Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

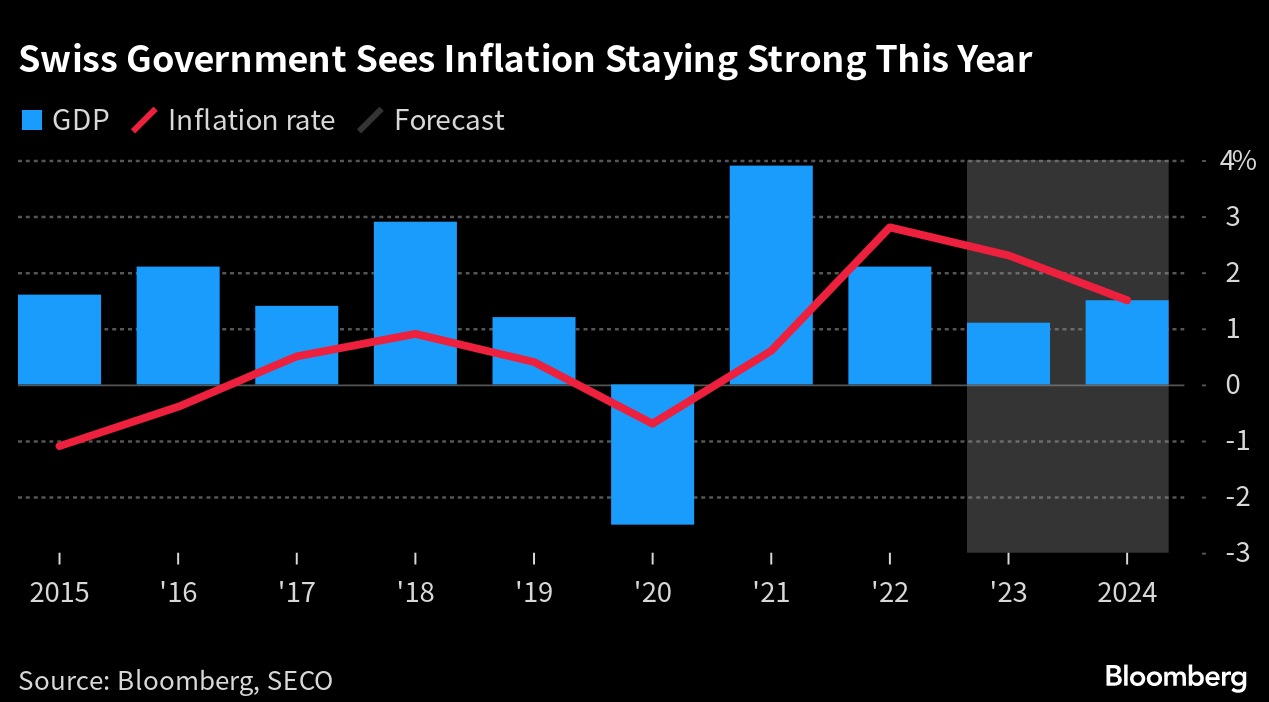

Switzerland’s new inflation forecast supports another SNB hike

The government expects inflation to be above the central bank’s target this year which reinforces a likely interest-rate hike next week. The SECO said consumer prices will rise 2.3% this year. That down from 2022’s 2.8%, and also slightly lower than a March prediction of 2.4%.

Source: Bloomberg, SECO

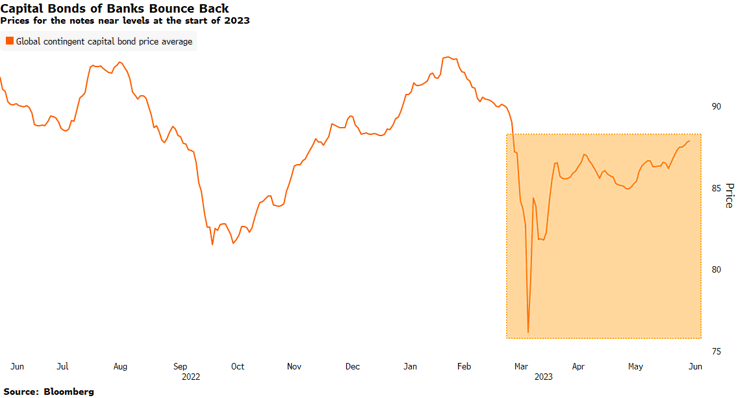

Riskier bank bonds back as returns rise, AT1 Market reopens

Two European banks on Tuesday sold the first

publicly-syndicated AT1 bonds on the continent since the Credit Suisse’s crisis.

Easing concerns about the health of the banking sector and hopes that major central banks are nearing the end of their tightening cycles contribute to the move. Source: Bloomberg

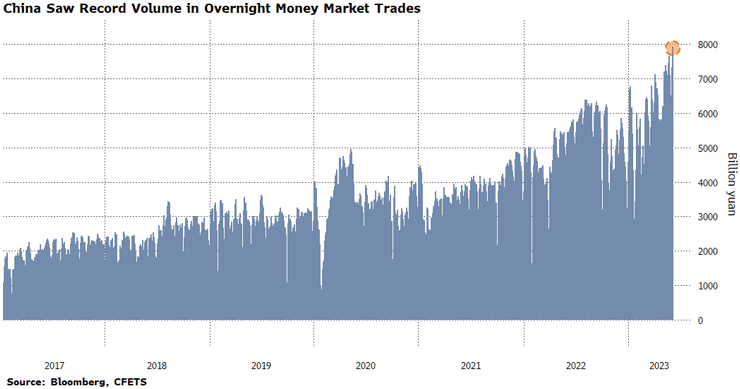

China traders are leveraging up the most on record fluch cash

A gauge of leveraged activity in China’s

money market has notched another record as onshore financial

institutions take advantage of ample liquidity to boost

borrowing.

Turnover of so-called overnight pledged repo trades surged

to an all-time high 7.9 trillion yuan ($1.1 billion) on Tuesday.

An increase in volume may be indicative of banks using cheap

funding costs to buy bonds, even if the transactions also

include the day-to-day financing needs of firms in the market.

Source: Bloomberg

Greece’s 10-year government bond yield fell to 3.80%

The rate is down more than 110 basis points since last year’s high, taking down the spread to Italy bonds to -40bps.

Prime Minister Kyriakos Mitsotakis’s center-right New Democracy received almost 41% of the vote vs 20% for the leftist Syriza party. Mitsotakis could maybe secure a single-party government in about a month.

Will Greece be back in Investment Grade party?

Source: Bloomberg

Treasuries reaction to debt ceiling result will be noisy

One look at the recent price compression for 2-year Treasury futures and its clear that bond traders have a lot resting on the outcome from the debt ceiling talks.

If a deal is reached -> Fed speakers become the key for direction

No deal -> The X-date comes into play

Source: Bloomberg

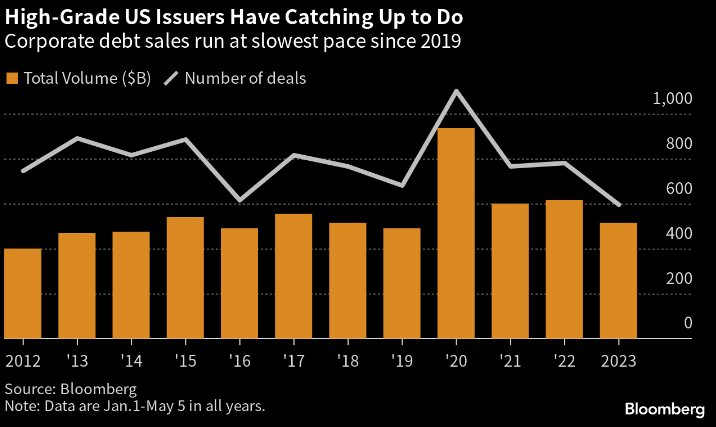

Refinancing? All is about timing for bond deals

Highly rated US companies have sizable amounts of debt in need of refinancing. Blue-chip firms have an estimated $427 billion maturing in the second, third and fourth quarters of 2023, according to S&P Global. High-grade issuers are finding that windows to sell new debt close as fast as they open. And, on top of that, good days easily get crowded, leading issuers to stand down. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks