Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The unwinding of popular strategies such as the yen carry trade in traditional markets have been adding to the selling pressure on bitcoin.

The yen carry-trade strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns. According to Matt Maley, chief market strategist at Miller Tabak & Co, “Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline.” “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.” Source: zerohedge

Bitcoin investors are now eyeing the $80,000 price level for support

- Rate cuts can't pump BTC. - Pro-crypto President can't pump BTC. - Weak dollar can't pump BTC. - Institutional adoption can't pump BTC. - Fed injecting liquidity can't pump BTC. - Stocks new ATH can't pump BTC. Is there anything that could pump BTC now? Which comes first? BTC $300k or a massive suck out of global liquidity??? Source: Zerohedge

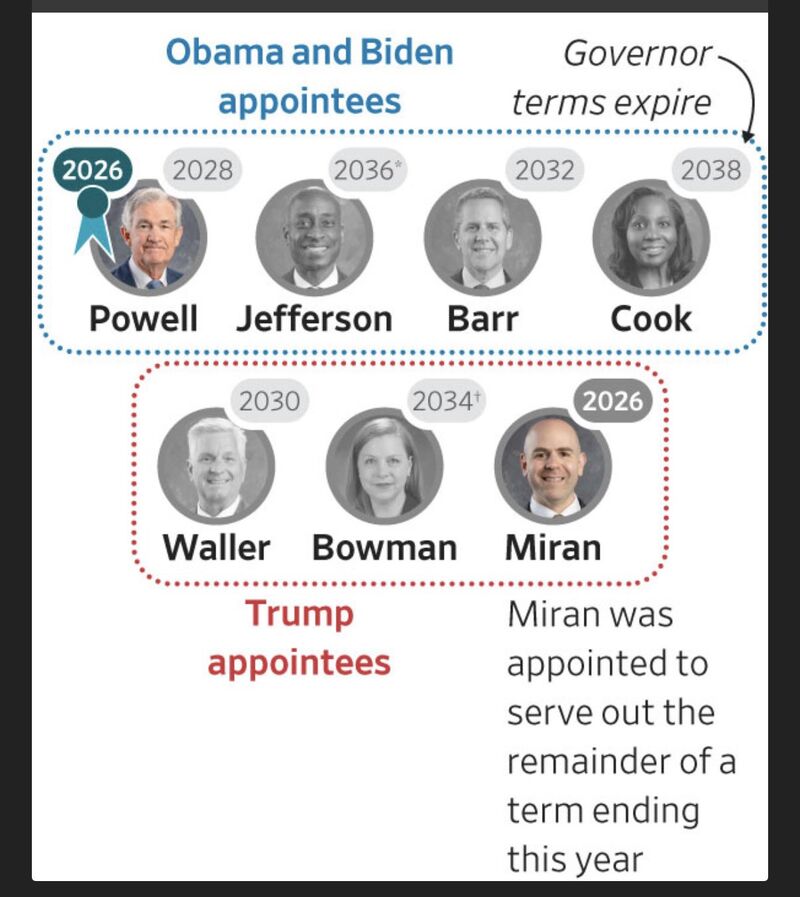

From "Hawks and Doves" to "Red and Blue"?

In a sign of the times, this Wall Street Journal chart characterizes members of the Federal Reserve Board by their political nominations rather than their expertise, experience, or hawkish/dovish inclinations. Source: Mo El Erian

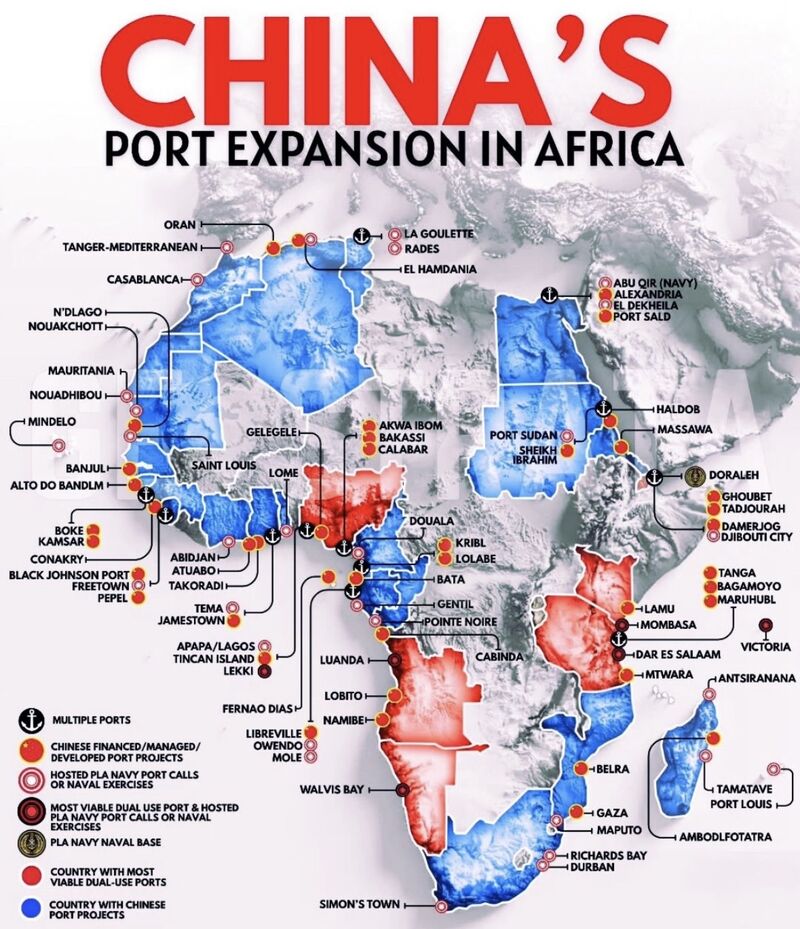

The map of global trade is being rewritten. 🌍⚓ And most people aren't looking at the right coordinates.

While the world discusses "influence," China is building infrastructure. Not just a few docks, but a literal nervous system for the African continent. Here is the reality of the "New Maritime Silk Road": 40+ African Ports: Financed, built, or operated by Chinese state-backed firms. Total Coastal Coverage: From the Atlantic to the Indian Ocean and the Red Sea. Dual-Use Potential: What starts as a commercial hub today can become a naval asset tomorrow. Beyond Djibouti: The PLA Navy’s reach is no longer confined to one base—it’s moving into the heart of global shipping lanes. Why this matters for the global economy: In 2026, Ports = Power. By controlling the gates, you control the flow of: ⚡ Energy 🌾 Food 📦 Commodities 🛡️ Security The Takeaway: China isn't just "surrounding" Africa. It is wiring itself into the very bedrock of global trade. When you own the infrastructure, you own the future of the supply chain. The board is being set. Are we playing the same game? Source: Jack Prandelli on X

🚨 Silver plummets 15%, gold falls 7%, dragging down miners and ETFs🚨

Friday morning felt like a "day of reckoning" for the markets. Gold and silver—the absolute titans of 2025—just took a massive hit. 📉 Here is the breakdown of the "Perfect Storm" hitting your portfolio right now: 💰 The Numbers are Jarring: Silver: Plunged 15%, crashing back below the psychological $100 milestone. Gold: Shed 7%, fighting to hold the $5,000 line. The Ripple Effect: Platinum and Palladium followed suit, dropping 14% and 12% respectively. 📉 Mining & ETFs are bleeding: From London to Wall Street, the sell-off is aggressive. Fresnillo is down 7%, while silver miners like Endeavour and First Majestic are seeing double-digit pre-market losses. Silver ETFs are feeling the heat even more, with some down as much as 25%. 🤔 Why is this happening NOW? After a record-smashing 2025 (Gold +65%, Silver +150%), the market is facing a "concentration risk" reality check. - Crowded Trades: Just like AI tech stocks, everyone was leaning the same way. When the narrative shifts, the exit door gets very small, very fast. - The "Trump/Fed" Factor: The market is on edge awaiting the nomination of the next Fed Chair. Speculation that a more "dollar-friendly" successor might replace Jerome Powell is sending shockwaves through dollar-sensitive assets. - Geopolitical Fatigue: While tensions in Venezuela, Iran, and even Greenland pushed prices to record highs, the "Greenback" has finally stabilized, removing the primary tailwind for metals. 💡 The Lesson: Even "safe haven" assets aren't immune to gravity. As Katy Stoves of Mattioli Woods puts it: "When everyone is leaning the same way, even good assets can sell off." Is this a healthy correction or the start of a long-term reversal? Source: CNBC

Trump nominates Kevin Warsh for Federal Reserve chair to succeed Jerome Powell

After months of speculation, President Trump has officially named Kevin Warsh to succeed Jerome Powell as Fed Chair. This isn't just another personnel move. It’s a seismic shift for the U.S. economy. Here is why every professional needs to be paying attention: 1. The End of an Era (and a Feud) 🥊 The tension between Trump and Powell has been no secret since 2018. By picking Warsh, the President is looking for what he calls a "GREAT" chairman to lead a new direction. 2. Credibility is the Currency 💎 Wall Street is breathing a sigh of relief. Why? Because Warsh has been there before. As David Bahnsen noted, he has the "respect and credibility" of the markets. He’s seen as a pro who understands the plumbing of the financial system. 3. The Fight for Independence 🛡️ The big question: Can the Fed stay independent? With debates swirling about White House oversight and interest rate consultations, Warsh will be walking a tightrope between political pressure and economic reality. 4. A "No-Fire, No-Hire" Economy 📉 Inflation isn't at 2% yet, and the labor market is cooling. Warsh inherits a "precarious" moment where the margin for error is razor-thin. The Bottom Line: Kevin Warsh called for "regime change" at the Fed last summer. Now, he’s the one holding the keys. 🔑 Markets are pricing in stability for now, but with Jerome Powell potentially staying on as a Governor to protect Fed independence, the boardroom in D.C. is about to get very interesting.

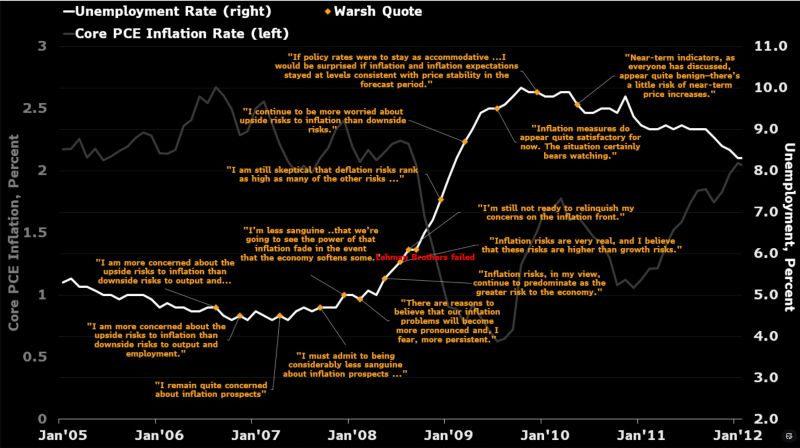

🚨 Is the market misreading the next potential Fed Chair? 🚨

If the goal is "easy on inflation," the history books tell a very different story about Kevin Warsh. Looking back at the FOMC transcripts from 2006-2011, one moment stands out that should make every investor pause. 📍 The Setting: April 2009. The world was still reeling 7 months after the Lehman Brothers collapse. - Unemployment: 9% - Core PCE Inflation: A mere 0.8% - Despite a crashing economy and deflationary pressure, Warsh’s stance was clear: "I continue to be more worried about upside risks to inflation than downside risks." The Takeaway: Warsh has historically been an "inflation hawk," even when the data suggested the opposite. If he takes the helm, we might be looking at a much more aggressive Fed than the "dovish" transition many are currently pricing in. Source: Bloomberg, Anna Wong @AnnaEconomist

Investing with intelligence

Our latest research, commentary and market outlooks