Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

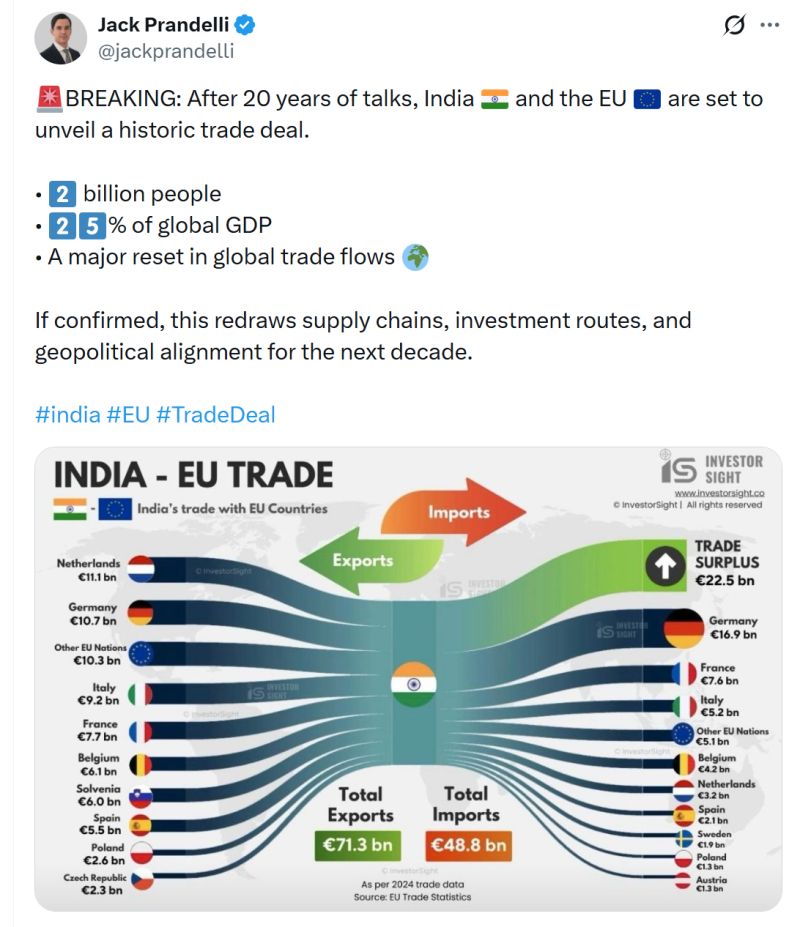

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A Historic Moment for Silver

Yesterday, SLV (the world’s largest Silver ETF) traded $38 Billion in total value and 393 Million shares in total volume: - It was SLV’s highest-ever value traded (no other day in history even came close). - It was SLV’s highest-ever volume (prior records: May 5 2011, February 1 2021). To gauge the true scale of this frenzy… Let’s compare it to SPY which traded $42 Billion yesterday (chart). In its entire 20-year history, SLV traded this much relative to SPY *only once* before: On April 25 2011. Source: Macro charts

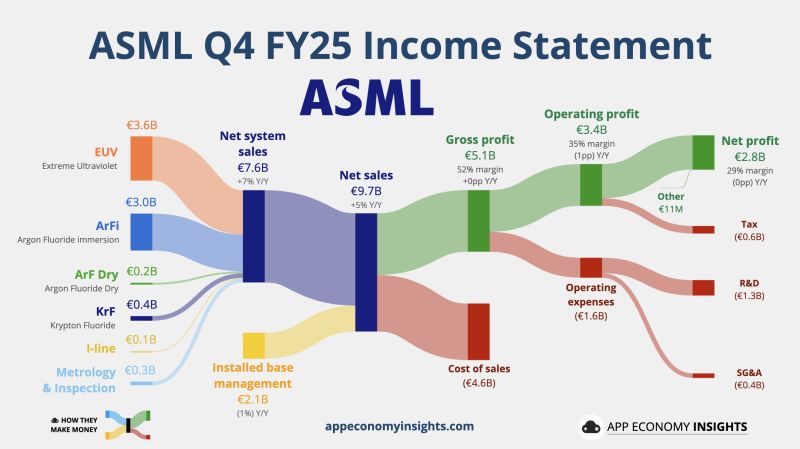

ASML just dropped their Q4-25 earnings, and the market is absolutely electric. ⚡️

Shares jumped 7%, and it’s not hard to see why. While the world was debating an "AI bubble," ASML’s customers just placed a record-breaking bet on the future. The headline? A massive demand explosion. 🚀 The Numbers You Need to Know: Net Bookings: €13.2B (Massive beat vs. €7B estimate). The demand isn't just there; it’s doubling expectations. Revenue: €9.7B (Beating the €9.58B estimate). Backlog: A staggering €38.8B. ASML has years of work already sold. 2026 Guidance: Revenue projected between €34B - €39B (Top end well above the €35B consensus). The "AI Realism" Shift 🧠 CEO Christophe Fouquet’s statement is the real kicker. He noted a "notably more positive assessment" from customers regarding the sustainability of AI-related demand. This isn't hype. This is capacity planning. This is the "picks and shovels" of the AI revolution being bolted into factories right now. Two High NA systems (the most complex machines humans have ever built) were officially recognized in Q4 revenue. The future is being shipped. Shareholder Value 💰 ASML isn't just growing; they are rewarding. A new €12B share buyback program through 2028 shows massive confidence in their long-term cash flow. The Verdict: ASML remains the ultimate bottleneck of the digital age. If you want AI, you need chips. If you want chips, you need ASML. Period. Is the semi-cycle just getting a second wind? 🌬️ Below the numbers and breakdown by App Economy Insights @EconomyApp · $ASML ASML Q4 FY25: • Net bookings €13.2B (€6.9B beat). • Net sales +5% Y/Y to €9.7B (€0.1B beat). • Gross margin 52% (+0pp Y/Y). • Operating margin 35% (-1pp Y/Y). • EPS €7.35 (€0.23 miss). • FY26 Net sales ~€36.5B (€1.4B beat).

Chinese-financed infrastructure projects across Latin America

Source: Amazing Maps

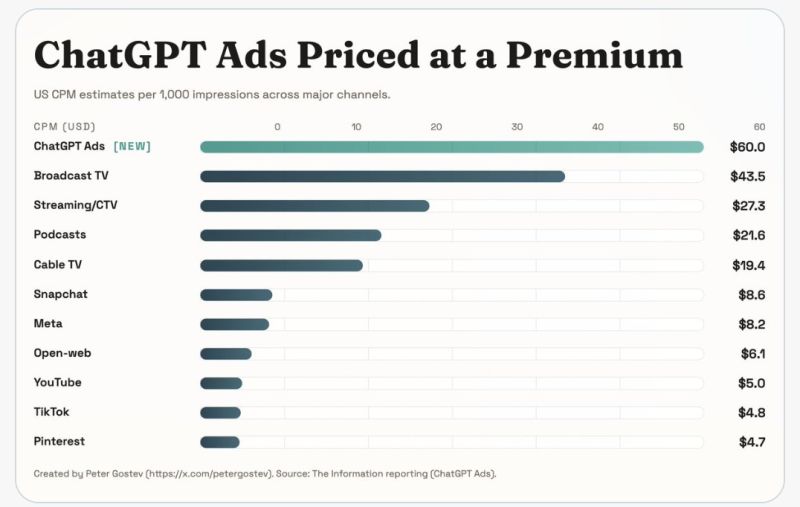

According to The Information, ChatGPT ads are being priced at $60 per 1000 impressions - which is way above other digital ads, even above TV/Streaming

Source: Peter Gostev (in SF 2-6 Feb) @petergostev

Did someone front run Trump's dollar announcement by going all-in gold?

At exactly 3pm, a large block of gold‑linked call (GLD) trading went through, coinciding with the sharp move higher in spot gold. In over‑the‑counter equivalent terms, a trader rolled 250k deltas out of an in‑the‑money 4,950/5,050 call spread, and into a Feb. 20 5,250/5,400 call spread, representing 1.1 mm ounces of gold exposure ($5.1BN). The client paid $30MM in net premium to implement the new structure. Source: zerohedge

While the world watches the US Dollar and Yen with bated breath, the "Swissie" just hit its strongest level in over a decade.

Here is why the global markets are shaking: 🚀 The "Gold Nugget" Effect Investors are fleeing to safety. With Gold crossing $5,000/oz and political volatility rocking major powers, the Swiss Franc has become the ultimate "reliable" haven. It’s up 3% this year, following a massive 14% gain last year. 📉 The SNB's Impossible Choice A currency this strong is a double-edged sword. It keeps inflation low (currently at 0.1%), but it puts a massive squeeze on Swiss exporters. The Swiss National Bank (SNB) is now stuck between a rock and a hard place: Cut rates? They are already at 0%. Going negative again is a move they want to avoid. Intervene? Direct intervention risks the "currency manipulator" label and diplomatic friction. 🌍 The Bigger Picture When the "linchpin" of the global economy (the USD) feels erratic, capital doesn't just disappear—it migrates. We are seeing a fundamental shift in where the world stores The Lesson: In a world of volatility, stability is the most expensive luxury on the market. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks