.

Source: Bloomberg

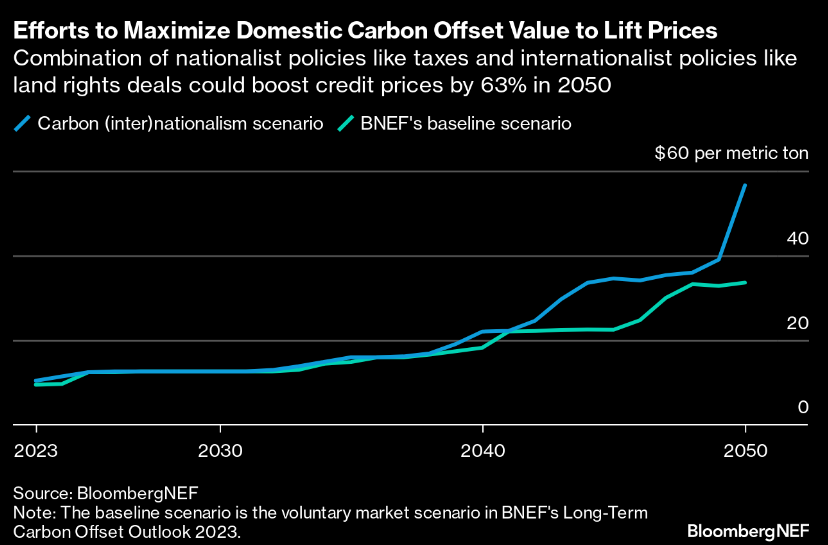

Goldman, Citi ready Trading Desks for new wave of Carbon deals

As the carbon offset market gets a new lease on life from the COP28 climate summit in Dubai, bankers from Wall Street and the City of London are positioning themselves to get a chunk of the dealmaking they say is coming.

Banks that have been building up carbon trading and finance desks include Goldman Sachs Group, Citigroup, JPMorgan Chase and Barclays.

Source: Bloomberg

One bond market is defying global selloff with mega returns

As bond markets everywhere get battered by a cocktail of higher interest rates, deficit angst and hawkish central bankers, one class of debt instrument is handing creditors double-digit returns: catastrophe bonds.

Because of the way the bonds are structured, their coupons keep going up as Treasury yields rise, and investors get a sizable risk premium on their capital, as long as catastrophe doesn’t hit.

Source: SwissRe, Bloomberg

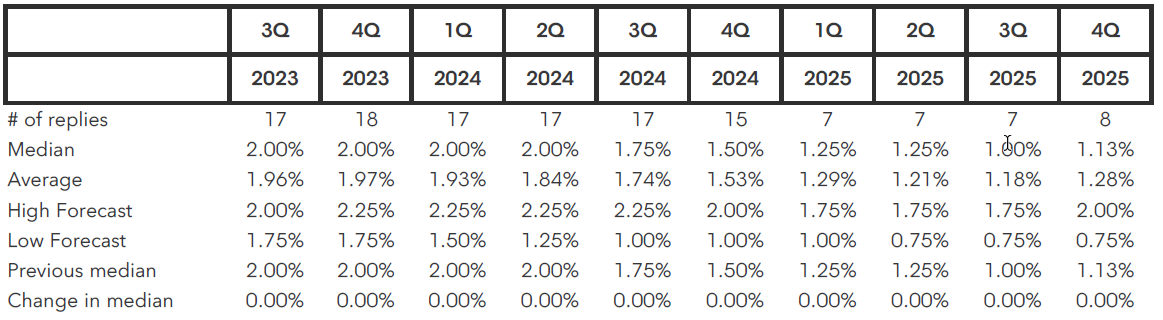

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

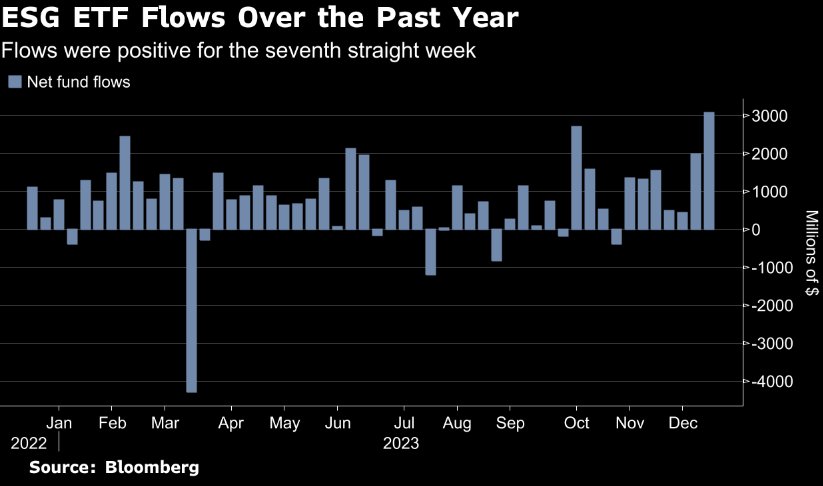

EU watchdog monitors surge of cash going into biodiversity funds

The surge in money going into biodiversity funds is the "next frontier" of ESG investing and warrants increased monitoring to avoid greenwashing, the European Union's securities regulator said.

The cumulative flow of money into biodiversity funds reached 854 million euros ($931 million) in the two years to June 2023, with 73% of the funds launched since 2022.

Source: Reuters

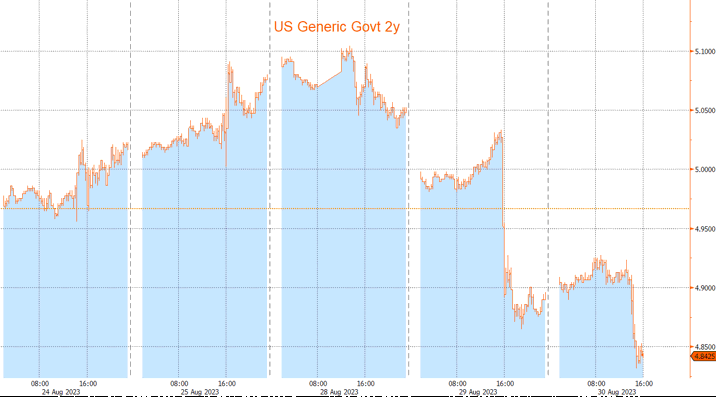

Treasury yields extend retreat from year’s highs after GDP data

Short-maturity yields led the move, with two-year yields declining about five basis points to around 4.85%, and most yields reached the lowest levels in more than two weeks. The

benchmark 10-year note’s yield touched 4.085%, the lowest level since Aug. 11.

Following downward revisions to the economy’s Q2 growth rate and related inflation measures, swap contracts tied to Fed meeting dates priced in slightly less than a 50% chance of another rate increase this year. Source: Bloomberg

SNB may hike rates next month even if ECB pauses

The Swiss National Bank could end up hiking interest rates next month to contain inflation even if its counterpart in the euro zone pauses tightening, according to Credit Suisse economist Maxime Botteron.

“Compared with the past, the interest-rate differential between the SNB and the ECB is relatively large. So there is certainly room for the Swiss to raise rates further.”

Source: Bloomberg, Credit Suisse

Investing with intelligence

Our latest research, commentary and market outlooks