Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Might be a bit early to say if Truflation works but if it does, this looks pretty good. Here's why Truflation could the "anti-CPI" index disrupting economic forecasting

1. Goodbye Surveys, Hello Big Data 📡 The official CPI relies on manual surveys and "judgmental adjustments." Truflation uses 18 million+ data points in real-time. It scrapes e-commerce APIs, transit data, and housing aggregates every 24 hours. 2. The "45-Day Edge" 🏃💨 Traditional inflation data is a rearview mirror. Truflation acts as a leading indicator, often sniffing out price pivots 45 days before they hit government reports. 3. Censorship-Resistant Math ⛓️ Ever feel like the "official" numbers don't match your receipt? Truflation puts its data on-chain (via Chainlink). It’s immutable. No "seasonal adjustments" or political massaging—just pure, transparent code. 4. The Current Reality (Jan 2026) 📊 While headlines debate the latest "sticky" CPI prints, Truflation’s dashboard often shows a different story: Official CPI: Hovering around 2.3% Truflation: Currently tracking closer to 1.7% The Takeaway: In a world of high-frequency trading and instant supply chain shifts, "monthly" is the new "obsolete." By the way, hashtag#blockchain is the structural backbone of Truflation. While it collects data from traditional sources (like e-commerce sites and retailers), it uses blockchain to ensure that data is verifiable, transparent, and tamper-proof. The ecosystem has its own native token ($TRUF) which handles the "business" side of the data: - Staking: Node operators (the people running the computers that verify the data) must stake tokens as collateral to ensure they provide honest numbers. - Governance: Token holders can vote on things like which new data categories should be added or how the inflation formula should be weighted. - Payments: Users often pay in tokens to access premium, high-speed data streams Source chart: Bloomberg, RBC

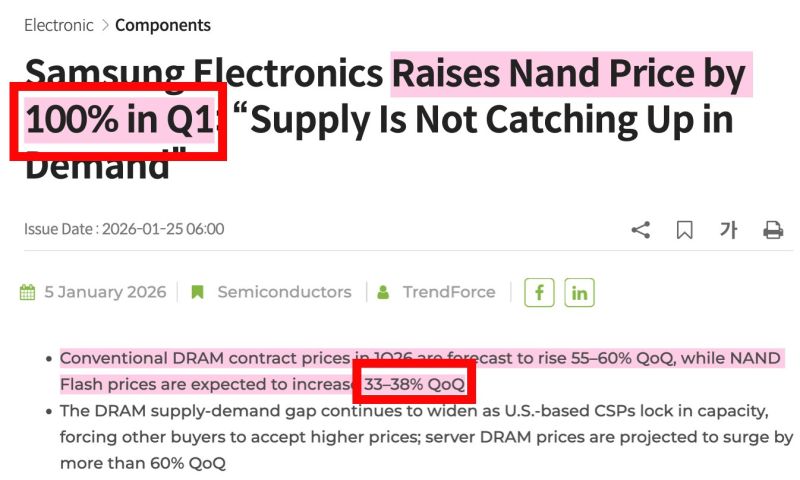

In case you missed it... This just happened: "Samsung increases NAND prices by 100%"

Estimates were 33-38% Q/Q growth - Trendforce This is an absolute shock. It's called the "Memory Supercycle" for a reason with $MU, Samsung, and SK Hynix + $SNDK. In simpler terms: That extra 65% increase (from 35% to 100%) is pure, added high-margin profit. If $MU guided for 68.0% gross margins Q2 2026, and we see a 100% NAND hike from 33-38% est, that could bring gross margin projections over 73-75%+. This is a blowout. Source: Serenity @aleabitoreddit

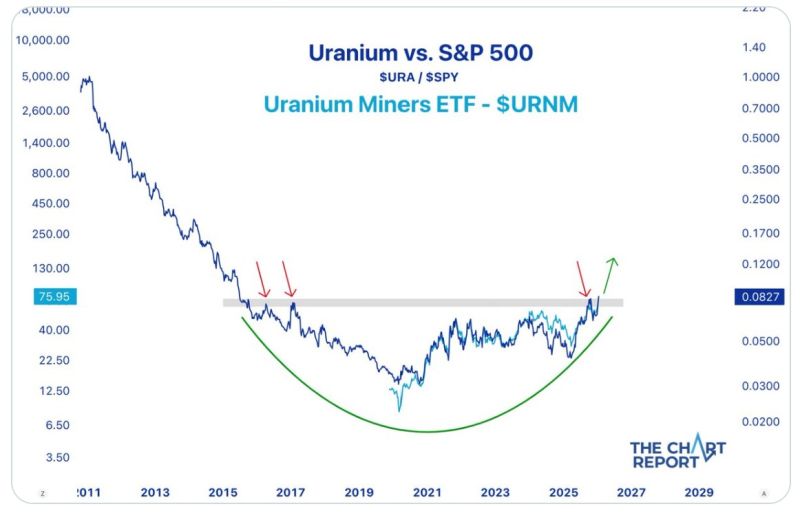

Uranium miners closed at new all-time highs last week. Is the relative trend just getting started

$URA $URNM $SPY Source: Donovan Jackson @TheDonInvesting on X The chart report

CoreWeave Behind the AI Hype, a Debt-Fueled Illusion

Nvidia is investing $2B in CoreWeave, deepening a partnership central to AI infrastructure expansion. CoreWeave plans to build over 5 GW of AI data centers by 2030 using Nvidia’s next-gen platforms. However, despite the hype, CoreWeave’s financials raise serious concerns: the company is losing money on every dollar of revenue, carries a massive working-capital deficit, holds over $10B in long-term debt, and relies on rapidly depreciating GPU assets. Facing weak demand, CoreWeave is increasingly using “compute-for-equity” deals—trading GPU capacity for startup equity at inflated valuations—effectively acting like an AI venture capitalist rather than a stable infrastructure provider. The business model depends on continued access to debt markets; if funding dries up, risks fall heavily on retail investors while early institutional players are likely already exiting.

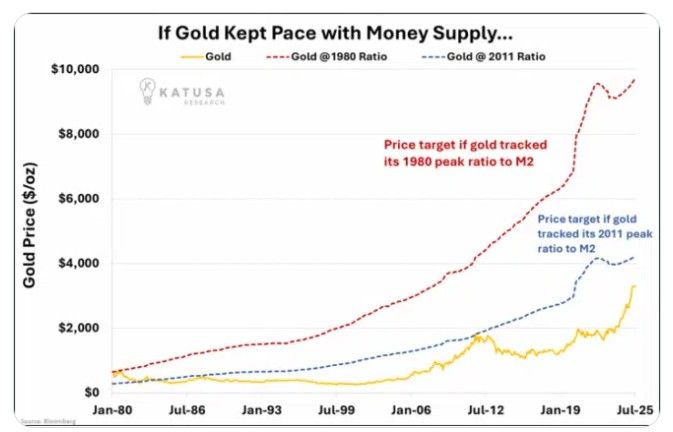

Gold would be ~$9,700 if it kept up with M2 To hit $40,000/oz, Gold would need to add about $246 Trillion in market cap from today's levels.

Source: Katusa Research @KatusaResearch

ECB President Christine Lagarde: "Europe is going to do a big SWOT analysis and decide what do we need to do to be strong by ourselves."

Source chart : FT Source image: Reuters

Countries joining Trump's peace board

Source: Rothmus @Rothmus on X

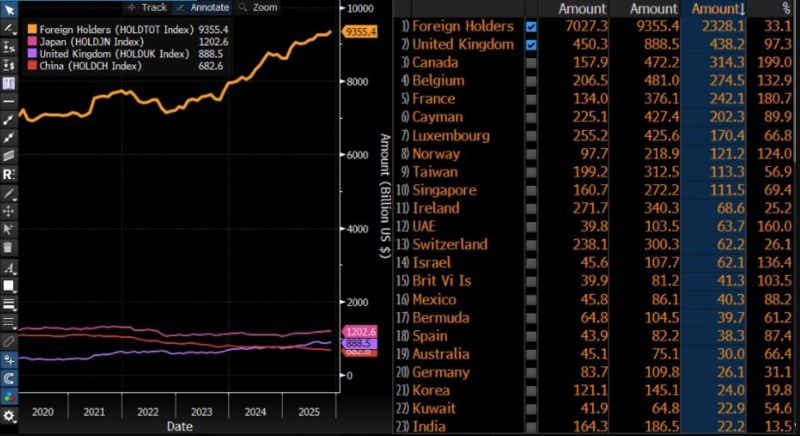

Foreign ownership of US debt rises to an all-time high.

Source: Daniel Lacalle @dlacalle_IA Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks