Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

~$9.6 trillion of U.S. marketable government debt will mature over the next 12 months, the most ever.

That’s roughly 1/3 of ALL outstanding public debt that needs to be refinanced. Most of it was originally issued when rates were near zero. Now it refinances at 4–5%. The math: even a 2% average rate increase on $9.6T = ~$192B in added annual interest costs alone. For context, net interest on U.S. debt is already on pace to exceed $1 trillion/year in 2026, more than the defense budget. The largest refinancing wall in history is here. Source: @NoLimitGains on X

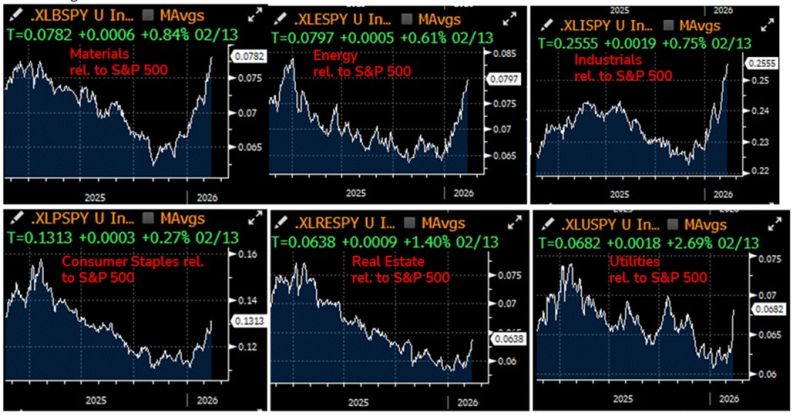

US equities market broadening in a few pics.

“Old economy” and interest-rates sensitive sectors have been outperforming lately Note there are also parts of the economy which are LESS subject to AI-disruption Source: Bloomberg, RBC

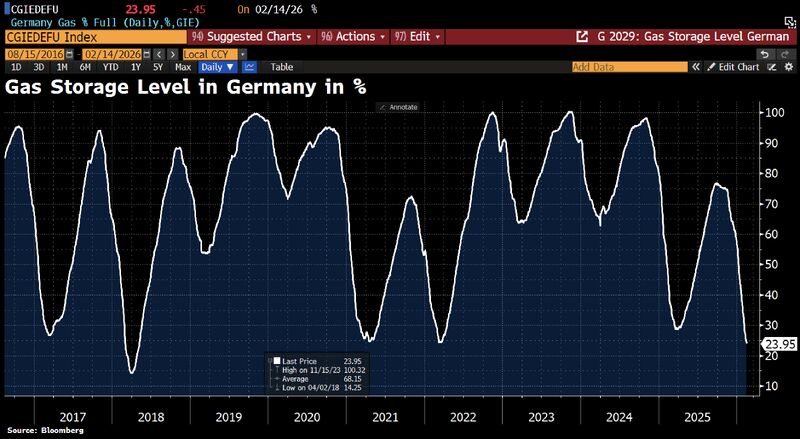

In Germany, gas storage levels have fallen below 24%

a record low for this time of year. Typically, storage levels average around 50.7% at this point. At 23.95%, inventories are also at their lowest level since May 2018. Source: Bloomberg, HolgerZ

The "Feel good story of the day".

If you invested $10,000 in Beyond Meat in 2021, today you would have $41. The stock was as fake as the meat. Source: Brew Markets @brewmarkets Wall Street Mav

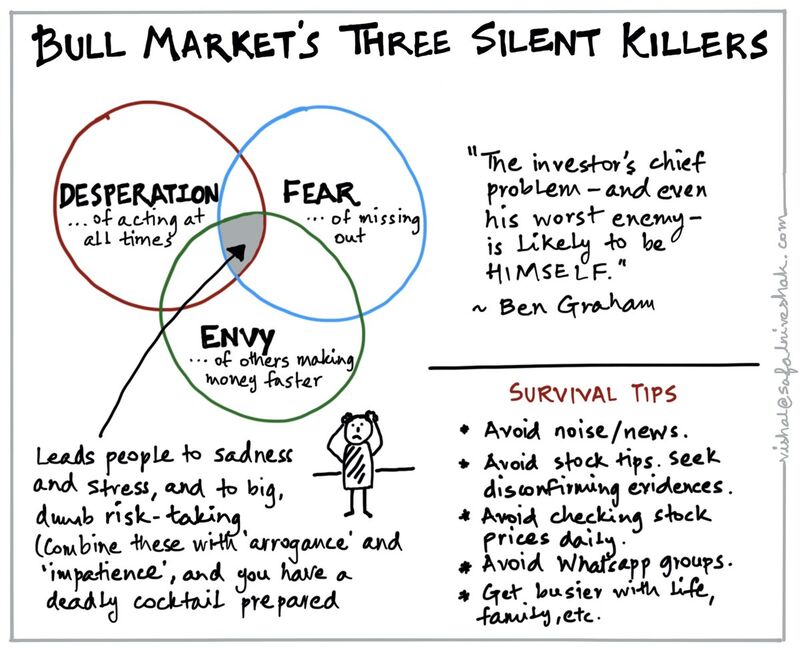

Three silent killers of bull markets.

"The investor's chief problem - and even his worst enemy - is likely to be HIMSELF" - Ben Graham Nice visual by @safalniveshak

Anthropic has raised $30bn from investors including GIC, Coatue, Founders Fund and Nvidia

reaching a $350bn pre-money valuation ahead of a potential IPO. Founded in 2021 by former OpenAI researchers, the company focuses on enterprise AI tools. About 80% of its $14bn revenue run rate comes from business clients. Its Claude Code product has gained strong adoption, with over 500 customers spending more than $1mn annually. Source: Financial Times

Investing with intelligence

Our latest research, commentary and market outlooks