Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

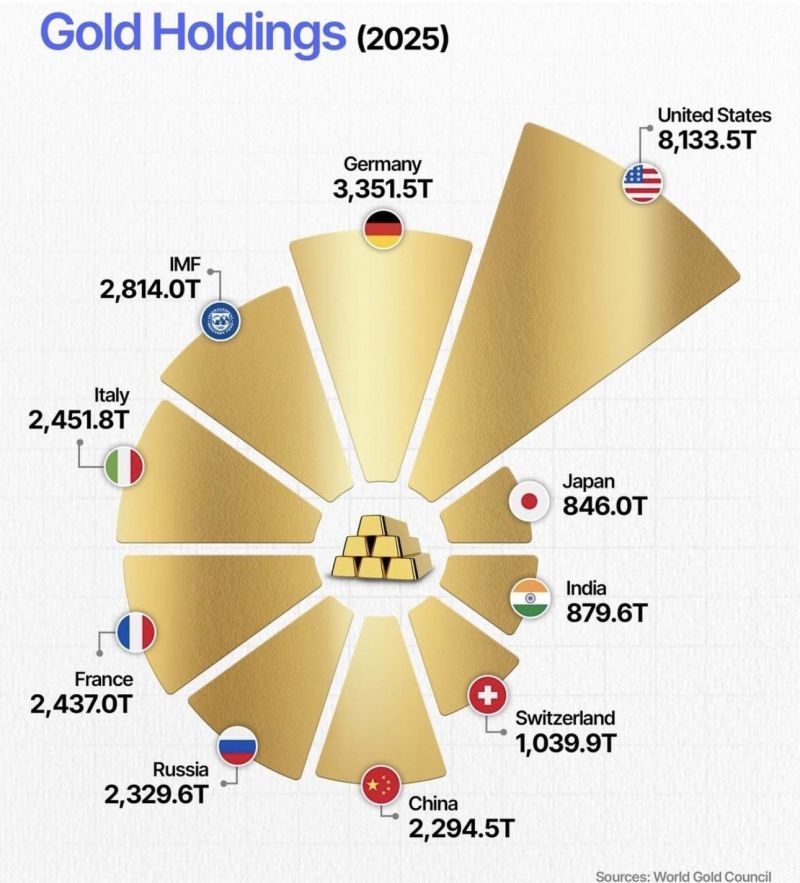

Who really holds the world’s gold?

• 🇺🇸 United States still dominates with 8,100+ tonnes • 🇩🇪 Germany remains Europe’s anchor • 🇮🇹 🇫🇷 🇷🇺 all sit around 2,300–2,450 tonnes • 🇨🇳 China keeps climbing, quietly • 🇨🇭 Switzerland punches far above its size • 🇯🇵 🇮🇳 hold far less than their economic weight

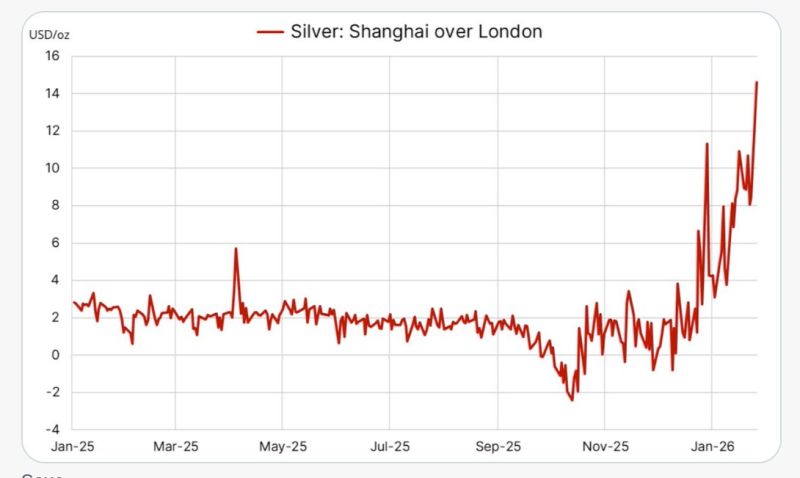

The spread between silver prices in Shanghai vs London is skyrocketing...

Source: Markets & Mayhem

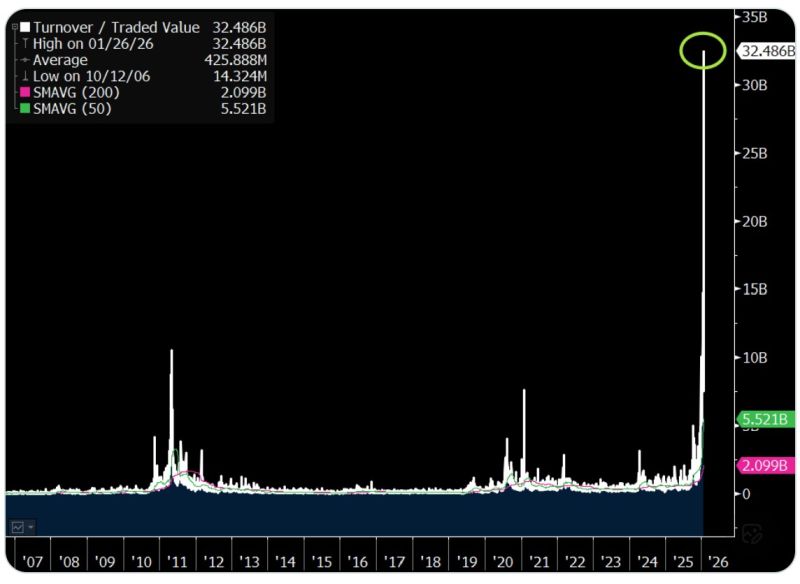

The volume in the silver ETF $SLV is $32b..

That's 15x its average and by far the most volume of any security on the planet. For context, $SPY is $24b, $NVDA and $TSLA $16b... Source: Bloomberg, Eric Balchunas

Indian Stocks $INDA form a Death Cross ☠️ for the first time this year

The last one sent prices plunging more than 10% over the next 10 weeks 📉📉 Source: Barchart

Silver is currently beating the performance of the NASDAQ 100 over the last decade

Source: Stocks World

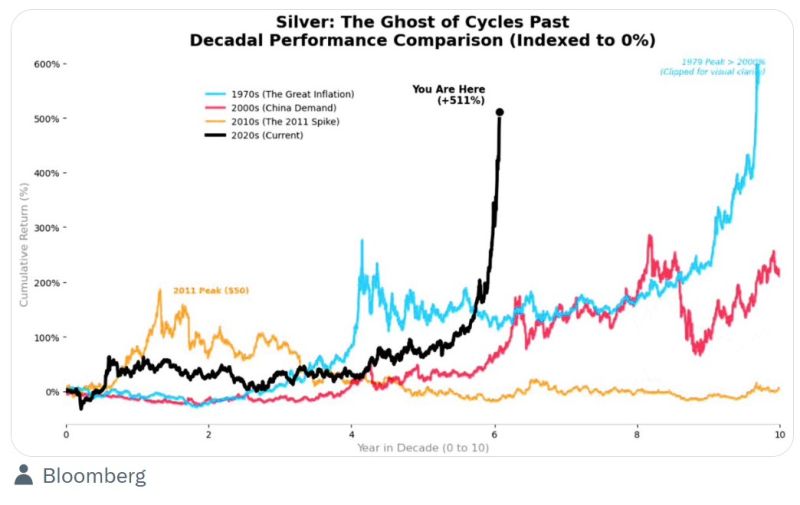

This is the most insane run in silver ever during such a short span of time.

Source: Markets & Mayhem

THE MASTER EARNINGS CALENDAR

Here are the most popular stocks that report earnings this week January 26th - January 30th Source: Earnings Hub

Investing with intelligence

Our latest research, commentary and market outlooks