Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury 10-Year real yield tops 2% for first time since 2009

The yield on 10-year inflation-protected Treasuries extended its ascent from year-to-date lows near 1%.

Rising real yields reflect firmer economy and higher deficit.

Source: Bloomberg

European gas spikes on market jitters over LNG strike risk

European natural gas futures spiked for the second time in less than a week, with market tensions running high over the possibility of strikes in Australia that could severely tighten the global market.

Source: Bloomberg

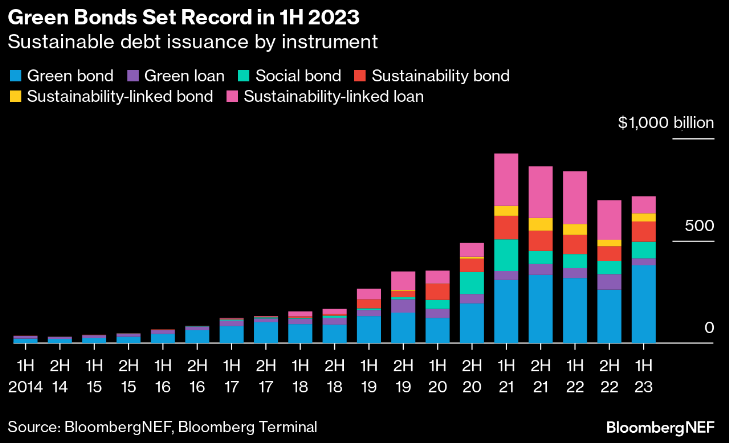

Record green bond sales lift outlook for ESG debt

Green bonds issuance globally hit a record $380 billion in the first half of 2023, rebounding from $261 billion during the prior six months.

Governments and financials are the main contributors. Germany, Italy and Hong Kong governments in combination sold $52 billion green bonds, 150% more than each half of 2022.

Source: Bloomberg

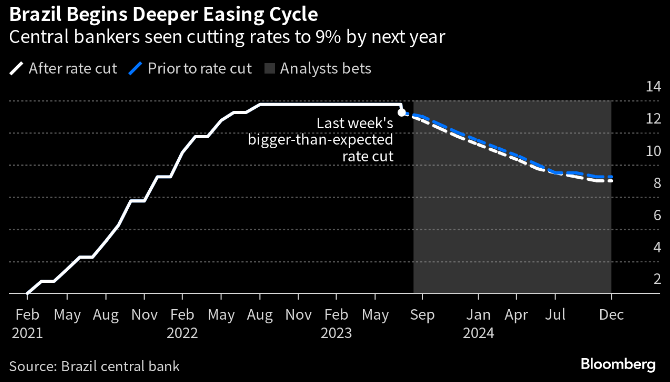

Brazil central bank says faster key rate cuts are Unlikely

“The Committee judges that there is low probability of an additional intensification in the pace of adjustment,” central bankers wrote in the minutes of their Aug. 1-2 meeting published on Tuesday.

Source: Brazil Central Bank, Bloomberg

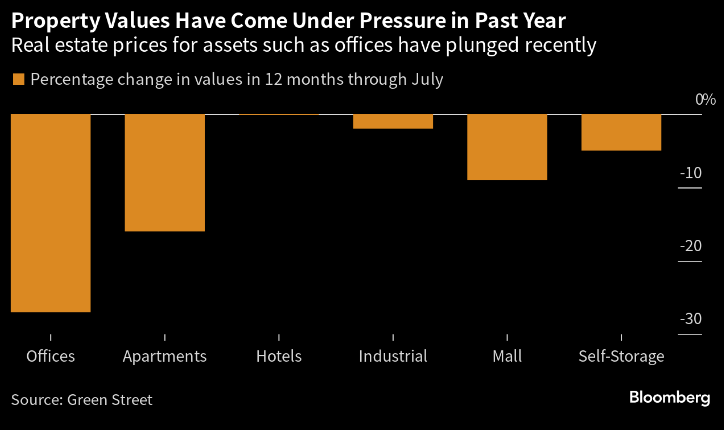

US Property loans are so unappealing that banks want to dump them

Lenders including GS and JPM. have been trying to sell debt backed by offices, hotels and even apartments in recent months, but many are finding that tidying up loan books is no easy feat when concerns about commercial real estate have surged.

Maturing loans that will need to be refinanced is a major concern in a high-interest-rates environment. Source: Bloomberg, Green Street

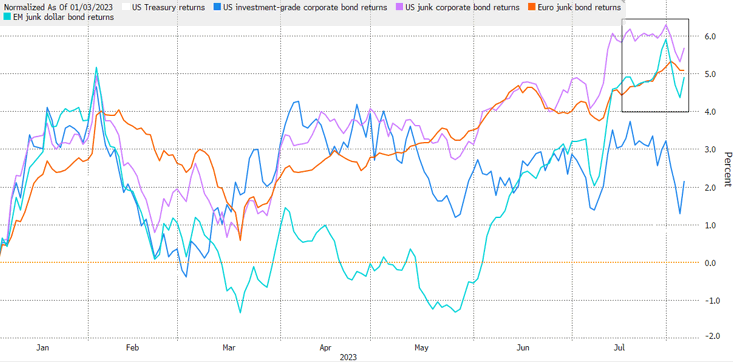

Junk bonds are outperforming as soft landing narrative builds

High-yield has returned 6.50% this year vs 3.70% for high-grade.

Junk bonds are emerging as a sweet spot in global fixed-income markets wracked by some of the worst volatility this year, as investors increasingly bet that major economies will avoid recession for now.

Source: Bloomberg

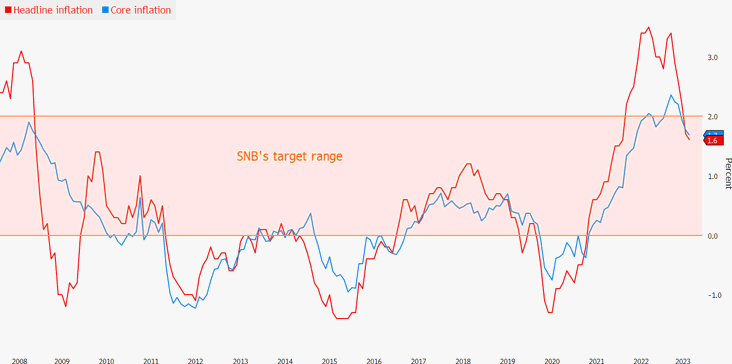

Swiss inflation slows further as SNB mulls september rate hike

Swiss inflation slowed to the lowest rate in one and a half years, testing the determination of SNB officials who have signaled that a further tightening step in September is likely.

Consumer prices rose 1.6% in July from a year earlier, down from 1.7% the previous month.

Source: Bloomberg, Swiss Fed statistical office

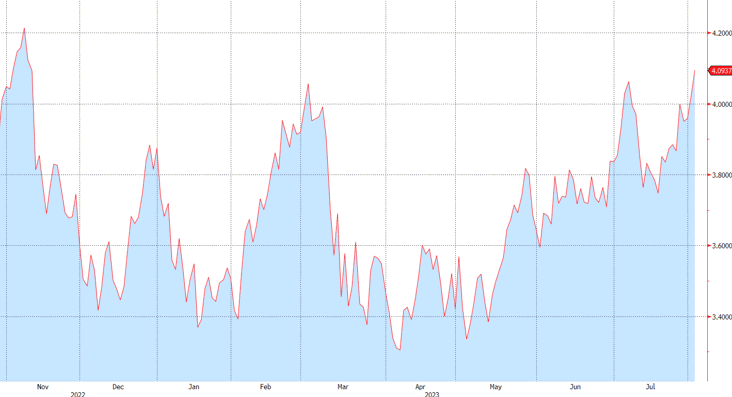

US Treasury 10-Year yield increases to highest level since november 2022

Treasuries fell across the curve, pushing the 10-year yield to the highest level since November as traders digest an uptick in US government issuance, a sovereign credit downgrade and a stronger-than-expected private job report.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks