Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Over the last two days (February 11–12, 2026),CBRE Group Inc. (CBRE) stock plummeted approximately 25% to 30% from its recent all-time highs.

CBRE stock fell despite record revenue and strong core earnings due to shifting investor narratives and accounting impacts. AI disruption fears triggered multiple contraction, reducing valuation. GAAP net income declined 14.6% due to one-time pension and safety charges, creating negative headlines. Revenue slightly missed expectations, disappointing a market pricing perfection. High institutional ownership amplified technical selling through stop-loss triggers. Overall, sentiment, valuation reset, and temporary accounting effects—not business weakness—drove the sharp decline recent market reaction after earnings announcement period release. Source: CBRE Group

Perhaps the trade this year isn't so much "sell America"rather something like: "spend a lot more money everywhere else" -

At least so far this year. For example, Asian stocks have made their best start over US equities since at least 2000: @TheTerminal Source: Lisa Abramowicz @lisaabramowicz1 Bloomberg

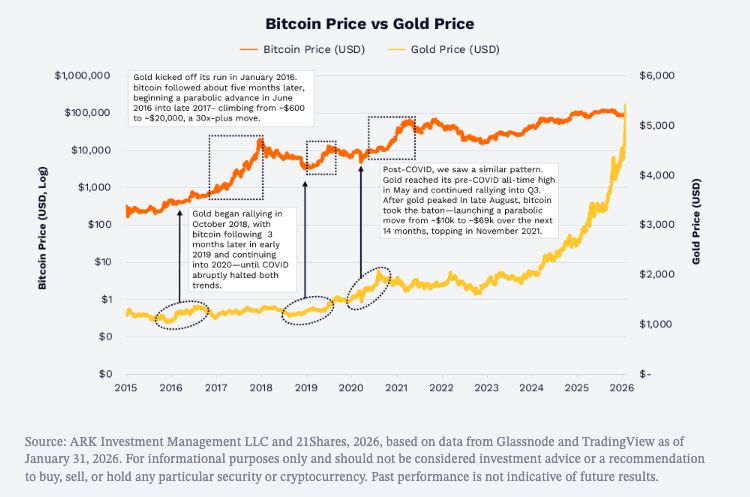

BITCOIN VS GOLD

- Gold rallied first in 2016 → Bitcoin followed months later (+30x into 2017) - Gold rallied again in 2019 → Bitcoin followed into 2020–21 - In 2025, gold surged to new highs while Bitcoin lagged - Since 2020, BTC–gold correlation: 0.14 Historically, gold has led. Source: Ark Invest Tracker @ArkkDaily

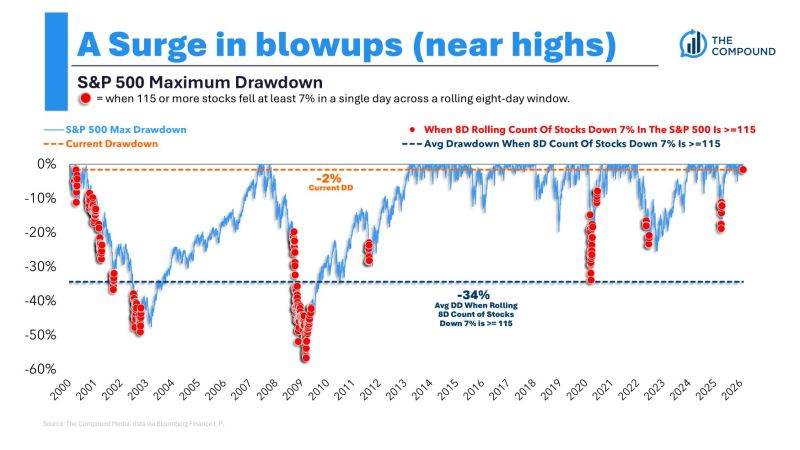

Wild market.

Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day. The average drawdown when that happens is 34%. Right now we're 1.5% below the all-time high. Source: Michael Batnick @michaelbatnick

IS THE BOTTOM IN FOR BITCOIN? Aggregated data says "Squeeze Incoming

Aggregated data shows extremely negative Bitcoin funding rates, signaling overcrowded short positions. Historically, similar conditions preceded a market bottom and an 83% rally within four months. Negative funding means short sellers pay longs, increasing squeeze risk if prices rise. High leverage amplifies liquidation potential, forcing rapid buying. This imbalance reflects widespread fear and low confidence. Although not guaranteeing immediate gains, such extreme sentiment often creates conditions for reversals. Investors should remain patient, avoid emotional reactions, and monitor funding dynamics closely. Source: Santiment

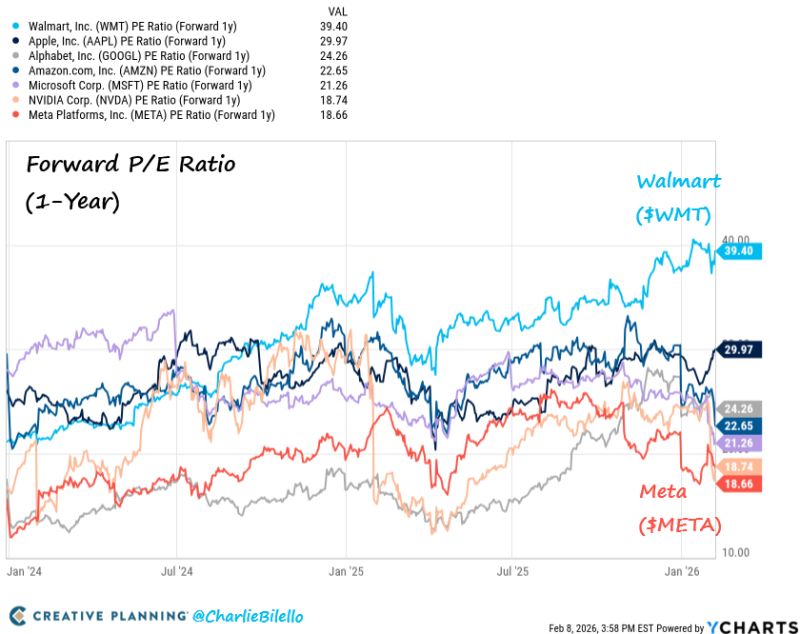

Who has the highest P/E among these mega caps? Answer: Wal-Mart $WMT...

Meta $META and Nvidia $NVDA are the cheapest, but if we factored in growth rates $NVDA is way cheaper than $META Source: Charlie Bilello

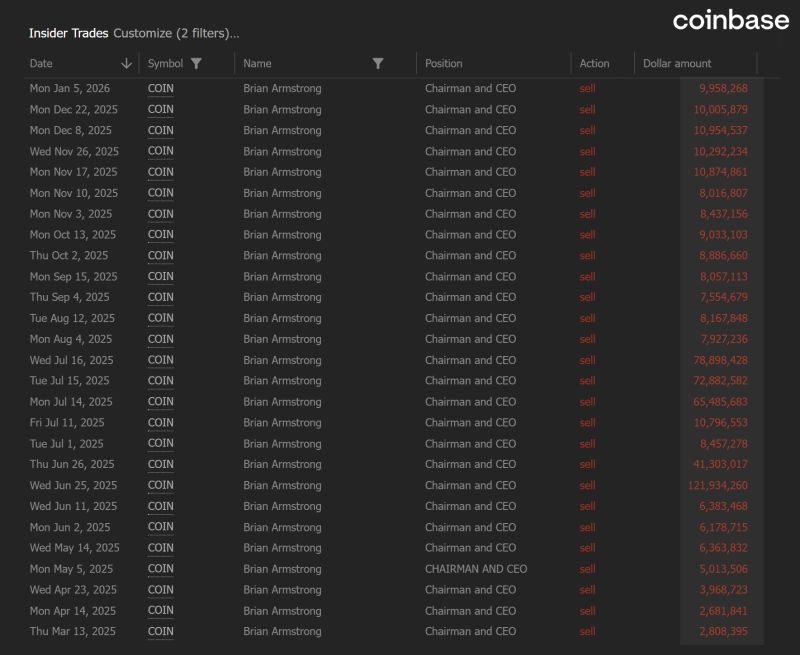

$COIN is now down -69% from its highs.

Over the past year, CEO Brian Armstrong has sold 1.5M shares, totaling $743M. Source: Trend Spider

The Trump Administration secretly smuggled 6,000 Starlink satellite terminals into Iran in January after the Iranian government cut off internet in the country, per WSJ.

Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks