Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

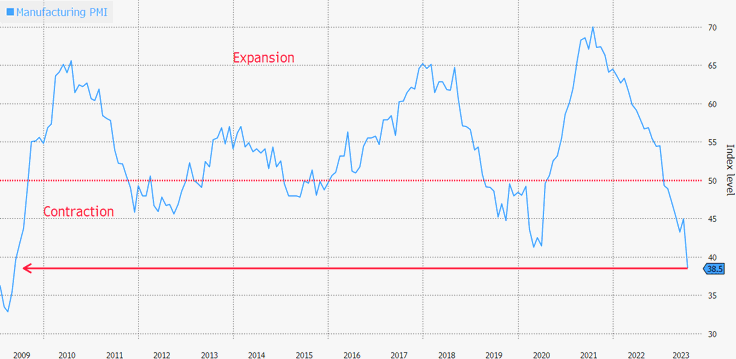

Swiss Manufaccturing PMI at lowest since 2009

Swiss manufacturing activity plummeted at the start of the third quarter, with PMI dropping to 38.5 points in July from 44.90 in June. While the gauge has been below the vital threshold of 50 since the start of the year, this is the worst reading since 2009.

Source: Bloomberg, Credit Suisse

JP Morgan AM says global bond rally is just starting

The rally that erupted after this week’s US inflation report was the moment Wall Street veteran Bob Michele has been waiting for.

“More and more indicators are at levels you only see in recession. We are buying every backup in yields. The considerable central bank tightening is starting to bite hard in the real economy.”, said Michele

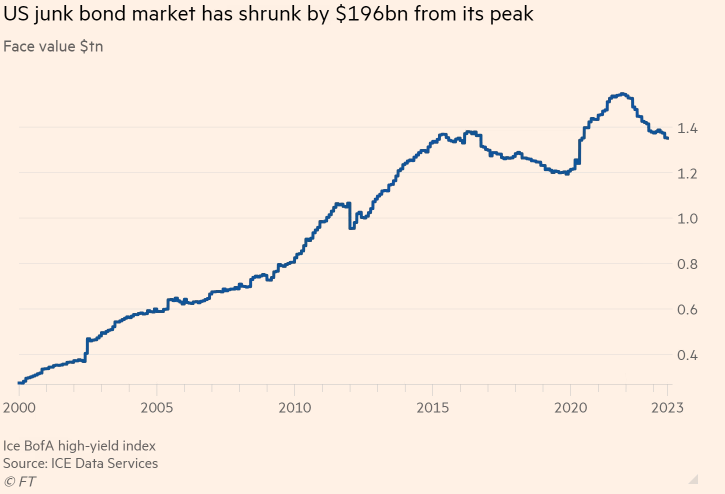

The $1.35tn US junk bond market has shrunk by 13% since all-time peak

High-yield market contracts 13% from 2021 peak amid fears of false signals about American economy’s health.

A steep rise in interest rates since early last year has helped deter companies from selling new bonds, while several companies have climbed out of the high-yield market into investment grade territory. The spread has simultaneously widened out to 4.05% from roughly 3%.

Source: Financial Times

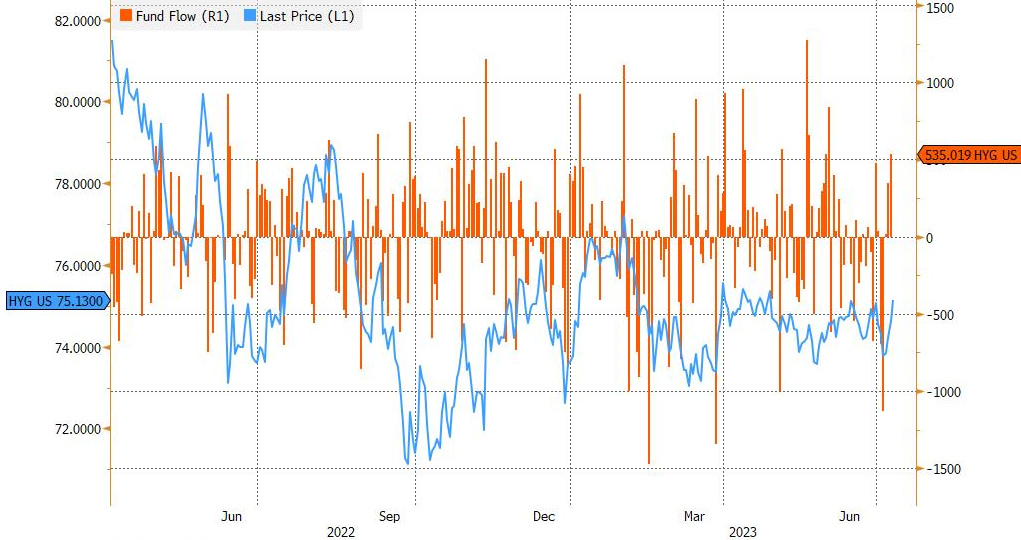

Investors added a net $535 million to IShares iBoxx High Yield corporate bond

This was the biggest one-day increase since June 2 and the third straight day of inflows, totaling $897.9 million. The fund's assets increased by 6.9% during that span. The fund has suffered net outflows of $543.4 million in the past year. Source: Bloomberg

Israel pauses after 10 rate hikes but signals it may not be done

Israel’s central bank left interest rates

unchanged for the first time in over a year, halting an

unprecedented cycle of monetary tightening but signaling it’s

still on alert for the threat of faster inflation.

Source: Bloomberg

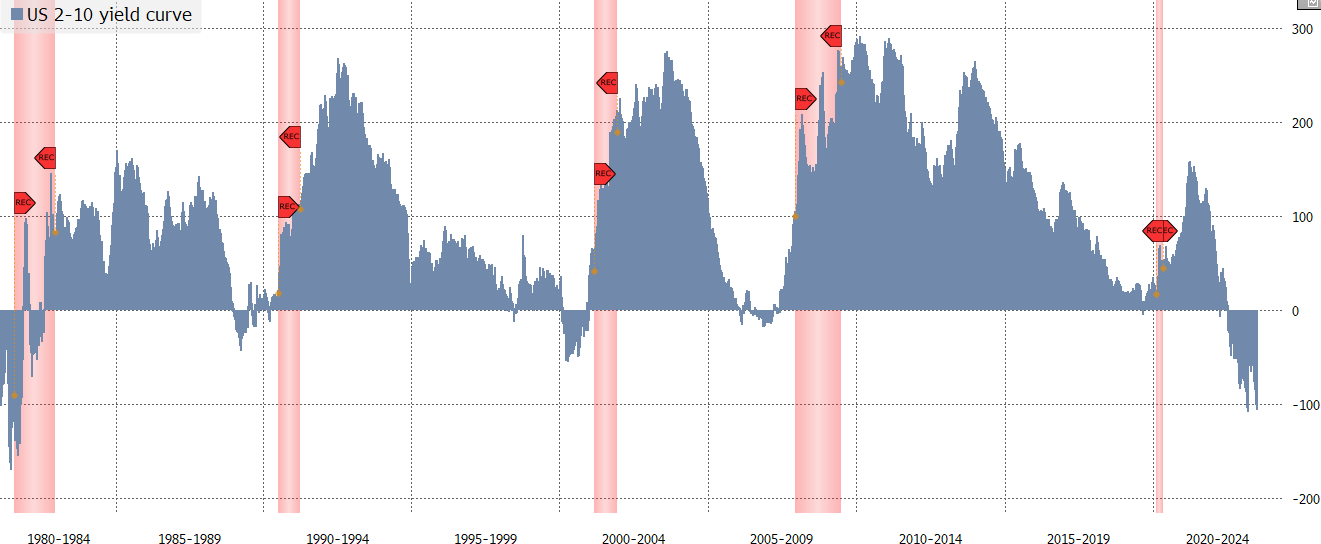

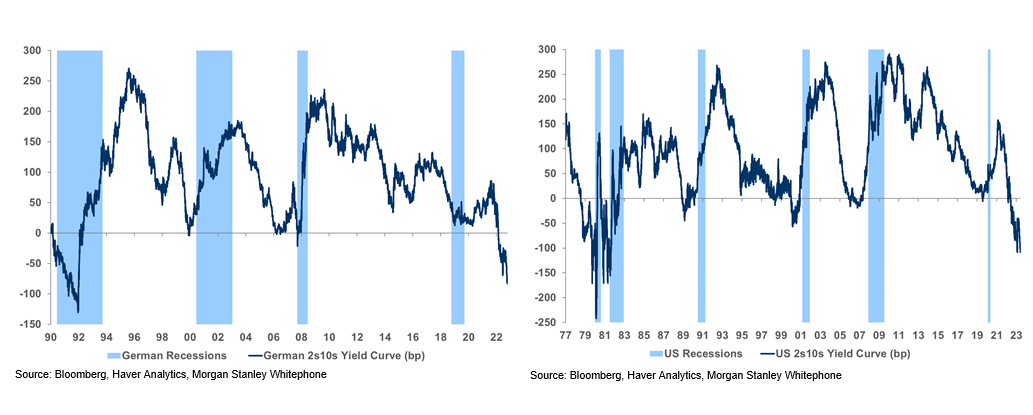

German and US yield curves are deeply diving into low levels of inversion

US Curves flattened further, with the 2s10s curve hitting -109bp, in-line with the lowest level in 42 years.

Bund yields rose, while the 2s10s curve dropped to -83bp, the most inverted level in over 30 years.

Source: Bloomberg, Haver Analytics, Morgan Stanley Whitephone

Swiss Inflation returned below SNB’s 2% Ceiling in June

The figures offer limited reassurance to officials who have already signaled further

tightening is likely.

CPI YoY rose 1.7%, down from 2.2% the previous month, as energy costs fell. Underlying inflation, which strips out such volatile elements, also slowed to 1.8%. Source: BBG, Swiss statistics agency

Europe’s debt market sees first live deal halted this year

The EU market saw its first postponement of a live deal this year as borrowers struggled to tighten pricing in an active session for the market.

German building society Bausparkasse Schwaebisch Hall AG halted a €500 mio offering of 10y covered bonds after setting final terms. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks