Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 MARKET MELTDOWN: $6.5 TRILLION GONE IN 24 HOURS. 🚨

If you thought your Tuesday was stressful, take a look at the global markets. We just witnessed one of the most violent 24-hour wealth erasures in modern history. 📉 The numbers are honestly hard to process: 1️⃣ The Metals Massacre 🪙 This wasn’t just a "dip"—it was a cliff dive. - Gold: -10.9% ($4.1 TRILLION evaporated) - Silver: -21.5% - Platinum: -23% - Palladium: -20% Safe havens? Not today. 2️⃣ Tech & Equities Bleed 💻 While the indices didn't drop as far percentage-wise, the dollar amounts are staggering. - Nasdaq: -$480 Billion - S&P 500: -$380 Billion Even the "magnificent" names are feeling the gravity. 3️⃣ Crypto Chaos ₿ Digital assets followed the macro trend down. - Bitcoin: -6.6% (-$108 Billion) - Ethereum: -7.5% (-$25 Billion) Why does this matter for you? In a world of "instant liquidity" and "algorithmic trading," volatility is the new baseline. When correlations go to 1.0, everything drops at once. There was nowhere to hide today. Over $6,500,000,000,000 wiped off the map🧐 Source: Bull Theory

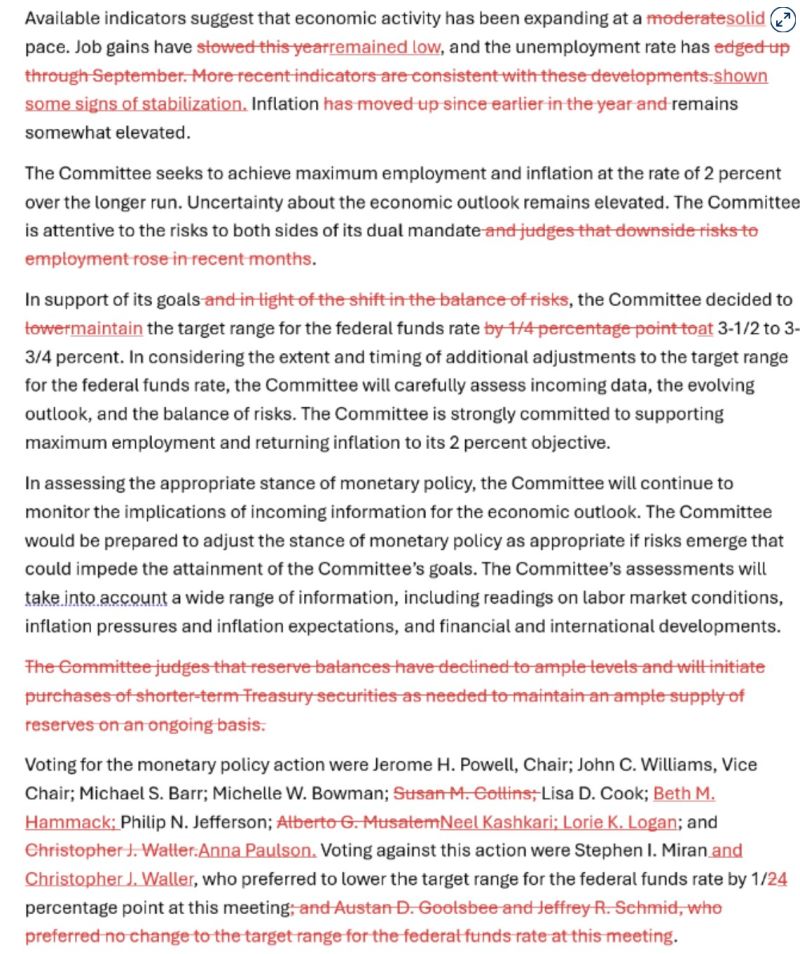

The Fed just hit the "Pause" button. 🛑

After three straight cuts, the FOMC is holding rates at 3.5%–3.75%. But the real story isn't the percentage—it’s the pressure. Here is what you need to know about the shift in DC today: 🔹 The "Labor Scare" is over: The Fed removed the language suggesting they're worried about the job market. They now see risks as "balanced." 🔹 Inflation is sticky: With growth tracking at a massive 5.4%, the Fed is worried about a second wave of price hikes. 🔹 A House Divided: Two Trump-appointed governors (Miran and Waller) dissented, pushing for more cuts despite the hold. 🔹 The End of an Era: Jerome Powell has only two meetings left. Between DOJ subpoenas over office renovations and a Supreme Court battle over firing governors, the Fed’s independence is being tested like never before. The big question for the markets: Who takes the wheel next? 🏎️ Prediction markets are currently betting on BlackRock’s Rick Rieder to succeed Powell. Below is the Fed statement with changes in red Source: CNBC

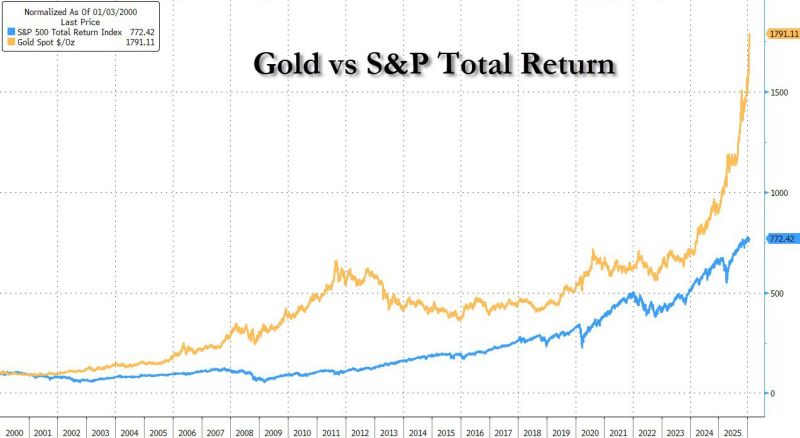

Gold vs S&P total return.

A rock has outperformed the collective genius of the US capital markets by more than 100% Source: zerohedge

$MSFT with a strong double beat in Q4. The stock is down 6% despite the strong results due to heavy spending.

Microsoft delivered impressive headline numbers, with revenue jumping 17% to $81.3 billion and Azure cloud growth accelerating to 39%, driven by fierce AI demand. The Intelligent Cloud segment is now a massive engine, crossing $32.9 billion in sales. However, capital expenditure nearly doubled to ~$30 billion, raising fears about cash burn. Second, the massive 60% profit jump can be misleading as it includes a $7.6 billion paper gain from the OpenAI investment. Stripping that out, real profit growth was much lower, leaving investors worried that the costs of the AI boom are rising faster than the immediate cash returns. 🔹 EPS: $4.14 vs. $3.91 est. ✅ 🔹 Revenue: $81.27B vs. $80.31B est. ✅ Key takeaways: 🔸 Intelligent Cloud rev: +29% YoY 🔸 Productivity rev: +16% YoY 🔸 Computing rev: -3% YoY 🔸 MSFT Cloud rev: +26% YoY 🔸 Azure/Cloud: +39% YoY Source: KaizenInvestor @Kaizen_Investor Barchart

It looks like negative interest rates are returning to Switzerland...

Government bonds with maturities of up to 4 years are now yielding negative returns. Source: HolgerZ, Bloomberg

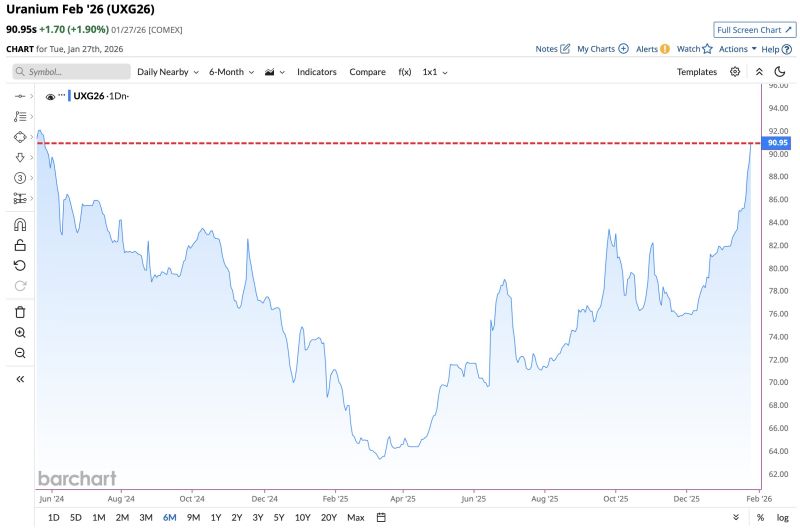

Uranium on fire as it jumps to highest price since May 2024

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks